Vehicle Bill Of Sale Tn As Is No Warranty With No Warranty

Description

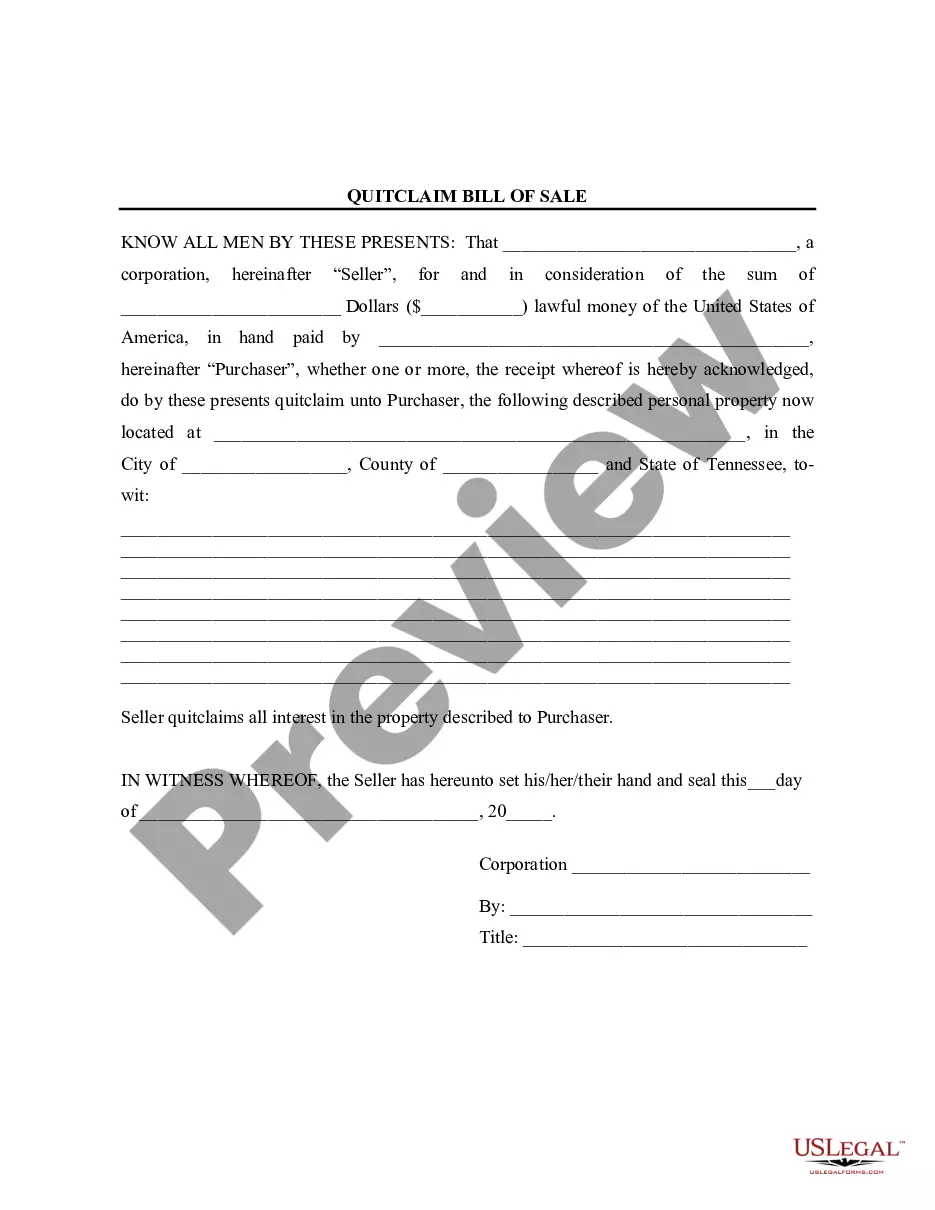

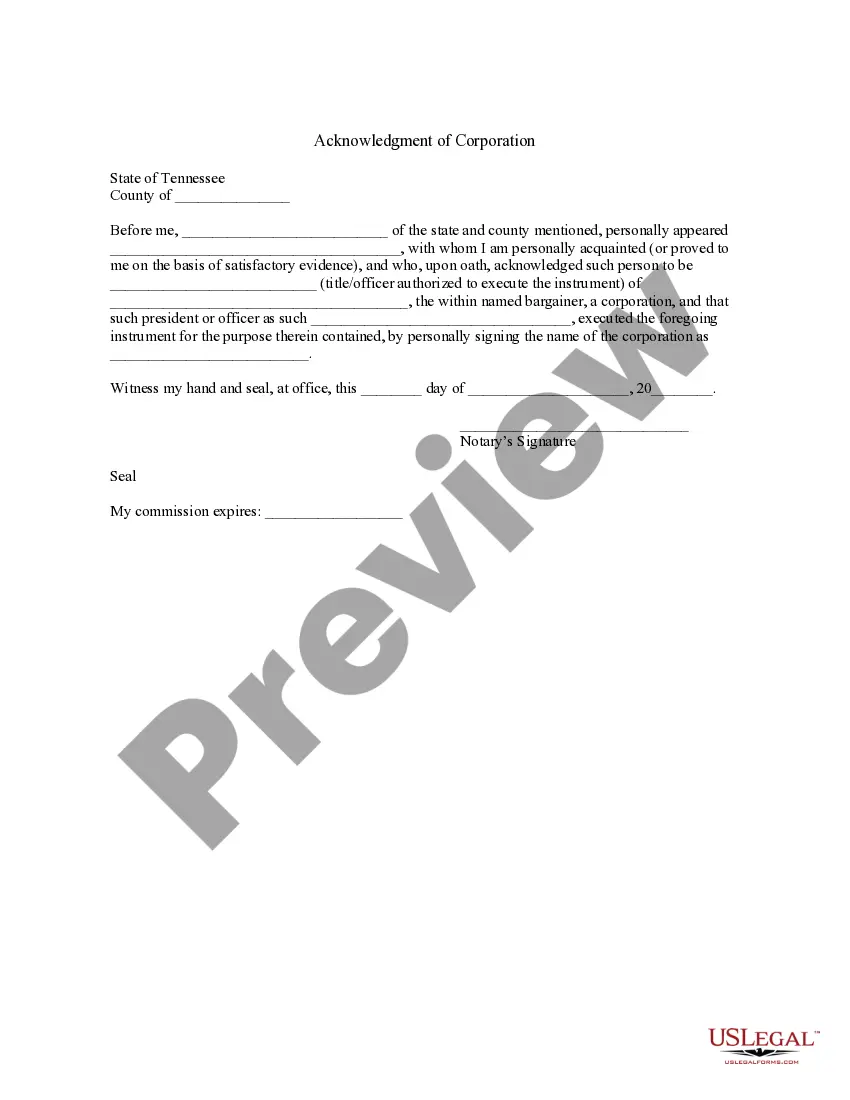

How to fill out Tennessee Bill Of Sale Without Warranty By Corporate Seller?

Handling legal documentation can be exasperating, even for the most adept specialists.

When you seek a Vehicle Bill Of Sale Tn As Is No Warranty With No Warranty and lack the opportunity to invest in finding the correct and current version, the process can become stressful.

US Legal Forms caters to any requirements you may encounter, whether personal or business-related paperwork, all consolidated in one location.

Utilize advanced tools to complete and manage your Vehicle Bill Of Sale Tn As Is No Warranty With No Warranty.

Upon acquiring the form you require, follow these steps: Verify it is the correct document by previewing it and reviewing its details. Confirm that the sample is accepted in your state or county. Click Buy Now when you're ready. Choose a subscription plan. Select the format you need, and Download, complete, sign, print, and send your documents. Enjoy the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your routine document management into a seamless and user-friendly experience today.

- Access a repository of articles, tutorials, and guides relevant to your situation and requirements.

- Conserve time and effort in searching for the necessary documents, employing US Legal Forms' sophisticated search and Review feature to find Vehicle Bill Of Sale Tn As Is No Warranty With No Warranty and obtain it.

- If you hold a membership, Log In to your US Legal Forms account, look for the form, and obtain it.

- Check your My documents section to see the documents you have previously saved and to organize your folders as desired.

- If it’s your initial visit to US Legal Forms, create a free account and gain unrestricted access to all the platform’s advantages.

- A comprehensive online form repository may be a transformative tool for anyone aiming to navigate these circumstances effectively.

- US Legal Forms stands out as a premier provider of virtual legal documents, offering over 85,000 state-specific legal forms available for your convenience.

- Access legal and business documents tailored to your state or county.

Form popularity

FAQ

