Letter Of Representation For Insurance Company

Description

How to fill out Tennessee Attorney Letter Of Representation And Claim?

What is the most reliable service to obtain the Letter Of Representation For Insurance Company and other current forms of legal documentation? US Legal Forms is the answer!

It's the largest collection of legal documents for any circumstance. Each sample is expertly composed and verified for adherence to federal and state laws. They are organized by field and area of use, making it simple to find the one you require.

US Legal Forms is a fantastic solution for anyone who needs to handle legal documentation. Premium users can enjoy even more features as they can fill out and approve the previously saved documents electronically at any time using the built-in PDF editing tool. Try it out today!

- Skilled users of the site just need to Log In to the platform, verify their subscription status, and click the Download button next to the Letter Of Representation For Insurance Company to obtain it.

- Once stored, the sample will be accessible for additional use within the My documents section of your profile.

- If you do not yet have an account with our database, here are the steps you need to follow to create one.

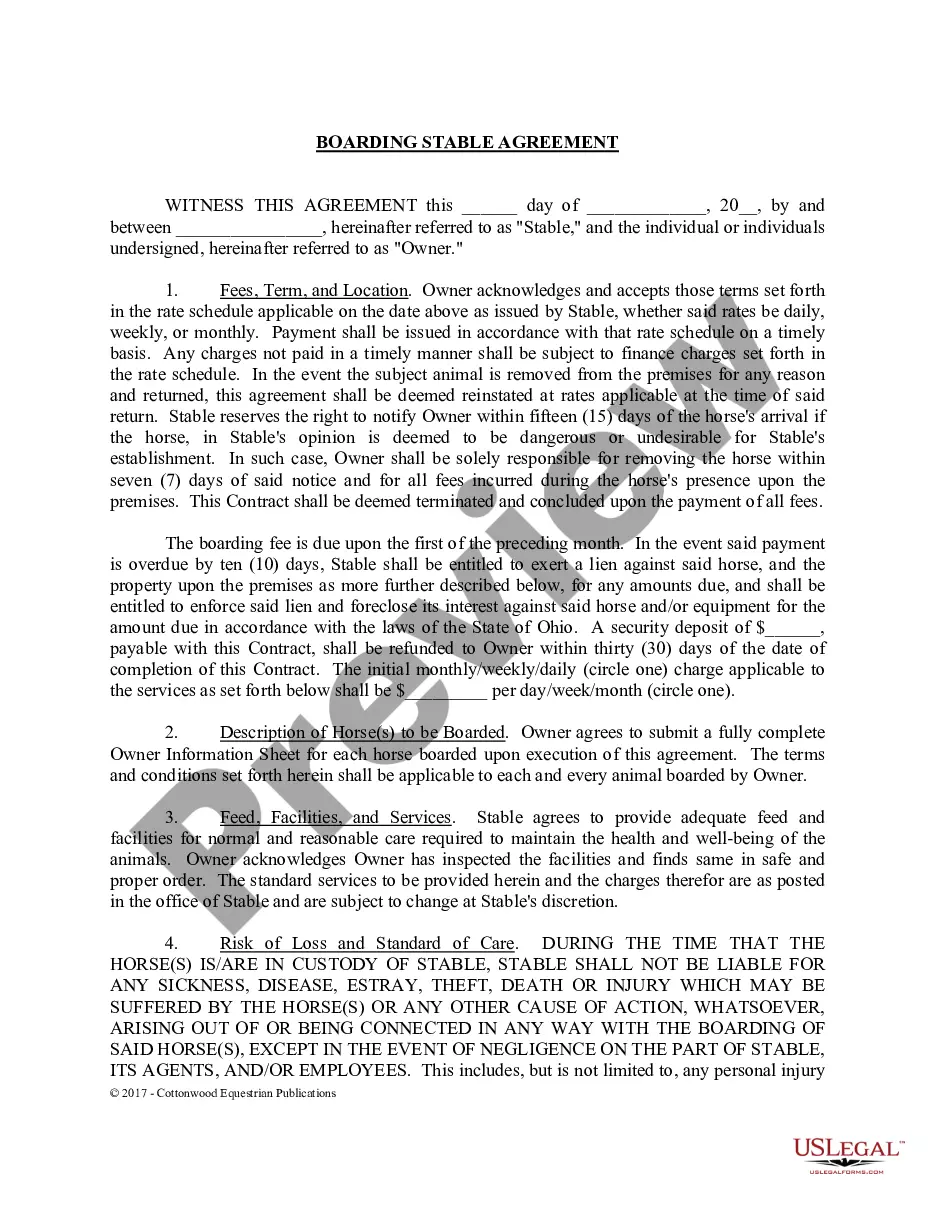

- Template compliance review. Before you obtain any form, you must ensure it meets your use case requirements and complies with your state or county's regulations. Review the form overview and utilize the Preview if offered.

Form popularity

FAQ

To write a letter to an insurance company for a claim, start by clearly stating your intention. Include your policy number, a detailed description of the incident, and any relevant documentation to support your claim. It is also important to specify what you are requesting from the insurance company. By utilizing a letter of representation for the insurance company, you can ensure your communication is effective and professional, leading to a smoother claims process.

Once you have sent a letter of demand, the next step typically involves waiting for the insurance company’s response. This response may involve negotiations, requests for more information, or an offer to settle. Engaging in this process is much easier when you have already sent a letter of representation for insurance company, as this establishes your role and protects your interests during negotiations.

The time it takes to obtain a letter of representation can vary based on a few factors, including how quickly you provide the necessary information to your attorney. Generally, it can take just a few days to draft and send this letter. Utilizing our platform can help you streamline this process and expedite obtaining a letter of representation for insurance company.

After sending a letter of representation, the insurance company is obliged to communicate with your attorney instead of the client. This transition helps ensure a more professional handling of the claim. Following this, your attorney will engage with the insurance company to discuss the details of the claim and negotiate on behalf of the client.

The timeline for receiving a settlement after a demand letter varies significantly, often depending on the complexity of the case and the insurance company’s response time. Typically, it can take anywhere from a few weeks to several months. By sending a comprehensive letter of representation for insurance company, you help facilitate a smoother process, possibly leading to quicker settlements.

A letter of representation for insurance is a specific type of document that signifies the appointment of a legal representative to advocate for a client in their dealings with an insurance company. This letter makes it clear that all relevant communications regarding the claim should go through the attorney, not the client. It plays a crucial role in safeguarding your client's interests while they navigate the complexities of insurance claims.

A letter of representation performs several important functions. It establishes your authorization to act on behalf of the client, ensuring that the insurance company recognizes your authority. This document also helps streamline communications, allowing you to manage the claim effectively, protecting your client's rights and interests in the process.

Writing a letter of representation involves several key steps. Begin by including your contact information, the client's details, and the insurance company's information. Clearly state your role as the legal representative, outline the nature of the claim, and request that all future correspondence be directed to you. Using our platform, you can find templates that simplify the process of creating a letter of representation for insurance company.

The letter of representation serves to formally notify an insurance company that a legal representative has been retained to handle a client's claim. This document protects the interests of both the client and attorney by ensuring that all communications are directed to the lawyer. By sending a letter of representation for insurance company, you set clear boundaries for how your claim will be managed moving forward.

To write an official letter to an insurance company, use a formal structure, starting with your address and date at the top. Address the letter to a specific person or department if possible, and clearly state the purpose of the correspondence. An organized letter of representation for insurance company can help communicate your issues or requests effectively, leading to a better response.