Tax Correction Form Online With Example

Description

How to fill out Texas Correction Warranty Deed?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and substantial financial investment.

If you’re looking for a simpler and more economical method of generating Tax Correction Form Online With Example or any other paperwork without unnecessary complications, US Legal Forms is readily available.

Our online catalog of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters.

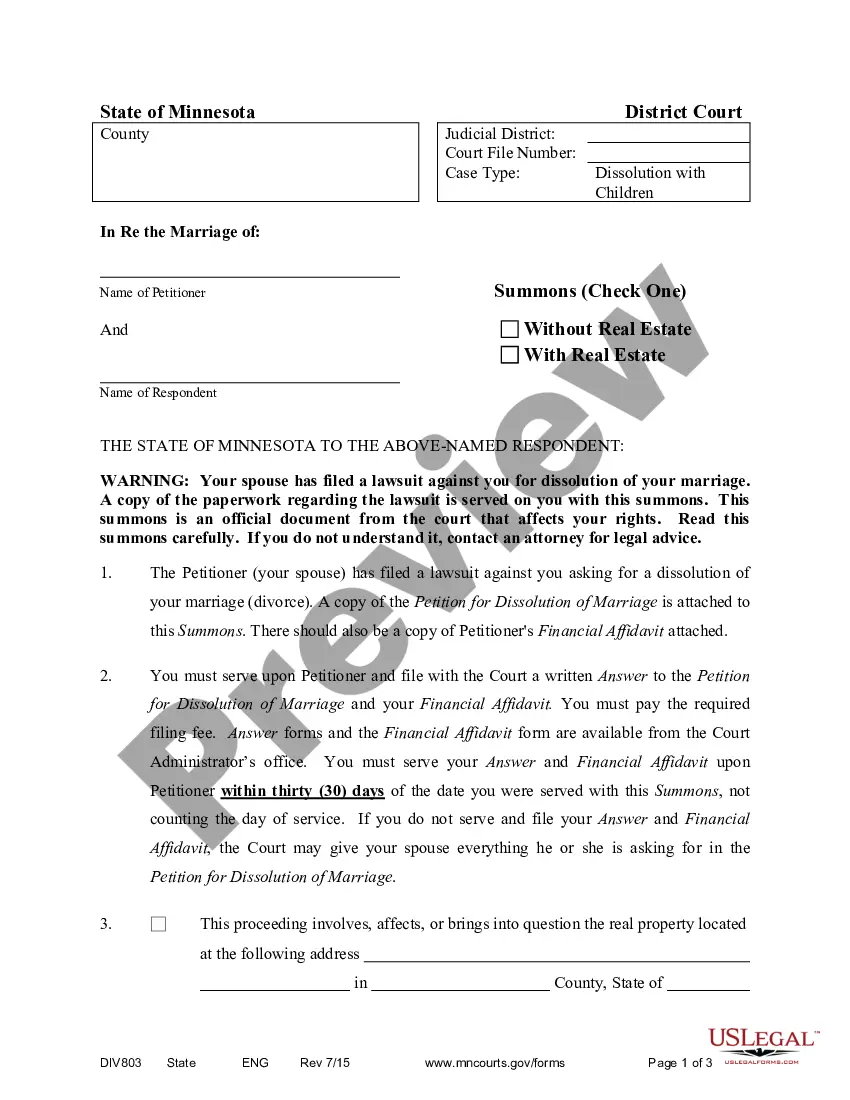

Examine the form preview and descriptions to ensure you have located the document you need. Verify that the template you select aligns with the laws and regulations of your state and county. Choose the most suitable subscription plan to acquire the Tax Correction Form Online With Example. Download the document, then complete it, sign it, and print it out. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and make document handling straightforward and efficient!

- With just a few clicks, you can swiftly access state- and county-compliant templates meticulously crafted by our legal professionals.

- Utilize our platform whenever you require dependable and trustworthy services to easily find and download the Tax Correction Form Online With Example.

- If you are familiar with our site and have already created an account, simply Log In to your account, choose the template, and download it or re-download it anytime later in the My documents section.

- Don’t have an account? No problem. It takes just a few minutes to sign up and explore the library.

- However, before directly downloading the Tax Correction Form Online With Example, adhere to these suggestions.

Form popularity

FAQ

Most individual tax returns can be amended by mailing in a Form 1040X. This form amends a previously filed Form 1040, Form 1040A, or 1040EZ Forms. You can use this Form 1040X if there are changes in your filing status, income, credits or deductions.

You can now file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 and 1040-SR, and 2021 or later Forms 1040-NR. For more details, see our June 2022 news release on this topic. Paper filing is still an option for Form 1040-X.

Use Form 1040X, Amended U.S. Individual Income Tax Return, to file an amended tax return. Be advised ? you can't e-file an amended return. A paper form must be mailed.

If you discover an error after filing your return, you may need to amend your return. Use Form 1040-X to correct a previously filed Form 1040, 1040-SR, or 1040-NR, or to change amounts previously adjusted by the IRS.

Amending Returns Electronically Select the period for which you want to submit an amended return for under "Recent Periods" tab. Select "File, Amend, or Print a Return" under the "I Want To" column. Select "Amend Return" under the "I Want To" column. Complete the online tax return with your amended figures.