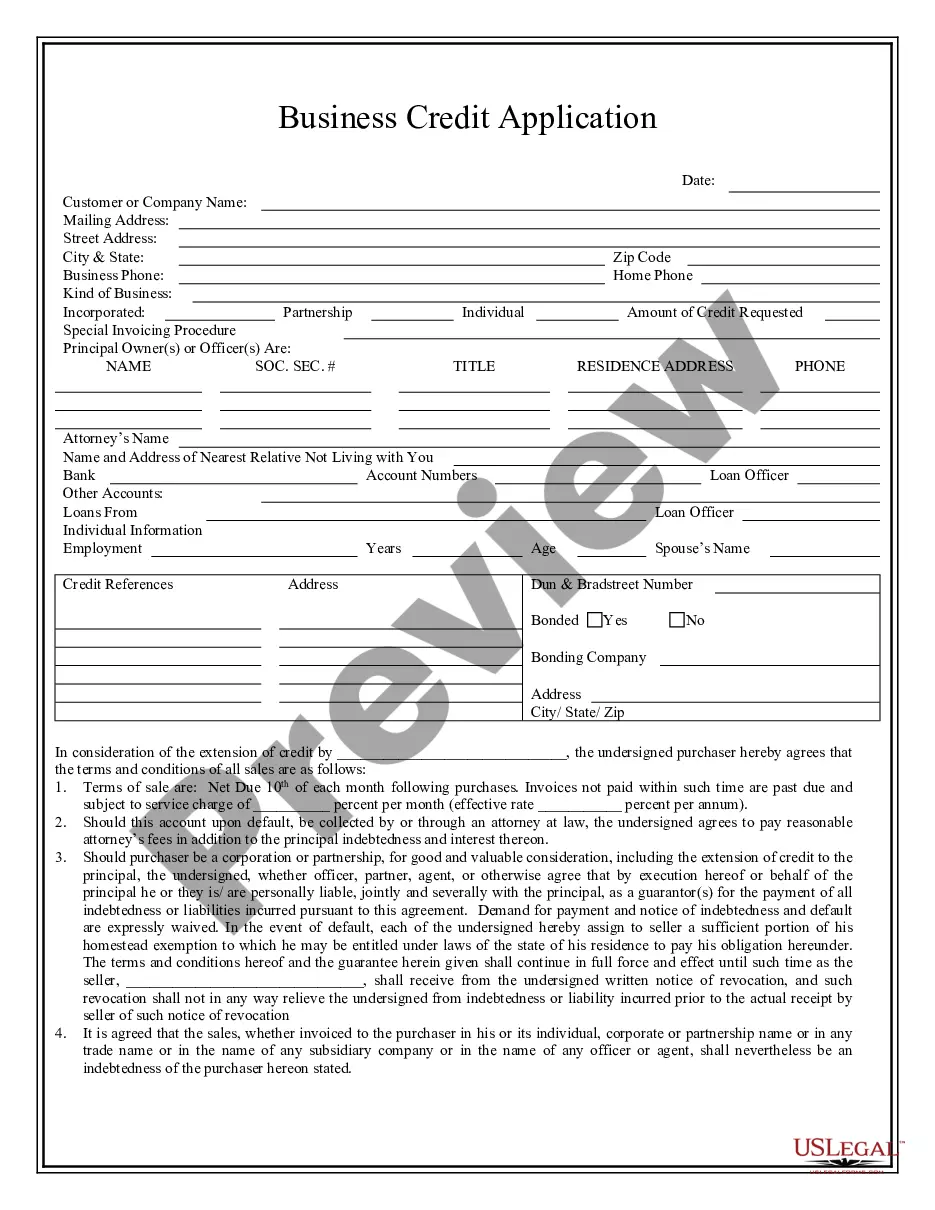

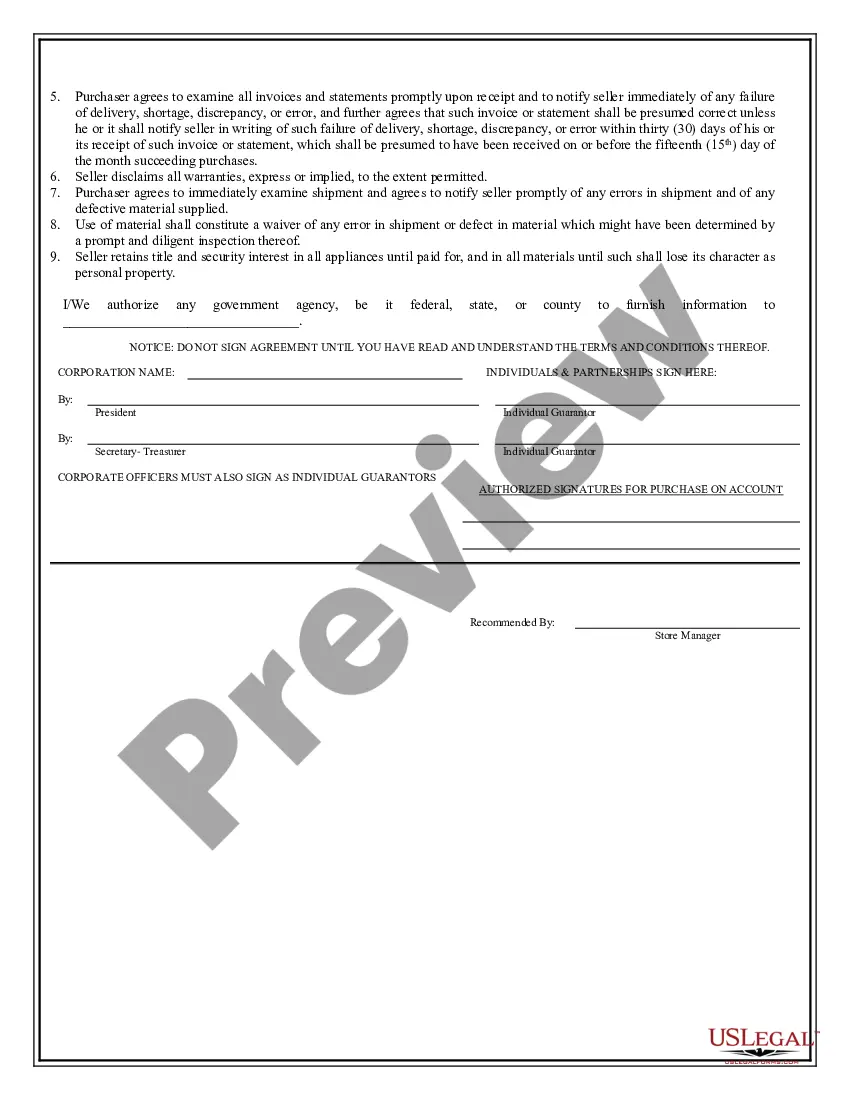

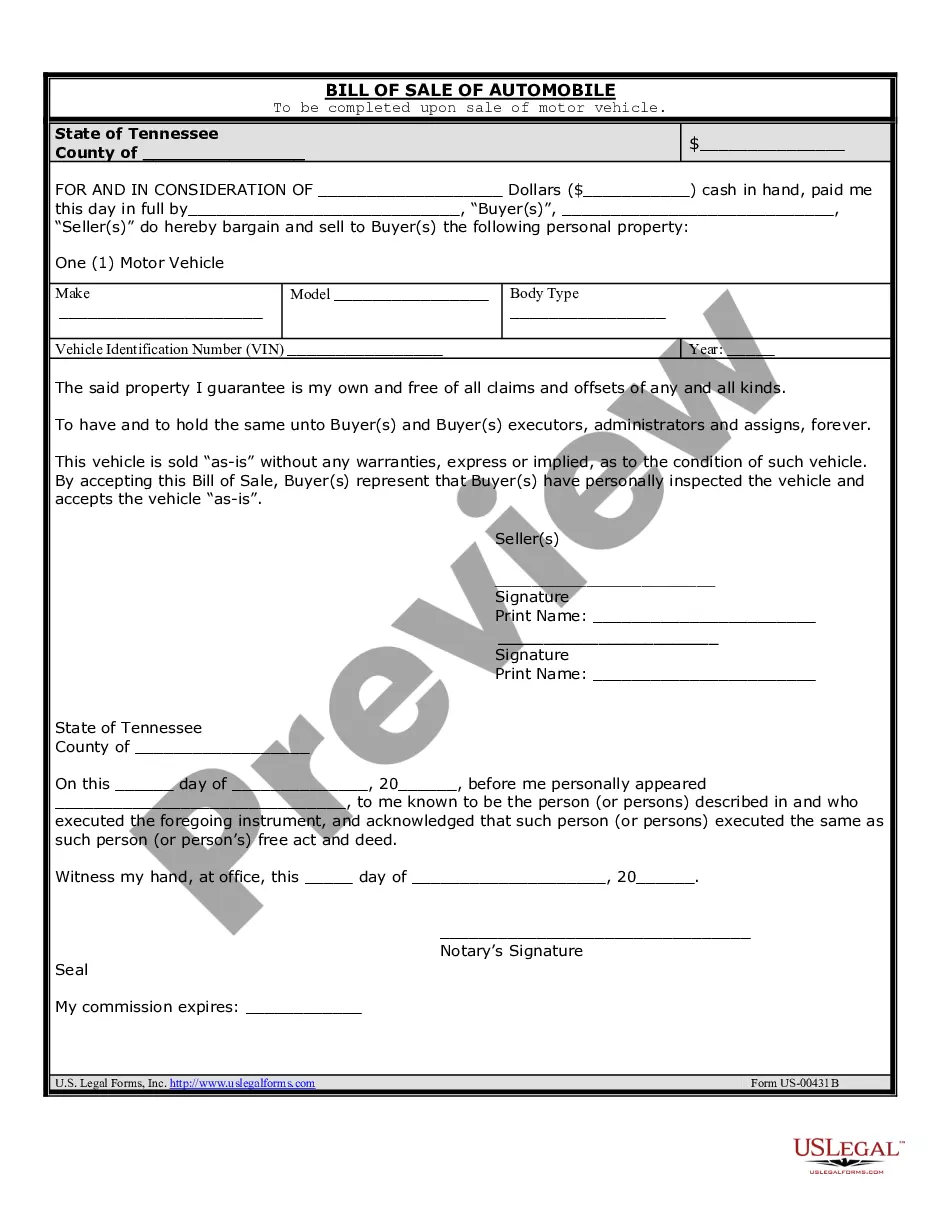

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Business Credit Application Form Template

Description

How to fill out Texas Business Credit Application?

Locating a reliable resource to acquire the latest and suitable legal templates constitutes a significant portion of the challenge involved in navigating bureaucracy.

Acquiring the correct legal documents necessitates accuracy and meticulousness, which is why it's essential to source samples of the Business Credit Application Form Template exclusively from reputable providers, such as US Legal Forms. An incorrect template could consume your time and delay your current situation.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms library, where you can discover legal templates, verify their appropriateness for your circumstances, and download them instantly.

