Petition For Excess Proceeds Form Florida

Description

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Managing legal documents can be daunting, even for seasoned professionals.

When you seek a Petition For Excess Proceeds Form Florida and lack the opportunity to invest time in finding the correct and current version, the procedures can be stressful.

US Legal Forms addresses any needs you might have, ranging from personal to business paperwork, all in one location.

Utilize advanced tools to fill out and manage your Petition For Excess Proceeds Form Florida.

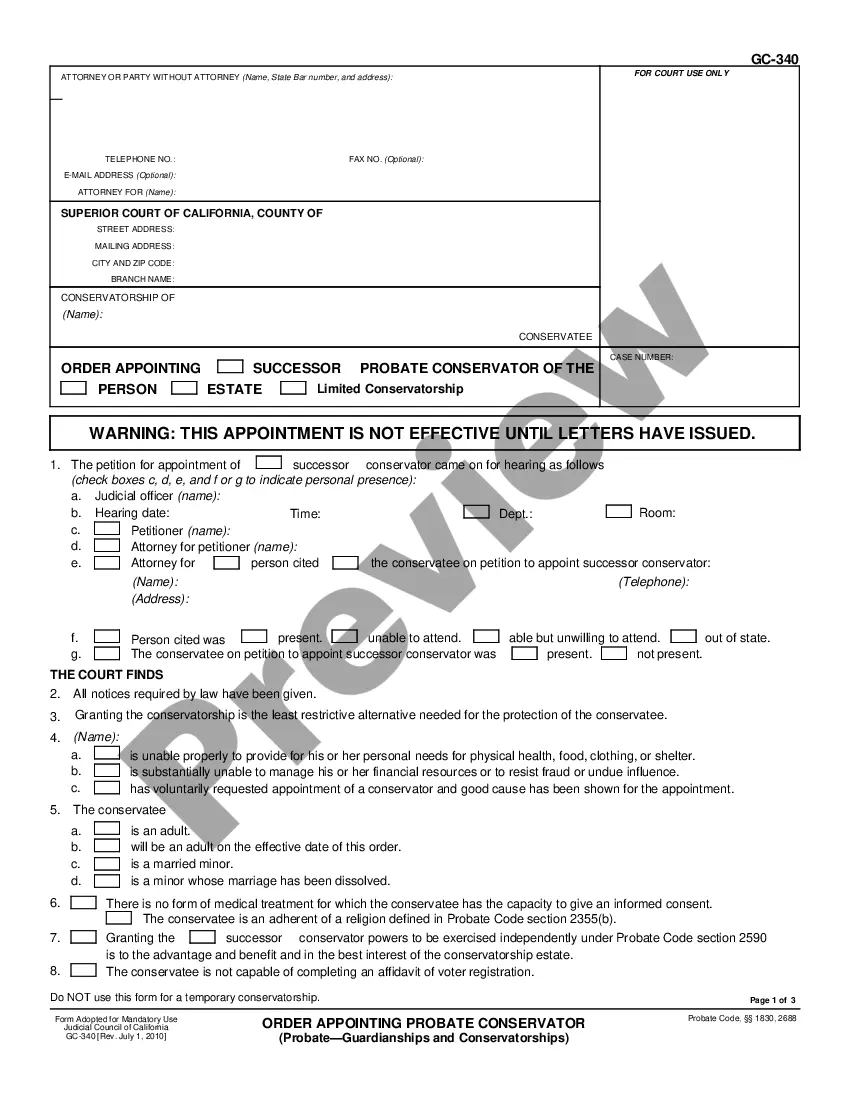

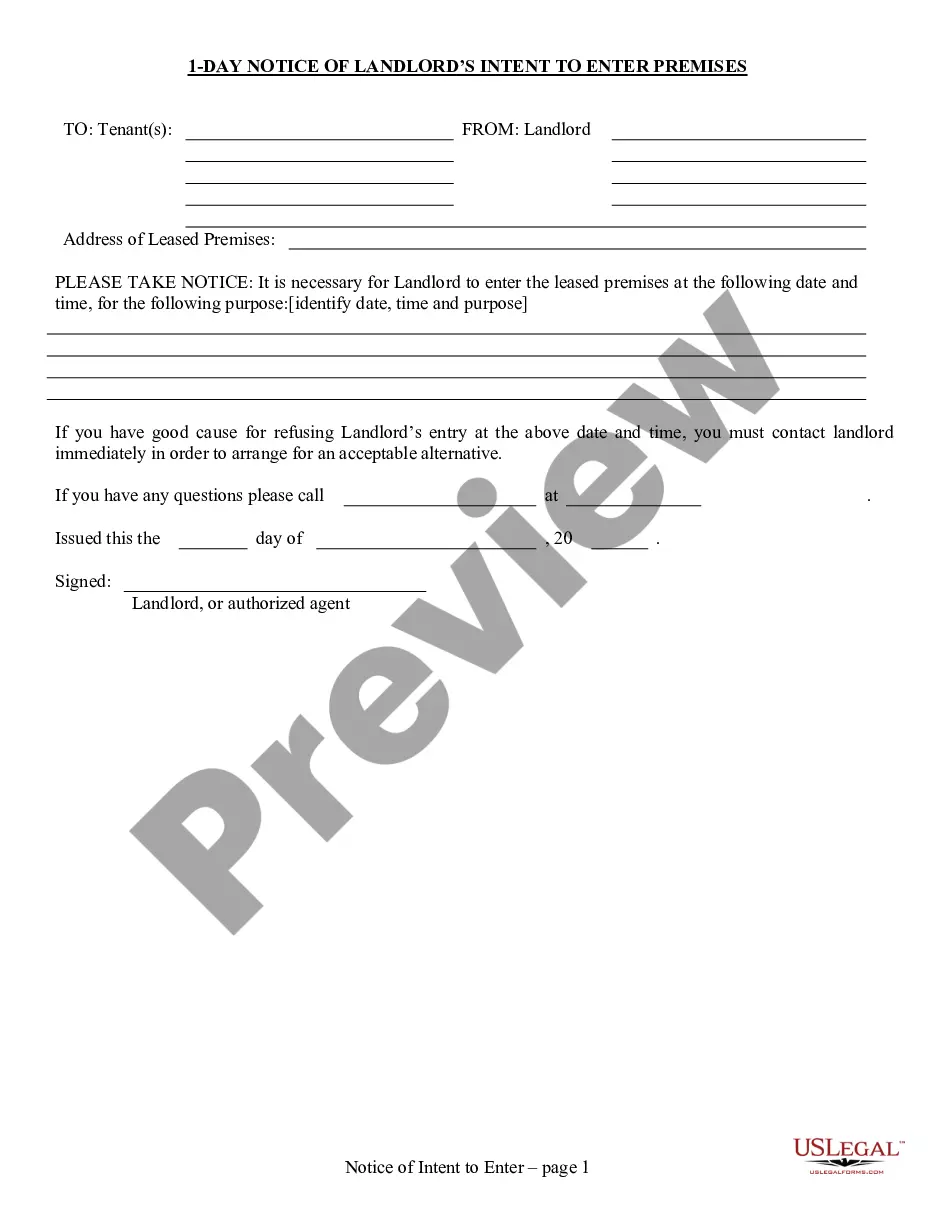

Here are the steps to follow after obtaining the form you need: Confirm this is the correct form by previewing it and reviewing its details. Ensure that the template is accepted in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Choose the format you desire, and Download, fill out, sign, print, and submit your documents. Enjoy the US Legal Forms online library, backed by 25 years of experience and trustworthiness. Streamline your regular document management into a straightforward and user-friendly process today.

- Access a valuable resource library of articles, guides, and manuals pertinent to your circumstances and needs.

- Save time and effort in finding the documents you require, and make use of US Legal Forms’ enhanced search and Review feature to locate Petition For Excess Proceeds Form Florida and download it.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously downloaded and to organize your folders as needed.

