Fha Loan Winnipeg

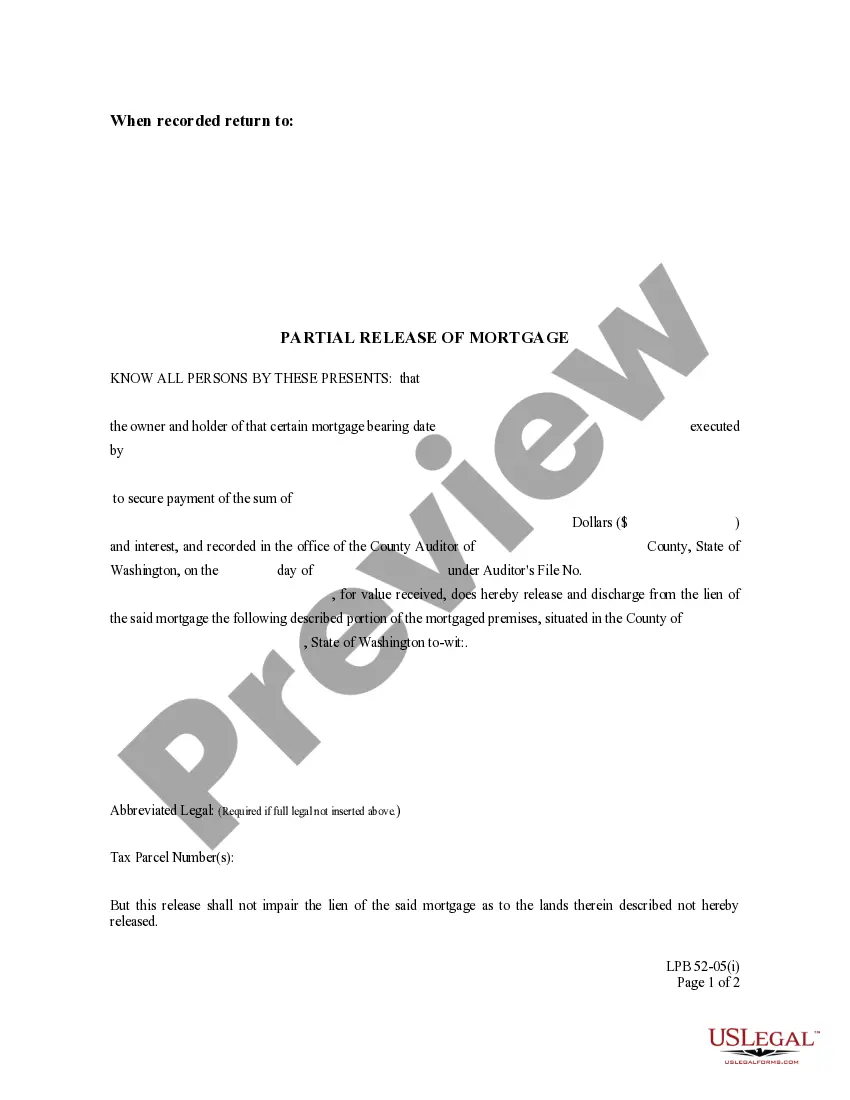

Description

How to fill out Texas Financing?

- If you're an existing user, log in to your account and select the desired template. Ensure your subscription is active; otherwise, renew it based on your payment plan.

- For first-time users, start by browsing through the Preview mode to examine the descriptions of the forms available. Confirm that the template aligns with your needs and adheres to local regulations.

- If you can't find the right form, utilize the Search feature at the top of the page to discover alternative templates that fit your requirements.

- Once you've identified the correct document, click on the Buy Now button and select your preferred subscription level. You will need to create an account to access the full library.

- Proceed with the purchase by entering your credit card information or using your PayPal account to finalize your subscription payment.

- Download the selected template onto your device for easy access. You can later find it in the My Forms section of your profile.

By using US Legal Forms, you're benefitting from an extensive library of over 85,000 editable legal templates that cater specifically to your needs. Their vast collection ensures you have access to far more forms than competitors, along with expert assistance.

Explore US Legal Forms today and experience a more efficient way to manage your legal documents. Unlock the convenience of getting your FHA loan forms in Winnipeg easily!

Form popularity

FAQ

The amount FHA will approve you for depends on several factors, including your income, credit score, and debt-to-income ratio. Generally, FHA loans allow for a higher debt ratio compared to conventional loans, which can benefit borrowers in Winnipeg. It's essential to provide your financial information accurately to receive the best estimate. For tailored guidance, consider using US Legal Forms to explore your options for FHA loans in Winnipeg.

FHA loans in Winnipeg will not be approved for properties that do not meet certain guidelines. This includes properties with significant damage, those located in flood zones without proper insurance, or homes classified as investment properties. It's essential to understand these limitations as they can affect your home buying journey. Using services like US Legal Forms can assist you in navigating these regulations effectively.

An FHA inspection focuses on the safety and livability of the home. Issues like structural problems, missing handrails, or unsafe electrical systems can lead to a failed inspection. Buyers should keep in mind that FHA loans in Winnipeg require homes to meet specific health and safety standards. Preparing your property accordingly can help ensure a smoother process.

In Manitoba, the required down payment often starts at 5% for homes purchased up to $500,000. This applies to many financing options, including FHA loans in Winnipeg, which support buyers in achieving homeownership with lower down payments. Be sure to evaluate your finances to determine what works best for your situation.

The best bank for FHA loans in Winnipeg often depends on your individual needs and preferences. However, you should look for lenders that specialize in FHA loans and offer competitive rates. Banks with a solid understanding of the FHA program can provide tailored advice and support. To find the right lender, consider using tools available through US Legal Forms to compare various lenders and their offerings.