Lease Guarantor Companies Texas For Rent

Description

How to fill out Texas Guaranty Attachment To Lease For Guarantor Or Cosigner?

It’s clear that you cannot become a legal expert instantly, nor can you quickly learn how to draft Lease Guarantor Companies Texas For Rent without a specialized background.

Generating legal documents is a lengthy process that necessitates specific training and expertise. So why not entrust the creation of the Lease Guarantor Companies Texas For Rent to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court papers to templates for internal corporate communication.

If you need a different template, start your search again.

Create a free account and select a subscription option to purchase the form. Click Buy now. After the transaction is finalized, you can download the Lease Guarantor Companies Texas For Rent, fill it out, print it, and send it by post to the specified individuals or organizations. You can access your documents again from the My documents tab anytime. If you’re a current client, you can simply Log In and find and download the template from the same tab. Regardless of the intent of your forms—be it financial and legal, or personal—our platform has everything you need. Try US Legal Forms now!

- We understand how vital compliance and adherence to federal and state laws and regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to begin with our platform and obtain the form you require in just a few minutes.

- Find the form you need using the search bar at the top of the page.

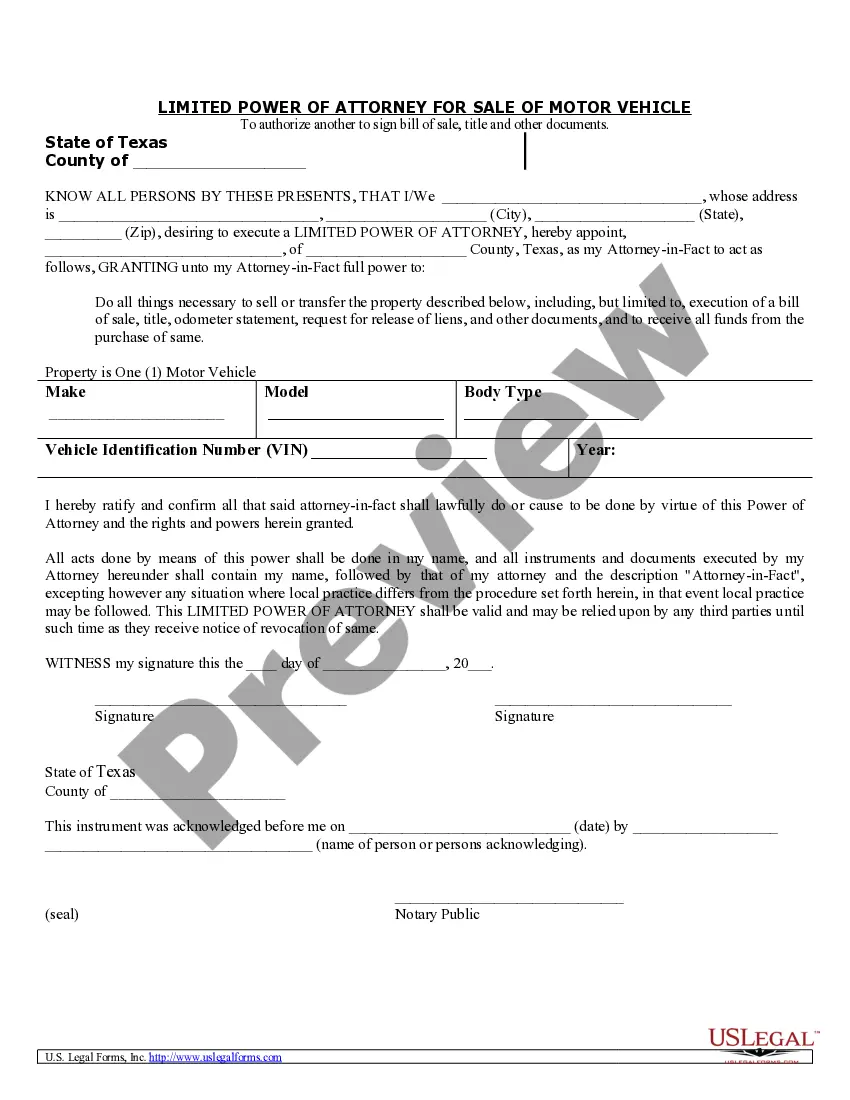

- Preview it (if this option is available) and read the accompanying description to see if Lease Guarantor Companies Texas For Rent is what you seek.

Form popularity

FAQ

As Guarantor, I hereby agree to guarantee payment of all amounts due under the lease, or that may come due, and all other obligations of the Tenant for the entire duration of the lease attached hereto unless the tenant gives notice of termination within the guidelines of the lease; however, if the lease is renewed ...

The guarantor lives within the United States and has a social security number. The guarantor meets our credit and criminal history requirements. The guarantor has verifiable monthly income which equals 4X's the amount of the rent.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

A person who guarantees the repayment of a borrower's debt if the borrower cannot make loan repayments is known as a guarantor. Guarantors put up their property as security for the loans. A co-applicant works alongside a borrower during the loan underwriting and approval process.

applicant or a coborrower is a person who wants to take on a shared debt with another person. applicant applies with the primary borrower for a loan and jointly shares the responsibility of paying the equated monthly installments (EMIs). A guarantor can either be a cosigner or a coapplicant.