What Would You Do Texas

Description

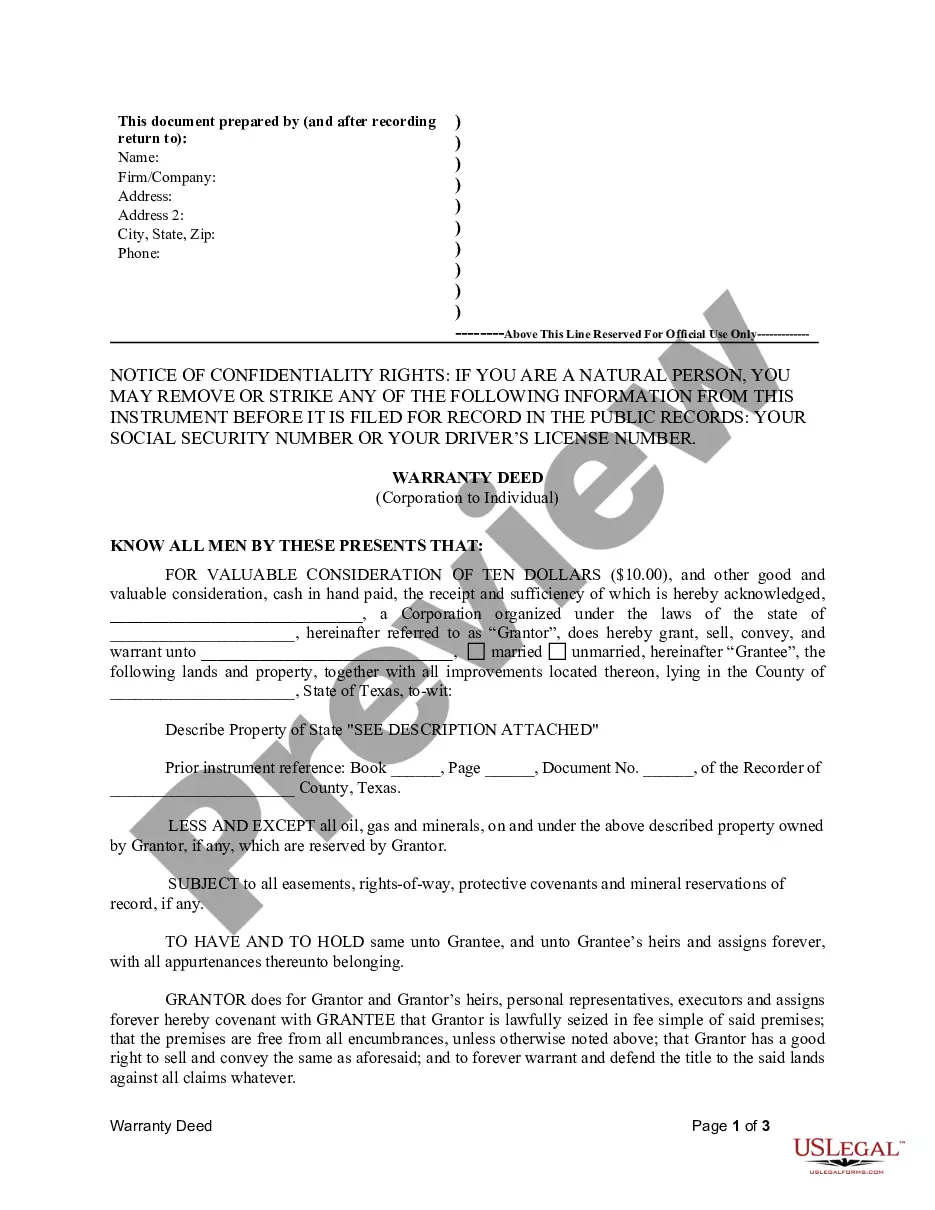

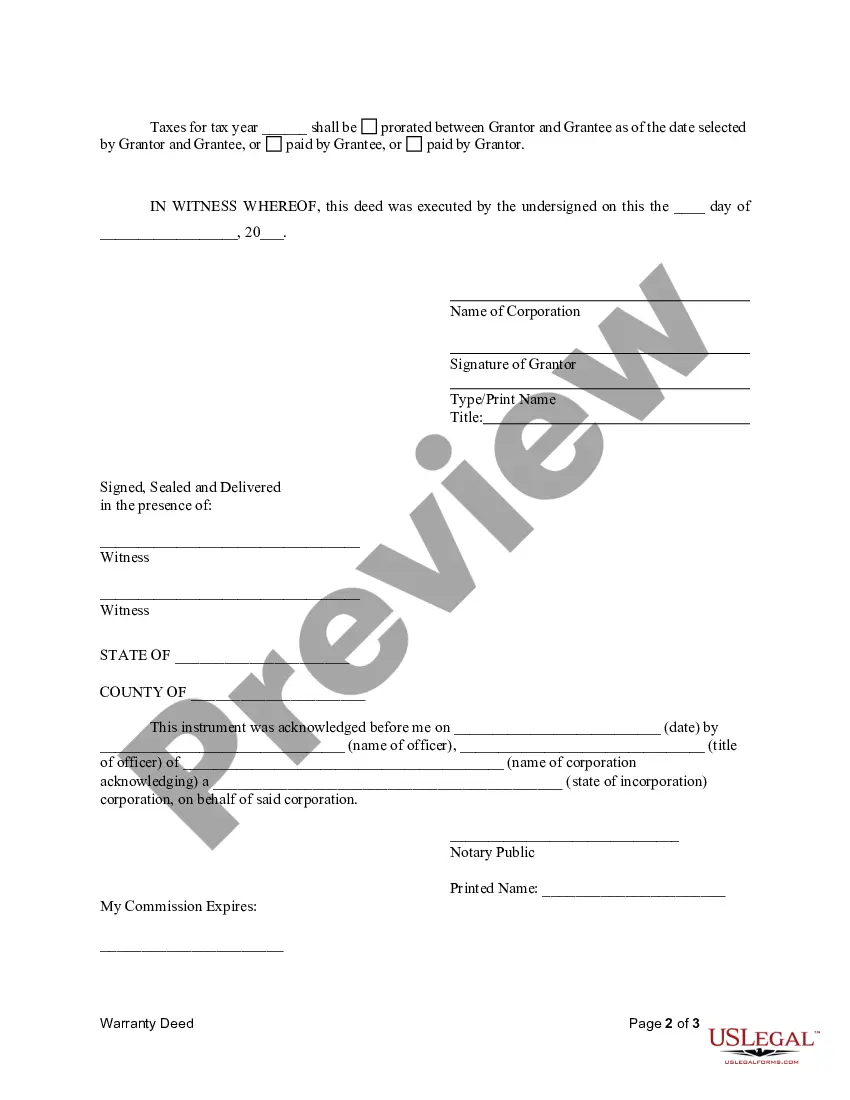

How to fill out Texas Warranty Deed From Corporation To Individual?

- If you are a returning user, log in to your account and ensure your subscription is active. Head over to the download section and click the Download button to retrieve your form.

- For first-time users, begin by browsing the Preview mode to familiarize yourself with the form's details and ensure it meets your local jurisdiction's requirements.

- If you need to search for a different template, use the Search tab above to find a suitable option. When you locate the right document, you can continue to the next step.

- To purchase the document, click the Buy Now button and select your preferred subscription plan. Create an account to gain access to our extensive library of forms.

- Complete your purchase by entering your credit card details or opting to use your PayPal account to finalize the subscription.

- Once your transaction is successful, download your selected form. You can easily save it to your device and will find it later in the My Forms section of your profile.

US Legal Forms empowers users to swiftly execute legal documents, providing access to premium experts who can assist with form completion, ensuring that all documents are accurate and legally sound.

Ready to simplify your legal documentation process? Don't hesitate to explore US Legal Forms today and experience the difference!

Form popularity

FAQ

You can find all seasons of 'What Would You Do?' on various streaming platforms. Services like Hulu or ABC’s official site often feature full seasons for viewers to enjoy. If you're eager to watch past episodes that inspire reflection on social ethics, don't hesitate to explore these options. Remember, when you view these scenarios, think deeply about what would you do Texas as you engage with the content.

Yes, the production of 'What Would You Do?' episodes is ongoing. The show has been a staple of social commentary on television and continues to produce new episodes that engage viewers across the nation. As they explore complex moral questions, you might find yourself pondering, what would you do Texas? Tune in regularly to enjoy fresh content.

Over the years, 'What Would You Do?' has experienced various changes in its format and scheduling. Despite the shifts, the show continues to captivate audiences with its unique content. This retention of interest shows that social dilemmas resonate with viewers everywhere, including Texas. You can stay updated on its status through general entertainment news outlets.

