Tx Terminate Withholding Tax

Description

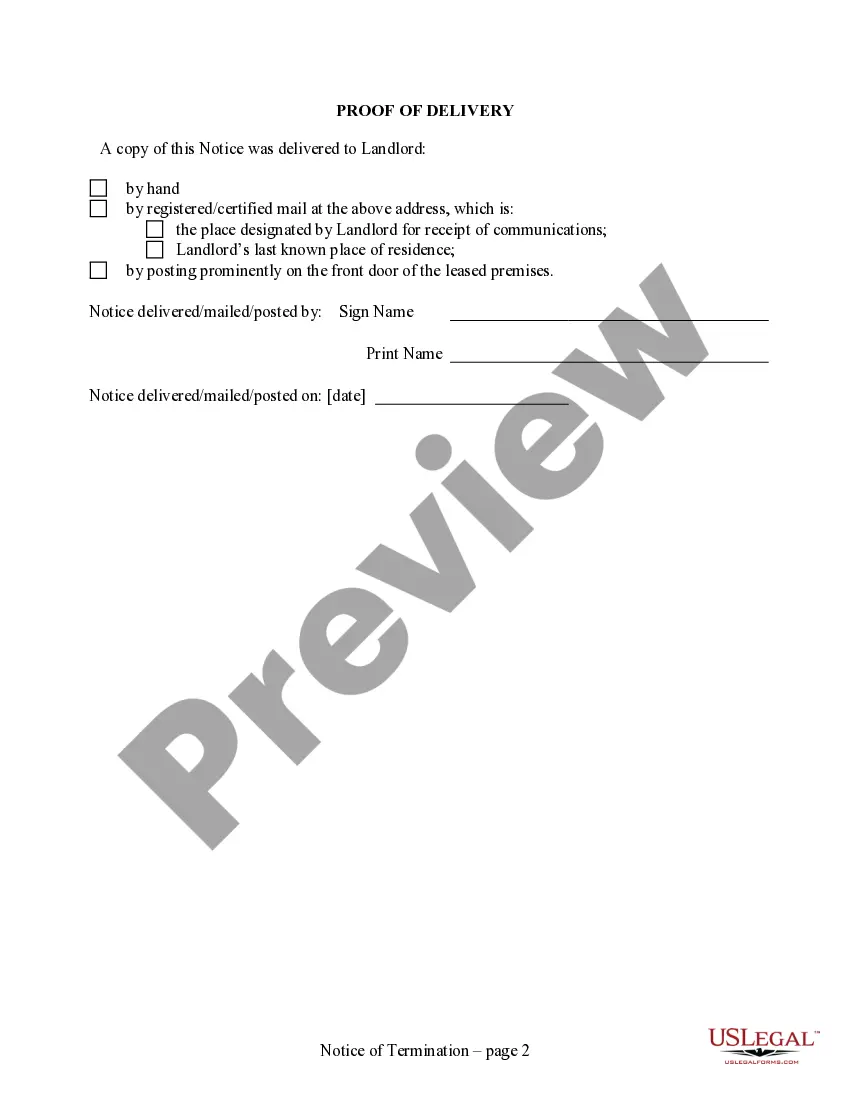

How to fill out Texas 30 Day Notice To Terminate Month To Month Lease For Residential From Tenant To Landlord?

Managing legal documents can be overwhelming, even for the most experienced individuals.

When you seek a Tx Terminate Withholding Tax and lack the time to locate the correct and updated version, the processes can be challenging.

Utilize a database of articles, guides, and manuals relevant to your specific circumstances and requirements.

Save time and effort looking for the documents you require by utilizing US Legal Forms' sophisticated search and Preview tool to find and obtain Tx Terminate Withholding Tax.

Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Transform your daily document management into a smooth and user-friendly experience today.

- If you have an account, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to see the documents you’ve downloaded before and manage your files as you wish.

- If you are new to US Legal Forms, create an account for unlimited access to all library benefits.

- After acquiring the form you need, confirm it is the correct document by previewing it and reviewing its details.

- Ensure the sample is accepted in your state or county.

- Select Buy Now when you are prepared.

- Choose a monthly subscription option.

- Select the desired file format, and then Download, complete, eSign, print, and send your documents.

- Access forms specific to your state or county for legal and business purposes.

- US Legal Forms addresses all your needs, from personal to business documents, all in one place.

- Employ advanced tools to complete and manage your Tx Terminate Withholding Tax.

Form popularity

FAQ

How do you dissolve a Texas corporation? To dissolve your Texas corporation, you file Form 651 Certificate of Termination of Domestic Entity and accompany that with a tax clearance certificate from the Texas Comptroller of Public Accounts indicating that all taxes have been paid by the entity.

You can notify the Comptroller's office that you are closing your account by entering the information on the Close Business Location webpage and selecting ?Close all outlets for this taxpayer number.?

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee. The form can be filed online. If you'd like to save yourself some time, you can hire us to dissolve your LLC for you.

If the Texas Comptroller forfeits an entity's ability to do business in the state, the entity will not be able to sue, and the entity's director and officers can be personally liable for the debts of the entity, including taxes. TBOC 171.252 and . 255.

How to Reinstate a Texas LLC. To revive a Texas LLC, you'll need to file either an Application for Reinstatement and Request to Set Aside Tax Forfeiture (Form 801) or a Texas Certificate of Reinstatement (Form 811) with the Texas Secretary of State.