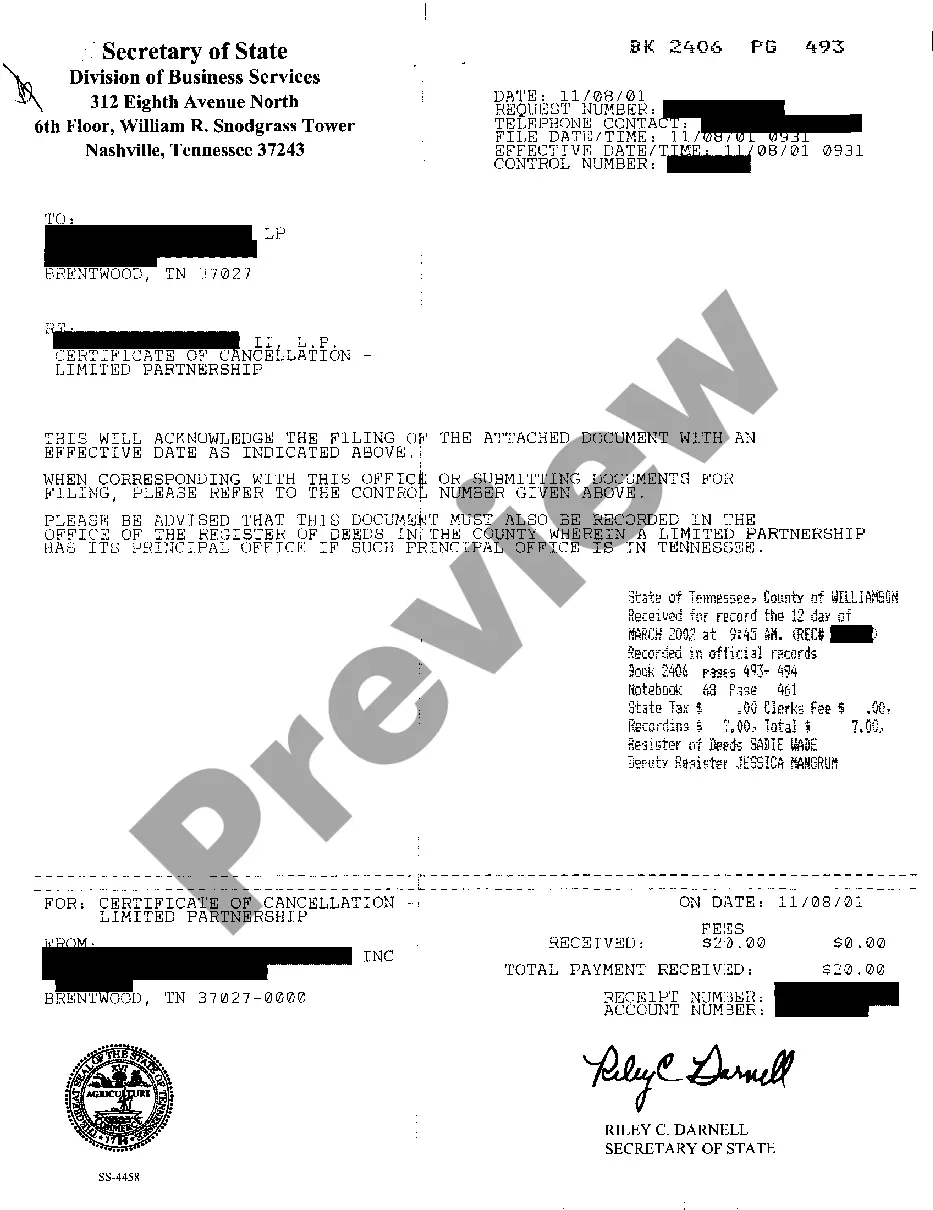

Certificate Of Cancellation For Ccj

Description

How to fill out Certificate Of Cancellation For Ccj?

Regardless of whether you frequently handle documents or occasionally need to submit a legal paper, it is essential to have a source where all the templates are related and current.

The very first step you should take with a Certificate Of Cancellation For Ccj is to confirm that it is indeed its most recent version, as it determines whether it can be submitted.

If you wish to streamline your search for the most recent document examples, look for them on US Legal Forms.

To acquire a form without needing an account, follow these steps: Use the search feature to locate the form you require. View the Certificate Of Cancellation For Ccj preview and description to confirm it is indeed the one you are interested in. After double-checking the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card information or PayPal details to complete the purchase. Select the file format you wish to download and confirm it. Eliminate any confusion when handling legal documents. All your templates will be organized and authenticated through your account at US Legal Forms.

- US Legal Forms is a repository of legal documents that contains nearly every document template you may need.

- Find the templates necessary for your needs, check their immediate relevance, and learn more about how to use them.

- With US Legal Forms, you can access over 85,000 document templates across a broad range of professions.

- Locate the Certificate Of Cancellation For Ccj examples in just a few clicks and save them anytime within your account.

- Having an account with US Legal Forms will provide you with easier and more efficient access to all the templates you require.

