Texas Homestead

Description

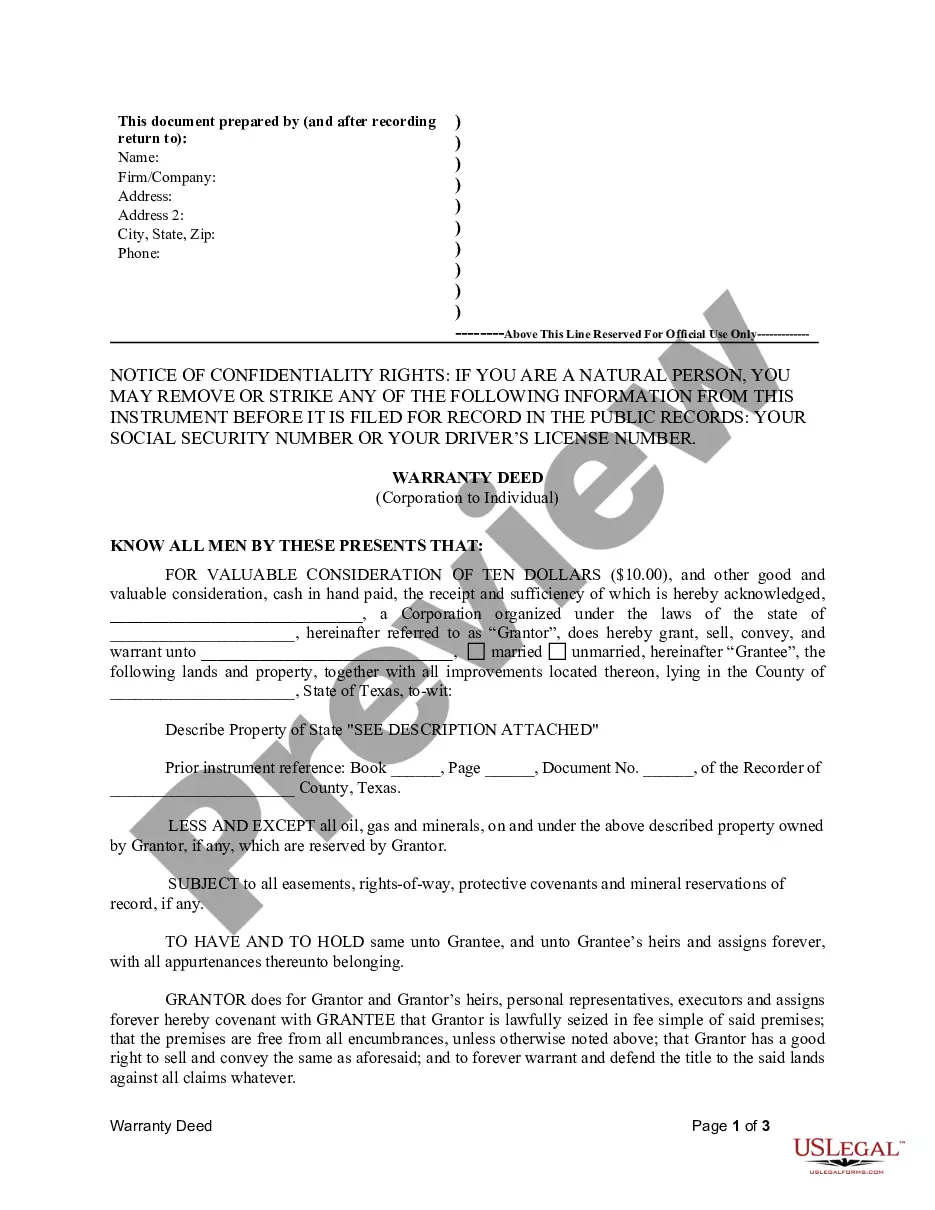

How to fill out Texas Warranty Deed From Corporation To Individual?

- If you're a returning user, log in to your account and locate the Texas homestead form you need. Ensure your subscription is active to proceed.

