Enhanced Life Estate For The Future

Description

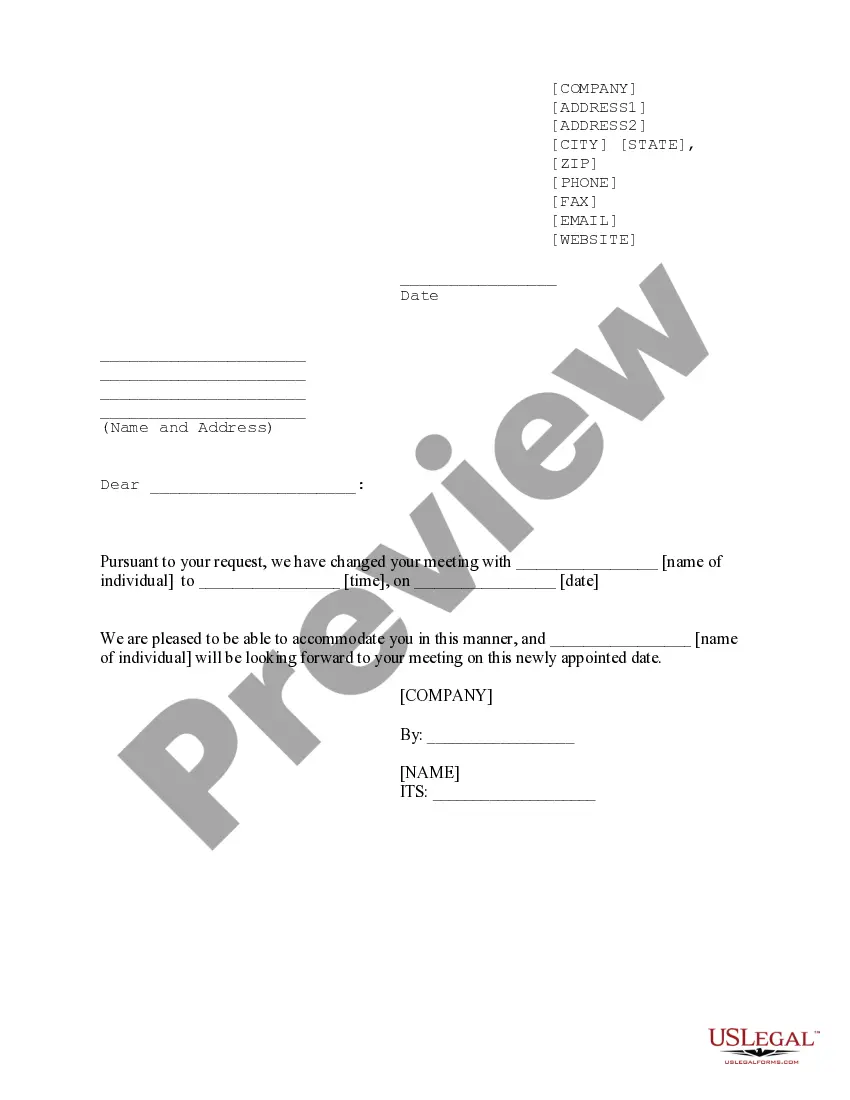

How to fill out Texas Lady Bird Or Enhanced Life Estate Warranty Deed - Individual To Individual?

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active or renew as needed.

- For first-time users, begin by reviewing the form preview and descriptions thoroughly to select the document that aligns with your needs.

- If you don’t find the right form, utilize the Search feature to locate alternative templates that fit your requirements.

- Once you’ve selected your document, click the Buy Now button and choose your preferred subscription plan; registration will be required to access your documents.

- Proceed with your payment using a credit card or PayPal for a seamless purchase experience.

- Finally, download your form and save it on your device for easy access. You can always retrieve it later from the My Forms section of your account.

By choosing US Legal Forms, you’re benefiting from a robust collection of over 85,000 editable legal documents, which often surpasses competitors in variety at a similar cost. Moreover, you can access guidance from premium legal experts to ensure your forms are completed accurately.

Take control of your future today with the right legal documents. Start your journey with US Legal Forms and secure your peace of mind.

Form popularity

FAQ

Many states in the U.S. recognize enhanced life estate deeds, allowing you to secure your property for the future. States such as Florida, Texas, and California have provisions for enhanced life estate for the future. This form of deed can provide clarity and ensure your property passes directly to your chosen beneficiaries without going through probate. If you are unsure about the regulations in your state, USLegalForms can help you navigate the process and find the right documents.

An enhanced life estate deed provides significant benefits for property owners in Florida. Not only does it help avoid the lengthy probate process, but it also allows you to retain full rights to the property during your lifetime. Moreover, as you plan for the future, this type of deed makes it easier for your heirs to inherit the property without complications. For those seeking a straightforward solution, US Legal Forms offers resources to facilitate this process effectively.

One major disadvantage of a life estate deed is the potential loss of control over the property. Once established, it can be challenging to modify or terminate without the consent of all parties involved. Additionally, with a traditional life estate deed, you may face tax implications upon transferring ownership, which is not the case with an enhanced life estate for the future. It's essential to weigh these factors carefully in your estate planning.

The enhanced life estate deed offers several advantages in Florida, making it an appealing choice for property owners. By creating this type of deed, you ensure that your property bypasses the probate process, leading to quicker transfer to your beneficiaries. Furthermore, an enhanced life estate for the future allows you to maintain full control of the property while alive, providing peace of mind and flexibility in how you manage your estate.

A life estate deed allows a person to maintain the right to live in a property until their death, before the property passes to their heirs. An enhanced life estate deed, however, provides the added benefit of avoiding probate, which means heirs receive the property faster. Additionally, with an enhanced life estate for the future, you retain control over the property during your lifetime but with less hassle for your heirs. Understanding this difference is crucial for effective estate planning.

To establish an enhanced life estate for the future, you'll need a properly drafted life estate deed, identification documents, and possibly a property survey. The deed should specify the life tenant and remainderman clearly. Consulting legal professionals can help ensure all necessary records are complete and compliant with local laws, safeguarding your property interests.

An enhanced life estate deed might state: 'I, John Doe, convey the property located at 123 Main Street to my daughter, Jane Doe, for her lifetime, with ownership transferring to my grandchild, Jake Doe, upon Jane's death.' This reflects the principles of enhanced life estates for the future, providing clear benefits like avoiding probate and ensuring seamless property transfer. Such deeds protect the rights of all parties involved.

Future interest in a life estate refers to the rights designated to the remainderman after the life tenant's passing. This concept is crucial for understanding enhanced life estates for the future, as it defines how property ownership transfers upon death. The remainderman holds an interest that becomes active only when the life estate ends, ensuring a clear transition of property rights.

A life estate can be created through various methods, including a deed, by operation of law, or through a will. First, a deed clearly outlines the life estate terms, as seen in enhanced life estates for the future. Second, a life estate can arise automatically under certain conditions, such as joint ownership. Lastly, a will can specify a life estate, ensuring the intention of the property owner is fulfilled after their passing.

Creating an enhanced life estate for the future requires precise language in the deed. You should use explicit terms that define the life tenant and the remainderman, ensuring clarity regarding rights and obligations. It's vital to state your intentions clearly to avoid confusion and protect your interests in the property.