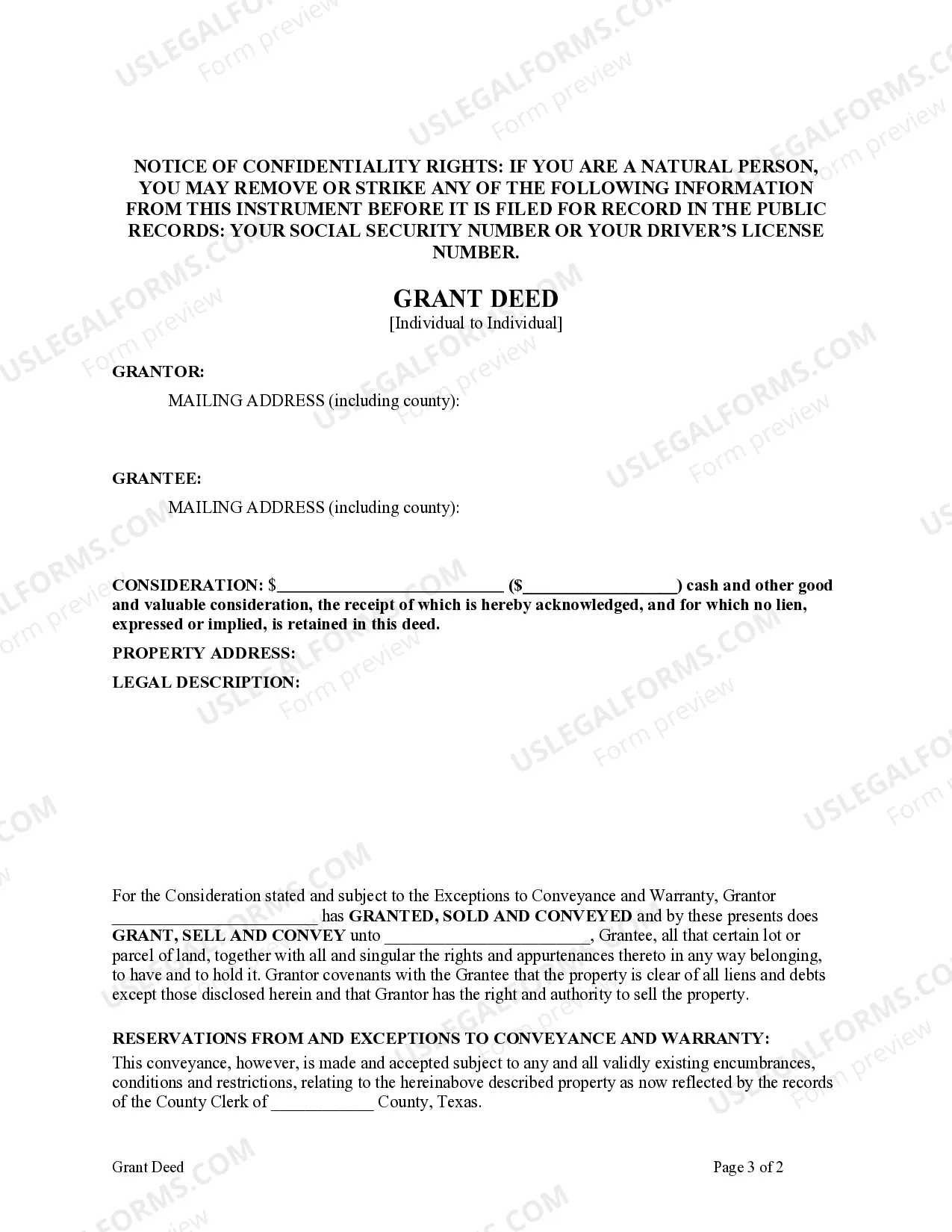

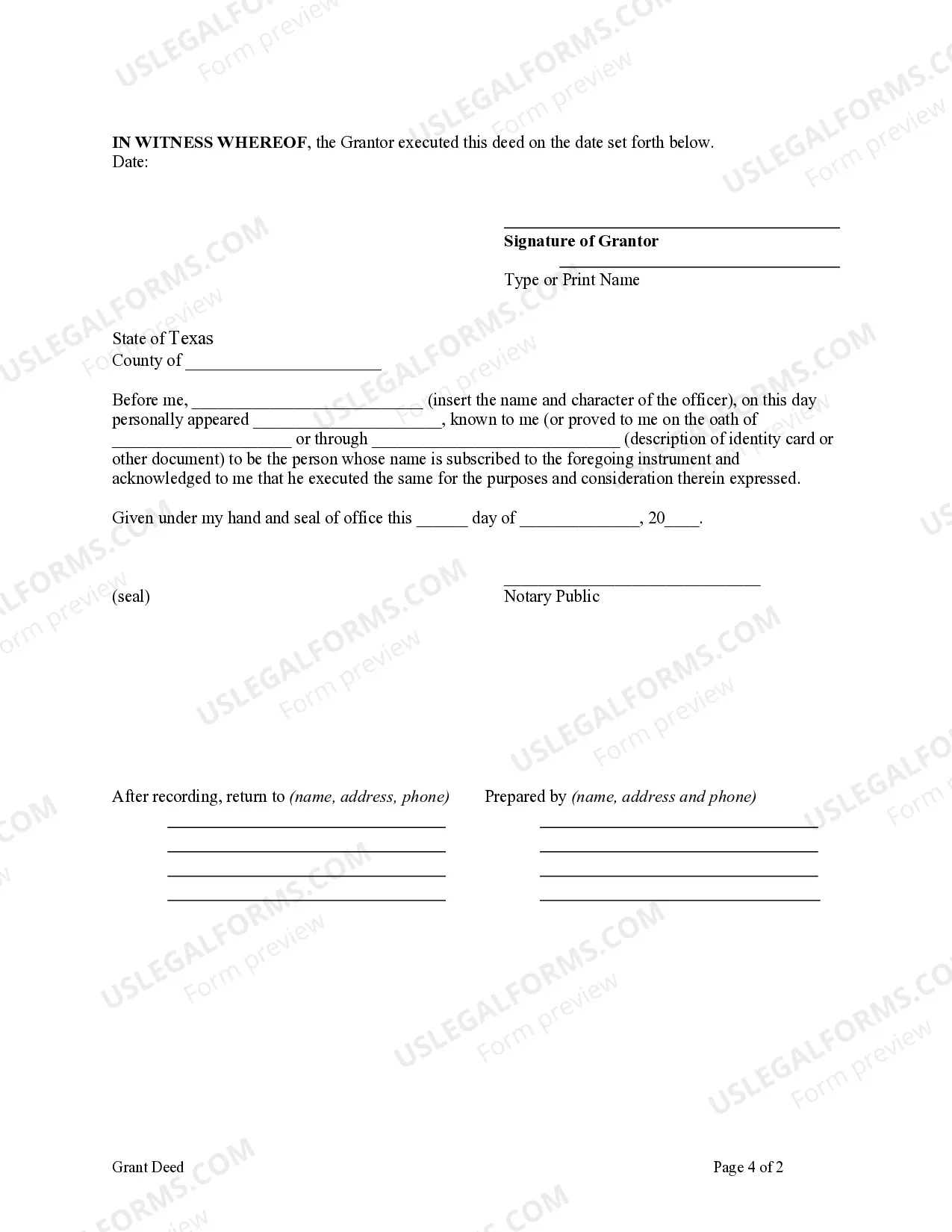

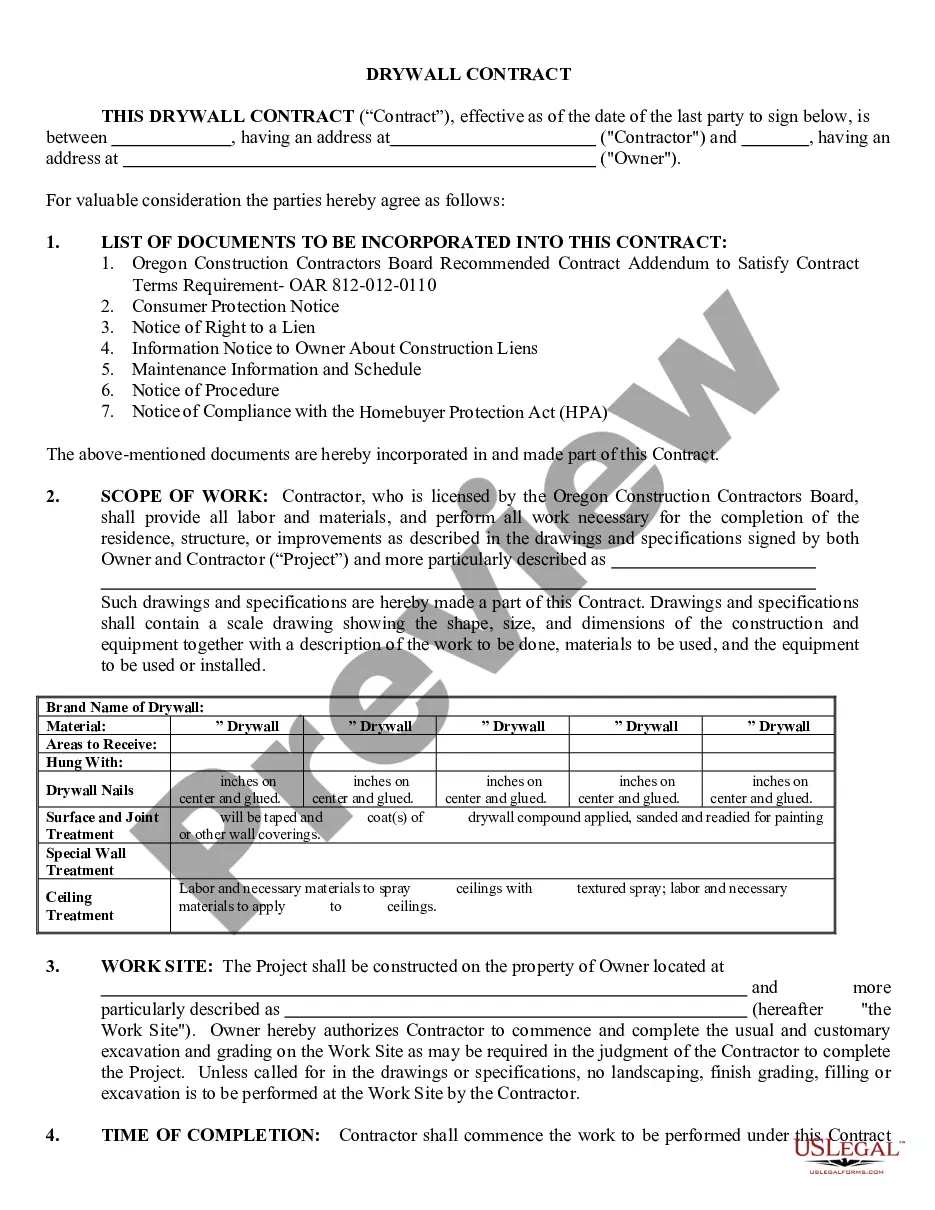

This form is a Grant Deed where the grantor is an individual and the grantee is an individual. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Grant Deed Texas With Life Estate

Description

How to fill out Texas Grant Deed From An Individual To An Individual?

Properly composed official paperwork is a principal assurance for preventing complications and disputes; however, acquiring it without the assistance of an attorney may require time.

Whether you're looking to swiftly obtain an updated Grant Deed Texas With Life Estate or various other documents for employment, family, or commercial matters, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, simply Log In to your account and click the Download button adjacent to the chosen file. Additionally, you can retrieve the Grant Deed Texas With Life Estate at any time, as all documents ever accessed on the platform remain accessible within the My documents section of your profile. Save time and money on creating official documents. Experience US Legal Forms today!