- You merely need to click Log In in the website header and navigate to the My documents section, where all the forms you need are readily available.

- You will not have to waste time either searching for the correct template or verifying its validity.

Form popularity

FAQ

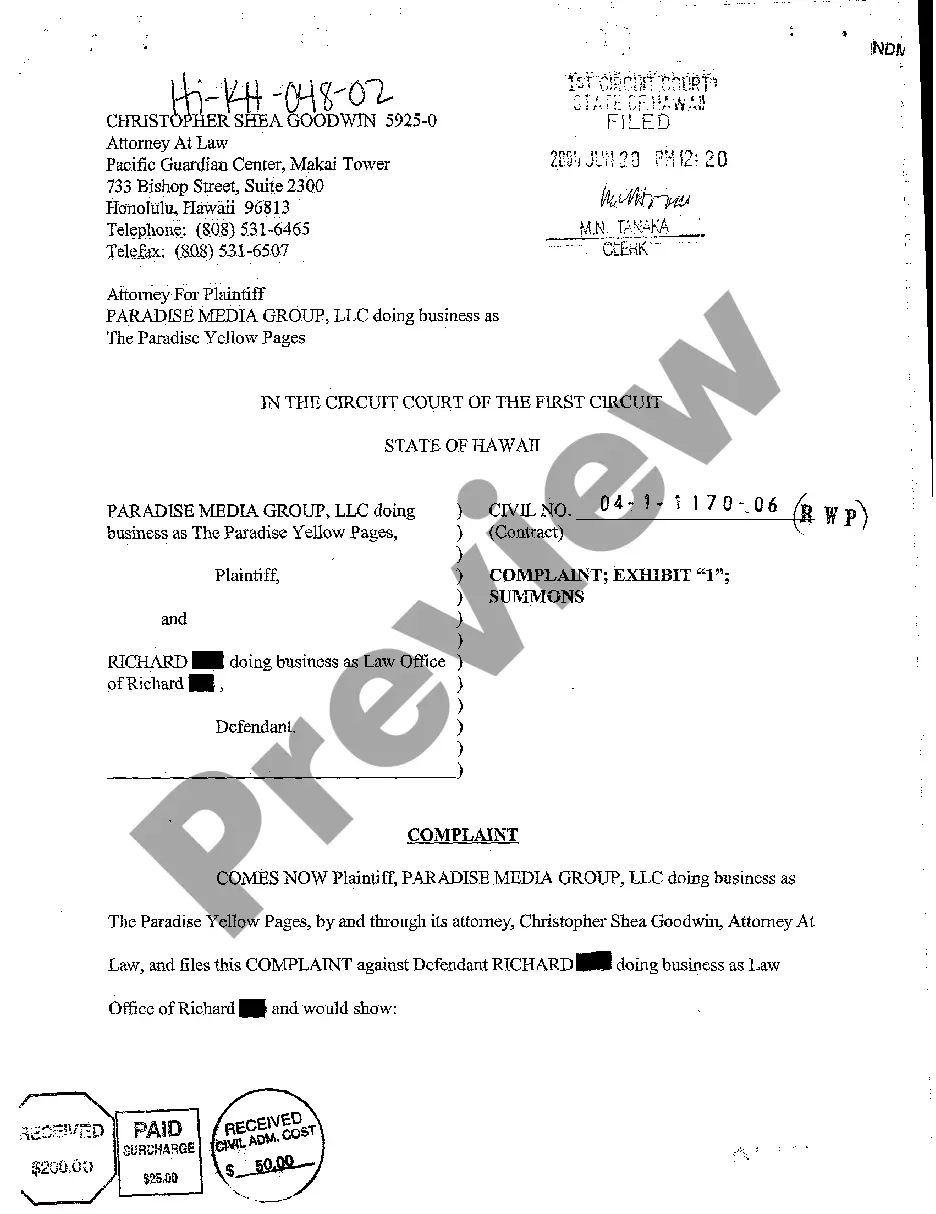

A CCJ remains active for six years from the date of the judgment unless it's canceled earlier. During this period, it can significantly impact your credit score and borrowing capabilities. If you manage to settle the debt before the six years are up, you should request a certificate of cancellation for ccj to update your financial records. US Legal Forms offers useful templates and guidance for handling CCJs to help you move forward.

When a CCJ expires after six years, it automatically falls off your credit report, and you no longer owe the debt. However, if any legal actions tied to the CCJ remain unresolved, they could still affect you. It's advisable to request a certificate of cancellation for ccj to ensure that all records reflect the cancellation accurately. US Legal Forms can help you manage all documentation related to CCJs effectively.

