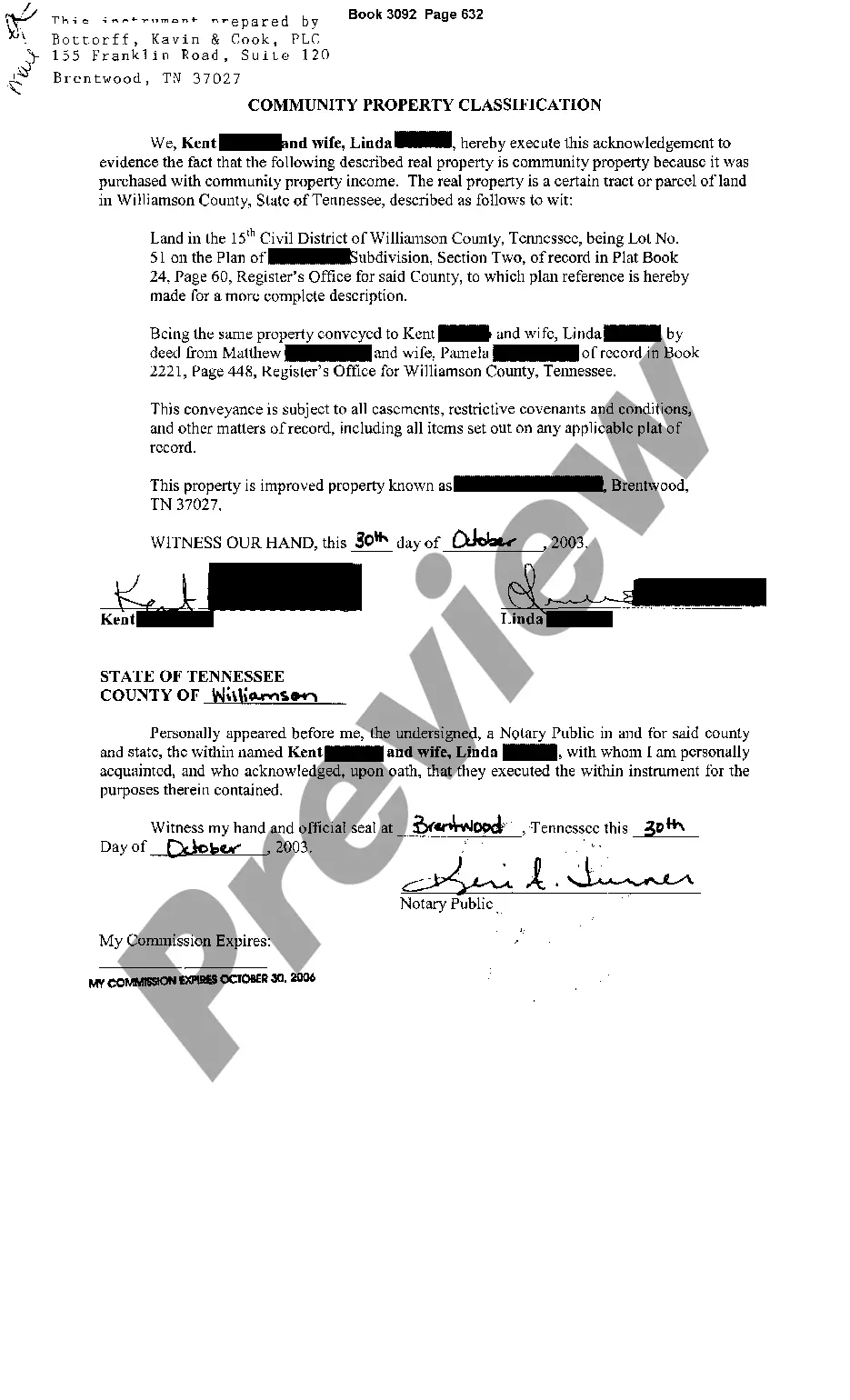

Tennessee Community Property With Right

Description

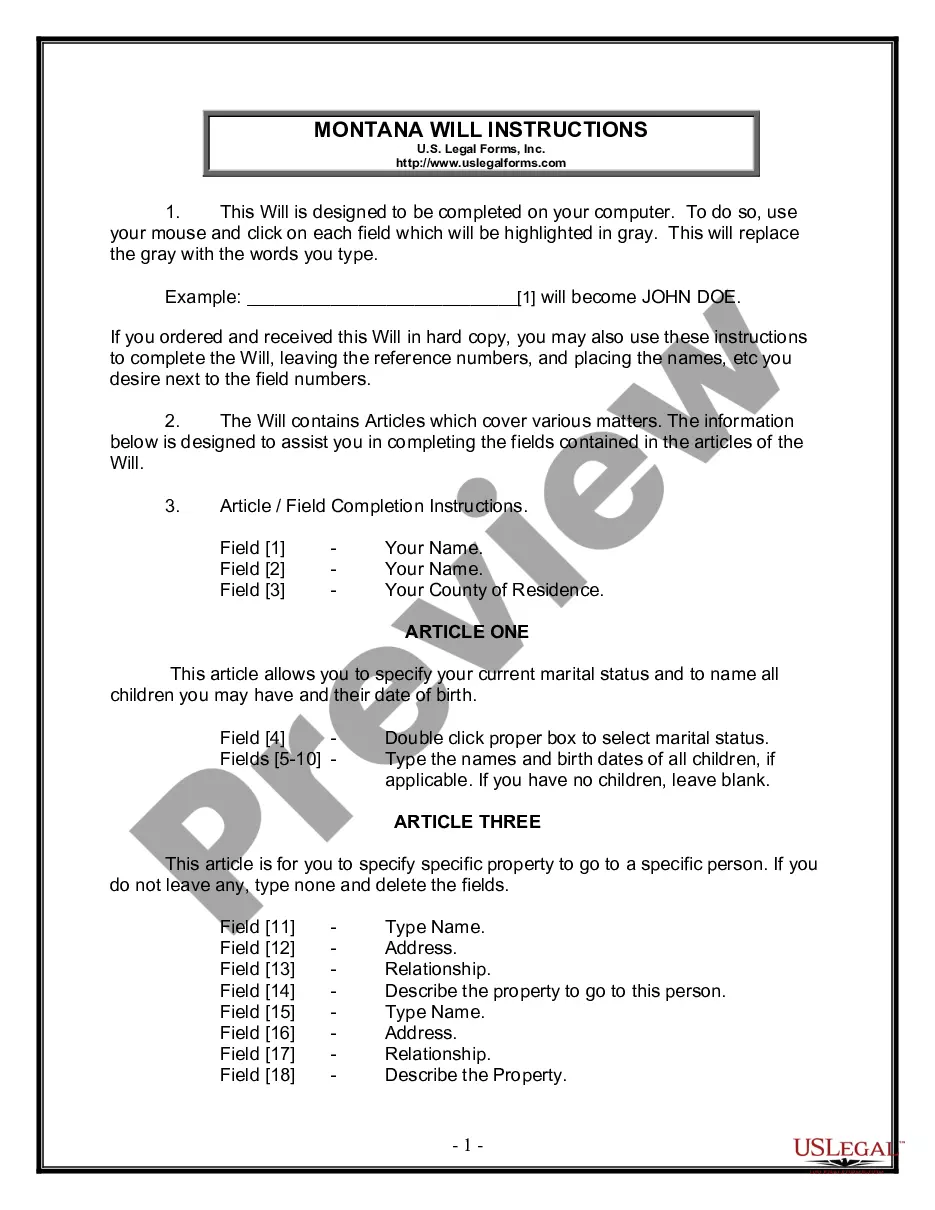

How to fill out Tennessee Community Property With Right?

Administration necessitates meticulousness and exactness.

If you do not manage completing documents like Tennessee Community Property With Right regularly, it may lead to some misunderstanding.

Selecting the correct template from the outset will guarantee that your document submission proceeds smoothly and avert any trouble of resubmitting a file or undertaking the same task entirely from the beginning.

Acquiring the right and current templates for your paperwork is a matter of minutes with an account at US Legal Forms. Eliminate bureaucratic worries and simplify your documentation process.

- Find the template using the search box.

- Verify that the Tennessee Community Property With Right you've found is suitable for your state or region.

- Inspect the preview or review the description that includes the details on the use of the template.

- When the outcome aligns with your query, click the Buy Now button.

- Select the suitable option among the provided pricing plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal account.

- Download the document in your preferred format.

Form popularity

FAQ

If you file married filing separately, the property taxes will typically be claimed by the spouse whose name appears on the property deed. In a community property state like Tennessee, however, both parties may have a claim to property taxes. It's essential to be clear about your property ownership and responsibilities when filing taxes. USLegalForms can equip you with relevant tools to navigate these nuances effectively.

When filing married separately, each spouse has to report their own income and claim their own deductions. This filing status can result in higher taxes due to limitation on certain credits and deductions. It’s important to keep accurate records of shared expenses and beware of community property laws in Tennessee. Consulting resources like USLegalForms can aid in ensuring compliance with these rules.

Tennessee does not officially recognize community property laws as some states do. However, the court may treat marital assets as belonging to both parties equally under equitable distribution laws during a divorce. Understanding this distinction is essential to effectively manage your assets. The insights on USLegalForms can help clarify your rights regarding Tennessee community property with right.

Yes, you can file married filing separately if you reside in different states, including community property states like Tennessee. Each spouse must file a return for their state, reporting their own income accurately. However, this can complicate matters regarding community property, so be aware of different state laws affecting your filings. USLegalForms can provide insights specific to your circumstances.

