Tx Information Law For 2023

Description

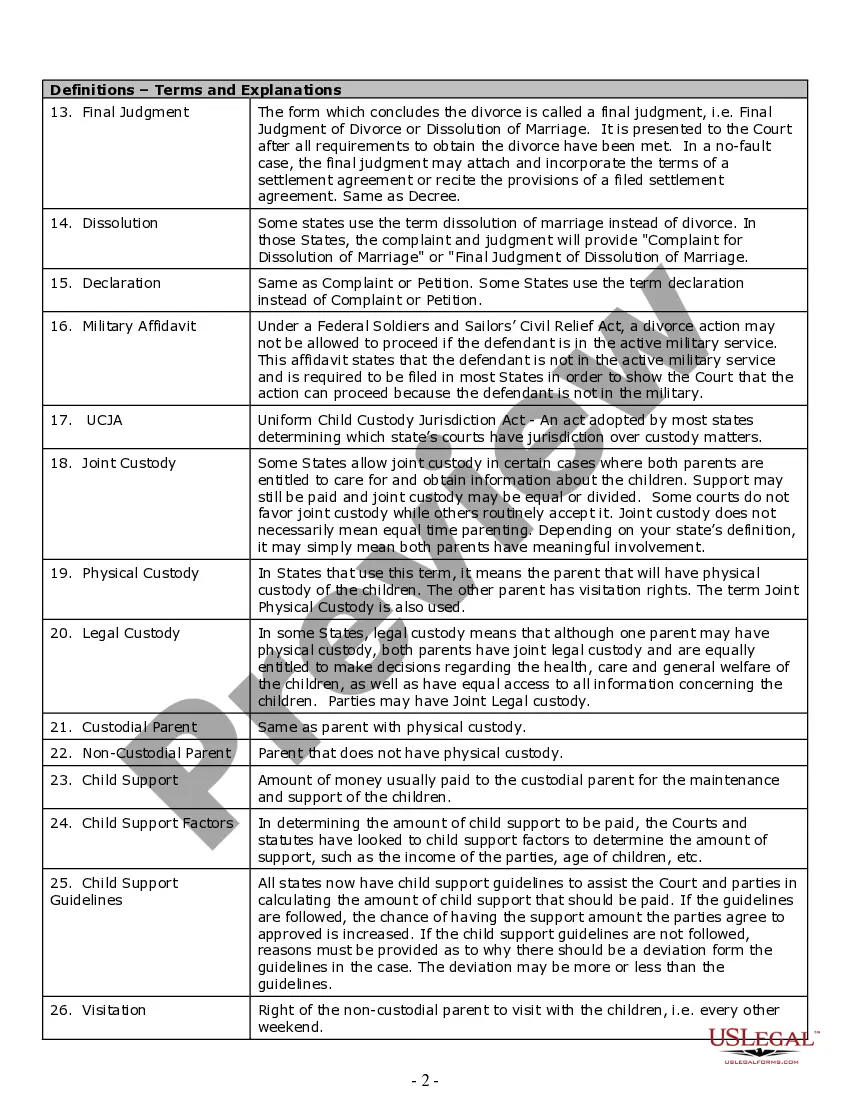

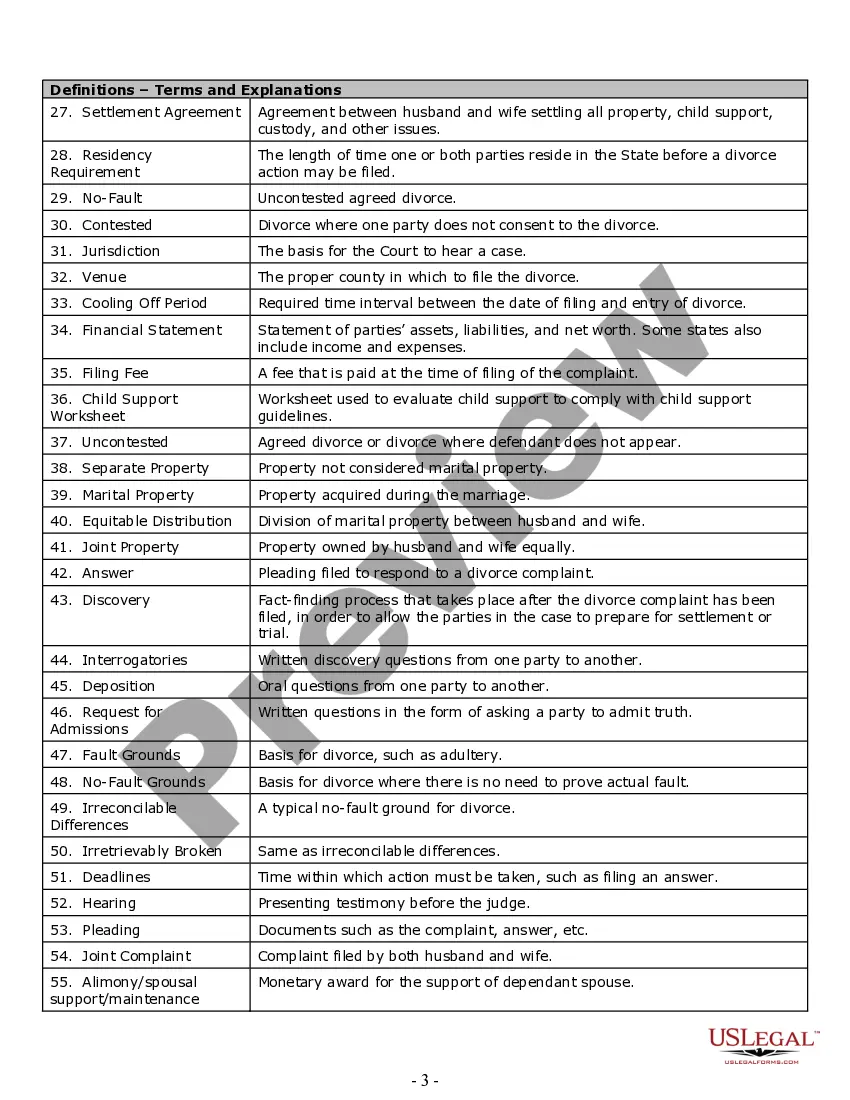

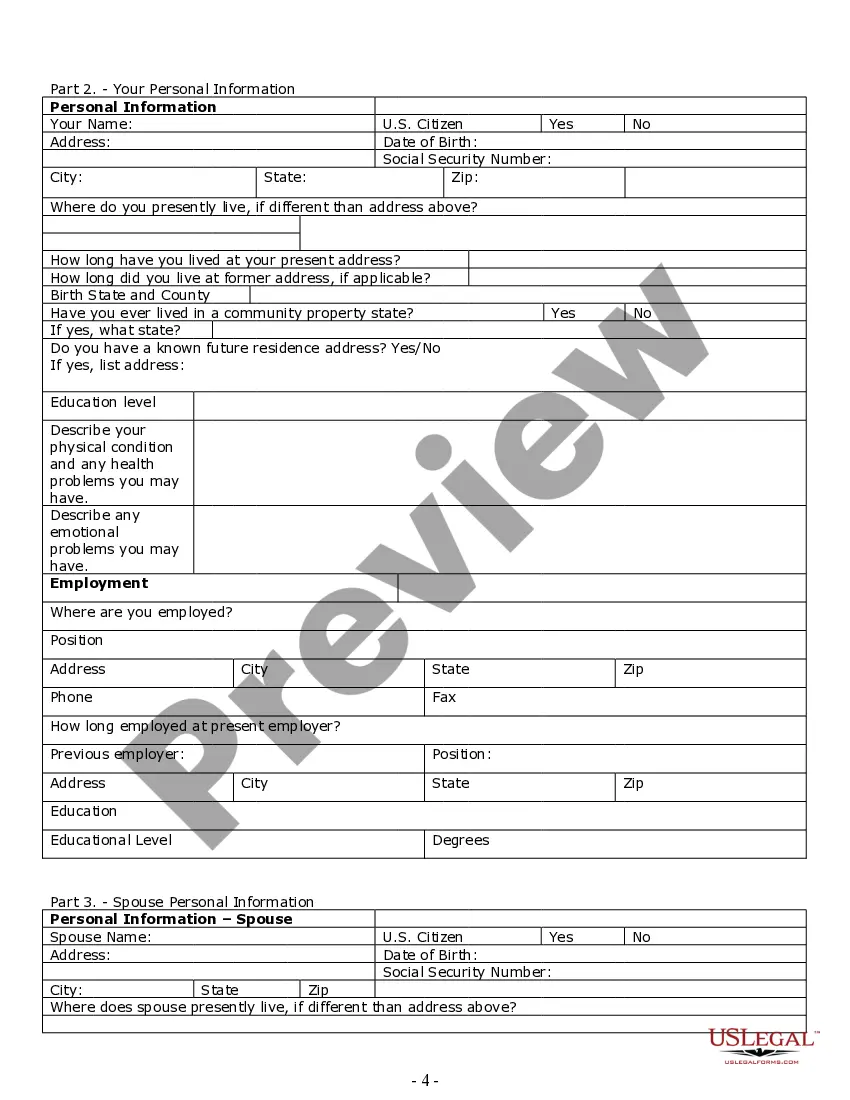

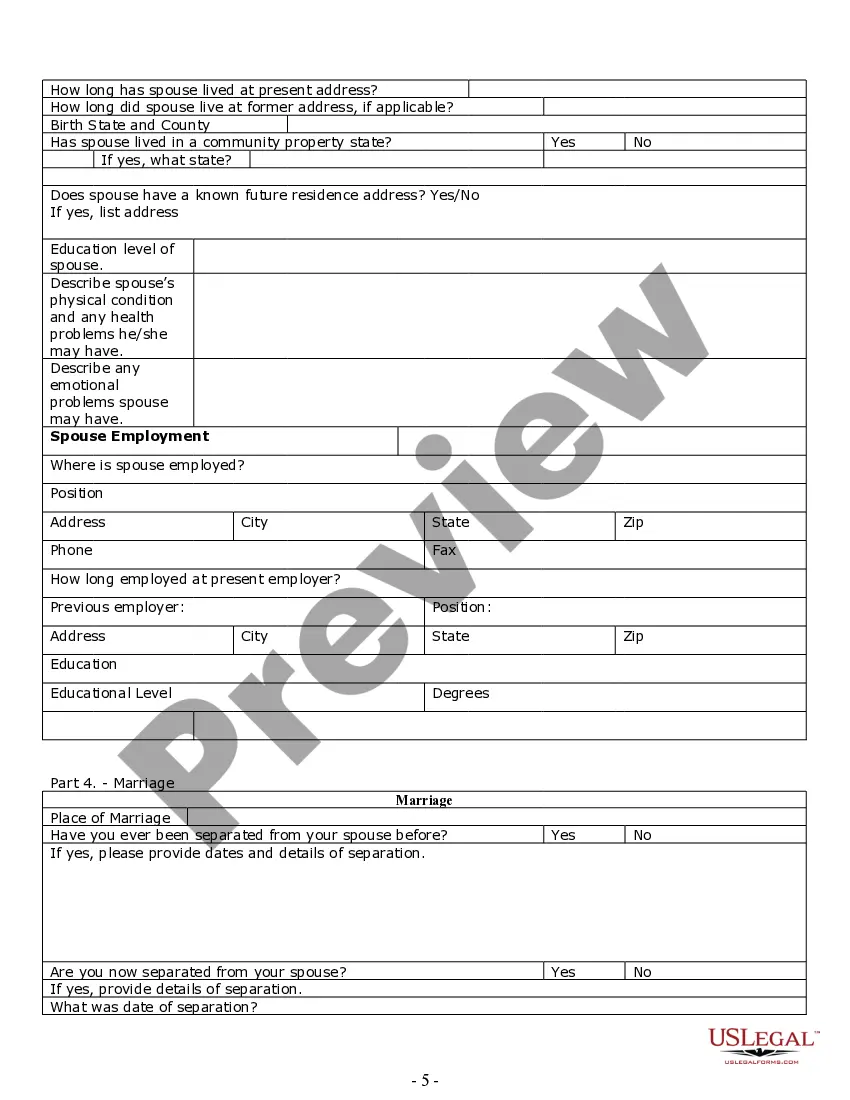

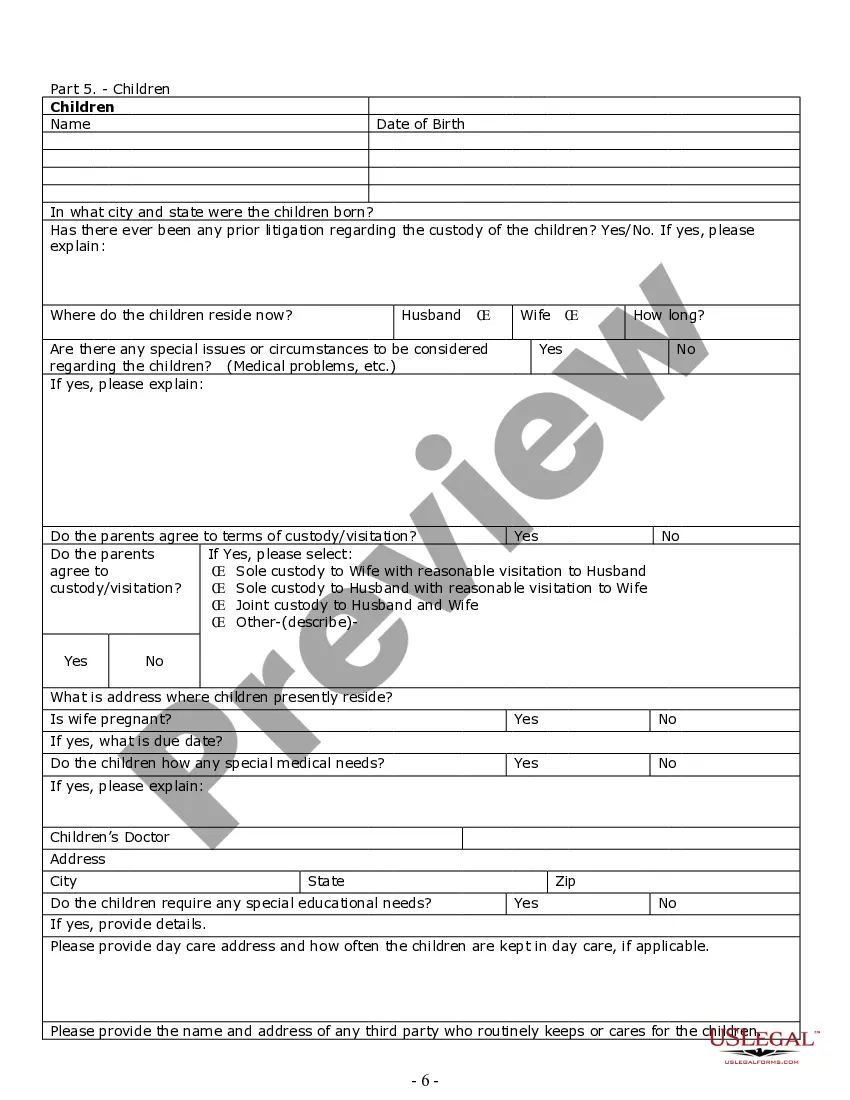

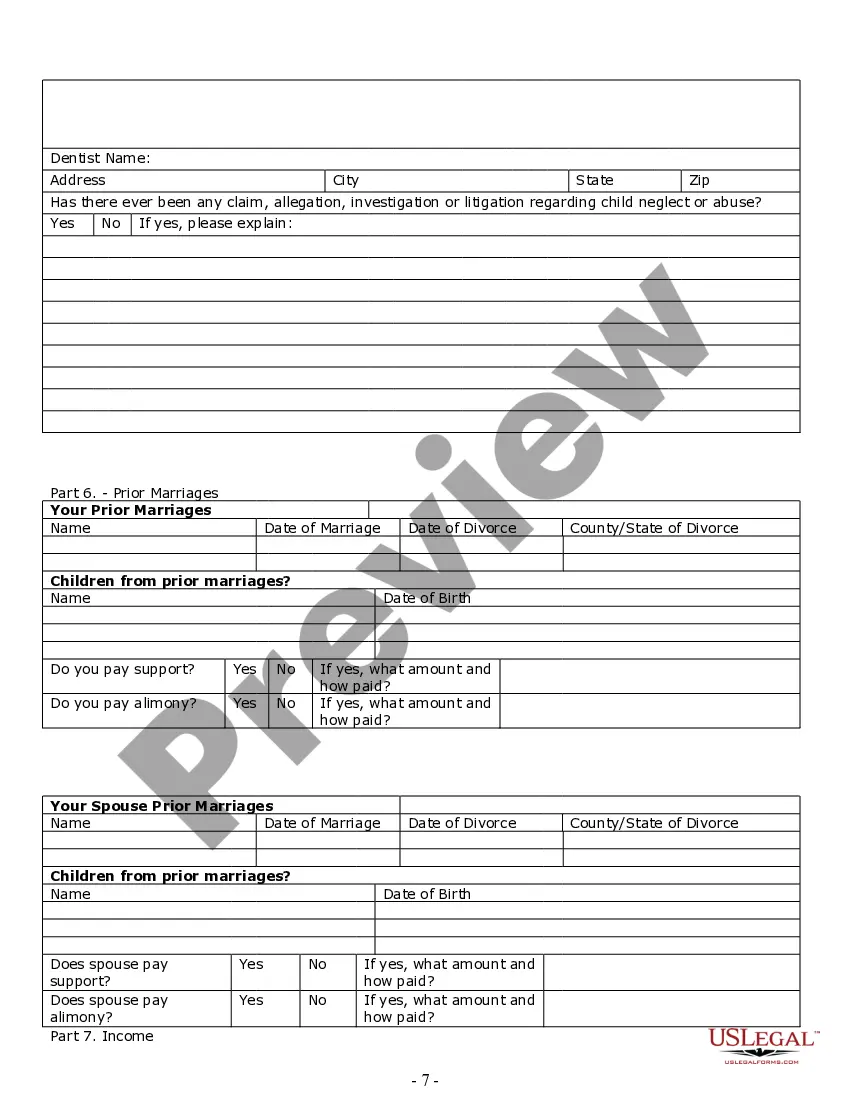

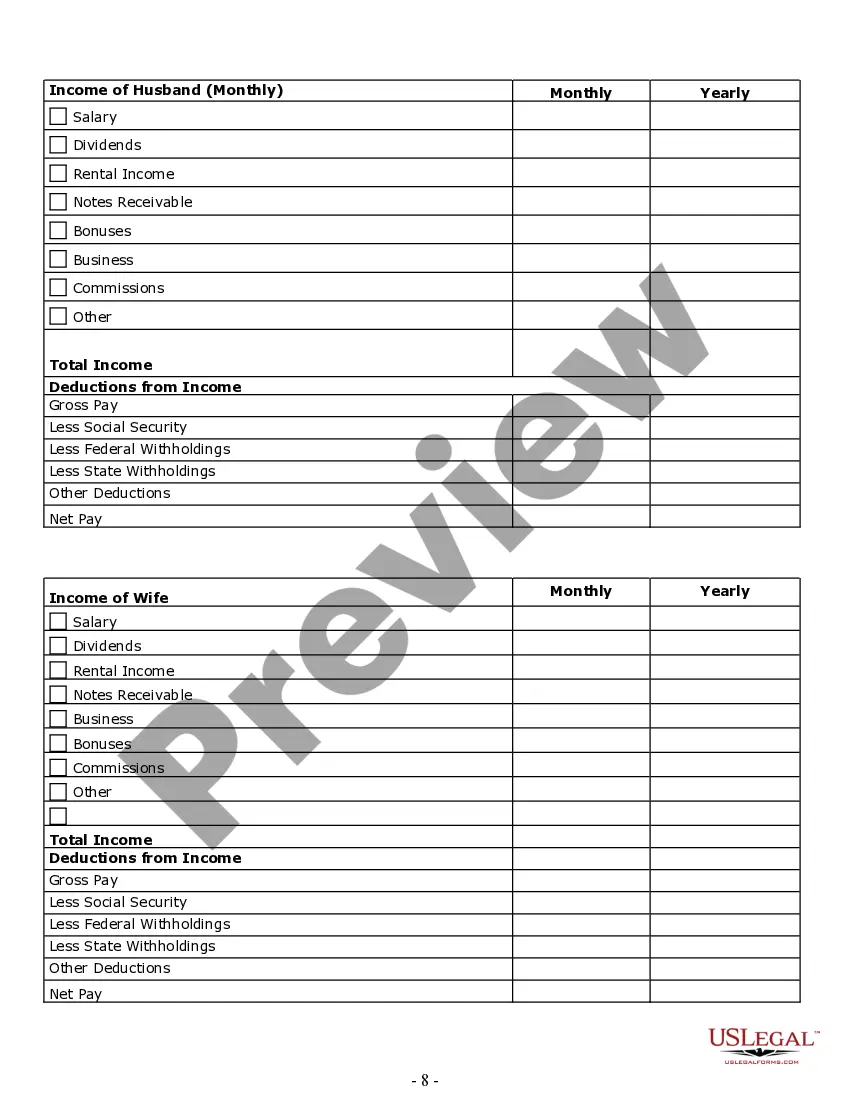

