Eviction Process In Texas For Apartments

Description

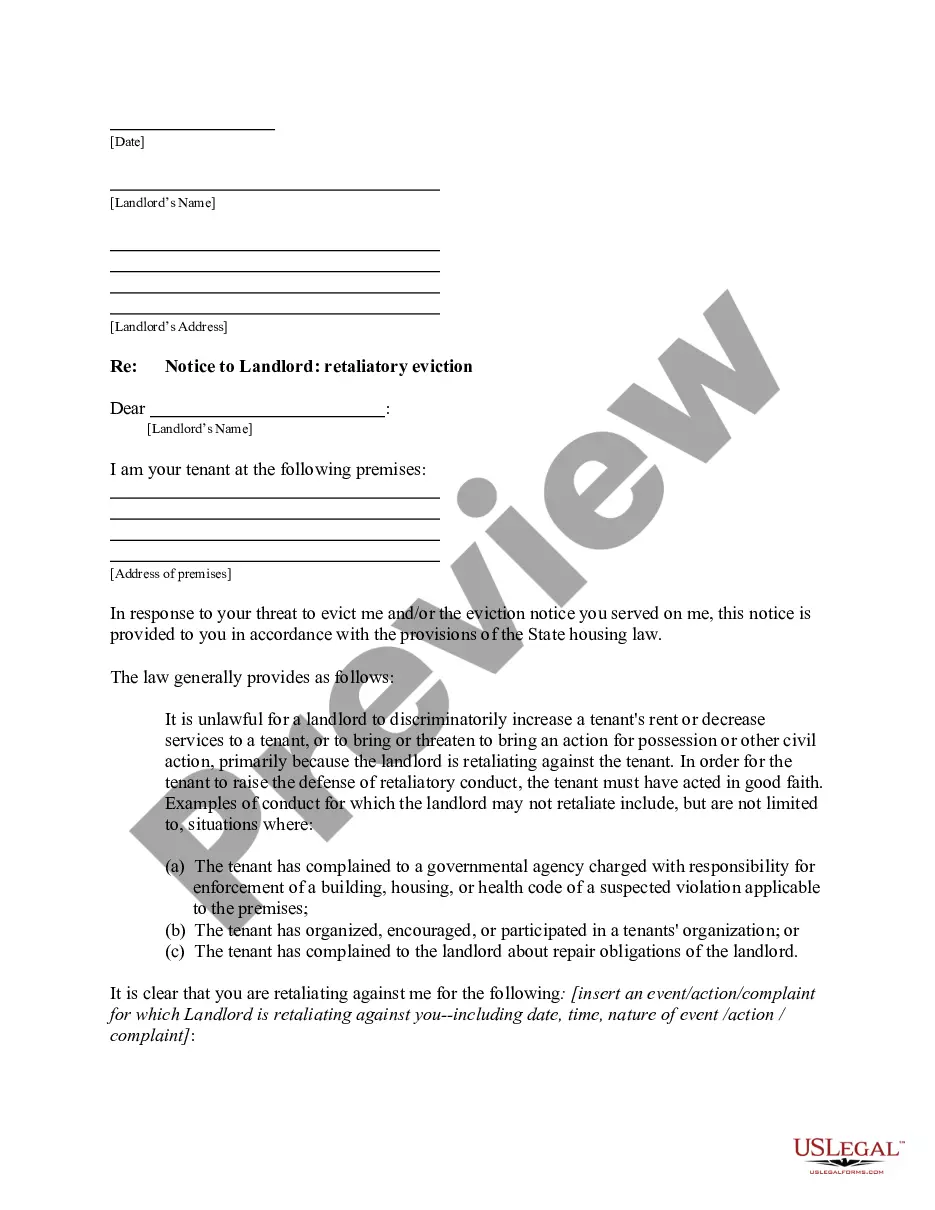

How to fill out Texas Letter From Tenant To Landlord Containing Notice To Landlord To Cease Retaliatory Threats To Evict Or Retaliatory Eviction?

