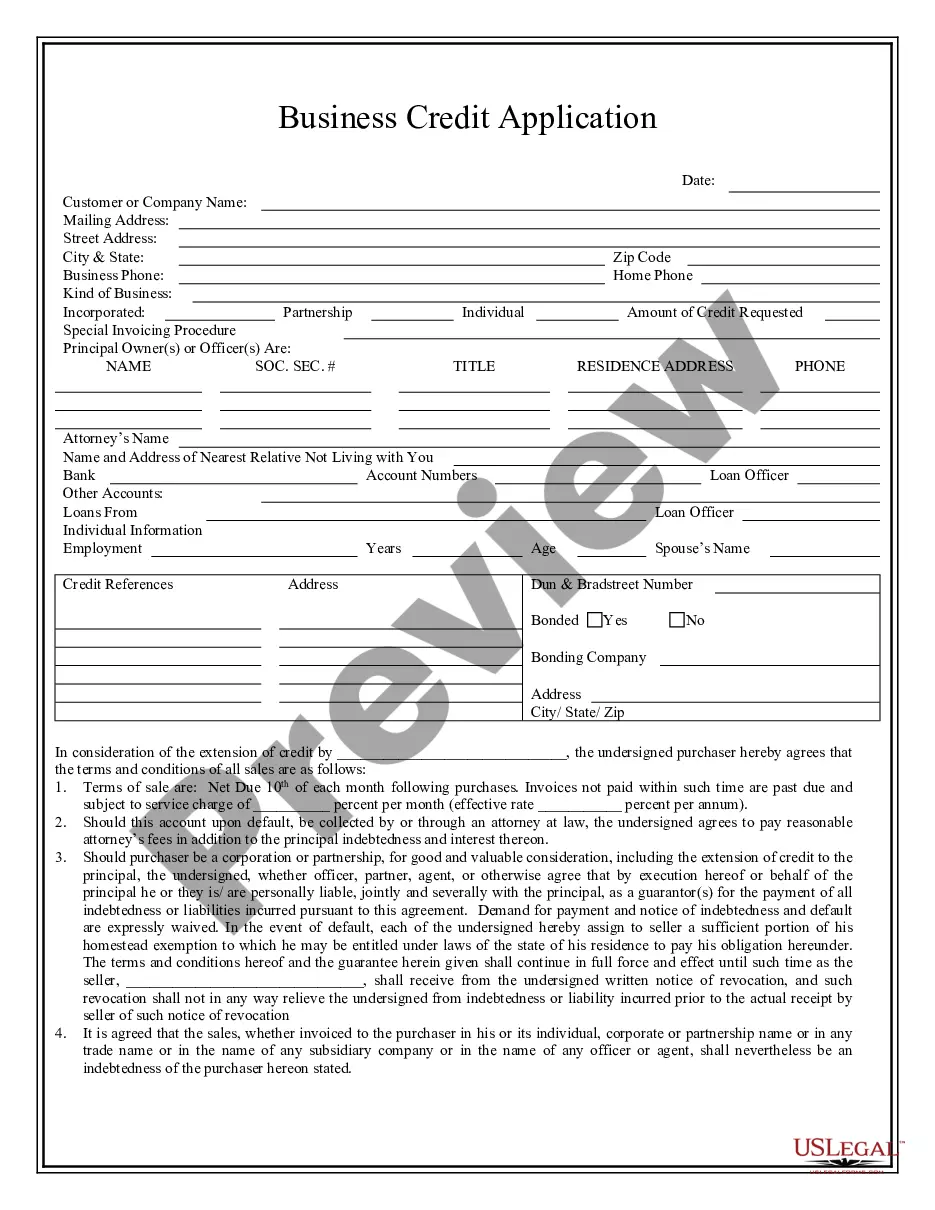

Business Application Form With Irs

Description

How to fill out Texas Business Credit Application?

Creating legal documents from the ground up can frequently be intimidating.

Certain circumstances may require extensive research and a significant financial investment.

If you're looking for a easier and more budget-friendly method for preparing Business Application Form With Irs or any other documentation without unnecessary complications, US Legal Forms is readily available.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters.