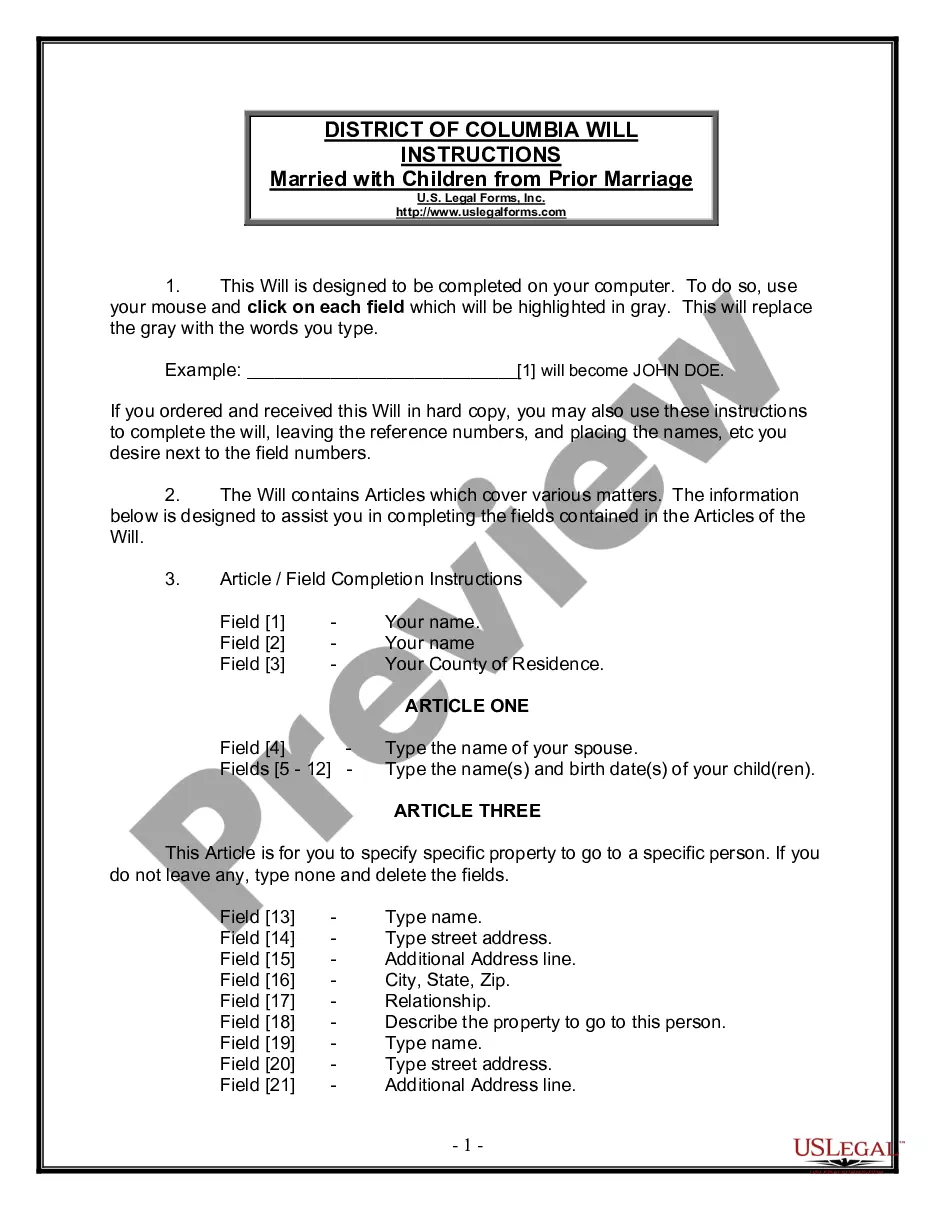

- Confirm that the form is appropriate for your situation and jurisdiction by reviewing the description and preview.

- Search for additional templates (if necessary) using the Search bar located in the page header.

- Select Buy Now once you identify the correct template.

- Choose a pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX format for your Grant Deed Texas With Life Estate.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

In Texas, a life estate deed grants someone the right to live in a property for the duration of their life, while transferring the remainder interest to another party after their passing. A ladybird deed, on the other hand, allows the property owner to retain full control and use of the property during their lifetime, even though they are transferring the ownership upon death. Both options are forms of a grant deed in Texas with life estate features, but they serve different purposes and needs. Understanding these differences can help you choose the right option for your estate planning.

Yes, Texas recognizes the enhanced life estate deed, often referred to as a Lady Bird deed. This type of grant deed in Texas with life estate allows property owners to retain control over their property during their lifetime, while also facilitating a smooth transfer of the property to beneficiaries upon their passing. The enhanced life estate deed provides flexibility by allowing property owners to sell or mortgage the property without needing consent from the remaindermen. This legal instrument is particularly beneficial for estate planning, as it helps avoid probate and simplifies the transfer process.

In Texas, the life tenant is responsible for paying property taxes on a life estate. They must keep up with tax payments to maintain their rights to the property. If you need assistance understanding your obligations or want to ensure compliance, services like USLegalForms can offer valuable resources to help you navigate property tax responsibilities.