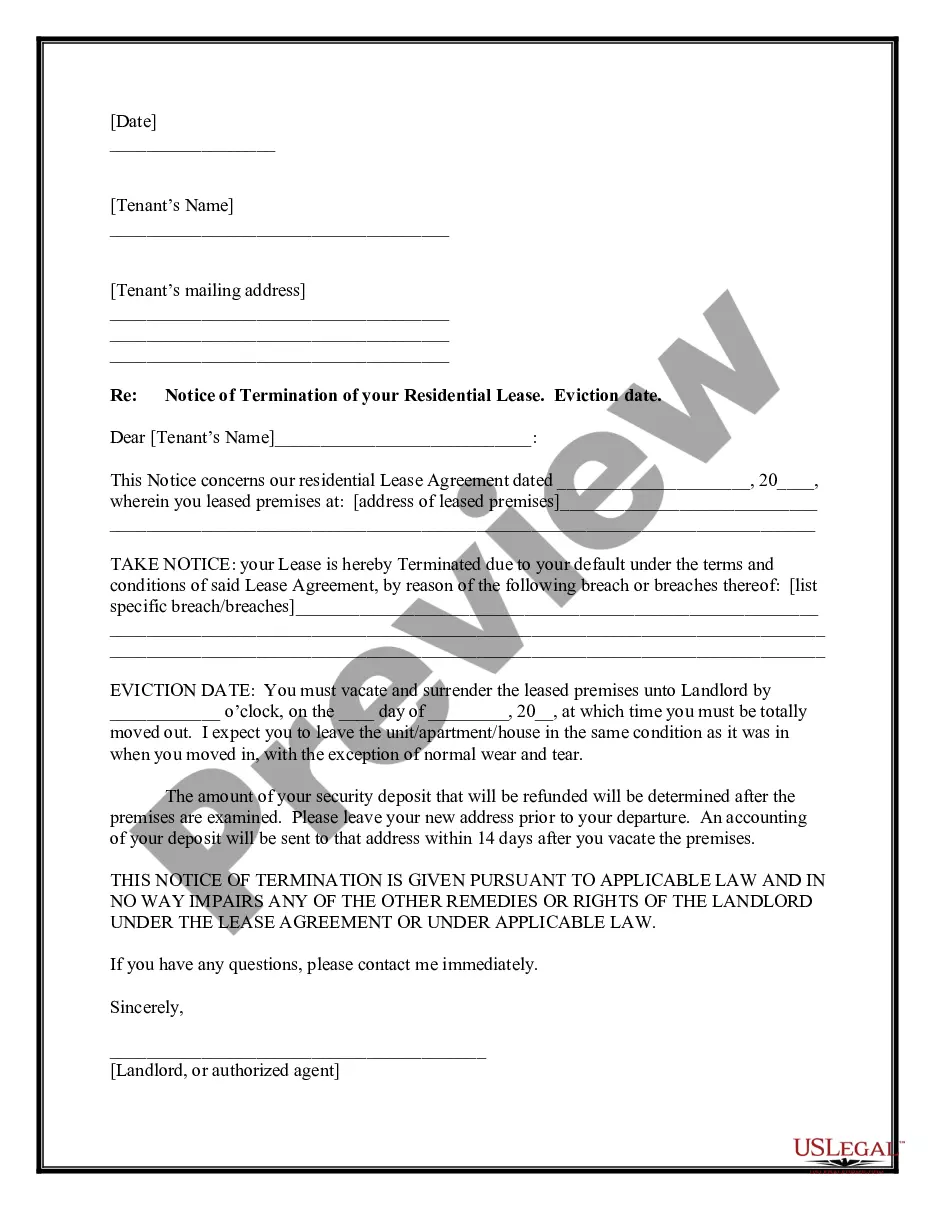

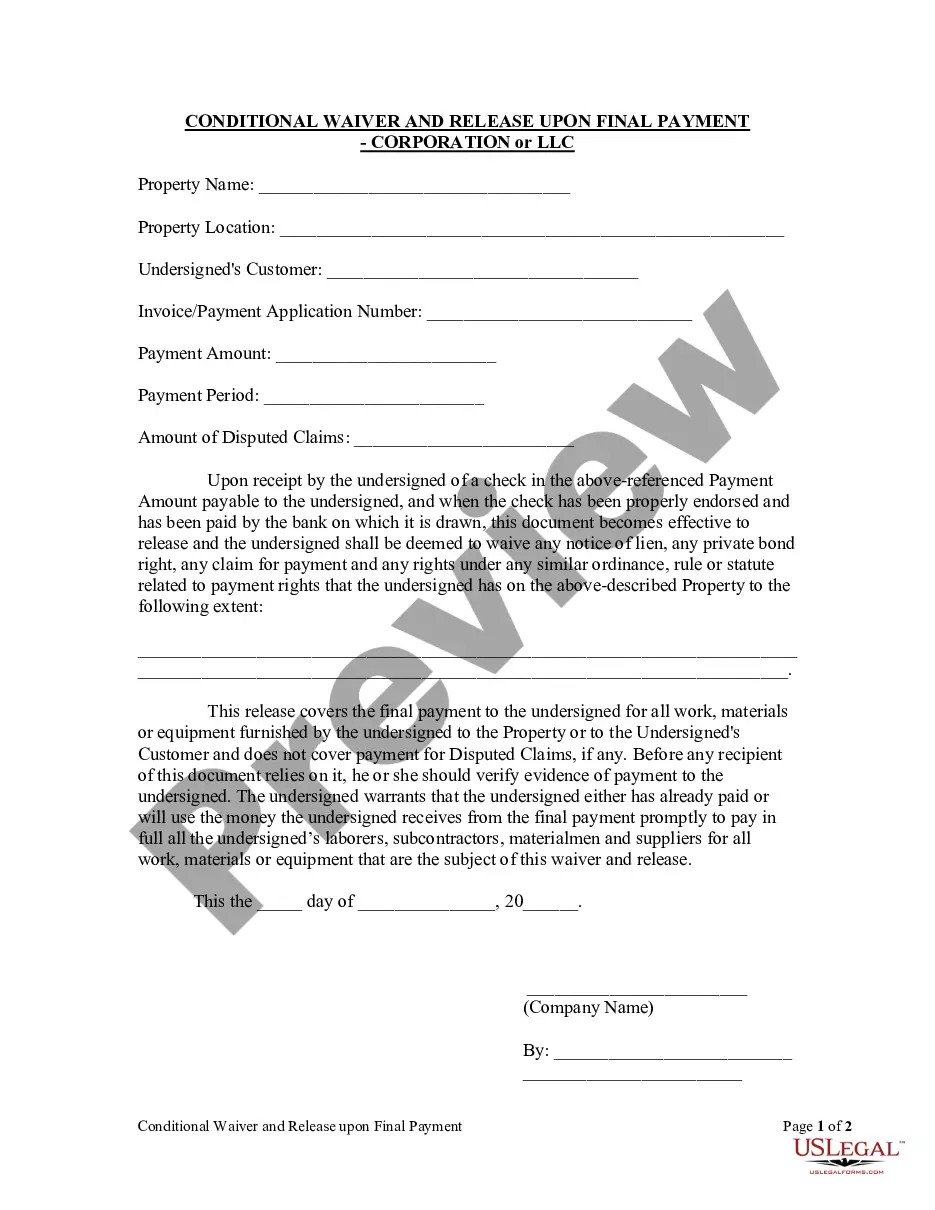

The Eviction Procedure in Texas for Apartments you see on this page is a reusable legal framework drafted by experienced attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal circumstance. It’s the fastest, simplest, and most dependable way to acquire the documents you require, as the service assures the highest level of data security and anti-malware safeguards.

Choose the format you want for your Eviction Process in Texas for Apartments (PDF, Word, RTF) and save the template on your device.