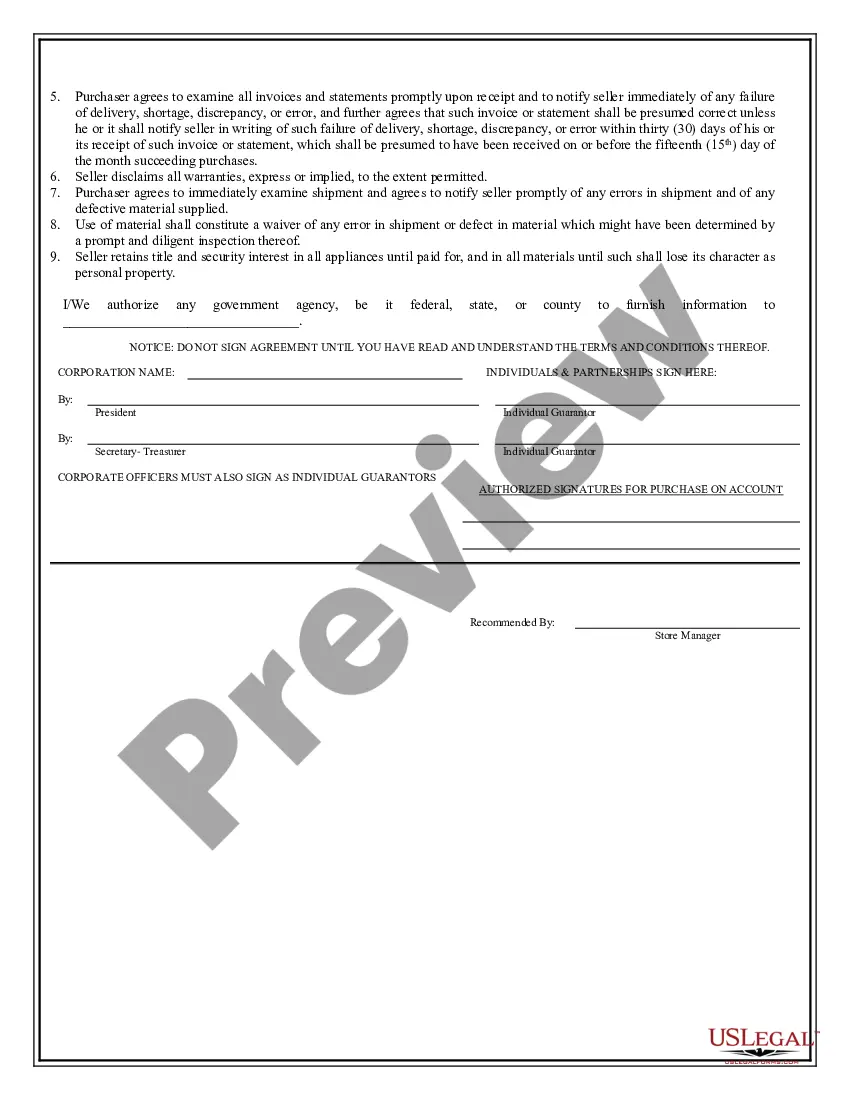

But before directly downloading the Business Application Form With Irs, adhere to these suggestions: Check the document preview and descriptions to ensure you have the correct document. Verify that the template you select meets your state and county specifications. Choose the most appropriate subscription plan to acquire the Business Application Form With Irs. Download the file, then complete, sign, and print it. US Legal Forms is well-regarded and boasts over 25 years of experience. Join us today and simplify the process of form execution!

- With just a couple of clicks, you can swiftly find templates that meet state and county regulations, carefully assembled by our legal experts.

- Utilize our website whenever you require dependable services where you can easily search for and obtain the Business Application Form With Irs.

- If you're familiar with our site and have previously registered an account, simply Log In to your account, select the form, and download it or retrieve it again anytime in the My documents section.

- Not yet registered? No worries. Setting it up takes just a few minutes, and you can browse the catalog easily.

Form popularity

FAQ

You can get the SS-4 form by visiting the IRS website or by using online resources that offer downloadable forms. This form is essential for establishing your business and serves as the primary business application form with IRS. Ensure you provide accurate information to facilitate a smooth application process. If you need help, US Legal Forms can help you access this form and provide guidance on completing it.

Step by Step: How to Apply for an EIN Go to the IRS website. ... Identify the legal and tax structure of your business entity. ... If your business is an LLC, provide information about the members. ... State why you are requesting an EIN. ... Identify and describe a contact person for the business. ... Provide the business' location.

Schedule C: Profit or Loss from Business is an Internal Revenue Service (IRS) tax form that is used to report income and expenses for a business.

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Income tax forms Sole business owners must also submit a Schedule C (Form 1040 or Form 1040-SR), Profit or Loss from Business. Additionally, partnerships must file an information return (Form 1065, U.S. Return of Partnership Income, and Form 965-A, Individual Report of Net 965 Tax Liability).

Use Form SS-4 to apply for an EIN. An EIN is a 9-digit number (for example, 12-3456789) assigned to sole proprietors, corporations, partnerships, estates, trusts, and other entities for tax filing and reporting purposes. The information you provide on this form will establish your business tax account.