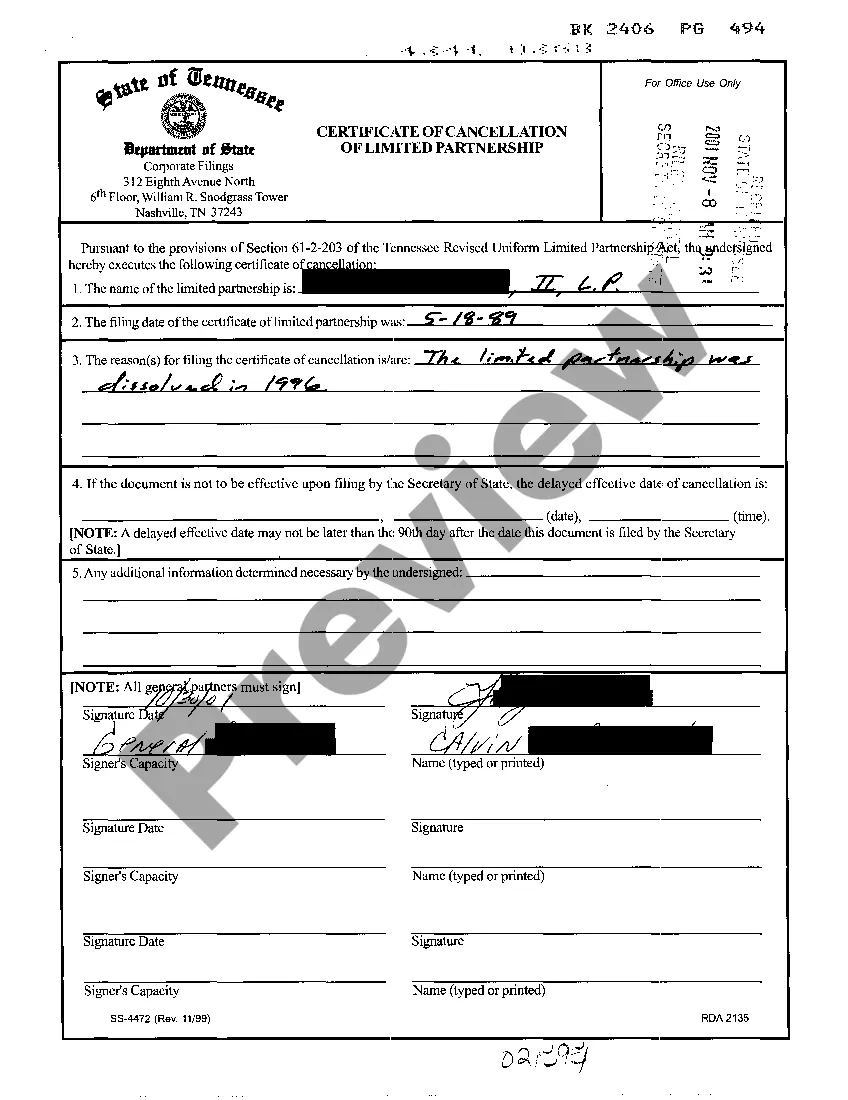

To get a CCJ canceled, you must first demonstrate that it is no longer valid or justified. You typically need to apply for a certificate of cancellation for ccj once you have settled the debt. This process can involve submitting relevant documentation and possibly participating in a court hearing. The US Legal Forms platform provides resources to guide you through this procedure efficiently.

Yes, a CCJ can be reapplied under certain circumstances. If the CCJ was canceled, you may need to ask for a certificate of cancellation for ccj to confirm this status. However, if the CCJ remains active, you need to address the reasons that led to it before reapplication can be considered. Seeking legal advice can also help clarify your options.

A CCJ typically remains on your credit record for six years from the date of judgment. If the CCJ is settled, you can request a certificate of cancellation for CCJ, which confirms its resolution. However, this certificate may not automatically remove the CCJ from all records immediately. It's essential to follow up with credit agencies to ensure accurate updates.

To check if a CCJ has been removed, you can obtain a credit report from major credit agencies. These reports will indicate if the CCJ is no longer present or if it has been marked as settled. Additionally, you can seek a certificate of cancellation for CCJ from the court, which serves as proof that the judgment is resolved. Regularly monitoring your credit report can help you stay informed about such changes.

When a CCJ is removed or marked as settled, you may see a noticeable increase in your credit score. The actual increase varies based on your overall credit history and current financial situation. Therefore, obtaining a certificate of cancellation for CCJ could be a significant step toward restoring your credit standing. Consider consulting a credit specialist for tailored advice.

Fighting a judgment requires you to gather evidence and present a strong case in court, demonstrating why the CCJ was unjust. If you believe the judgment is based on incorrect information or if you were not properly notified, consider seeking legal advice. You may also explore options for obtaining a certificate of cancellation for ccj if you successfully manage to overturn the judgment.

Yes, satisfying a CCJ is often worth your time as it shows lenders that you are taking responsibility for your debts. Even if the CCJ remains on your record, a satisfied judgment may look more favorable to creditors. Additionally, obtaining a certificate of cancellation for ccj will help you clean your credit history and move forward financially.

A certificate of cancellation is an official document that confirms a CCJ has been canceled. It provides proof that the court no longer considers the judgment valid. Obtaining this certificate enables you to clear your record and improve your credit score, making it a valuable step towards financial recovery.