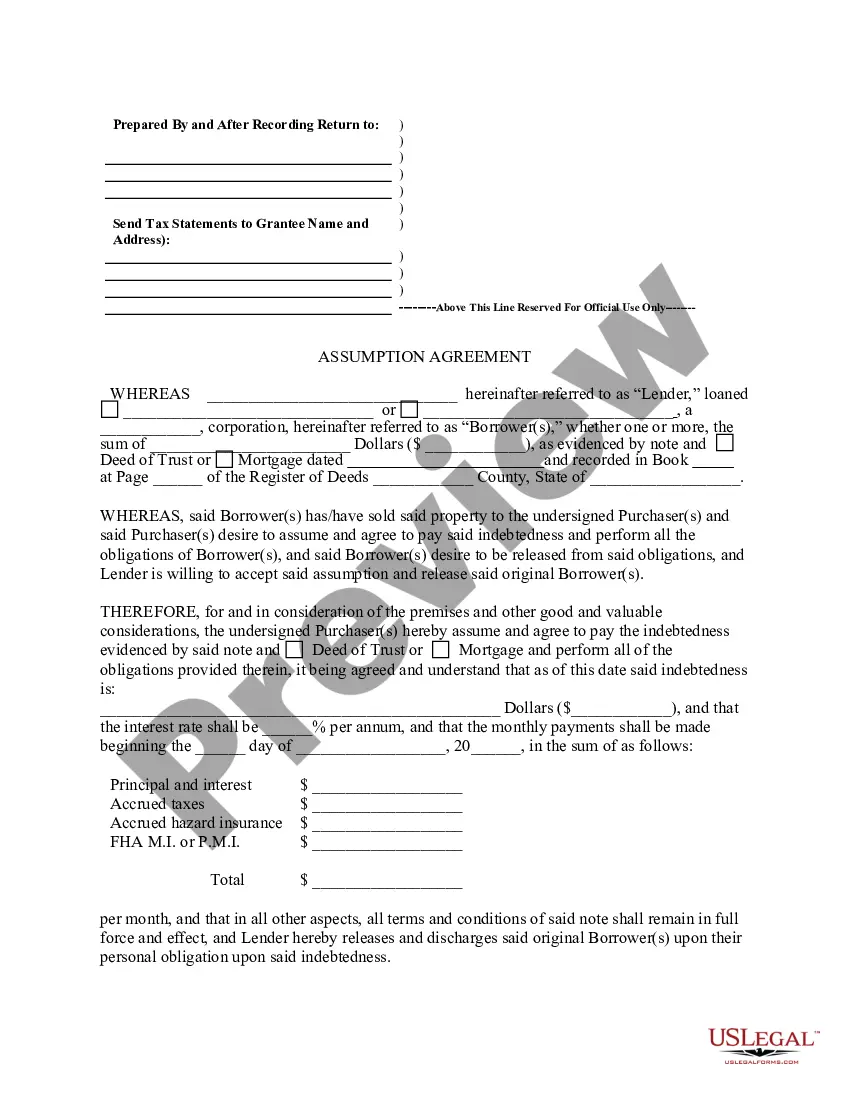

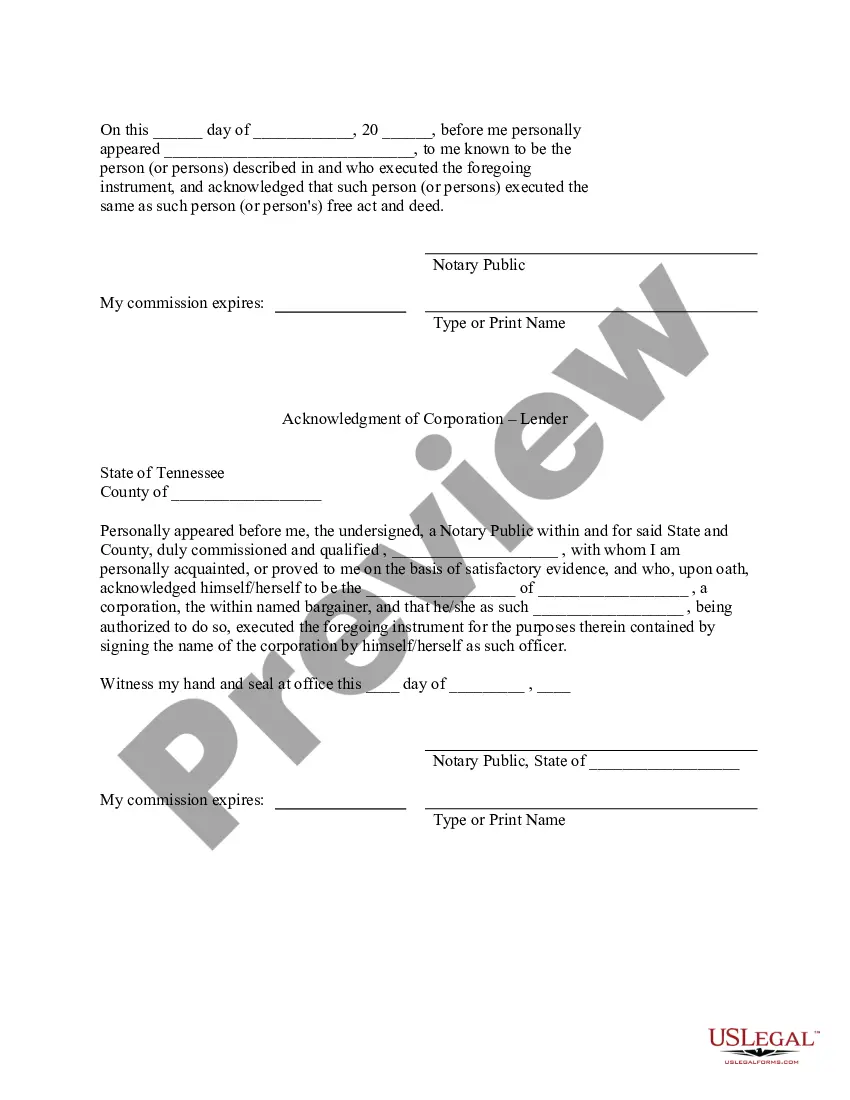

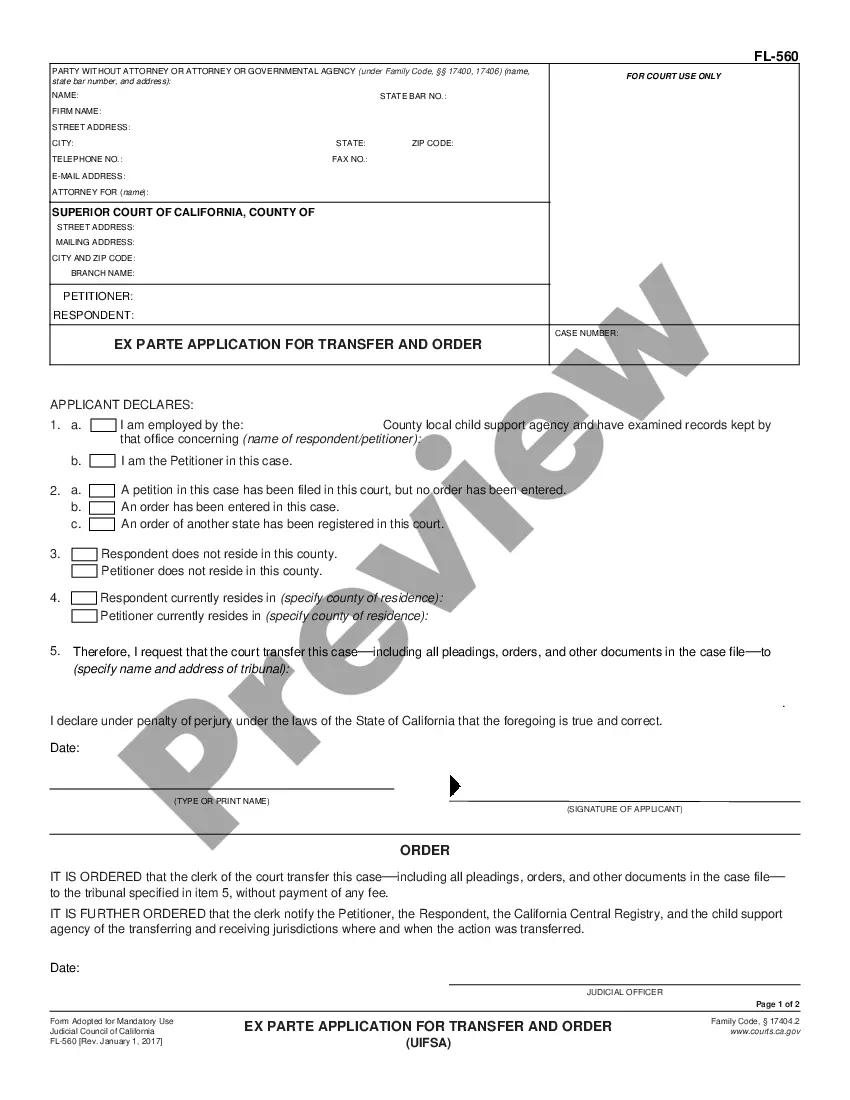

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Deed Of Trust For Assumption

Description

How to fill out Deed Of Trust For Assumption?

Individuals often link legal documentation with something intricate that only an expert can manage.

In a particular sense, this is accurate, as creating a Deed Of Trust For Assumption necessitates considerable knowledge of the subject matter, including local and state laws.

Nonetheless, with US Legal Forms, everything has become easier: pre-made legal templates for any personal and business scenario tailored to state regulations are gathered in a single online repository and are now accessible to all.

Select a subscription option that fits your needs and financial plan. Create an account or Log In to continue to the payment section. Make your payment using PayPal or your credit card. Choose the format for your file and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they are saved in your profile. You can access them as required through the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides more than 85,000 current forms categorized by state and purpose, making the search for a Deed Of Trust For Assumption or any other specific template quick.

- Previously registered users with an active subscription must Log Into their account and click Download to acquire the form.

- New users will need to create an account and subscribe before they are able to download any documents.

