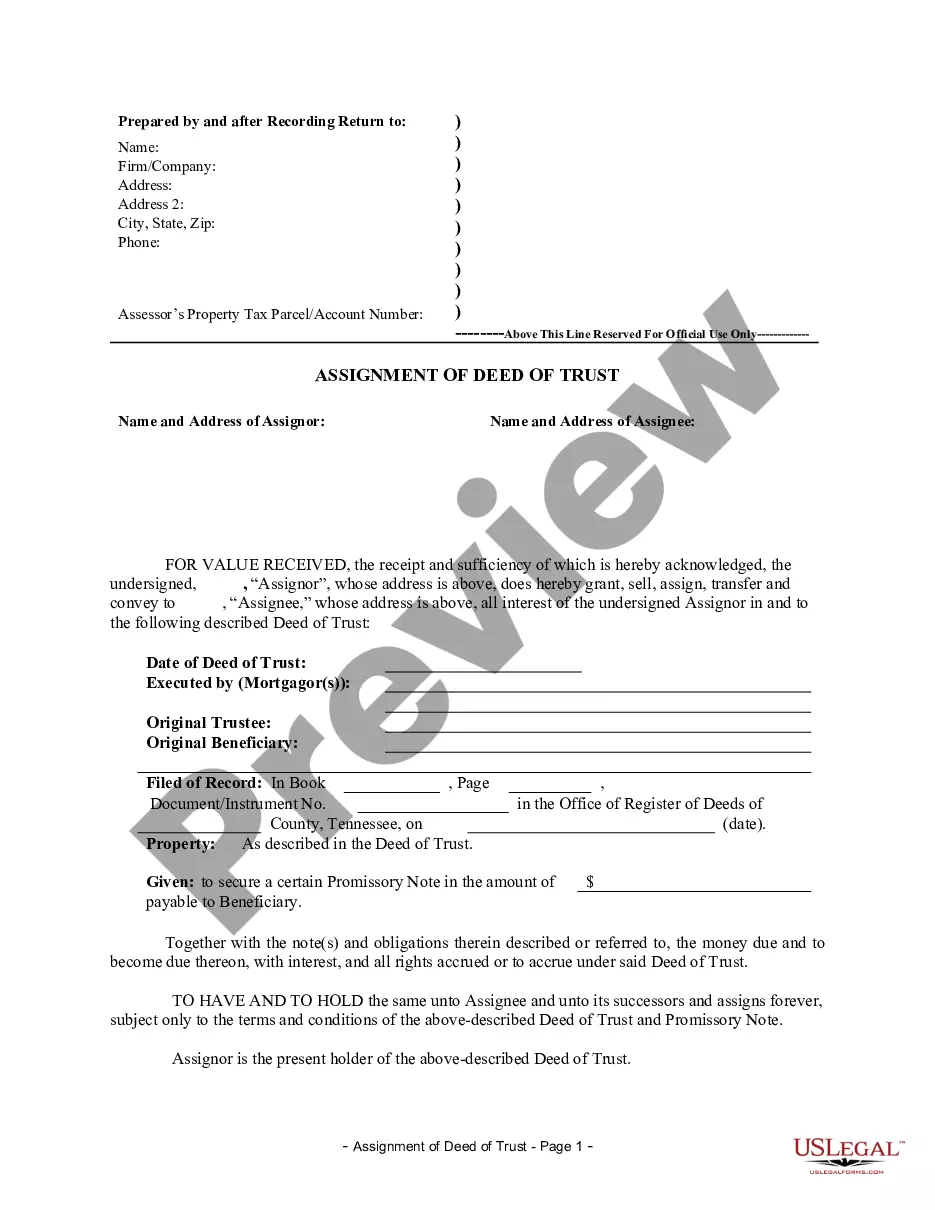

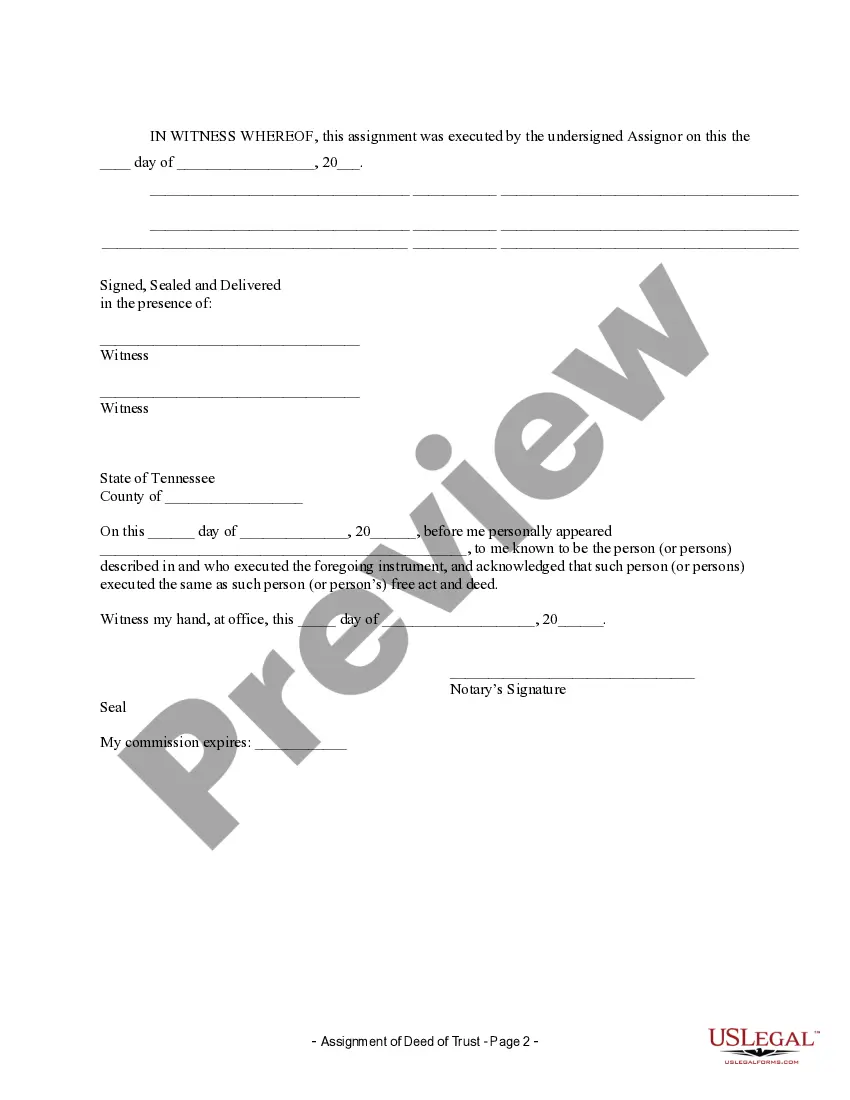

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Tennessee Deed In Lieu Of Foreclosure

Description

How to fill out Tennessee Deed In Lieu Of Foreclosure?

What is the most trustworthy option to acquire the Tennessee Deed In Lieu Of Foreclosure and other up-to-date forms of legal documentation.

US Legal Forms is the solution! It boasts the largest assortment of legal documents for any event. Each template is accurately drafted and confirmed for adherence to federal and local laws and regulations.

Form compliance verification. Prior to obtaining any template, it's essential to confirm that it satisfies your use case requirements and complies with your state or county's regulations. Review the form description and utilize the Preview if available.

- They are organized by field and state of application, making it effortless to find the one you require.

- Seasoned users of the site simply need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Tennessee Deed In Lieu Of Foreclosure to retrieve it.

- Once stored, the template remains accessible for future use within the My documents section of your profile.

- If you do not yet possess an account with our library, here are the steps you need to follow to create one.

Form popularity

FAQ

A deed in lieu of foreclosure can lower your credit score by 100 to 200 points, depending on your overall credit history. This decrease can remain on your credit report for up to seven years, impacting your ability to obtain loans during that time. Nevertheless, recovering from this situation is often quicker than recovering from a full foreclosure. Therefore, exploring options through platforms like uslegalforms can help navigate the Tennessee deed in lieu of foreclosure process.

While a deed in lieu of foreclosure is less damaging than a full foreclosure, it still has negative implications for your credit score. It generally results in a significant credit score drop, which can affect future borrowing. However, it may offer a quicker path to financial stability compared to prolonged foreclosure proceedings. Therefore, homeowners should assess their options when considering a Tennessee deed in lieu of foreclosure.

