Deed Of Trust Format

Description

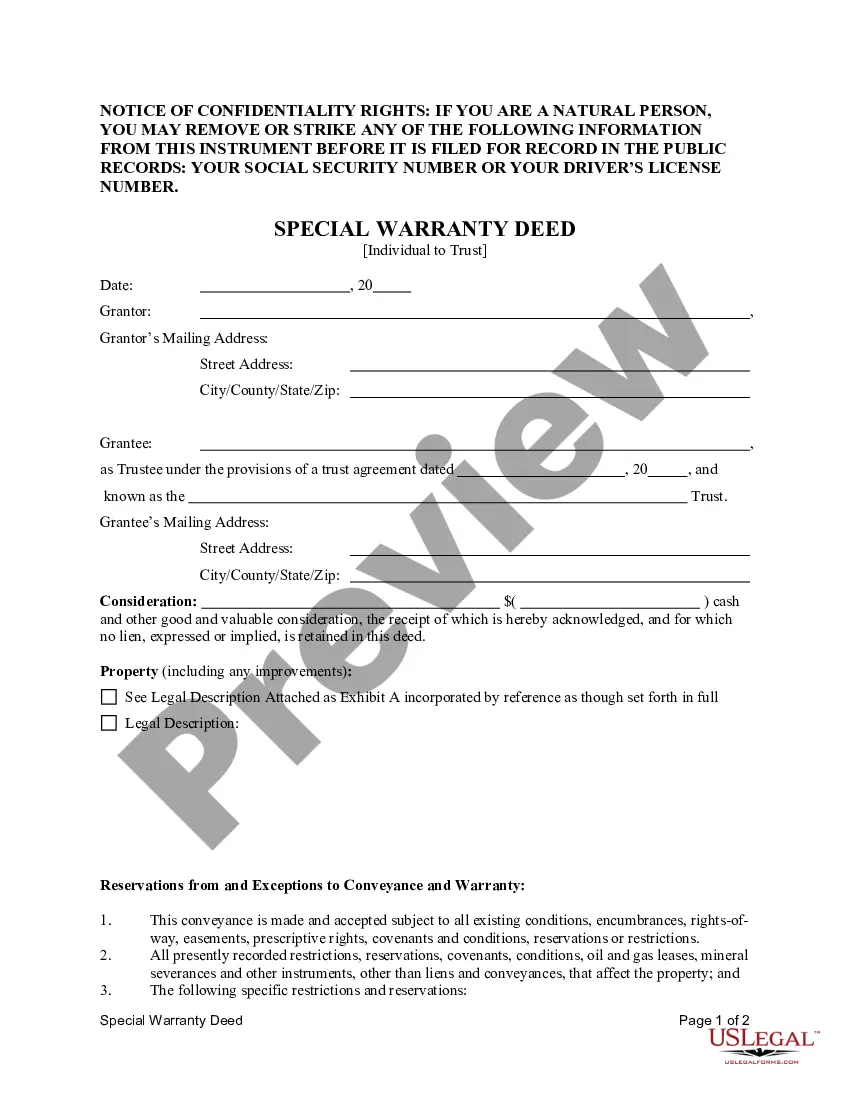

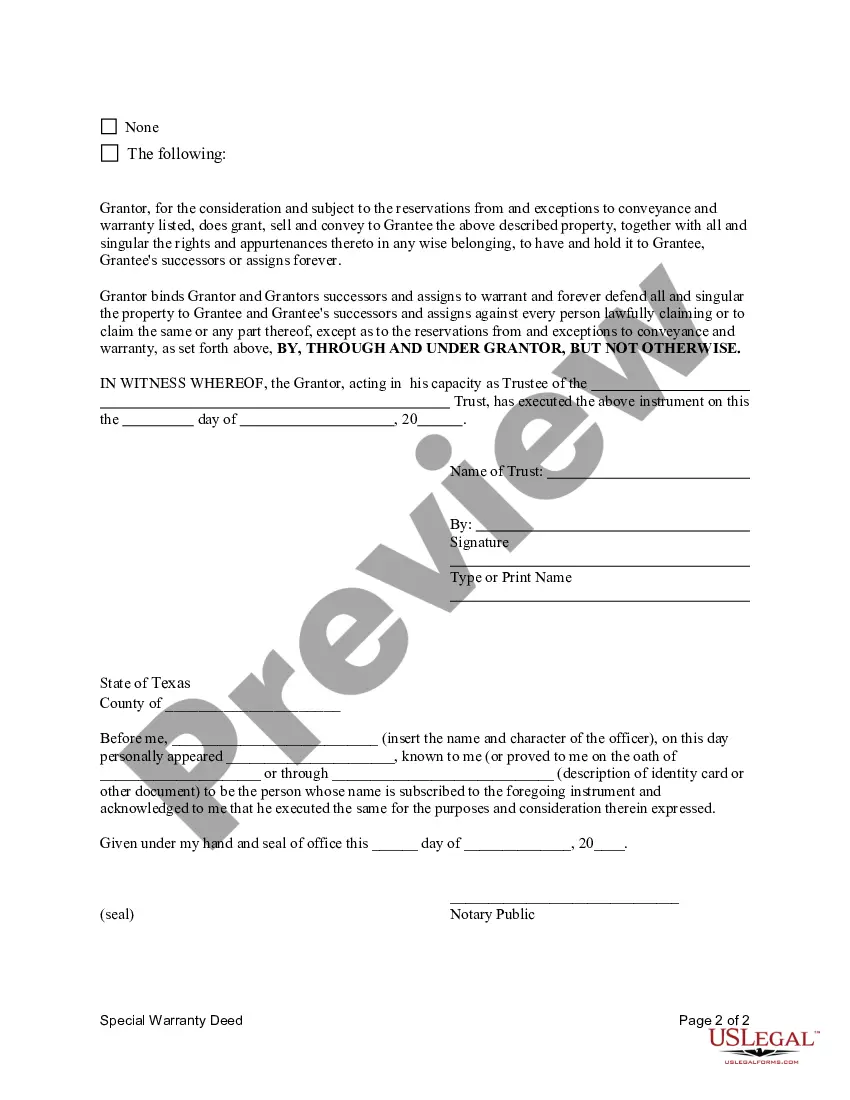

How to fill out Texas Special Warranty Deed From An Individual To A Trust?

It’s obvious that you can’t become a legal professional overnight, nor can you grasp how to quickly prepare Deed Of Trust Format without the need of a specialized set of skills. Creating legal documents is a time-consuming process requiring a certain education and skills. So why not leave the creation of the Deed Of Trust Format to the pros?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the form you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Deed Of Trust Format is what you’re looking for.

- Start your search over if you need any other template.

- Set up a free account and choose a subscription plan to purchase the form.

- Pick Buy now. As soon as the transaction is complete, you can get the Deed Of Trust Format, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.