When filing married separately in a community property state like Tennessee, each spouse reports half of the community income on their tax return. However, both partners are still legally responsible for their community debts. This method often leads to complex tax implications, so it is advisable to seek assistance from financial professionals. Platforms like USLegalForms can offer resources tailored for navigating these situations.

Married couples in Tennessee can hold property under specific titles, such as joint tenancy or tenancy by the entirety. This means both spouses have equal ownership and rights over the property. Additionally, they can separately own property acquired before marriage or through gift or inheritance. Familiarity with these ownership types helps ensure proper management of Tennessee community property with right.

In Tennessee, community property includes assets acquired during the marriage. Both spouses share ownership of this property equally, regardless of whose name is on the title. To establish community property legally, documentation of joint purchases or agreements may be necessary. Understanding your rights regarding Tennessee community property with right is vital to managing your assets effectively.

To file married filing separately in a Tennessee community property state, you must gather all necessary income and expense documents. Each spouse reports their own income and deducts their own expenses. Remember, this method often leads to complications regarding the division of community property, so be sure to consult legal resources or a professional. USLegalForms provides useful guidance to help you navigate this process.

Tennessee indeed has joint tenancy with the right of survivorship in its property laws. This means that two or more people can own a property together, ensuring that the property automatically transfers to the surviving owner upon death. For those looking to secure their property rights and plan for the future, it's essential to understand how Tennessee community property with right plays a role in these arrangements. Using resources from US Legal Forms can clarify the complexities involved and provide necessary legal documents.

Yes, Tennessee does recognize joint tenancy with right of survivorship. This legal structure allows co-owners to inherit each other's share automatically upon death, avoiding probate. It is a popular choice among married couples for planning their estates. Being informed about how Tennessee community property with right interacts with joint tenancy is crucial for effective estate management.