Correction Deed Form Texas Withholding Tax

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

Locating a reliable source for the latest and suitable legal templates is a significant part of navigating red tape.

Acquiring the appropriate legal documents requires accuracy and careful observation, which is why it's crucial to source Correction Deed Form Texas Withholding Tax exclusively from reputable providers, such as US Legal Forms.

Once you have the form on your device, you can modify it using the editor or print it for manual completion. Eliminate the burdens associated with your legal paperwork. Explore the extensive US Legal Forms library, where you can locate legal documents, evaluate their applicability to your situation, and download them instantly.

- Make use of the catalog navigation or search bar to find your template.

- Examine the form's details to ensure it meets the specifications of your state and locality.

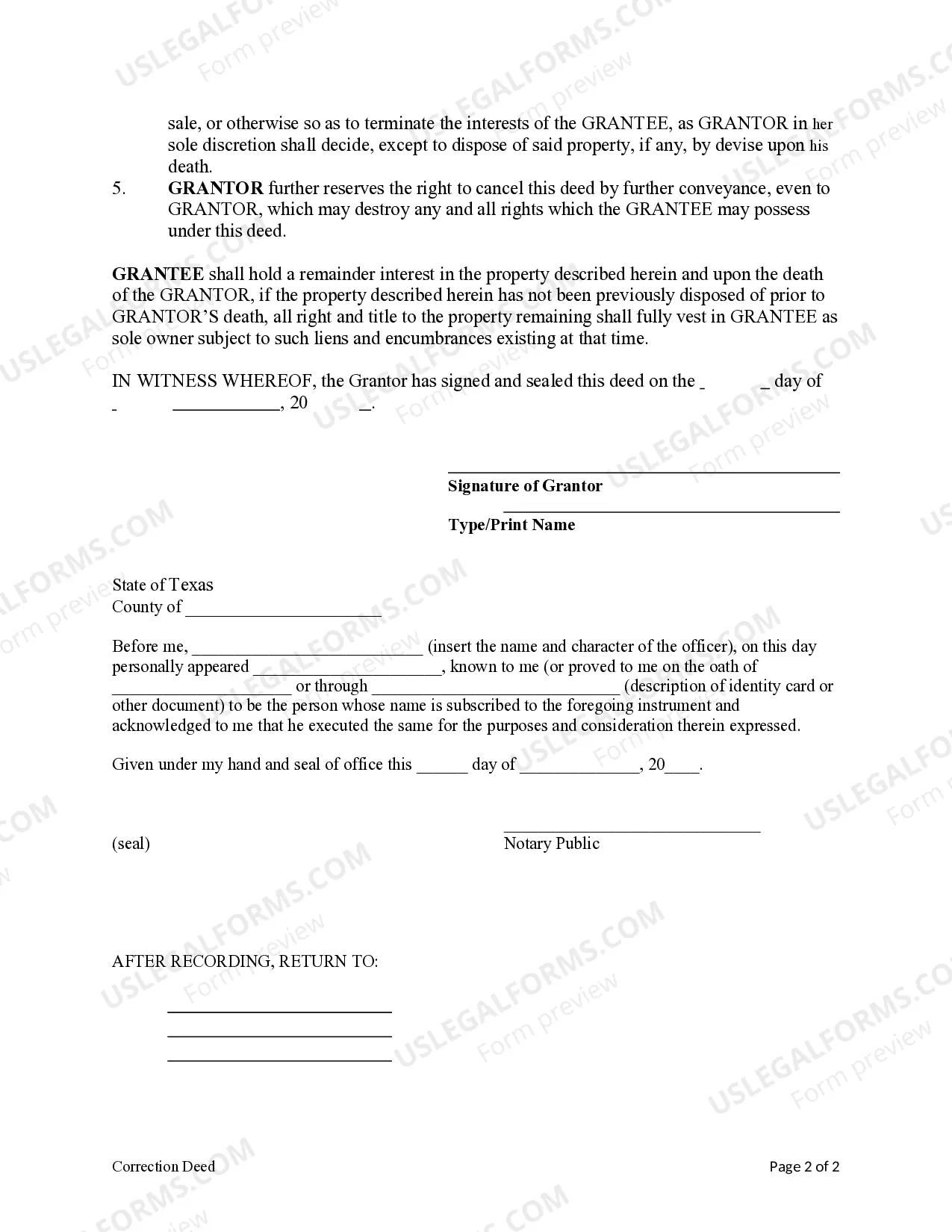

- Check the form preview, if available, to confirm that it's indeed the document you need.

- Return to the search to seek the correct template if the Correction Deed Form Texas Withholding Tax does not satisfy your requirements.

- If you are confident about the form's appropriateness, proceed to download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that meets your requirements.

- Continue with the registration process to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Correction Deed Form Texas Withholding Tax.

Form popularity

FAQ

In most cases, you can file an amended tax or fee return using Webfile. An amended return changes the data previously filed. Amended returns filed through Webfile will reflect the data originally filed with the Comptroller's Office. Change only the data that you need to amend.

When a property is foreclosed on from a tax sale, the owner of the property (we'll call them the ? debtor?) has a right of redemption in the property. This means the debtor has a time period in which they can come back and purchase the property back (i.e. ?redeem) from the foreclosure purchaser.

The steps below will show you how to lower property taxes in Texas, so you can move forward with your appeal. File a notice of protest. Prepare information for hearing. Attend an informal hearing at the Appraisal District office. Attend an Appraisal Review Board hearing. Appeal through district court or arbitration.

We're fortunate in Texas that we don't have to pay transfer taxes on real estate transactions. In fact, we're one of just 13 states that don't have this tax. For Texans, the prohibition on a transfer tax has been enshrined in our state constitution since 2016.

Texas is one of 13 states that has no transfer taxes. So if you're buying or selling a home in Texas, you don't need to worry about them.