Claims Against The Estate Examples

Description

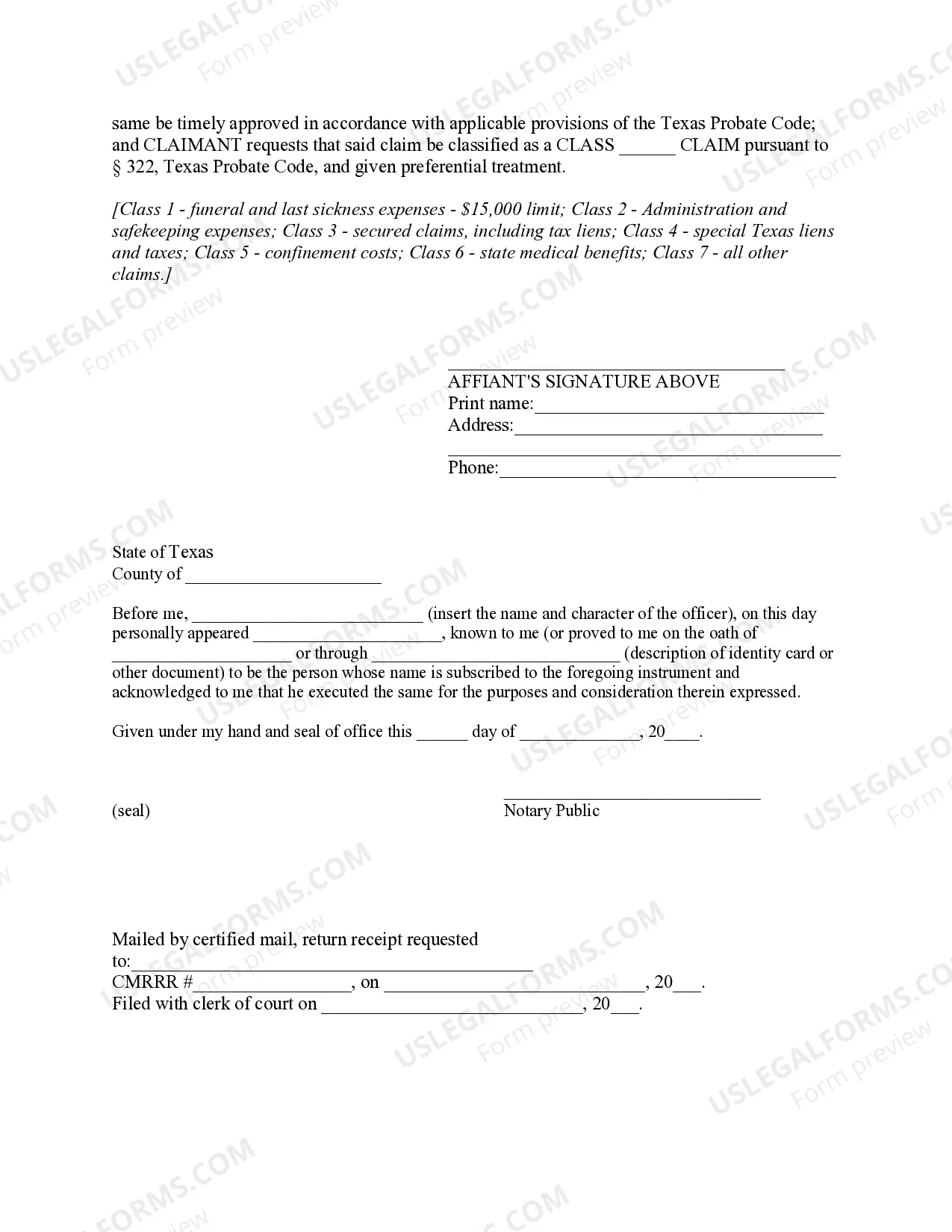

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

The Legal Templates for Claims Against The Estate presented on this site is a reusable legal document crafted by experienced attorneys in accordance with national and local laws.

For over 25 years, US Legal Forms has been supplying individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific templates for any professional and personal situation. It's the fastest, simplest, and most reliable way to acquire the documents you require, as the service ensures maximum data security and anti-malware safeguards.

Subscribe to US Legal Forms for access to authenticated legal templates for all of life's situations.

- Search for the necessary document and review it.

