Texas Deed Tx Formula

Description

How to fill out Texas Gift Deed For Individual To Individual?

Getting a go-to place to access the most current and relevant legal samples is half the struggle of working with bureaucracy. Finding the right legal files requirements precision and attention to detail, which explains why it is very important to take samples of Texas Deed Tx Formula only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and view all the details about the document’s use and relevance for the circumstances and in your state or region.

Take the listed steps to complete your Texas Deed Tx Formula:

- Make use of the catalog navigation or search field to find your sample.

- Open the form’s information to check if it suits the requirements of your state and region.

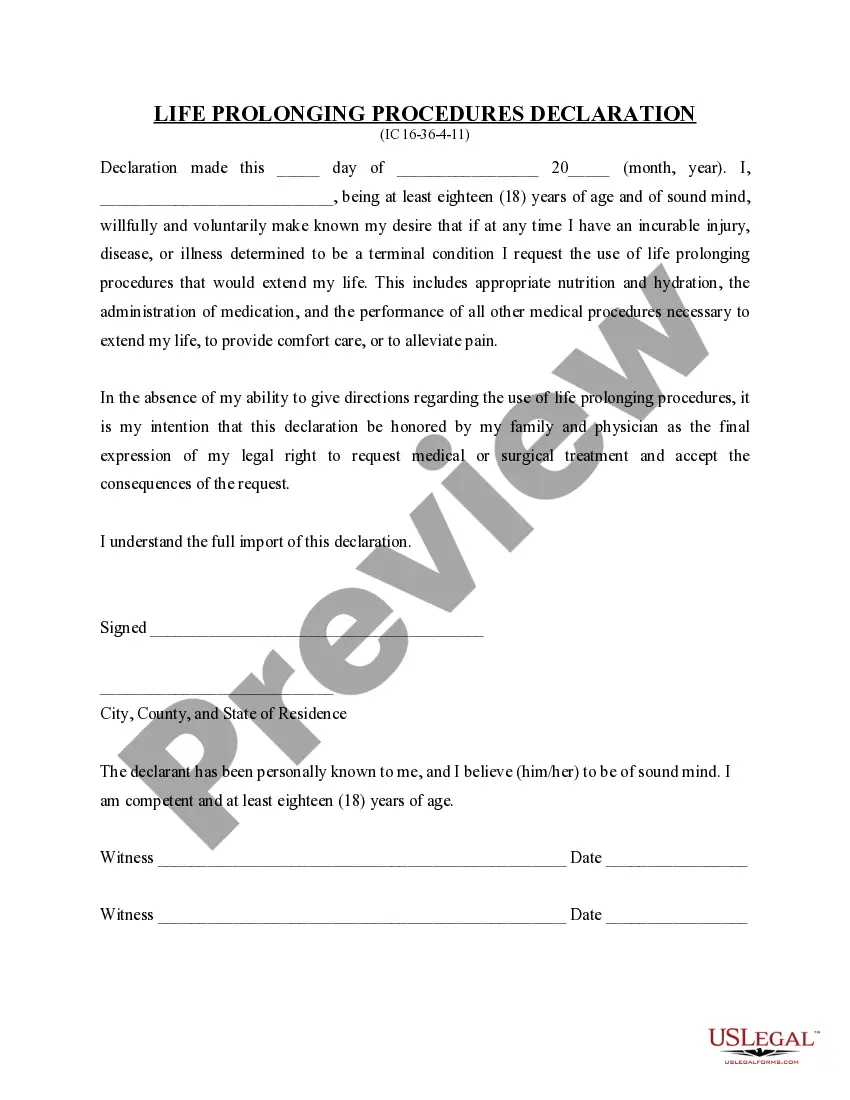

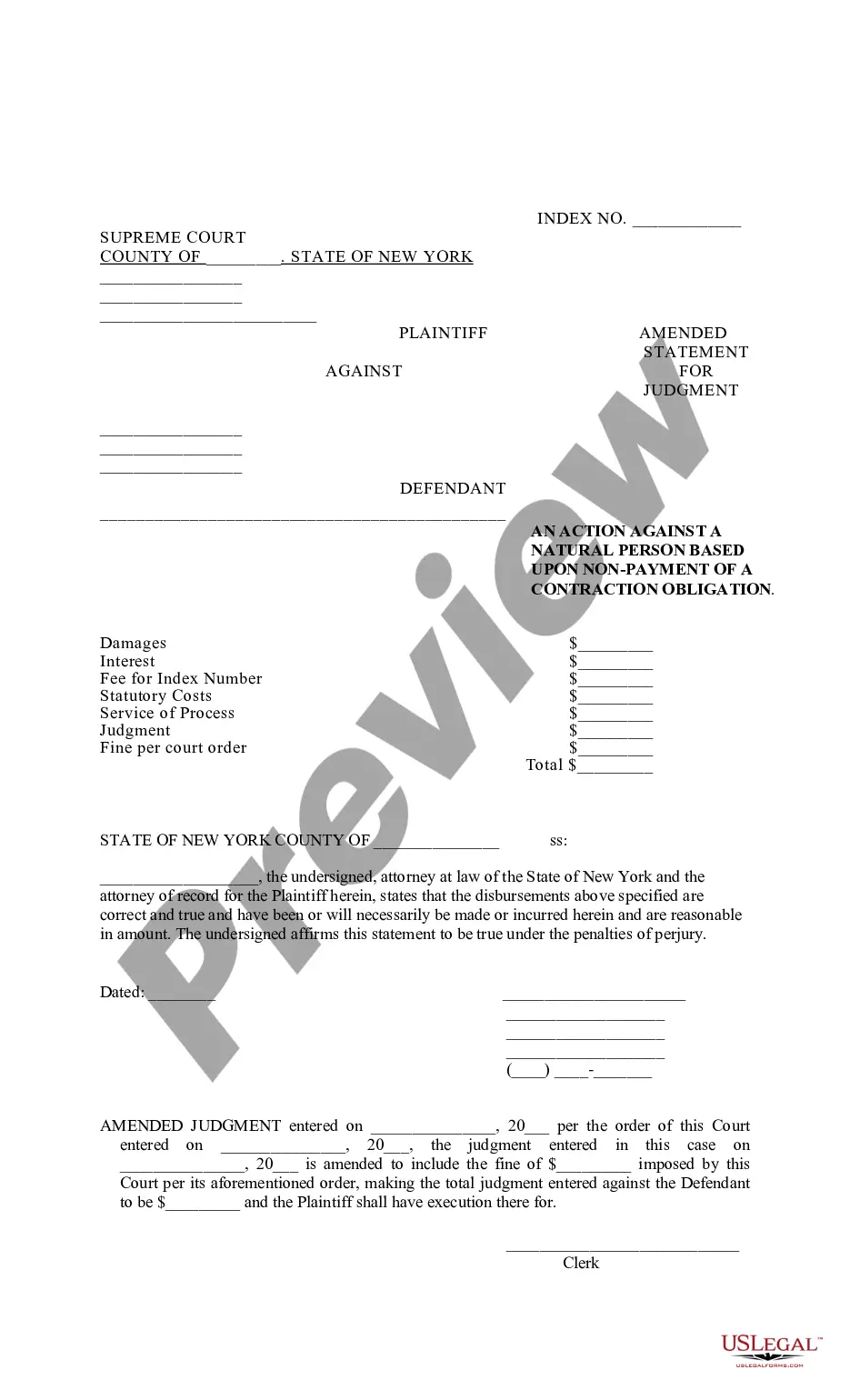

- Open the form preview, if available, to ensure the form is the one you are looking for.

- Return to the search and look for the appropriate document if the Texas Deed Tx Formula does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Choose the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Texas Deed Tx Formula.

- Once you have the form on your gadget, you may change it with the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal documentation. Check out the extensive US Legal Forms catalog to find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Address is different make sure you type in your mailing. Address here for section 3 put in the dateMoreAddress is different make sure you type in your mailing. Address here for section 3 put in the date you became the owner of the property. And then put the date you began living in the property.

In a mass appraisal, the appraisal district then classifies properties using a variety of factors, such as size, use, construction type, age and location. Using data from recent property sales, the appraisal district appraises the value of typical properties in each class.

Property taxes are based on appraised value. In Texas, all taxable property must be appraised at 100% of the fair market value as of January 1 each year. Market value is the price that it would sell for under current market conditions.

The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

Texas levies property taxes as a percentage of each home's appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.