Creditor With A Judgment

Description

How to fill out Texas Verification Of Mailing List?

Individuals typically connect legal documentation with something intricate that solely a specialist can manage.

In some respects, this is accurate, as creating a Creditor With A Judgment requires considerable knowledge of specific subject criteria, including state and county laws.

However, with US Legal Forms, the process has become more user-friendly: pre-made legal templates for various life and business scenarios tailored to state laws are compiled in a centralized online repository and are now accessible to everyone.

Create an account or Log In to advance to the payment section. Make your payment through PayPal or with a credit card. Select the file format for your document and click Download. Print your file or upload it to an online editor for faster completion. All templates in our library are reusable: once purchased, they are stored in your profile. You can access them anytime needed via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Sign up today!

- US Legal Forms offers over 85,000 current forms organized by state and category of use, so searching for a Creditor With A Judgment or any other specific template takes mere minutes.

- Returning users with an active subscription must Log In to their account and click Download to get the form.

- New users will first need to sign up for an account and subscribe before they can access any paperwork.

- Here is the detailed guideline on how to acquire the Creditor With A Judgment.

- Review the page content carefully to ensure it meets your needs.

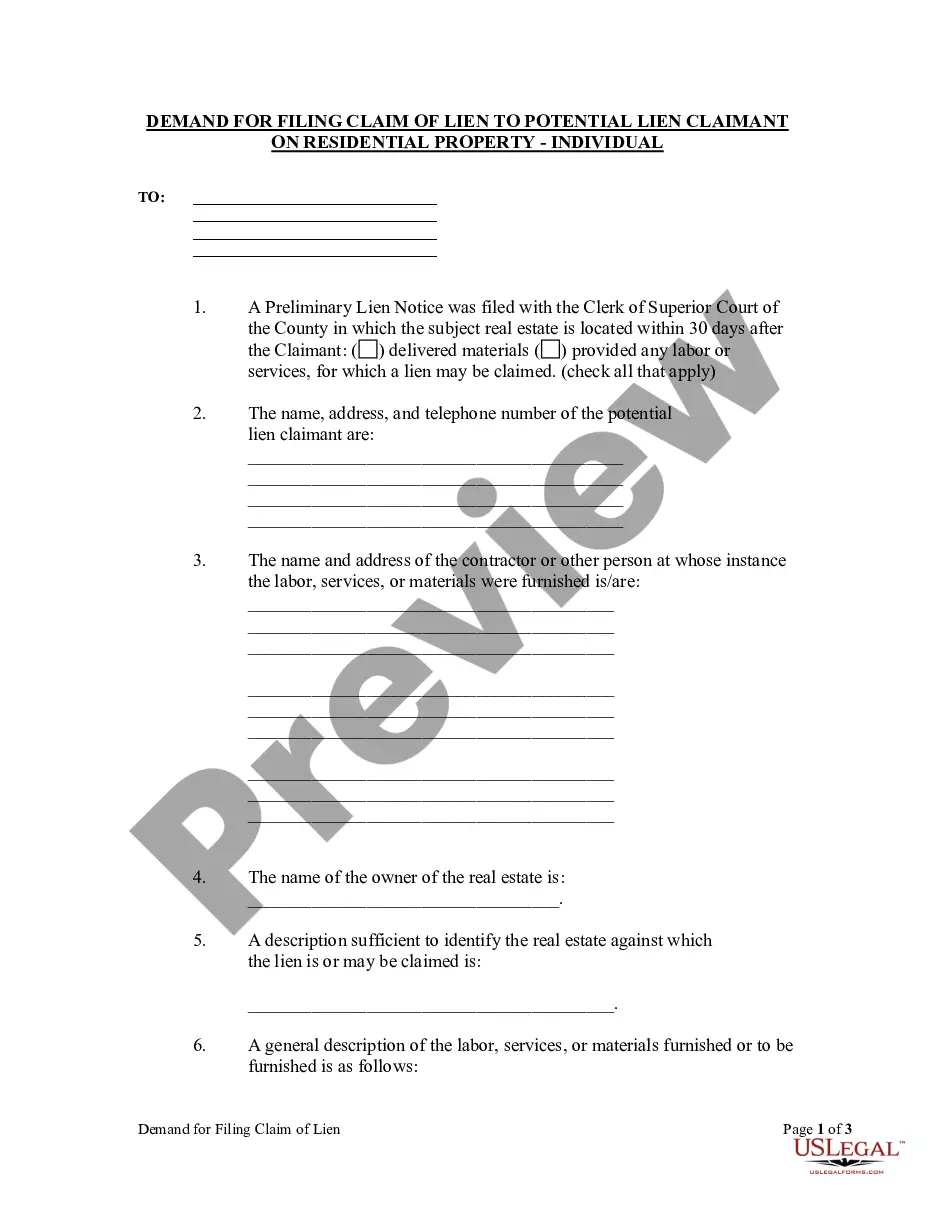

- Examine the form description or confirm it through the Preview option.

- If the previous template does not fit your requirements, use the Search field above to find another example.

- Once you find the appropriate Creditor With A Judgment, click Buy Now.

- Choose a pricing plan that aligns with your needs and budget.

Form popularity

FAQ

The three common types of creditors are consumer creditors, commercial creditors, and public creditors. Consumer creditors lend to individuals, commercial creditors to businesses, and public creditors include government entities like tax authorities. Identifying the type relevant to your situation can help you make informed decisions, especially when faced with a creditor with a judgment.

The three creditors generally referred to in financial contexts are secured creditors, unsecured creditors, and preferential creditors. Secured creditors have collateral for their loans, while unsecured creditors do not have such guarantees. Preferential creditors, like employees owed back wages, have priority during debt recovery, especially against a creditor with a judgment.

Creditors can be classified based on the nature of their claims and the backing of those claims. For example, creditors can be classified as secured or unsecured, as well as as individual or corporate creditors. This classification impacts the collection processes and how debts are enforced, particularly when dealing with a creditor with a judgment.

Generally, a creditor with a judgment has a specific time frame, typically up to 10 to 20 years, to collect on that judgment, depending on your state’s laws. This period can extend if they actively pursue collection actions. Make sure to keep thorough records of all communications with your creditor. Seeking help through resources like US Legal Forms can assist you in understanding your rights during this time.

When a judgment appears on your credit report, it can significantly impact your credit score. A creditor with a judgment may seek to collect the outstanding debt, and this can lead to wage garnishments or bank levies. The judgment will remain on your credit report for seven years, making it important to manage the situation proactively. Consider seeking legal advice to explore options for resolution.

To fight a judgment creditor, start by examining the details of the judgment for inaccuracies or errors. You may file a motion to contest the judgment if you believe it was entered incorrectly or if you have evidence to support your case. Legal options are available, and resources from platforms like US Legal Forms can guide you in drafting necessary documents. Being informed is your best weapon in these situations.

Typically, unpaid debt can become unenforceable after five years due to the statute of limitations in many states. This means that a creditor with a judgment may not be able to legally collect on the debt after this period. However, it’s important to check your state's specific laws, as these can vary. Understanding these nuances can empower you to take appropriate actions.

The phrase you can use is, 'I do not owe this debt.' Use this statement when talking to a creditor with a judgment to assert your rights. Its clarity can help redirect the conversation and express your stance on the debt. Additionally, documenting your communication can strengthen your case in any future disputes.