- Navigate through the file you searched and preview it or examine the form description to confirm it meets your needs. If it doesn't, utilize the search function to locate the suitable one. Hit Buy Now once you have identified the template you require.

- Select a subscription plan and Log In.

- Pick the pricing option that fits you and create an account. Use PayPal or a credit card for quick payment. If you already possess an account, Log In and check your subscription to continue.

- Acquire the fillable template.

- Select the format you want for your Claims Against The Estate Examples (PDF, Word, RTF) and download the document onto your device.

- Fill out and sign the document.

- Print the template to complete it manually. As an alternative, use an online versatile PDF editor to quickly and accurately fill out and sign your form with a valid signature.

- Redownload your documents as needed.

- Re-access the same document whenever necessary. Navigate to the My documents tab in your profile to retrieve any previously saved forms.

Form popularity

FAQ

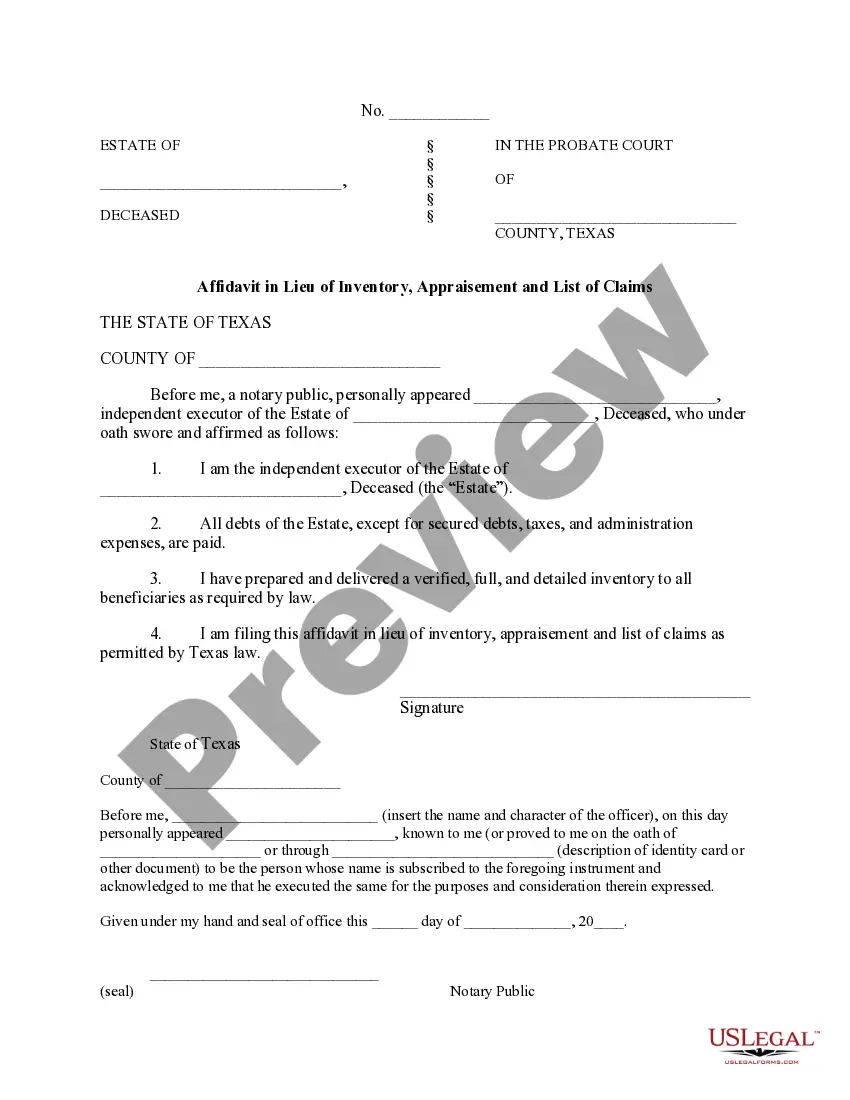

A Personal Representative, or executor, has 365 days in which to administer the estate of the deceased and to distribute their assets to the Beneficiaries. As complex estates can take longer than a year to wind up, this isn't a strict deadline.

The good news is that if you're a beneficiary of an estate, you do not inherit that estate's debts. Beneficiaries are typically not responsible for any outstanding debts that may be discovered after the probate period has passed or that can't be paid during the probate period.