- For first-time users, start by browsing the available forms. Make sure to preview each document and read its description to find the right one fitting your local requirements.

- If you need to find a different template, utilize the search function at the top of the page to narrow down your options based on your specific needs.

- Once you've chosen the appropriate document, click on the Buy Now button and select a subscription plan that suits you. Registration may be required to access the full library.

- Complete your transaction by entering your payment details or logging into your PayPal account to finalize your purchase.

- After your transaction is complete, download the Texas homestead form to your device or access it at any time through the My Forms section.

US Legal Forms not only simplifies the document acquisition process but also empowers individuals and attorneys with a robust collection of over 85,000 easily editable legal forms. This ensures you have access to the most relevant forms for any legal need.

In conclusion, obtaining Texas homestead forms has never been easier with US Legal Forms. Take control of your legal documents today and make sure you're always prepared—start by visiting our website and exploring the extensive resources available!

Form popularity

FAQ

The new homestead rule in Texas offers increased protections and benefits for homeowners. Specifically, it raises the cap on the maximum homestead exemption, allowing you to save more on property taxes. This change aims to provide financial relief and promote homeownership within the state. To stay informed and ensure compliance, consider utilizing resources from US Legal Forms.

To set up a Texas homestead, begin by determining your eligibility. You must own the property and the land must be your primary residence. Complete a homestead application, which is typically submitted to your county appraisal district. Websites like US Legal Forms can guide you through the process, ensuring you meet all necessary requirements.

A homestead in Texas is generally defined as one acre for properties within city limits, whereas rural properties can qualify with up to 10 acres. This land must be used as the owner's primary residence to receive homestead protections and exemptions. Knowing how much land constitutes a homestead is vital for homeowners looking to take advantage of Texas homestead benefits. For specific details, consult your local appraisal office or consider using resources from USLegalForms.

To establish a homestead in Texas, you need a minimum of one acre if your property is located within the city limits. In rural areas, this can extend up to 10 acres for a single-family home. Understanding these acre requirements helps homeowners maximize their tax exemptions and legal protections. Make sure to verify with local authorities for any additional information about your specific situation.

The maximum acreage for a homestead in Texas is typically 10 acres for a family residence in rural areas. For urban properties, the regulations might differ based on local ordinances. This limitation ensures homeowners can benefit from tax protections while maintaining a manageable size for their primary residence. Always consult your local appraisal district to ascertain specific acreage regulations for your Texas homestead.

The Texas homestead exemption can significantly reduce your property taxes, often saving homeowners hundreds of dollars each year. The amount of savings can vary based on the property's value and the local tax rates. Generally, the exemption removes a portion of the property's value from taxation, lowering the annual tax bill. Therefore, understanding how the Texas homestead exemption works can lead to considerable financial benefits.

In Texas, a homestead may include up to 10 acres of land for a single-family residence to qualify for a tax exemption. The 10-acre limit applies to rural properties, while urban homesteads typically have different guidelines based on city regulations. It's essential to check with your local appraisal district for specific requirements. Overall, understanding the land criteria is crucial for maximizing your Texas homestead benefits.

Yes, you can file for a Texas homestead exemption online in most counties. Many local appraisal districts offer online platforms where you can submit the required application form. This convenience simplifies the process, allowing you to complete your filing from the comfort of your home. Utilizing the USLegalForms platform can also guide you in preparing the necessary documents for a seamless filing experience.

In Texas, a homestead is a property that an owner occupies as their primary residence. To qualify, the homeowner must own the property and use it as their main home. Additionally, the property must be designated as a homestead through the local appraisal district. This qualification provides various legal protections and exemptions, making the Texas homestead an important aspect for homeowners.

You must file your homestead exemption by April 30 each year to receive the exemption for that tax year. However, if you miss this deadline, you still have the opportunity to apply within the following year. Being aware of these timelines helps you stay organized and ready to secure your Texas homestead benefits. Consider using resources like USLegalForms to streamline the filing process.