Tennessee Extended

Description

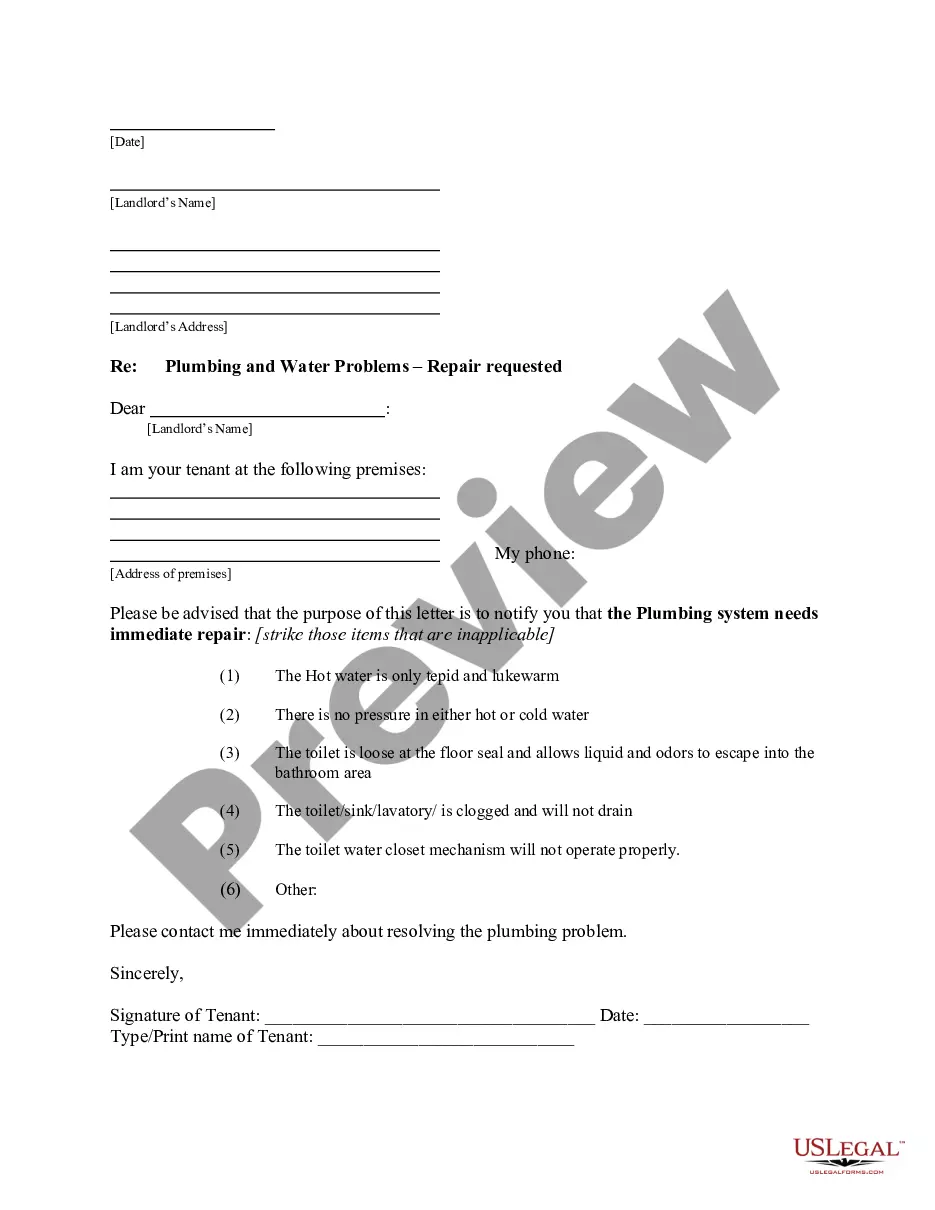

How to fill out Tennessee Letter From Tenant To Landlord With Demand That Landlord Repair Plumbing Problem?

