Tennessee Poa Powers With The President

Description

How to fill out Tennessee Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- If you're a returning user, log in to your account and download the necessary template by clicking the Download button. Ensure your subscription is active; if it's expired, renew it based on your chosen payment plan.

- For new users, begin by reviewing the Preview mode and form description to confirm that the form meets your needs and adheres to your local jurisdiction requirements.

- If the form doesn’t meet your expectations, utilize the Search tab above to locate an alternative template that fits your requirements.

- Once you find the right document, proceed to purchase it by clicking on the Buy Now button and selecting your preferred subscription plan. Remember to create an account to gain access to vast resources.

- Complete your purchase by entering your payment details, either through a credit card or PayPal account.

- Finally, download your completed form and save it on your device. You can also access it anytime through the My Forms section of your profile.

US Legal Forms stands out by offering a vast collection of forms, providing over 85,000 fillable and editable legal documents at a competitive price.

With access to premium experts for guidance on form completion, you can achieve precise and legally compliant documentation. Start your journey today and experience the confidence that comes with using the best legal form tool available.

Form popularity

FAQ

To file taxes as a power of attorney, ensure that you have the authorized power of attorney documentation in place, typically using Form 2848. This form grants you the authority to sign tax returns and handle communications with the IRS on behalf of the principal. Prepare the necessary tax documents accurately, sign as the power of attorney, and submit everything according to IRS guidelines. By doing this, you effectively leverage your Tennessee POA powers with the president to ensure compliance.

In Tennessee, a power of attorney grants significant rights to the agent, enabling them to make decisions regarding financial and legal matters for the principal. The specific powers can vary depending on what is detailed in the document. These rights can include managing bank accounts, signing documents, and making property decisions. Understanding the extent of these Tennessee POA powers with the president is crucial for both parties.

To file a power of attorney with the IRS, complete Form 2848. This form requires details about both you and your representative, along with the specific tax matters you are authorizing them to handle. After completing the form, submit it to the IRS, keeping a copy for your records. This will ensure your Tennessee POA powers with the president are formally recognized for your tax interactions.

Yes, the IRS does recognize a power of attorney. By using Form 2848, you allow someone to manage your tax matters and represent you in dealings with the IRS. It's essential that the form is filled out correctly, as any errors may lead to delays in recognition. By doing this right, you can effectively utilize Tennessee POA powers with the president in tax-related issues.

The processing time for a power of attorney with the IRS can vary, typically taking a few weeks. Once you submit Form 2848, the IRS will review it and may contact you for further verification. Staying proactive by ensuring all information is accurate will help expedite the process. Remember to maintain communication with your representative to monitor the status.

You can upload your power of attorney documents to the IRS. When you need to allow someone to represent you before the IRS, file Form 2848, which serves as your legal authority grant. This form allows your representative to act on your behalf for specific tax matters. Using this process ensures your Tennessee POA powers with the president are recognized effectively by the IRS.

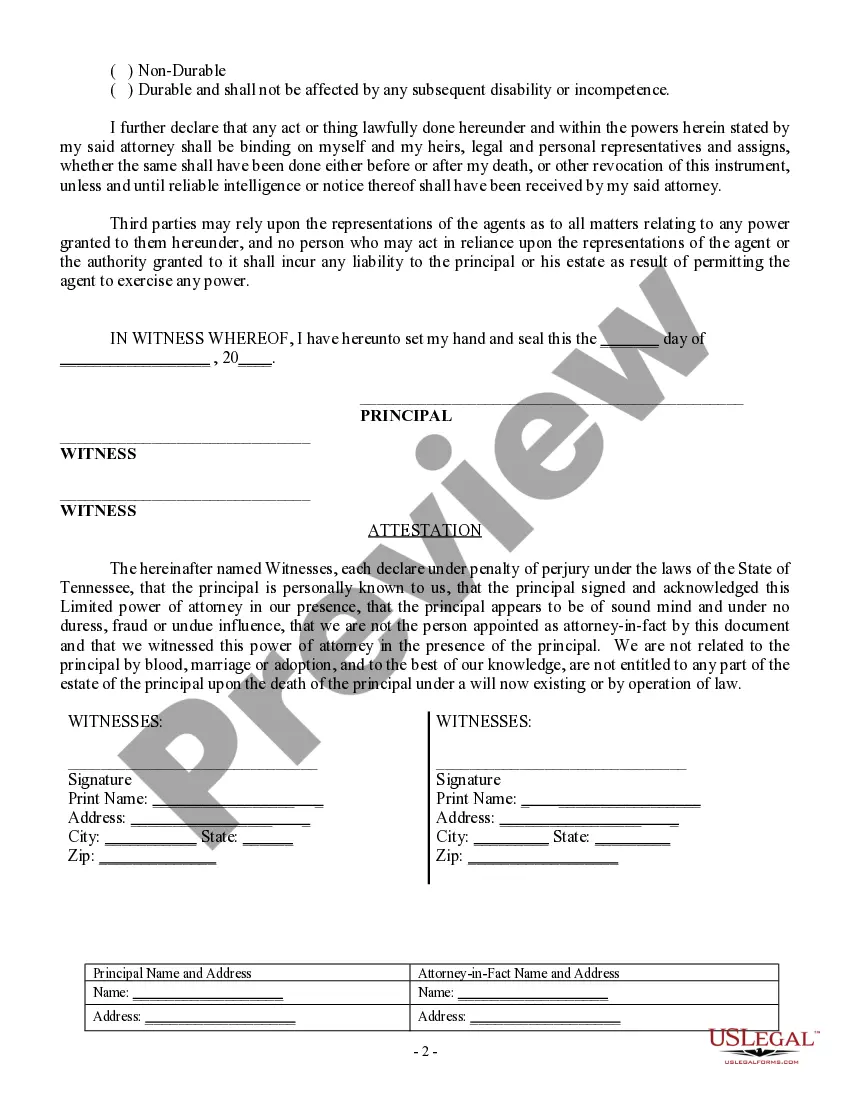

To file a power of attorney in Tennessee, you need to complete a power of attorney form that meets state requirements. Ensure you include the names of the principal and agent, along with specific powers granted. Once completed, sign the document in front of a notary public. Finally, consider recording it with your local county register to enhance its validity, especially for property matters.

A power of attorney in Tennessee cannot make decisions about the principal's life in a way that contravenes their wishes, such as ending life support if the principal has expressed their wishes otherwise. Additionally, the Tennessee poa powers with the president do not authorize agents to change the principal's will or make personal decisions that require the principal's direct input. Understanding these limitations is vital for both principals and agents. Explore US Legal Forms for tools and templates that clarify these boundaries.

A durable power of attorney in Tennessee allows an agent to act on the principal's behalf even if the principal becomes incapacitated. This Tennessee poa powers with the president provides peace of mind, as it ensures your financial and health decisions are managed by someone you trust. It's crucial to appoint a reliable agent to safeguard your interests during challenging times. You can create a durable POA using resources available on US Legal Forms for a clear and effective document.

In Tennessee, the rules surrounding power of attorney (POA) require that the document is signed by the principal and notarized. The Tennessee poa powers with the president can grant various authorities, such as health care decisions and financial transactions. It is important that the principal understands the extent of the powers they are granting. For your needs, you may consider using a reliable platform like US Legal Forms to ensure everything is set up correctly.