- If it’s your first time using US Legal Forms, create a free account and gain unlimited access to all the benefits of the platform.

- A robust online form repository could be transformative for anyone looking to navigate these matters effectively.

- US Legal Forms is a leader in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

You will need to reach out to the lienholder or bank that held your loan and inform them that there are excess funds that are due to you. This might require reaching out to more than one lender if you have a second or a third mortgage that is involved in the process.

IF YOU ARE THE PROPERTY OWNER, YOU MAY CLAIM THESE FUNDS YOURSELF. YOU ARE NOT REQUIRED TO HAVE A LAWYER OR ANY OTHER REPRESENTATION AND YOU DO NOT HAVE TO ASSIGN YOUR RIGHTS TO ANYONE ELSE IN ORDER FOR YOU TO CLAIM ANY MONEY TO WHICH YOU ARE ENTITLED.

Who is entitled to the surplus funds? Section 45.032 of the Florida Statutes sets out who may be entitled to the surplus funds. The Owners of Record (meaning the person who owned the property at the beginning of the foreclosure lawsuit) and Subordinate Lienholders are entitled to surplus funds.

Generally, any surplus funds from a Tax Deed sale will be held for one year by the clerk of courts, and if not claimed at that time, those surplus funds will be turned over to the Florida Chief Financial Officer and go into the Florida Unclaimed Property funds (and ultimately used for the Florida Schools).

Surplus funds are typically given to the most recent homeowner. As such, you should receive them after the foreclosure sale. However, other parties may come forward and try to claim the surplus funds.