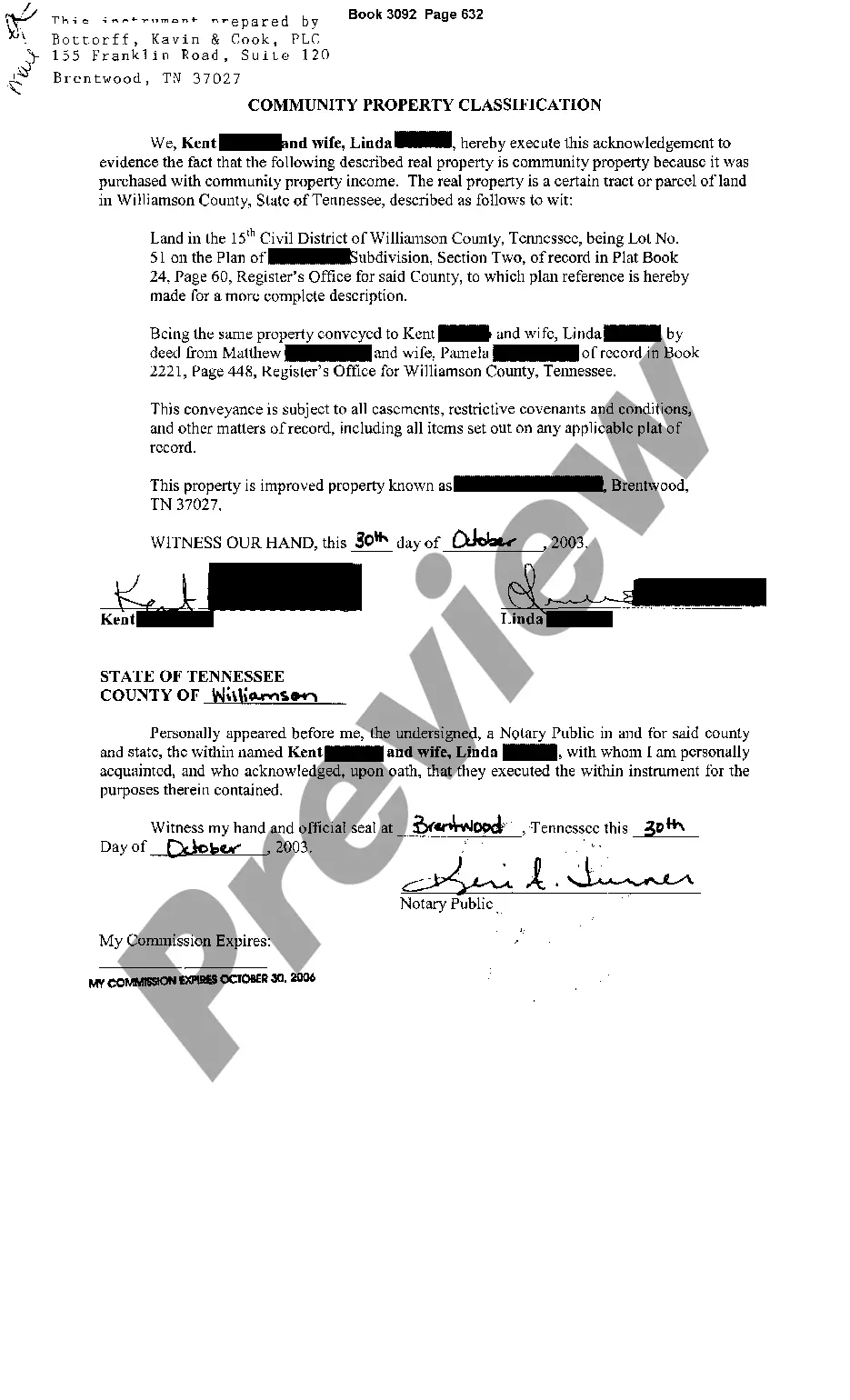

Tennessee Community Property With Ros

Description

How to fill out Tennessee Community Property With Ros?

Regardless of whether you deal with documentation frequently or need to present a legal report from time to time, it is essential to have a reference source where all the examples are pertinent and current.

The initial step you must take with a Tennessee Community Property With Ros is to verify that it is the most updated version, as this determines its acceptability.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

Utilize the search menu to locate the form you require. Review the Tennessee Community Property With Ros preview and details to ensure it is indeed what you are looking for. After confirming the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card information or PayPal account to finalize the purchase. Choose the file format for download and confirm it. Eliminate the confusion associated with managing legal paperwork. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly every sample form you may need.

- Look for the templates you need, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you have access to approximately 85,000 document templates across various sectors.

- Obtain the Tennessee Community Property With Ros examples in just a few clicks and save them anytime in your account.

- A US Legal Forms account enables you to access all the samples you need conveniently without hassle.

- Simply click Log In in the website header and navigate to the My documents section to have all the necessary forms at your fingertips, eliminating the need to spend time searching for the right template or verifying its suitability.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

The step up basis for Tennessee community property with ros refers to the adjustment of property value to its fair market value at the time of a spouse's death. This adjustment can significantly reduce capital gains taxes when the property is sold later. Understanding this concept is vital for estate planning, as it affects the financial outcome for surviving spouses.

Filing MFS in a community property state like Tennessee requires you to report half of the total community income on your tax returns. Use Form 8958 to ensure proper allocation of income between both spouses. It's beneficial to review specific state guidelines or consult with uslegalforms to ensure compliance and accuracy in filing.

Yes, you can file Married Filing Separately (MFS) for federal taxes while filing Married Filing Jointly (MFJ) for state taxes in Tennessee. This approach may benefit specific circumstances, but it can also lead to confusion regarding deductions and credits. Always consider consulting a tax advisor to find the most effective filing strategy.

To file community property income adjustments, you need to accurately report your income according to community property laws in Tennessee. Ensure that each spouse's share of income is correctly allocated on your tax return. Tools and resources, like uslegalforms, can help you understand what adjustments you need to make for an accurate filing.

Form 8958 is used to allocate income between spouses filing separately in community property states, including Tennessee. The form ensures each spouse reports half of the total community income, helping to maintain compliance with tax regulations. Properly completing Form 8958 allows couples to accurately reflect their income allocations on their tax returns.

Yes, you can file separately in a community property state like Tennessee. However, this choice affects taxation and income reporting, making it crucial to understand the implications. Residents should consult a tax professional to navigate filing status and community property laws effectively.

One disadvantage of Tennessee community property with ros is that both spouses share ownership during marriage, which may complicate financial decisions. Another issue is that if one spouse passes away, the other becomes the sole owner, possibly leading to challenges for other heirs. Additionally, this ownership structure can limit planning options for tax liabilities and estate distribution.

A community property with right of survivorship brokerage account allows both spouses to jointly own assets, ensuring that if one spouse passes away, the surviving spouse automatically inherits the full account. This arrangement provides simplicity and continuity in managing finance during difficult times. Understanding Tennessee community property with ROS will help you utilize this feature effectively within your financial planning.

To enter community property income adjustments, first calculate your total income and then determine the portion attributable to community property. In Tennessee, you must carefully document this to ensure a fair tax consideration. Utilizing tools from platforms like US Legal Forms can streamline this process and help you navigate the complexities of Tennessee community property with ROS.

Tennessee has no strict duration for marriage to qualify for alimony; however, longer marriages often result in more substantial support. Courts consider various factors, including financial need and standard of living. It is wise to consult legal resources like US Legal Forms for clarity on alimony and how Tennessee community property with ROS might influence your situation.