- If you're a returning user, log in to access your account and download the necessary form by clicking the Download button. Ensure your subscription is active; if not, renew it according to your payment plan.

- For first-time users, start by checking the Preview mode and form descriptions to confirm you've selected the correct template that meets your needs and adheres to local laws.

- If necessary, utilize the Search tab at the top to find an alternative template that better suits your requirements.

- Once you've found the right form, click the Buy Now button to select a suitable subscription plan. You’ll need to create an account to access the library.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize your subscription.

- Download the form to your device. You can also find it later in the My Forms section of your profile.

Using US Legal Forms not only saves time but also ensures you have access to accurate and legally valid documents.

Start your hassle-free legal documentation journey today by exploring our vast library of forms!

Form popularity

FAQ

Several new laws are set to take effect in Tennessee by 2025, focusing on education, healthcare, and labor. One major change involves increased funding for public schools and more stringent regulations for early childhood education. Moreover, updates in labor laws may alter the way businesses handle employee benefits. Staying informed about these upcoming changes helps you adapt and utilize Tennessee extended information and resources effectively.

The Tennessee phone extension refers to the additional digits assigned to local phone numbers in Tennessee. This system helps route calls efficiently within the state. It is essential for residents and businesses to be aware of their local area code and any corresponding extensions to ensure they connect with the right people. For assistance with Tennessee extended phone systems, resources are available to guide users.

Certain students are exempt from the 3rd grade retention law in Tennessee. For example, students with disabilities who have an Individualized Education Program (IEP) are not subject to retention if they are making adequate progress. Additionally, students who have been in the school system for less than two years also qualify for exemption. Understanding these exemptions ensures that parents and educators have clarity on how Tennessee extended laws apply.

In Tennessee, full-time employment generally requires at least 40 hours per week. However, some employers may designate positions with 32 hours as full-time based on their company policies. It is important to review individual employer guidelines to understand how they define full-time status. Utilizing Tennessee extended insights can help clarify these definitions for employees.

The new Tennessee retention law focuses on improving literacy rates among early elementary students. It requires students to demonstrate proficiency in reading by the end of 3rd grade to advance to the next grade level. This law also ensures that schools provide additional resources for students who struggle with reading, enhancing educational support throughout the state. Therefore, it establishes a framework where Tennessee extended support mechanisms can help students thrive.

To extend the TN FAE 170, you must file a request for an extension by using Form FAE 170. This form should be submitted before the original deadline to extend your time for filing the franchise tax return. If you're unsure, reviewing guidelines on official state resources can help simplify the process. Many find that legal platforms provide useful templates and assistance to navigate the Tennessee extended processes effectively.

The Tennessee franchise tax extension is filed using Form FAE 170. This form allows businesses to request an extension for their franchise and excise tax filings. It's crucial to file this form timely to avoid late fees. Always consider consulting online resources or platforms to ensure all details are correctly submitted and comply with Tennessee extended guidelines.

To file a TN extension, you need to submit Form INC 250, the Application for Extension of Time to File. This form extends your filing deadline for Tennessee taxes, allowing you more time to prepare your returns. Ensure you file this on or before the original due date for your return to avoid penalties. If you need assistance, consider using legal forms to help you navigate the process smoothly.

The tax extension form varies depending on your specific tax situation. For individuals and businesses in Tennessee, you typically use federal form 4868 for an automatic extension of time to file with the IRS. However, for state tax purposes, you should check the Tennessee Department of Revenue website for any state-specific forms needed to complete your Tennessee extended request. Tools from US Legal Forms can simplify this process by providing access to the necessary forms.

To file for an unemployment extension in Tennessee, you need to follow the state’s guidance on unemployment benefits. Generally, you can apply through the Tennessee Department of Labor and Workforce Development's website or contact them directly. Proper documentation is necessary to facilitate this process. Using the resources at US Legal Forms can help guide you through the requirements for a Tennessee extended unemployment application.