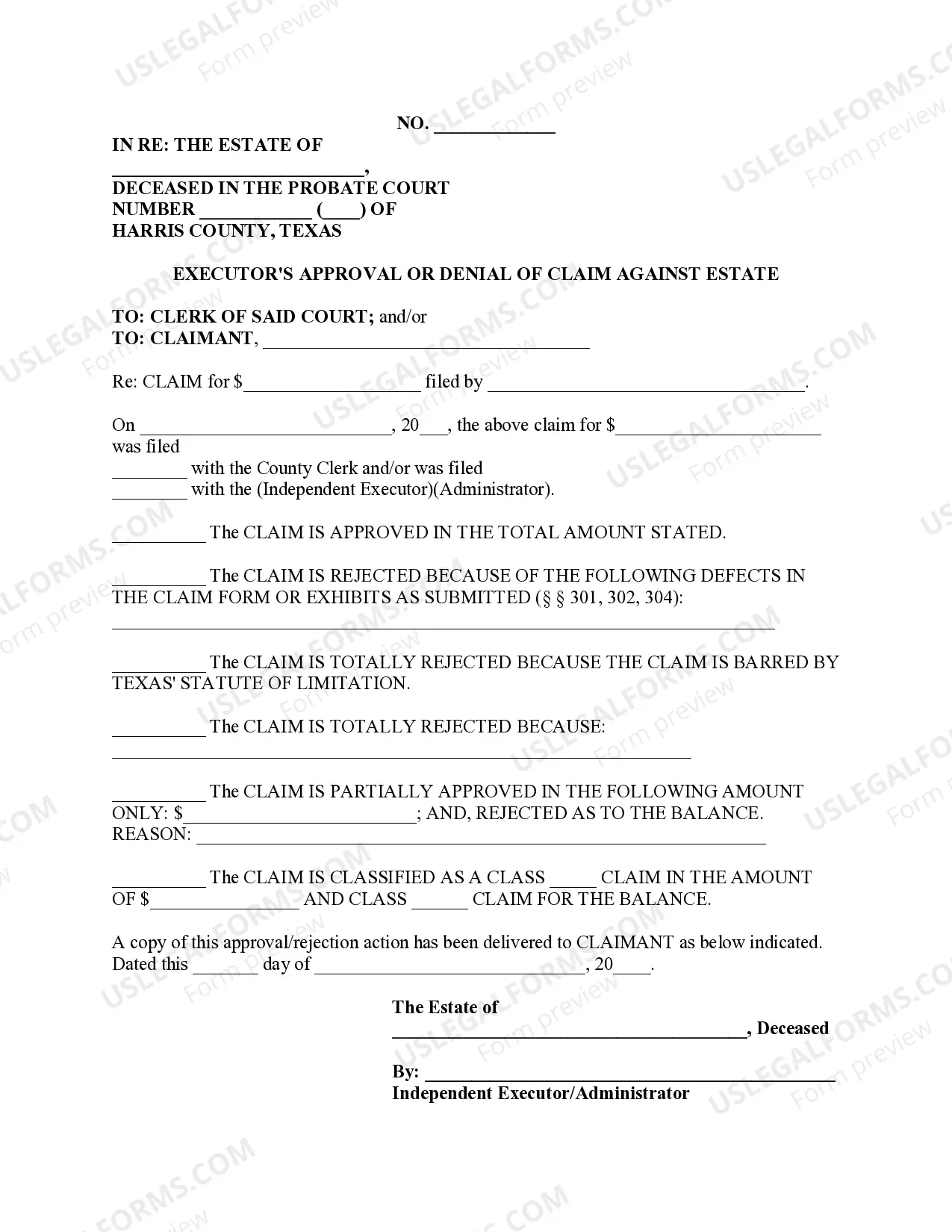

Creditor's claim (sometimes referred to as a proof of claim) is a filing with a bankruptcy or probate court to establish a debt owed to that individual or organization.

After one year, if the executor doesn't complete their duties, beneficiaries may demand payment (possibly with interest) by taking the executor to court.

When someone dies, their debts become a liability on their estate. The executor of the estate, or the administrator if no will has been left, is responsible for paying any outstanding debts from the estate.