You can catch 'What Would You Do?' on ABC. Typically, it airs in the evening, so check your local listings for the exact time. This engaging show blends social experiments with real-life issues, allowing viewers to reflect on their own values. If you're interested in the scenarios presented, remember to ask yourself, what would you do Texas?

In Texas, the income requirement to file taxes aligns with federal guidelines. It varies depending on your filing status, age, and whether you have dependents. Staying informed about these guidelines ensures you meet all obligations confidently. If you need comprehensive support, look into USLegalForms for what you would do Texas.

The amount you can make without filing taxes typically falls below federal limits. Each year, these limits may change based on your filing status and age. Familiarizing yourself with current income thresholds can save you from unnecessary filings. For assistance in navigating these regulations, USLegalForms can clarify what you would do Texas.

Texas does not require individuals to file annual reports, but businesses must adhere to specific filing requirements. This includes maintaining good standing with the state and staying updated on various regulations. Knowing these obligations can help maintain compliance. If you're unsure about annual reports, check out USLegalForms for tailored guidance on what you would do Texas.

To file taxes in Texas, your income must exceed the federal minimum reporting limits. The amount varies based on your filing status and age. It's essential to review these income levels each year. If you're unsure, USLegalForms can provide you with the necessary details on what would you do Texas.

The minimum income requirement for filing taxes in Texas aligns with federal rules, which change annually. If your earnings surpass this threshold, you must file a tax return. Understanding these thresholds can help you avoid potential issues. When in doubt, consider USLegalForms to give you the insights on what you would do Texas.

Filing taxes with earnings under $5000 generally isn't required. Still, it's wise to explore your circumstances closely. By doing so, you ensure you stay compliant with Texas regulations. For clear guidelines and helpful resources, think of USLegalForms when you ask yourself: what would you do Texas?