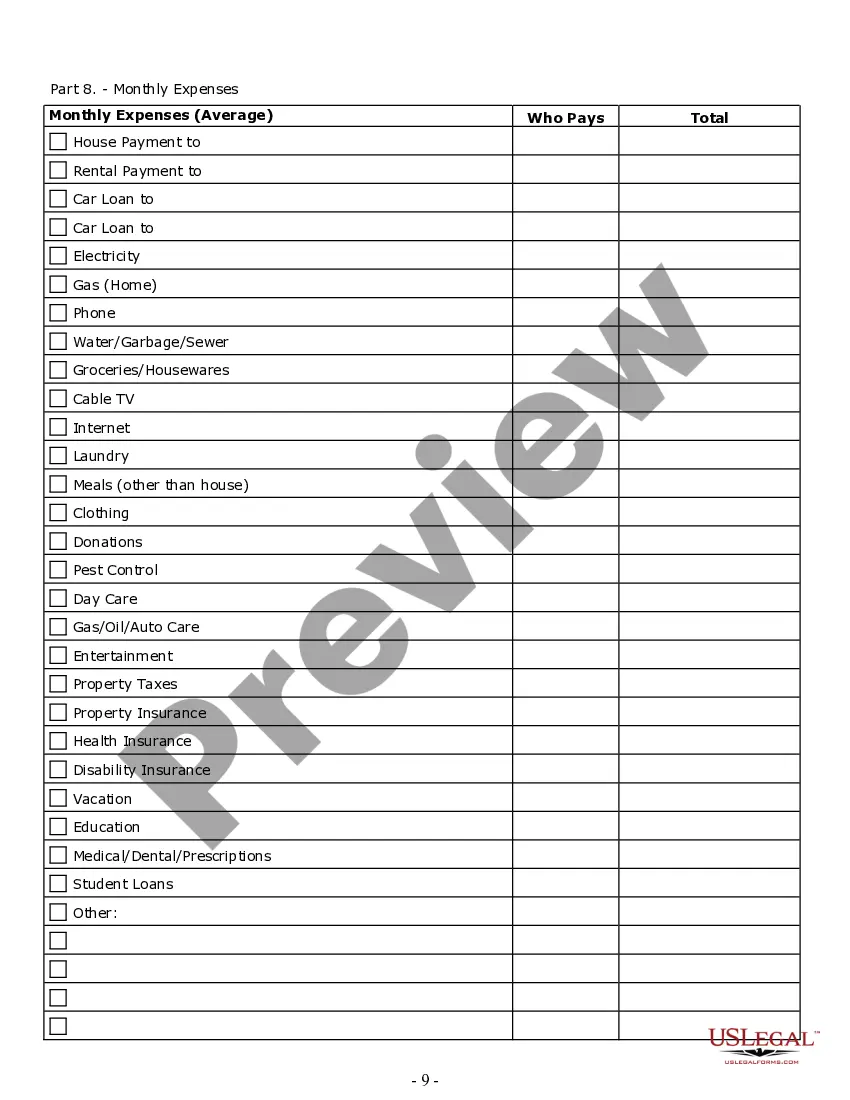

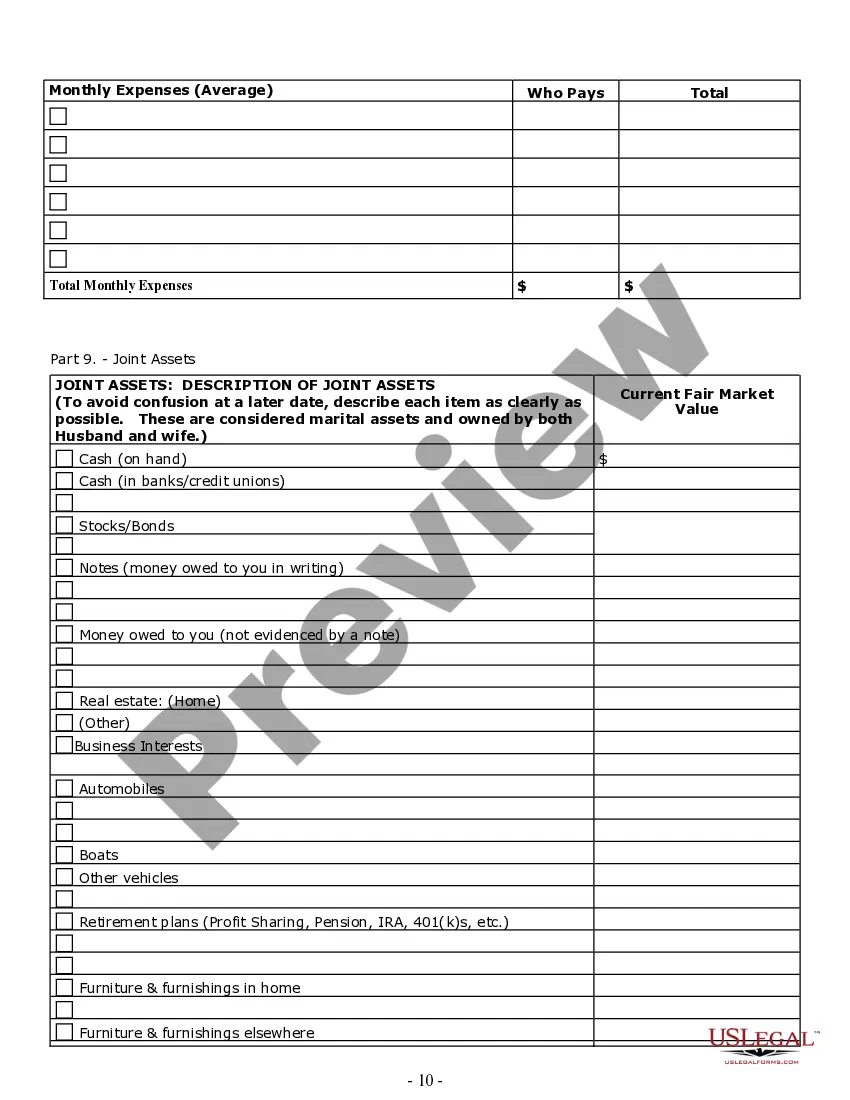

How to fill out Texas Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

The Tx Information Law For 2023 displayed on this page is a versatile official template created by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with more than 85,000 validated, state-specific documents for any personal and business situation. It’s the fastest, most direct, and most reliable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Pick the format you desire for your Tx Information Law For 2023 (PDF, Word, RTF) and save the document on your device.

- Search for the document you need and review it.

- Browse the file you searched and preview it or examine the form description to verify it meets your needs. If it doesn’t, utilize the search function to find the correct one. Click Buy Now when you’ve found the template you require.

- Sign up and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

The bill was signed by Abbott and takes effect on Sept. 1, 2023. SB 14 bans procedures and treatments for gender transitioning, gender reassignment, or gender dysphoria for children. Public money and public assistance are also prohibited from being used to provide those treatments.

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023. $1,180,000 for reports due in 2020-2021. $1,130,000 for reports due in 2018-2019.

774 new Texas laws go into effect on Sept. Another bans college transgender athletes from competing on teams that match their gender identity and one requires drunken drivers to cause the death of a parent to pay child support to the victim's surviving children. "774 new Texas laws go into effect Friday.

Filing Your Texas Annual Franchise Tax Report On the state website, go to the Franchise Tax page. If you wish to file online, click ?webfile eSystems Login.? If you wish you to file by mail, click ?Forms.?