Petition For Excess Proceeds In Texas

Description

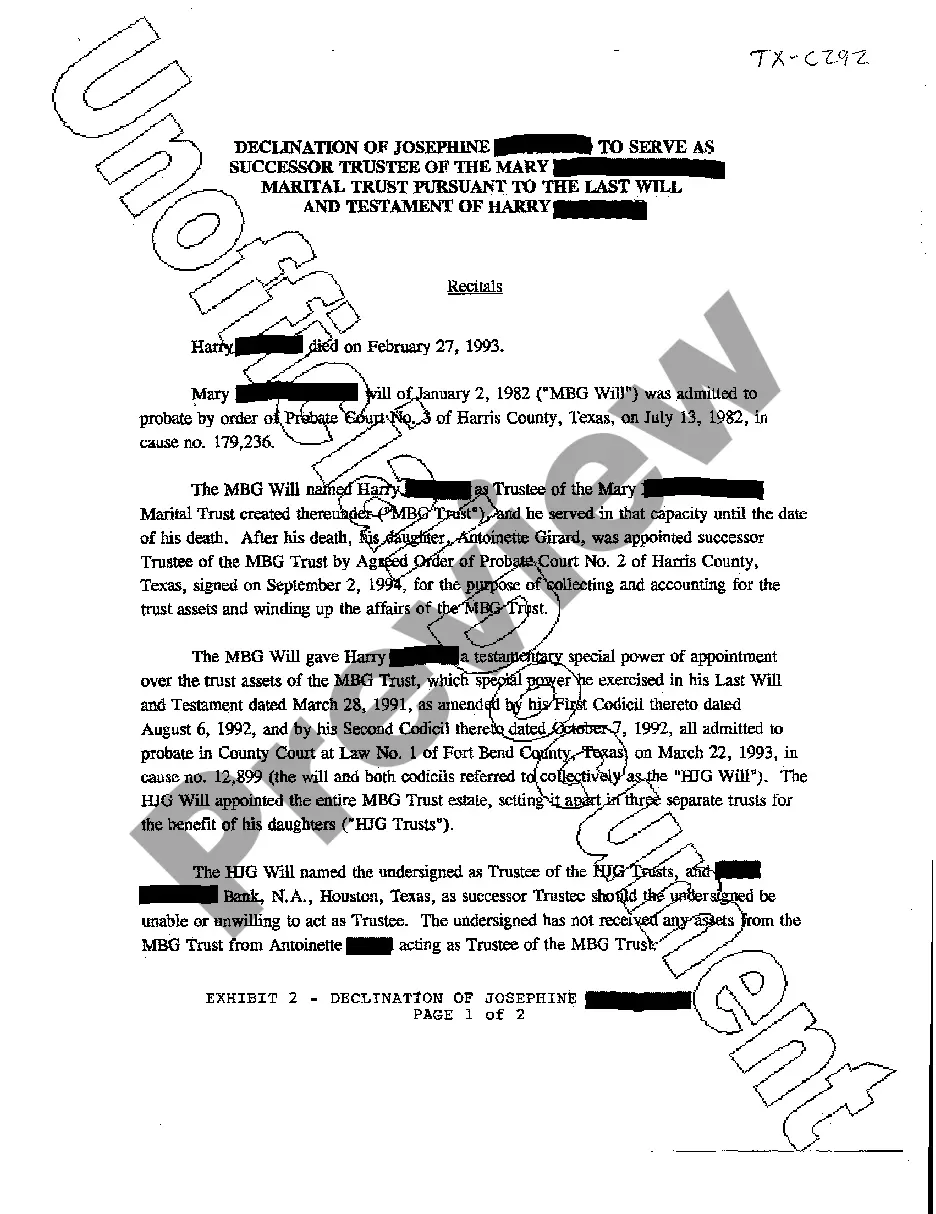

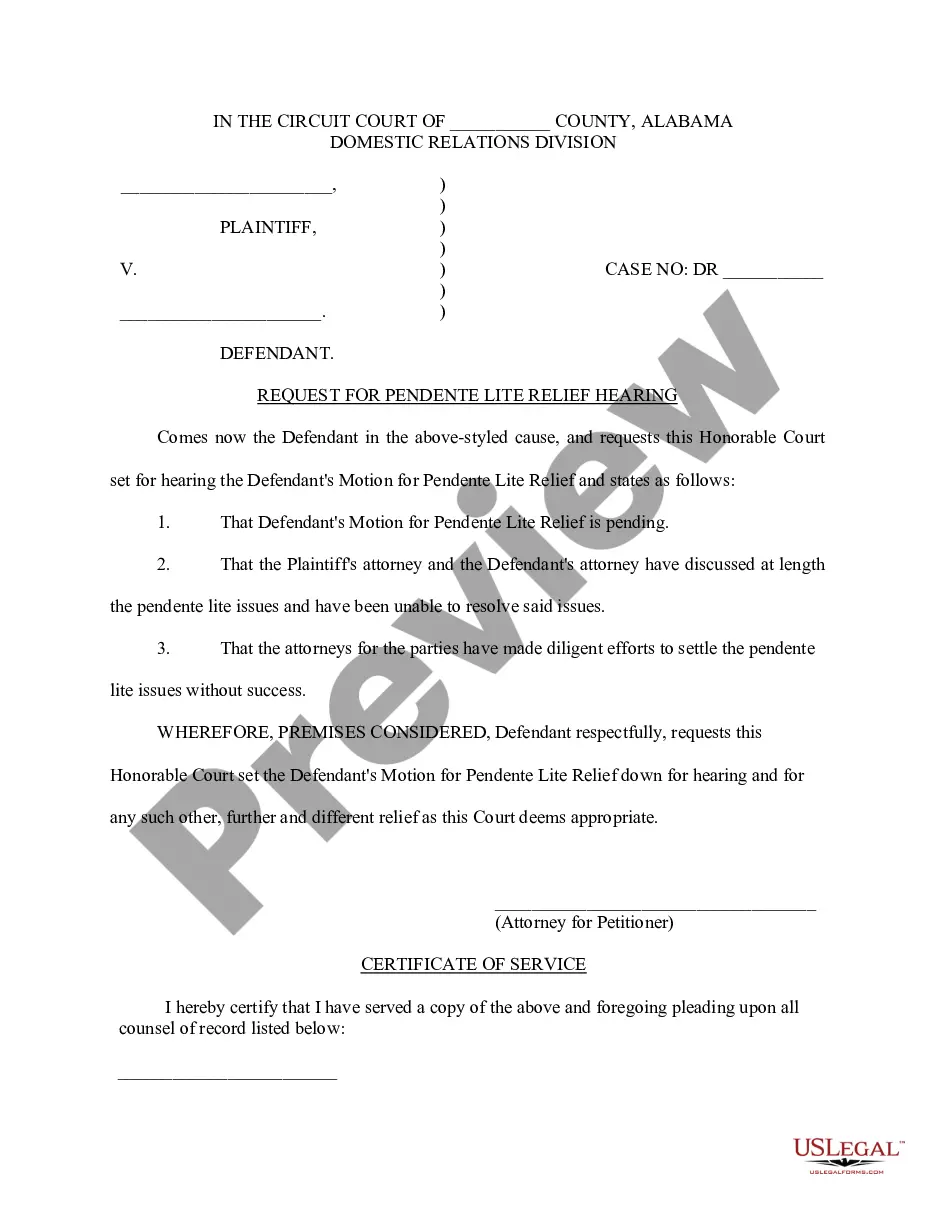

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Regardless of whether it’s for commercial reasons or personal matters, everyone must handle legal issues at some stage in their life. Completing legal documents demands careful consideration, starting from selecting the correct form template. For example, if you choose an incorrect version of the Petition For Excess Proceeds In Texas, it will be rejected upon submission. Thus, it is crucial to have a trustworthy source of legal documents such as US Legal Forms.

If you need to acquire a Petition For Excess Proceeds In Texas template, follow these straightforward steps.

- Obtain the template you require using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your circumstances, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search feature to find the Petition For Excess Proceeds In Texas template you need.

- Download the template if it suits your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the document format you prefer and download the Petition For Excess Proceeds In Texas.

- Once it is downloaded, you can complete the form using editing software or print it and finish it by hand.

- With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the appropriate template for any scenario.

Form popularity

FAQ

Excess Proceeds is the amount of funds remaining after the Treasurer and Tax Collector sells a tax-defaulted property and recovers the taxes, penalties and costs.

(i) A fee charged by an attorney to obtain excess proceeds for an owner may not be greater than 25 percent of the amount obtained or $1,000, whichever is less. A person who is not an attorney may not charge a fee to obtain excess proceeds for an owner.

Section 34.04 - Claims for Excess Proceeds (a) A person, including a taxing unit and the Title IV-D agency, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.

The Excess Proceeds stay in the Registry unless and until the Court orders all or a part of it to be paid to someone who proves a right to all or part of the Excess Proceeds. At the end of two years, any of the Excess Proceeds remaining in the Registry are paid to the state.

1. Excess Proceeds: If more than $25 is left from the foreclosure sale of your home after the lien and any costs are paid, you are entitled to claim that money. 2. Time Limits: You must file a claim for excess proceeds within two years of the sale of the property.