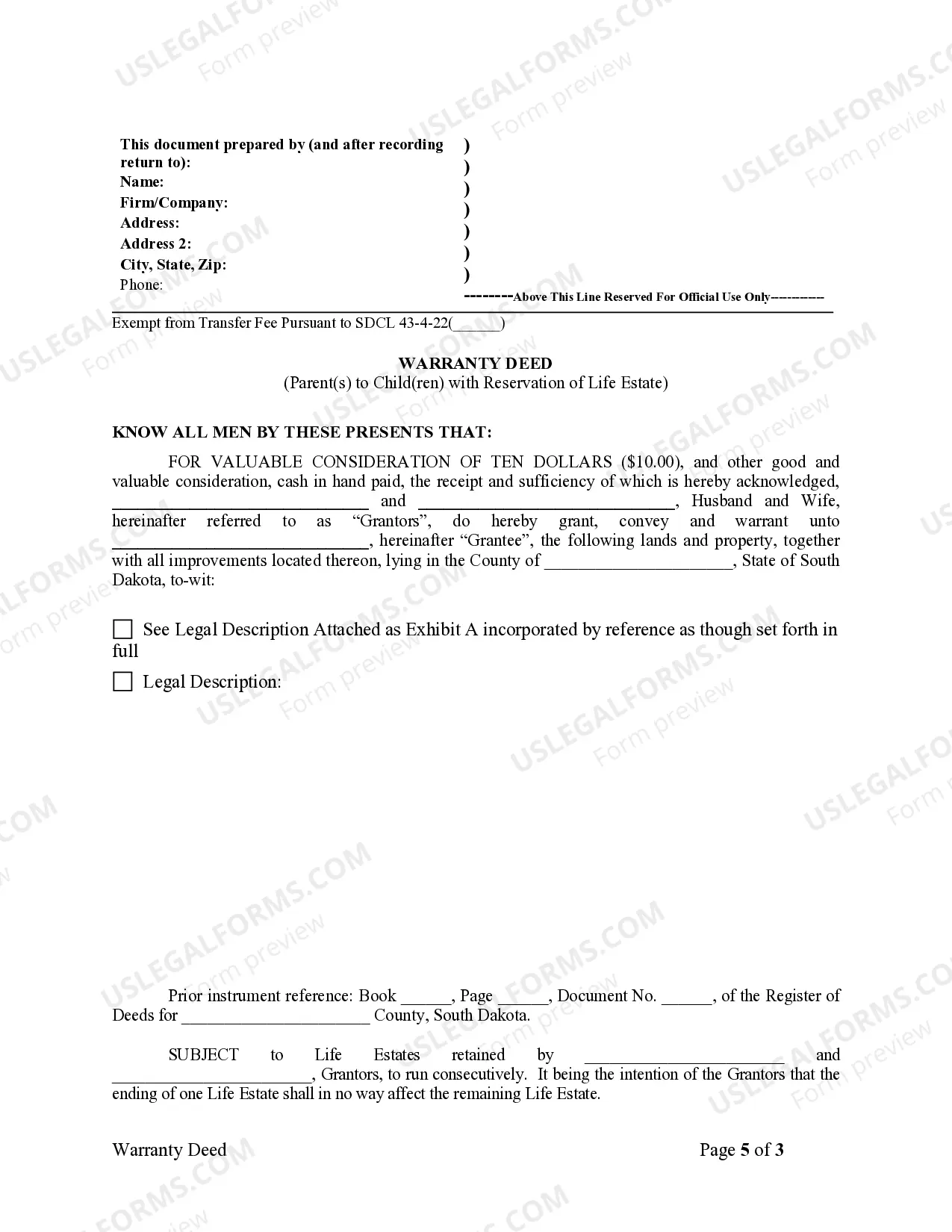

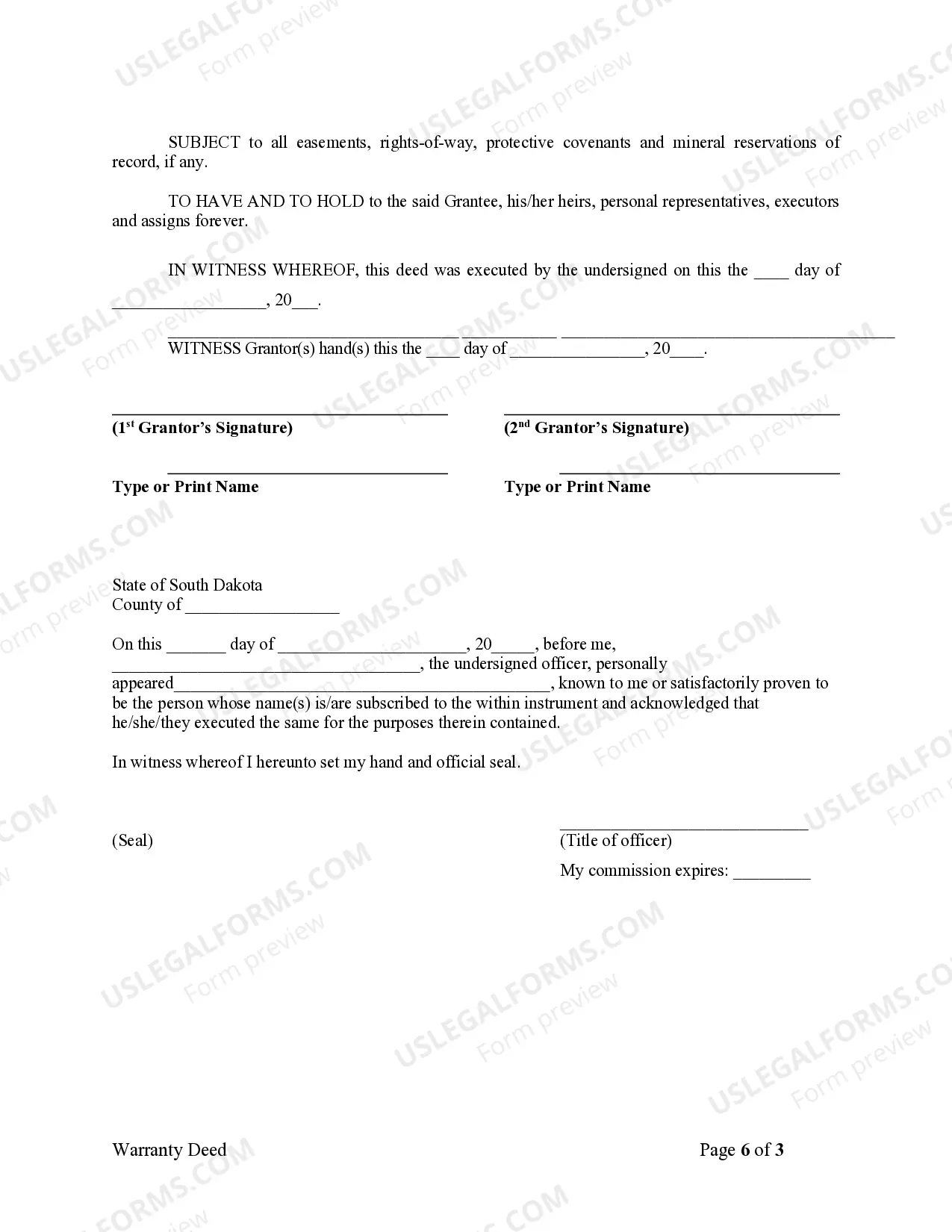

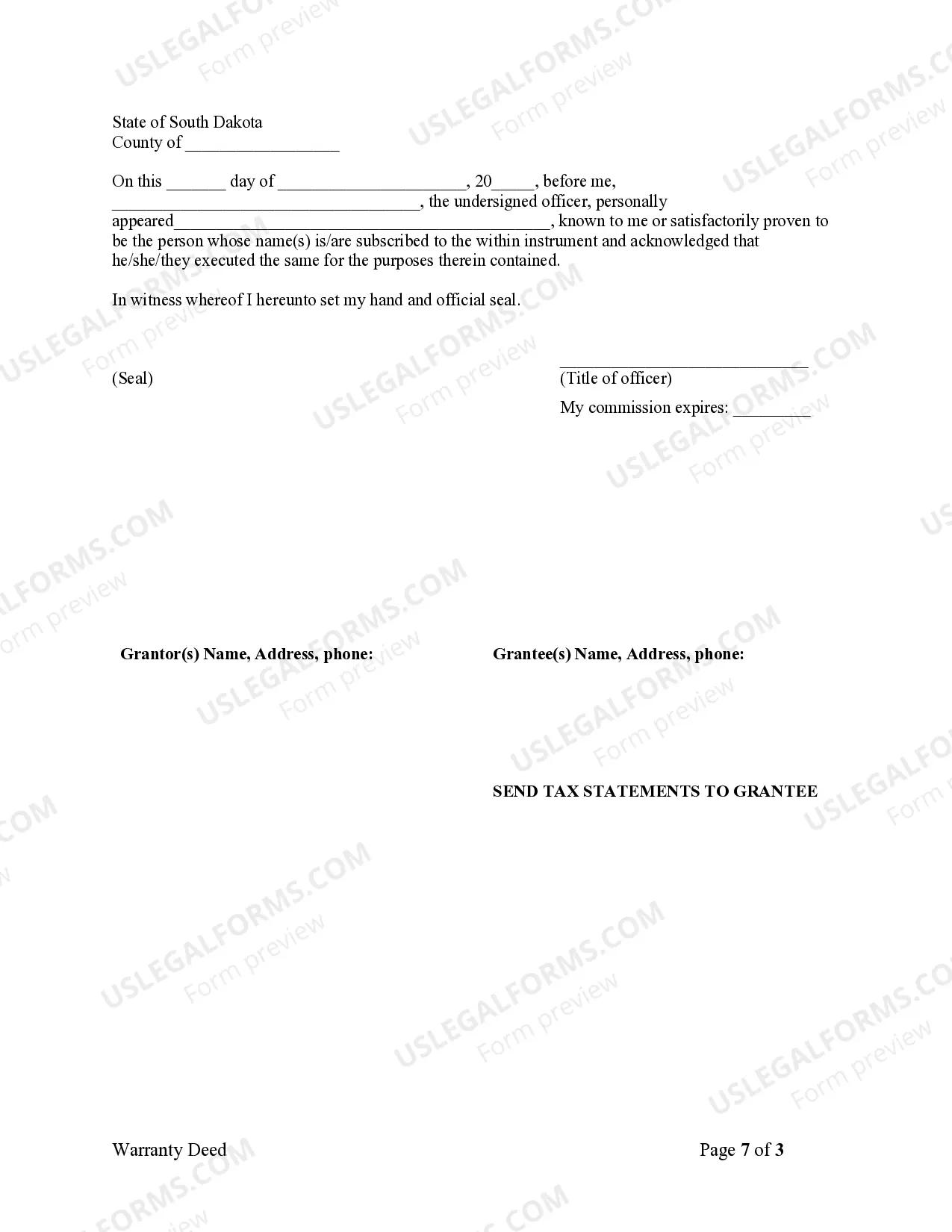

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Life Estate Deed South Dakota Without A Will

Description

How to fill out South Dakota Warranty Deed To Child Reserving A Life Estate In The Parents?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of working with bureaucracy. Finding the right legal papers calls for precision and attention to detail, which is the reason it is crucial to take samples of Life Estate Deed South Dakota Without A Will only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the details regarding the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to complete your Life Estate Deed South Dakota Without A Will:

- Make use of the library navigation or search field to find your sample.

- View the form’s description to see if it suits the requirements of your state and area.

- View the form preview, if available, to make sure the form is definitely the one you are searching for.

- Resume the search and find the proper template if the Life Estate Deed South Dakota Without A Will does not suit your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Pick the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Pick the file format for downloading Life Estate Deed South Dakota Without A Will.

- Once you have the form on your gadget, you may alter it using the editor or print it and finish it manually.

Get rid of the headache that comes with your legal documentation. Explore the comprehensive US Legal Forms library to find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

South Dakota Life Estate Deed Form An owner who records a life estate deed typically retains a life estate?or ownership for the rest of the owner's life. The owner grants the right to own the property when the owner dies (the remainder) to another person called the remainder beneficiary or remainderman.

In South Dakota, the following requirements must be met: The creator of the will (the ?testator?) must be at least eighteen (18) years old and of sound mind. The will must be written. The will must be signed.

South Dakota Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with the county register of deeds office before your death. ... The beneficiary's rights. ... Earlier wills or TOD deeds. ... Your rights. ... Medicaid. ... Other creditor claims. ... Revoking the deed.

If there are no surviving relatives who can inherit under the rules of intestacy, the estate passes to the Crown. This is known as bona vacantia. The Treasury Solicitor is then responsible for dealing with the estate. The Crown can make grants from the estate but does not have to agree to them.