Texas Deed Individual With Trust

Description

How to fill out Texas Gift Deed For Individual To Individual?

Handling legal papers and operations might be a time-consuming addition to the day. Texas Deed Individual With Trust and forms like it often require that you search for them and understand the way to complete them correctly. Therefore, regardless if you are taking care of economic, legal, or individual matters, having a comprehensive and convenient online catalogue of forms when you need it will significantly help.

US Legal Forms is the number one online platform of legal templates, offering over 85,000 state-specific forms and a variety of resources that will help you complete your papers effortlessly. Explore the catalogue of appropriate papers available to you with just one click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Safeguard your document management procedures with a high quality support that allows you to prepare any form within a few minutes without extra or hidden fees. Just log in to your account, locate Texas Deed Individual With Trust and download it straight away within the My Forms tab. You can also gain access to formerly downloaded forms.

Is it the first time utilizing US Legal Forms? Register and set up your account in a few minutes and you will have access to the form catalogue and Texas Deed Individual With Trust. Then, adhere to the steps listed below to complete your form:

- Be sure you have found the correct form using the Review feature and reading the form description.

- Pick Buy Now once all set, and select the subscription plan that fits your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise helping consumers manage their legal papers. Discover the form you want right now and improve any process without having to break a sweat.

Form popularity

FAQ

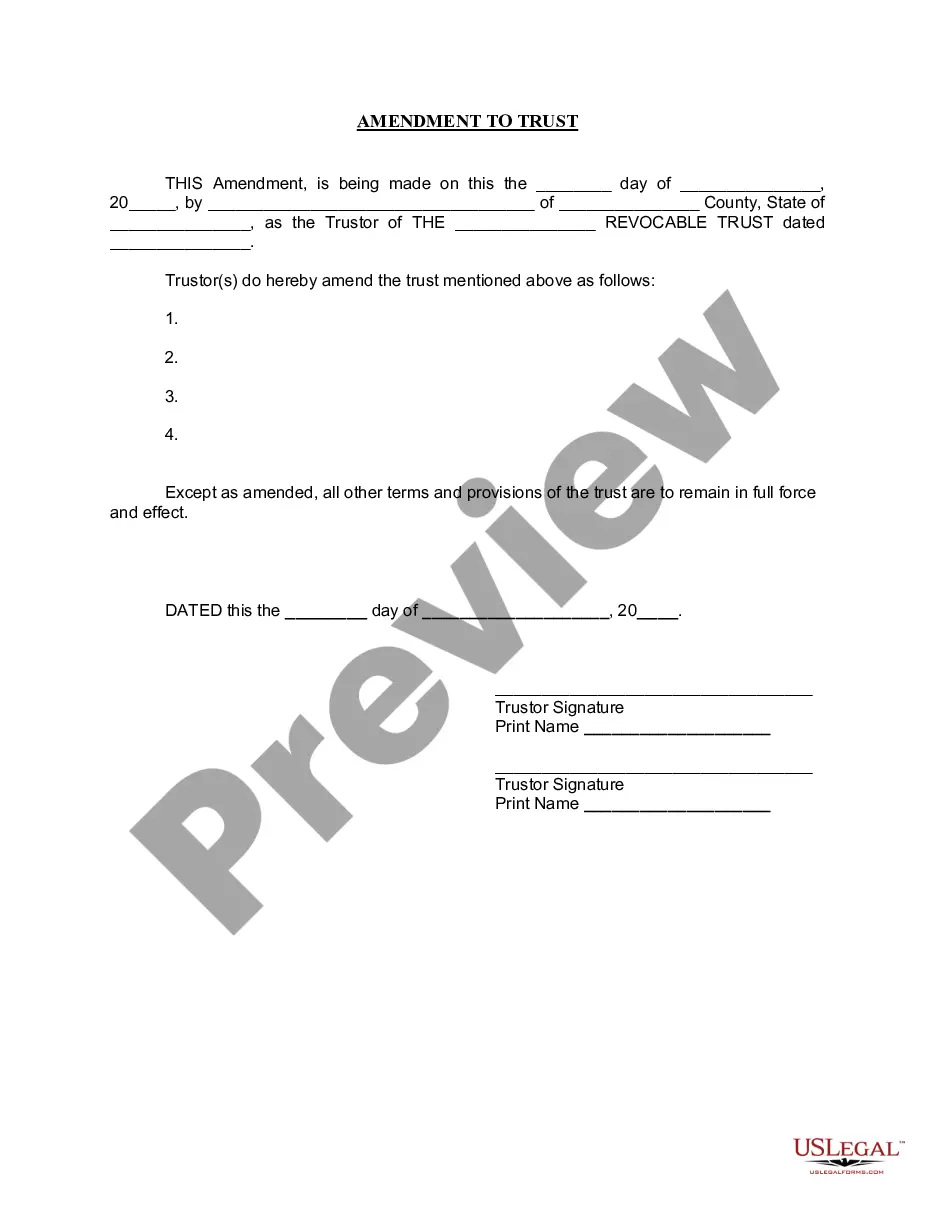

The trustee controls the assets and property held in a trust on behalf of the grantor and the trust beneficiaries. In a revocable trust, the grantor acts as a trustee and retains control of the assets during their lifetime, meaning they can make any changes at their discretion.

The Trustee, usually chosen by the lender, is the person who represents both the Grantor and the Grantee (Beneficiary) if there is a default under a Deed of Trust. When no specific trustee is required by the lender, someone willing and able to hold a foreclosure sale if necessary may be selected.

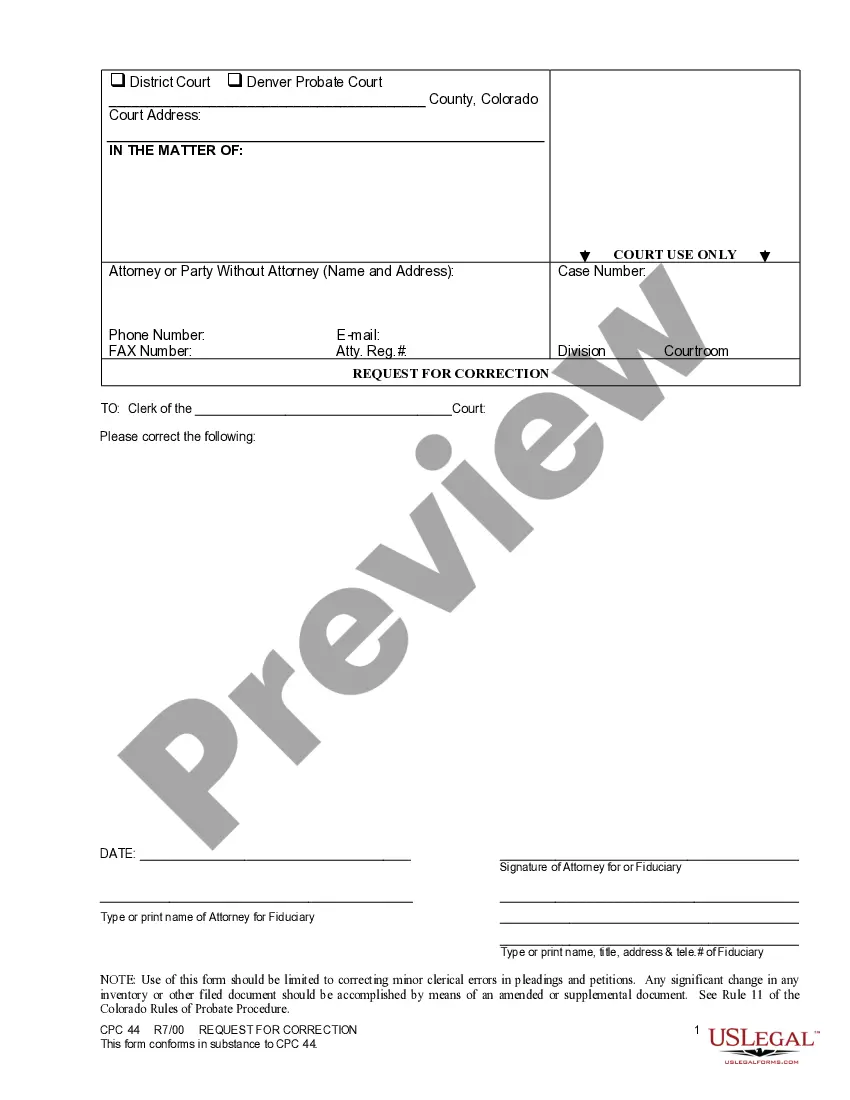

In Texas, the seller signs the deed over to you in front of a notary public and the deed is then filed in the county clerk's office so that the transfer of property is officially recorded. At this point, the trustee holds the physical deed, you hold equitable title and the lender holds the legal title.

As long as you are confident that your trust is validly formed in ance with state law, recording is not required nor necessary. However, for extra peace of mind, you may choose to record your Certificate of Trust with the county clerk's office in order to protect it from unauthorized changes or access.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...