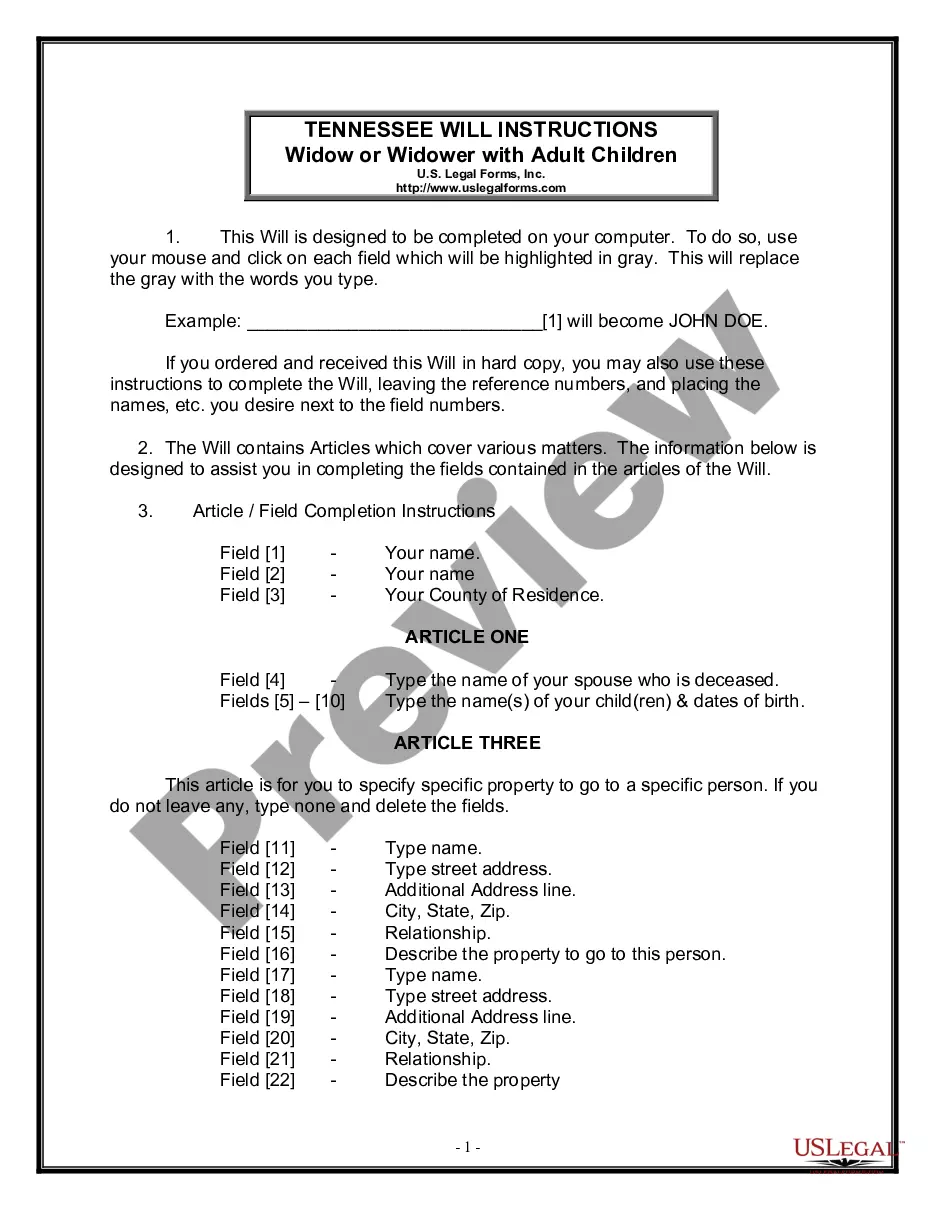

- Utilize the catalog navigation or search feature to locate your template.

- Examine the form's description to verify if it meets the requirements of your jurisdiction and locality.

- Review the form preview, if available, to confirm that the template is indeed what you need.

- Return to the search to find the appropriate document if the Business Credit Application Form Template does not meet your criteria.

- If you are certain about the form's relevance, download it.

- As a registered user, click Log in to validate and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to obtain the template.

- Choose the pricing plan that aligns with your requirements.

- Continue to the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Business Credit Application Form Template.

- After you have the form on your device, you can modify it with the editor or print it for manual completion.

Form popularity

FAQ

When filling out a credit card application, the business name should reflect your company's official registered name. If you're a sole proprietor, you may use your personal name, but it is best to include your business's registered name as listed with tax authorities. Using a business credit application form template from US Legal Forms can help guide you through this process, ensuring you provide the correct and relevant information to strengthen your application.

Achieving a 700 credit score in 30 days can be challenging but is possible with disciplined practices. Focus on paying down any existing credit card balances, ensuring you make all payments on time, and disputing any inaccuracies on your credit report. Additionally, consider applying for credit using a business credit application form template, which can help you present your financial situation clearly and accurately, aiding in potential credit approvals.

To write a credit application, start by gathering all necessary personal and business information, such as income details and the business structure. Clearly state the purpose of the credit, ensuring you provide concise and accurate information. If you're new to this process, using a business credit application form template from US Legal Forms can provide you with a solid structure, saving you time and ensuring compliance with typical requirements.

The 2/3/4 rule refers to how you should manage your credit card balances to maintain a healthy credit score. Specifically, it suggests keeping your total credit utilization below 30%, ideally below 20%. This means if you have a total credit limit of $10,000, you should aim to use no more than $3,000 to $4,000. If you're looking to improve your credit situation with a structured approach, using a business credit application form template might help streamline the application for credit options.