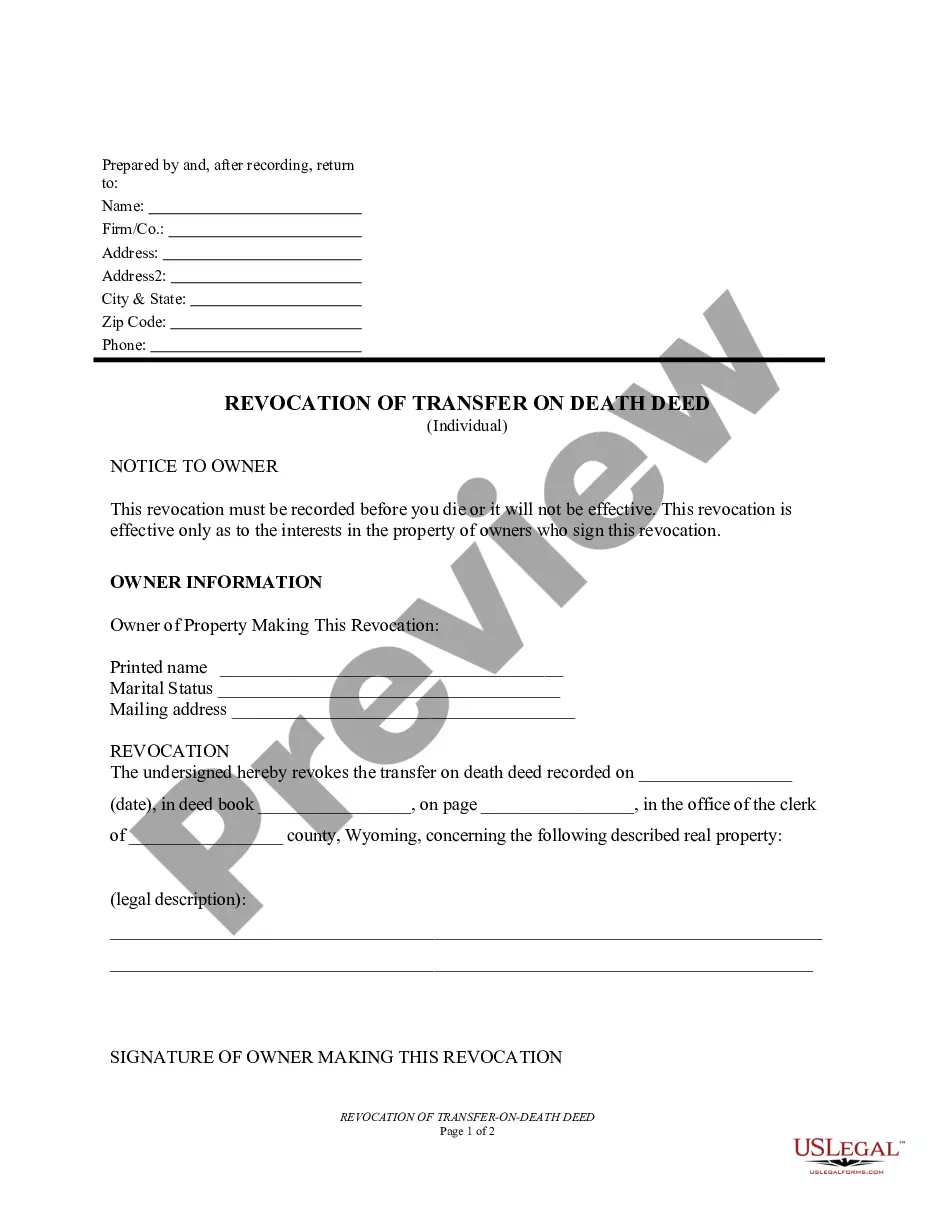

To transfer ownership of a property after death in Texas, you typically utilize a will or a life estate deed. The grant deed Texas with life estate can simplify this process, allowing designated beneficiaries to inherit the property without the delays associated with probate. Engaging with legal platforms like USLegalForms can provide you with the necessary documents and guidance for a smooth transfer.

When the owner of a life estate dies, the property automatically transfers to the remainder beneficiaries. They gain full ownership without going through probate, which can be time-consuming. Planning with a grant deed Texas with life estate can help ensure a smooth transition of ownership and avoid potential disputes among heirs.

In a Texas life estate, the life tenant has ownership rights for their lifetime, while the remainder beneficiaries hold future ownership interests. This means that the life tenant can use and enjoy the property, but they cannot sell it without the consent of the remainder beneficiaries. To establish clear ownership rights, a grant deed Texas with life estate is essential.

The life tenant is generally responsible for paying the mortgage in a life estate in Texas. Though they do have the right to live on the property, they also hold the obligation to maintain any loans against it. If you need assistance with documentation or understanding responsibilities, consider using USLegalForms to navigate mortgage matters effectively.

A life estate deed in Texas allows one person to retain ownership of the property for their lifetime, while designating a third party to receive ownership after their death. This arrangement ensures that the life tenant has rights to live on the property, while avoiding probate issues. Utilizing resources like a grant deed Texas with life estate can help simplify transferring property.

In Texas, a life estate cannot be easily reversed. However, you may choose to terminate the life estate through mutual agreement or by a court order. If you are uncertain about the implications, consider consulting with legal experts or platforms like USLegalForms, which can guide you through the process.

Yes, you can homestead a life estate in Texas. A life estate allows you to use and enjoy the property during your lifetime, while protecting it from certain creditors. By filing the appropriate paperwork, such as a grant deed Texas with life estate, you can establish your homestead exemption and safeguard your rights to the property.