Lenders often prefer a deed in lieu of foreclosure as it allows for a faster and less costly process than traditional foreclosure. It helps avoid lengthy legal battles and decreases the property’s carrying costs. Moreover, lenders can resell the property more quickly after accepting a deed in lieu. This efficiency makes the Tennessee deed in lieu of foreclosure an attractive option for many lenders.

In Tennessee, the foreclosure process typically follows a non-judicial route, meaning lenders can sell properties without court involvement. The borrower must receive a notice of default, and the lender must provide a 20-day notice before a sale. Also, borrowers can reinstate their loans up to five days before the sale. Understanding these rules empowers homeowners facing a Tennessee deed in lieu of foreclosure.

The main disadvantage for a lender in accepting a deed in lieu of foreclosure is the potential loss of recovery value. By taking back the property, the lender assumes responsibility for its upkeep and could incur costs related to maintenance. Moreover, the property’s market value may have declined, which can impact the lender’s overall financial position in that transaction.

While a deed in lieu of foreclosure can provide relief, there are some disadvantages to consider. The borrower may still carry tax implications, as forgiven debt may be taxable income. Additionally, not all lenders will accept a deed in lieu of foreclosure, which can limit this option. Understanding these details will help you make an informed choice.

A deed in lieu of foreclosure in Tennessee is a legal process where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure. This approach allows borrowers to walk away from their mortgage obligations while the lender avoids the lengthy foreclosure process. It is often a more amicable resolution for both parties and helps borrowers preserve their credit score compared to a foreclosure.