Tx Gift Individual File With Tax

Description

How to fill out Texas Gift Deed For Individual To Individual?

It’s well-known that you cannot instantly become a legal expert, nor can you learn to swiftly prepare Tx Gift Individual File With Tax without a specific skill set.

Drafting legal documents is a lengthy process necessitating certain education and abilities.

So why not entrust the creation of the Tx Gift Individual File With Tax to the professionals.

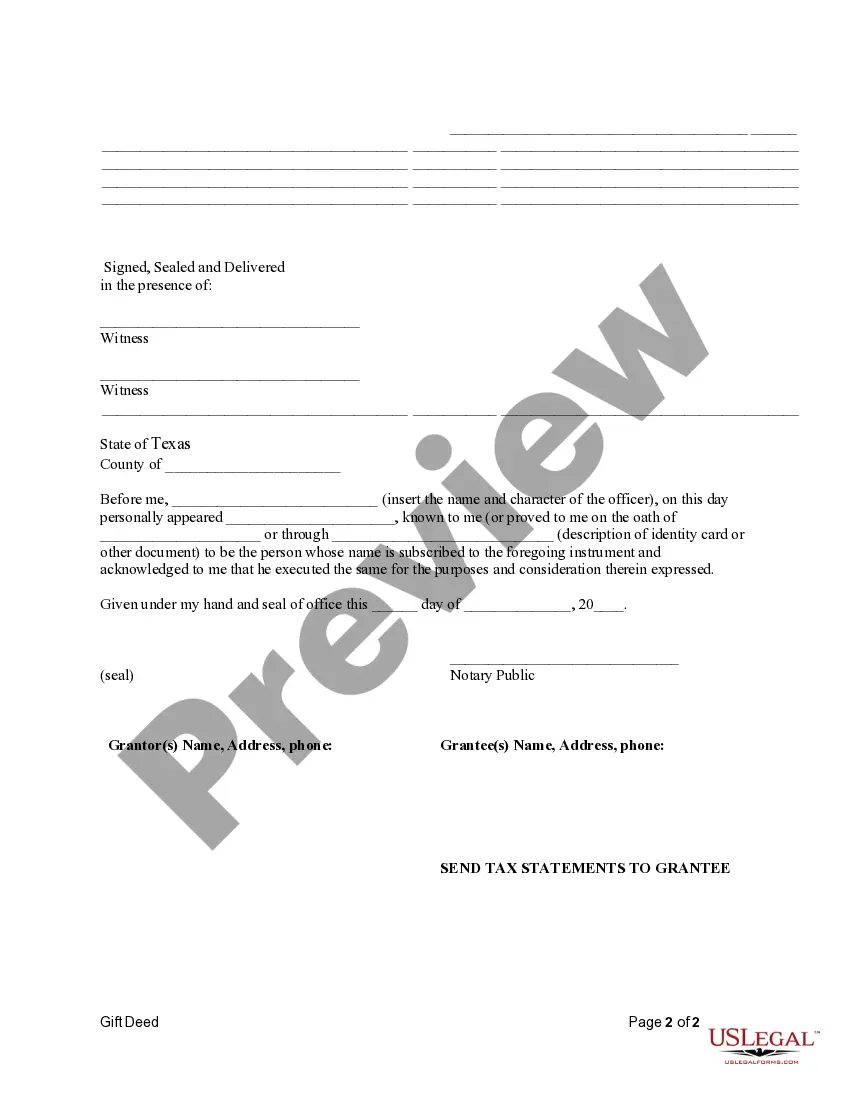

Select Buy now. Once the payment is complete, you can access the Tx Gift Individual File With Tax, fill it out, print it, and deliver or send it to the appropriate individuals or organizations.

You can regain access to your forms from the My documents section at any time. If you’re a current client, you can simply Log In and locate and download the template from the same section.

- Start your journey with our platform and acquire the document you need in just a few minutes.

- Find the form you require using the search tool located at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain whether Tx Gift Individual File With Tax is what you are looking for.

- If you require a different template, start your search over.

- Create a free account and select a subscription plan to purchase the template.

Form popularity

FAQ

In addition to weddings, cash gifts given at Christmas and birthdays also aren't taxed, provided you're not reducing your standard of living by giving the money.

From an income tax perspective, receipt of a gift from a relative does not trigger taxation, i.e., it is exempt in the hands of the receiver. However, it has to be disclosed as exempt income in Schedule EI of the ITR form.

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2022 is $16,000 per year per recipient, increasing to $17,000 in 2023.

Gift Tax Exemptions Though gift tax is applicable on gifts whose value exceeds Rs. 50,000, the gift is exempted from tax if it was given by a relative.

To calculate the tax payable, the value of the present has to be declared by the donee at the time of filing Income Tax Returns under the head ?Income from Other Sources.? Thus, the taxable value of the gift becomes part of the income of the donee for the Financial Year.