Yes, you can sell a car with just a bill of sale, but it may complicate the process for the buyer if they need to register the vehicle. It's important to disclose to the buyer that the bill of sale is the only document available. By using a comprehensive vehicle bill of sale TN as is no warranty with no warranty, you can provide clear terms and protect yourself from potential disputes.

You need to file an Articles of Organization in order to create an LLC in Arizona. The Arizona Articles of Organization can be filed by mail or online. The fees for both are the same: $50 for regular filing and $85 for expedited processing. These filing fees are the only initial LLC formation cost in Arizona.

The document required to form an LLC in Arizona is called the Articles of Organization. The information required in the formation document varies by state. Arizona's requirements include: Registered agent.

Individuals can find all tax forms and instructions on the ADOR website or visit our local offices. Please note that the Arizona tax package and Arizona Booklet X Volumes 1, 2, and 3 are now available to download from our website. Taxpayers can also find fillable and non-fillable tax forms online.

How do I get copies of corporation or LLC documents? Most documents filed with the A.C.C. are already publicly available on the eCorp website. However, if you need to obtain a certified copy or a record that is preserved on microfilm or microfiche, you may submit a Records Request Form.

An articles of organization form is the document that one must complete and submit to the state to establish the creation of an LLC within the State of Arizona. It sets forth the name of the proposed company, the registered agent for service of process, and the address of the place of business, among other information.

These are the simple steps to follow in filing an article of Organization in Arizona. Step 1: Find Forms Online. Go to the Arizona Secretary of State to download the article of organization form for your LLC or to log into the online service. Step 2: Fill Out Form. ... Step 3: File Formation Certificates.

Single member LLCs may elect to be grouped as an S corporation, C Corporation, or a sole proprietorship. Multi-member LLCs can elect to be taxed as an S corporation, a partnership, or a C corporation.

One or more persons can form an Arizona LLC by signing and filing Articles of Organization with the Arizona Corporation Commission. A.R.S. § 29- 3201. These persons are called ?organizers.? ?Person? includes individuals and entities.