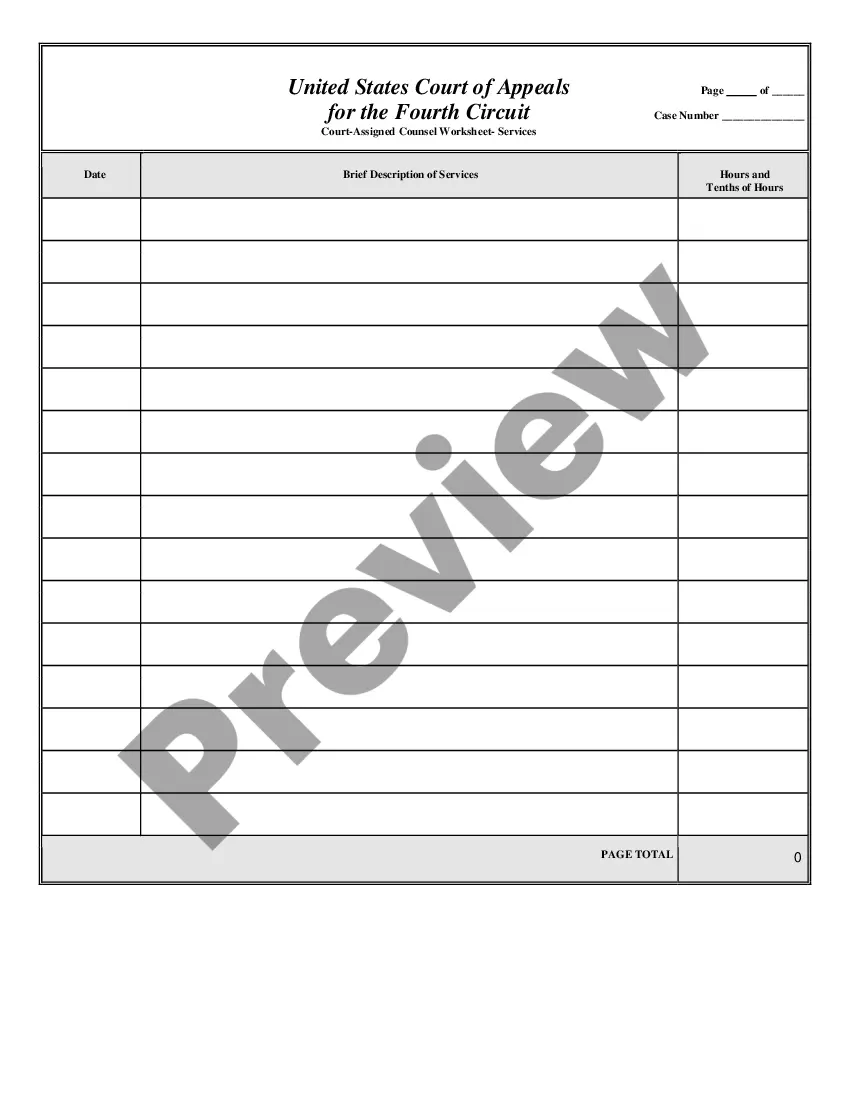

- Search for the document you need and examine it.

- Browse through the example you looked for and preview it or review the form description to ensure it meets your needs. If not, use the search function to find the correct one. Click Buy Now once you have found the template you require.

- Sign up and Log In.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card to process your payment promptly. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

Individuals: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file a return if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

A POA is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer. All applicable items must be filled in to properly complete Form DP-2848 New Hampshire Power of Attorney (POA).

You may file this return and pay the tax due online by logging on to .revenue.nh.gov/. If the net balance due is less than $1.00, do not pay but still file the return. If you file online, you do not need to mail the return to NH DRA.

New Hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 5% tax on dividends and interest. However, due to legislation, the tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

New Hampshire has no personal income tax, which means Social Security retirement benefits are tax-free at the state level. Income from pensions and retirement accounts also go untaxed in New Hampshire. On top of that, there is no sales tax, estate tax or inheritance tax here.

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

New Hampshire, NH State Income Taxes. New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return.