Tennessee Corporate Powers With The Same Base

Description

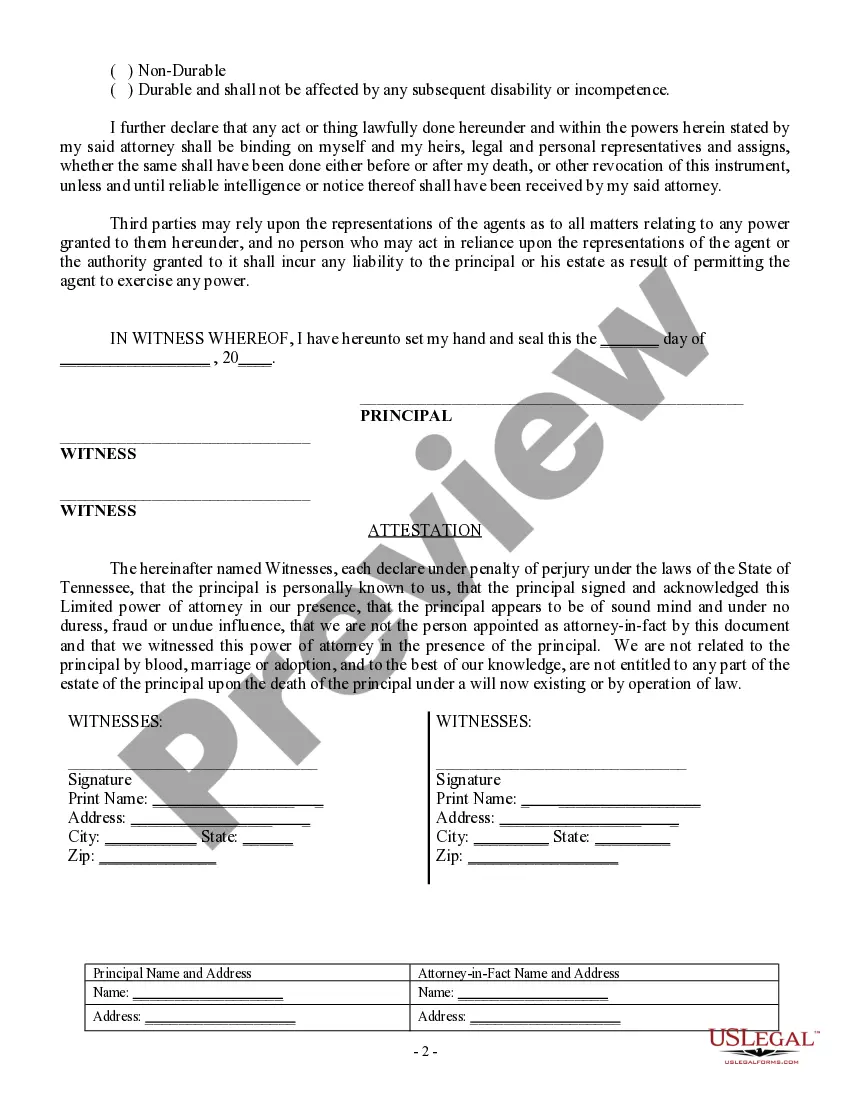

How to fill out Tennessee Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- If you’re returning, log in to your account and find your desired form. Confirm that your subscription is current; renew if necessary.

- For first-time users, start by browsing the Preview mode and checking the form description to ensure compatibility with your needs and local jurisdiction.

- If adjustments are needed, utilize the Search feature to find a more suitable template.

- Once you've identified the correct form, click on the Buy Now button and select your preferred subscription plan. You will need to create an account for full access.

- Proceed with the payment by entering your credit card details or using PayPal to finalize the purchase.

- After completing your transaction, download your form to your device, ensuring easy access in the My Forms section of your profile.

Concluding your purchase with US Legal Forms grants you access to a robust collection of legal documents, supported by expert assistance for optimal accuracy.

Ready to simplify your legal document needs? Start using US Legal Forms today!

Form popularity

FAQ

Tennessee taxes corporations primarily through the excise tax and franchise tax. The excise tax applies to income earned in the state, while the franchise tax is based on the net worth of the corporation. Familiarizing yourself with these aspects of Tennessee corporate powers can help you optimize your tax strategy. For comprehensive guidance, consider accessing resources on the US Legal Forms platform.

Yes, Tennessee allows corporations to request a federal extension for filing their tax returns. This extension typically provides additional time for filing corporate income tax returns at both federal and state levels. Utilizing this option can be beneficial in managing your obligations under Tennessee corporate powers. The US Legal Forms platform can offer detailed forms and resources to assist with this process.

Any business entity, whether a corporation or LLC, that conducts business in Tennessee must file a business tax return. This requirement encompasses both single member and multi-member LLCs. Understanding the scope of Tennessee corporate powers can help you identify your obligations. If you need assistance with the filing process, consider exploring the US Legal Forms platform.

In Tennessee, excise tax applies to corporations that earn income within the state. This includes both traditional and LLC corporations that meet certain revenue thresholds. Understanding these rules around Tennessee corporate powers can help ensure your business remains compliant and informed. For specifics, the US Legal Forms platform can provide essential guidance.

Yes, Tennessee taxes single member LLCs. These entities are typically treated as pass-through businesses for federal tax purposes, meaning the income passes directly to the owner. However, they may still be subject to Tennessee corporate powers, specifically the minimum franchise tax and business tax. To ensure compliance and make the most of your tax obligations, you might explore resources on the US Legal Forms platform.

Yes, you can start a corporation by yourself in Tennessee, but it's important to understand the responsibilities involved. As the sole founder, you’ll need to comply with all regulations governing Tennessee corporate powers. This includes filing the required documentation and establishing a board of directors, even if you're the only member. Utilizing platforms like UsLegalForms can help you ensure that you meet all legal requirements and set your corporation up for success.

Forming a corporation in Tennessee requires you to follow specific steps carefully. You need to select an available name, file necessary forms with the Secretary of State, and set up bylaws that govern your corporation. Additionally, appointing a registered agent is crucial, as they handle legal documents. For efficient assistance, the UsLegalForms platform can simplify this process by providing tailored resources and forms.

Yes, Tennessee imposes a state corporate tax on businesses operating within its borders. This tax is calculated based on your business's net earnings. Understanding the implications of this tax is vital for managing your finances as you navigate Tennessee corporate powers. Seeking guidance from tax professionals can streamline the process and ensure compliance.

Starting a corporation in Tennessee involves several straightforward steps. First, you need to choose a unique name that complies with Tennessee corporate powers regulations. Then, you must file a charter with the Tennessee Secretary of State, appoint a registered agent, and develop corporate bylaws. Providing your business with a solid foundation is essential for growth.

Tennessee offers various business entity types, each with unique characteristics. You can choose from sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, among others. These structures define how your business operates and how it interacts with Tennessee corporate powers. Make sure to evaluate each option to select the one that aligns best with your business strategy.