To obtain business credit, a score of 680 or higher is often recommended, though some lenders may accept lower scores. The specific requirements can vary depending on the lender, your business type, and the amount of credit requested. You can improve your chances by utilizing a business credit application form template to present accurate and organized information. A strong application reflects well on your business and can lead to better financing options.

Yes, many credit card issuers check your personal credit when you apply for a business credit card, especially if your business is new or lacks established credit. They do this to assess your creditworthiness and manage their risk. Therefore, it is essential to think about your personal credit score and maintain it in good standing. Using a business credit application form template can help you prepare the necessary information for both personal and business credit checks.

A credit application for a business is a document that provides information about your company's financial status and credit history. This application allows lenders to evaluate your business's creditworthiness. Utilizing a business credit application form template can streamline the process and ensure all necessary information is included. This ultimately enhances your chances of securing financing from different lenders.

A new LLC typically does not have an established credit score when you first register it. Instead, lenders may look at your personal credit history to assess your financial responsibility. To build business credit, consider using a business credit application form template to establish a solid foundation. Regularly using and responsibly managing credit will help your LLC develop its own credit score over time.

The credit approval process for a business typically begins with submitting a business credit application form template. This form collects key information about your business, including financial history and credit references. Once you submit the application, the lender reviews your information and assesses your creditworthiness. Depending on the results, you will receive either an approval, denial, or a request for additional information to continue the evaluation.

Typically, a personal credit score above 680 is favorable for acquiring business credit, although requirements may vary by lender. Your personal credit may play a role, particularly for new businesses without an established credit history. It’s wise to check your personal score regularly and improve it if needed. By utilizing a business credit application form template, you can present a stronger case to lenders with all necessary information at hand.