- Here is a detailed guide on how to obtain the Deed Of Trust For Assumption.

- Review the content on the page carefully to ensure it fulfills your requirements.

- Read the form overview or view it through the Preview option.

- If the first one is unsuitable, find another template using the Search field in the header.

- Once you discover the correct Deed Of Trust For Assumption, click Buy Now.

Form popularity

FAQ

A Trust Deed is a legal document that outlines the relationship between the borrower, lender, and a third-party trustee when property is financed. It serves as security for the lender, allowing property to be sold if the borrower defaults. This document is critical in property financing and helps ensure that all parties understand their rights and obligations. When looking into financing options, consider how a Deed of trust for assumption can protect both lenders and borrowers alike.

The primary difference between a general Warranty Deed and a special Warranty Deed lies in the extent of the warranties provided. A general Warranty Deed offers full and comprehensive guarantees against all claims, even those prior to the seller's ownership. In contrast, a special Warranty Deed only protects against issues that arose during the seller's ownership. When considering property transactions, understanding the role of the Deed of trust for assumption is essential for securing your investment properly.

A special Warranty Deed in Texas divorce refers to a legal document that transfers property ownership from one party to another, but only covers claims during the time the seller owned the property. It provides limited guarantees and does not cover issues that arose before the seller took ownership. This type of deed can be crucial in divorce settlements where the division of assets is involved. For a more comprehensive understanding, exploring the Deed of trust for assumption can help clarify property transfer processes.

The Acknowledgement of Trust deed verifies the existence of a trust and the powers granted to the trustee. It provides assurance that the trustee can act on behalf of the trust. When creating a Deed of Trust for assumption, understanding this deed can clarify the roles and responsibilities each party holds.

The main objectives of a trust deed include protecting the lender's interest and outlining the borrower's obligations. It establishes clear terms regarding default and foreclosure procedures, ensuring transparency in the borrowing process. When utilizing a Deed of Trust for assumption, these objectives help facilitate smoother property transitions.

An assumption document is a legal agreement where one party agrees to take over the obligations and rights of another under an existing contract, often seen in real estate transactions. For a deed of trust for assumption, this document is vital for formalizing the transfer of liability. It typically details the terms that the new party must abide by. Using USLegalForms can simplify the drafting and understanding of such documents.