Texas Filing Form Withholding

Description

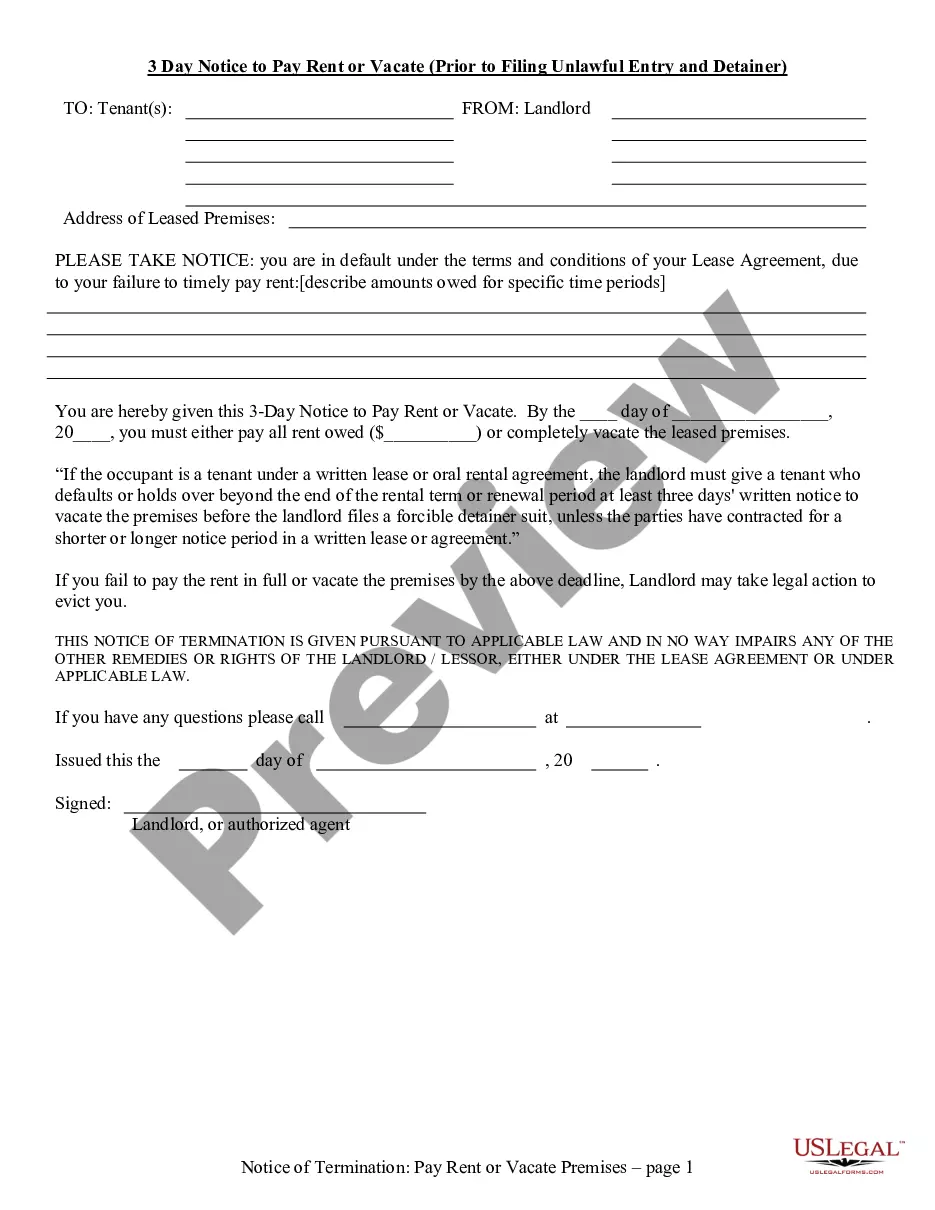

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Handling legal papers and operations can be a time-consuming addition to your day. Texas Filing Form Withholding and forms like it usually need you to search for them and navigate how you can complete them properly. For that reason, if you are taking care of financial, legal, or individual matters, having a extensive and convenient online library of forms when you need it will greatly assist.

US Legal Forms is the number one online platform of legal templates, offering over 85,000 state-specific forms and a number of tools to assist you to complete your papers quickly. Check out the library of appropriate papers open to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your document management procedures using a top-notch services that allows you to prepare any form within a few minutes without any additional or hidden fees. Just log in to the account, find Texas Filing Form Withholding and acquire it straight away in the My Forms tab. You may also access formerly saved forms.

Would it be your first time utilizing US Legal Forms? Register and set up up your account in a few minutes and you will gain access to the form library and Texas Filing Form Withholding. Then, follow the steps below to complete your form:

- Ensure you have discovered the correct form by using the Preview option and looking at the form description.

- Pick Buy Now when all set, and choose the monthly subscription plan that suits you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise helping users manage their legal papers. Get the form you require today and streamline any operation without having to break a sweat.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

How you fill out a W-4 can have a major effect on whether taxes are owed or a refund is given. Step 1: Enter your personal information. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

For 2023, you do not use the W-4 form to claim withholding allowances any longer. It has changed! You might be wondering what it means to claim a 0 or 1 on a W-4, but it's important to note that in 2023, you don't use the W-4 form to claim withholding allowances.

Unless your employees work in a state with no state income tax, they generally must fill out the W-4 state tax form before starting a new job. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax.