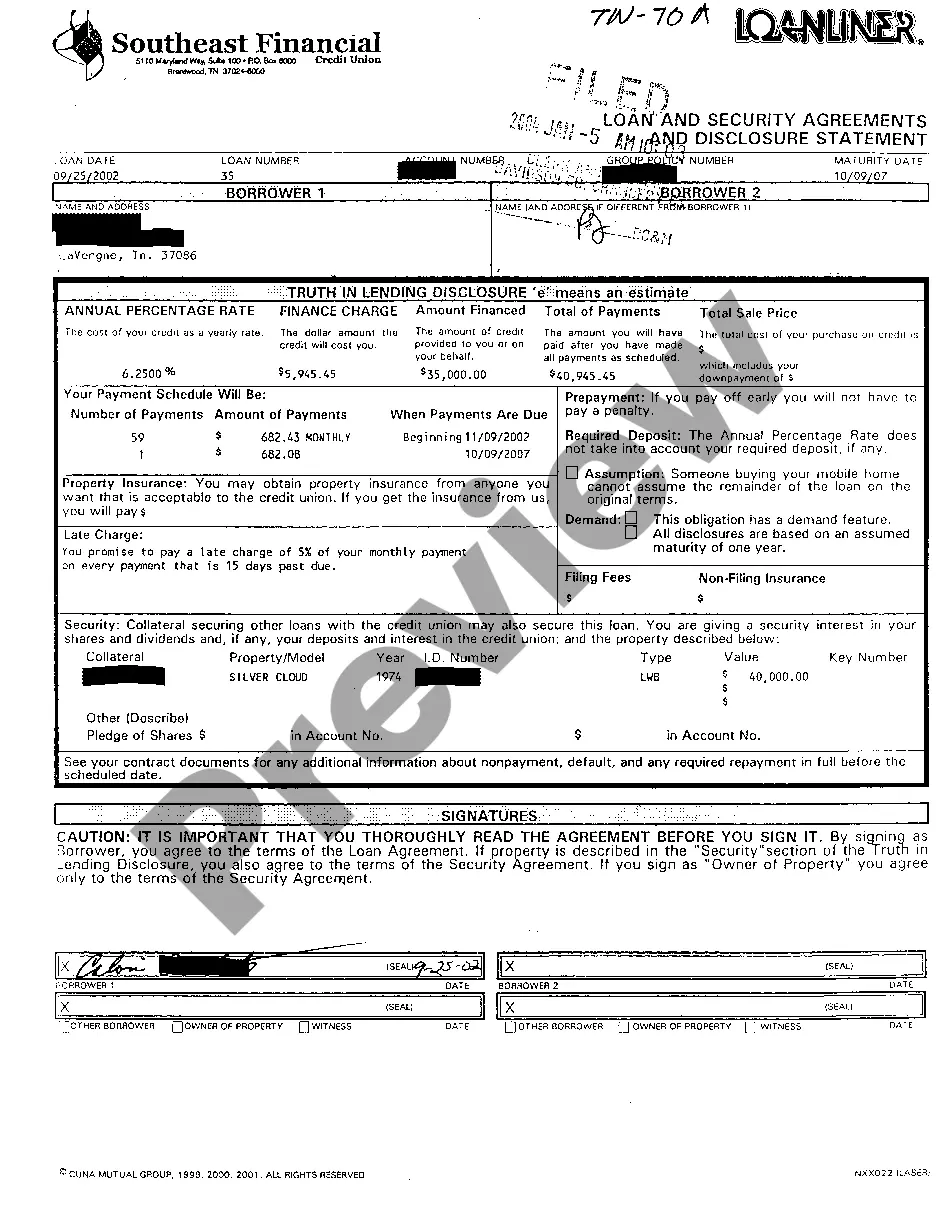

Car Loan Assumption Agreement Form

Description

How to fill out Tennessee Loan And Security Agreement?

Individuals often link legal documentation with complexity that only an expert can handle.

In a way, this holds some validity, as creating a Car Loan Assumption Agreement Form requires extensive understanding of specific criteria, including local and state laws.

Nonetheless, with US Legal Forms, accessibility has improved: ready-to-use legal templates for various life and business events tailored to state regulations are compiled in a single online directory and are now attainable for everyone.

Afterward, print your document or upload it to an online editor for expedited completion. All templates in our collection are reusable: once acquired, they remain stored in your profile. You can access them anytime through the My documents section. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Thoroughly review the page contents to confirm it meets your requirements.

- Examine the form description or assess it using the Preview option.

- If the previous form does not meet your needs, find another sample using the Search bar in the header.

- Click Buy Now when you identify the appropriate Car Loan Assumption Agreement Form.

- Choose a pricing plan that aligns with your preferences and financial situation.

- Register for an account or Log In to continue to the payment page.

- Complete your subscription payment through PayPal or your credit card.

- Select the file format you prefer and click Download.

Form popularity

FAQ

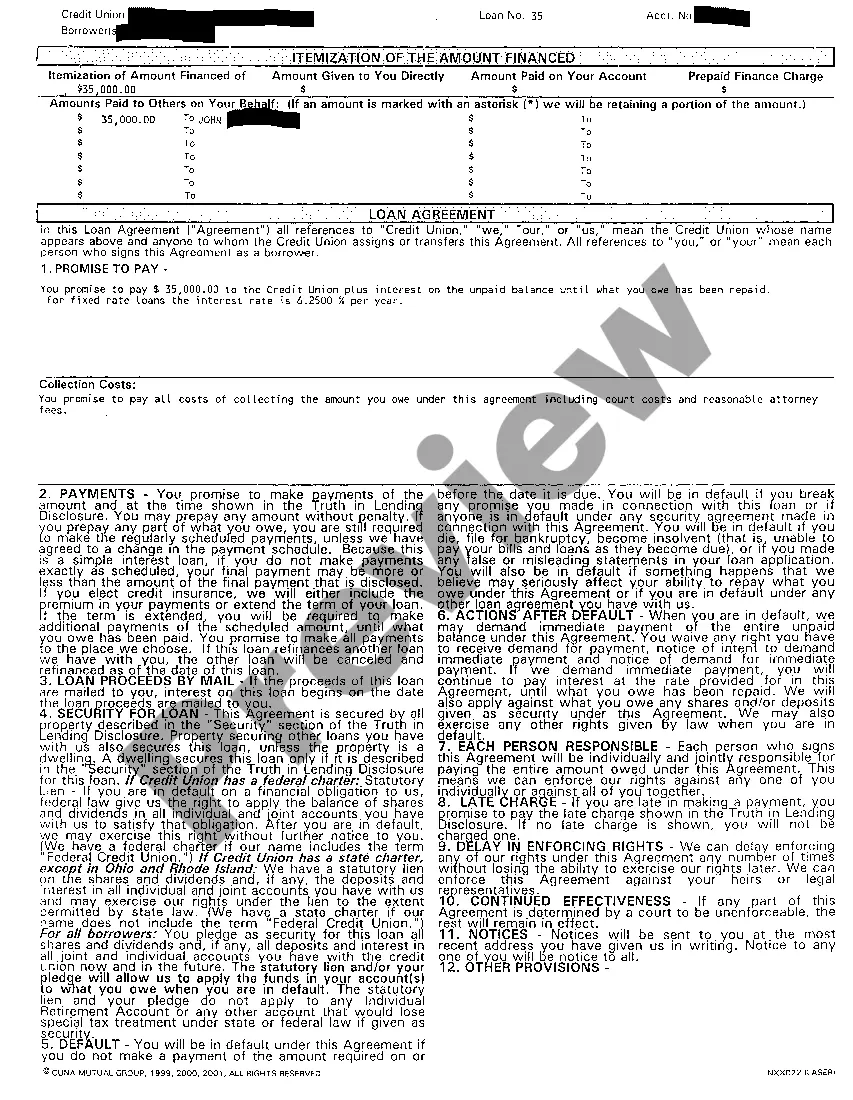

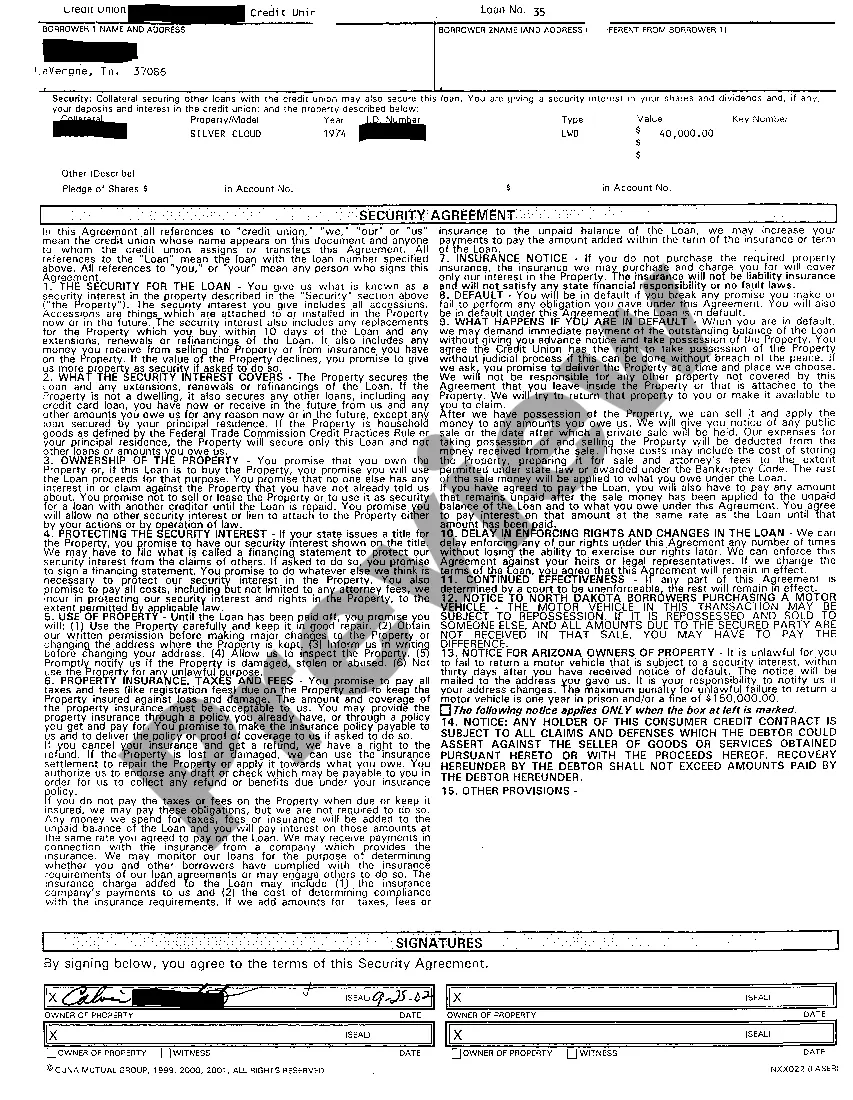

When a buyer assumes a loan it is with the lender's knowledge and approval. An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable.

How to Assume a Car LoanThe lender must allow the loan to be assumed.You must be approved to take over the loan.You will sign a loan agreement.Proof of insurance must be provided.Make your payments on time, every time.