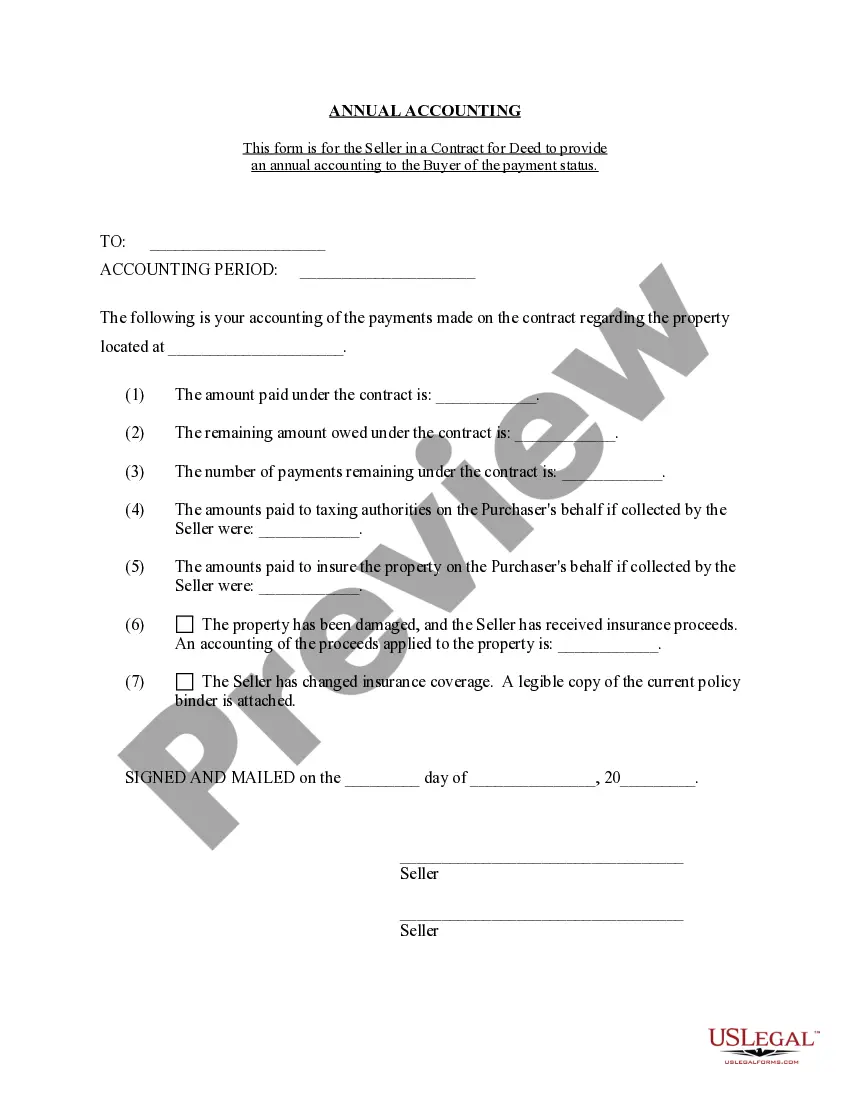

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

South Dakota Annual Foreclosures And Tax Lien Sales

Description

Form popularity

FAQ

South Dakota’s tax advantages include no income tax, limited taxation on certain goods and services, and favorable business conditions. These advantages make it an attractive destination for residents and businesses seeking tax relief. Engaging in South Dakota annual foreclosures and tax lien sales can utilize these benefits, creating wealth-building opportunities.

Being a resident of South Dakota offers various benefits, such as no personal income tax and proactive business regulations. These factors create an appealing environment for entrepreneurs and families. Additionally, participating in South Dakota annual foreclosures and tax lien sales provides access to lucrative investment opportunities that can further enhance financial well-being.

Yes, South Dakota is considered a tax-friendly state due to its lack of personal income tax and relatively low overall tax burden. This environment attracts many businesses and individuals looking for financial relief. Engaging in South Dakota annual foreclosures and tax lien sales can be an excellent way to capitalize on these tax advantages.

South Dakota offers various tax benefits, including no state income tax and low property tax rates. These advantages can appeal to individuals and businesses alike, encouraging economic growth. If you are involved in South Dakota annual foreclosures and tax lien sales, leveraging these tax benefits can lead to greater profitability.

South Dakota does not impose income tax on individuals, which is a significant benefit for residents. Additionally, certain types of sales, such as some agricultural products, are exempt from sales tax. Knowing what is not taxed can enhance your financial strategy, especially if you're exploring options like South Dakota annual foreclosures and tax lien sales.

In South Dakota, various goods and services are subject to sales tax. This includes items such as food, clothing, and certain services. Notably, sales tax applies to retail sales that take place in the state. If you’re looking to invest in South Dakota annual foreclosures and tax lien sales, understanding the tax implications can help you maximize your returns.

In South Dakota, most goods and services are subject to sales tax, including electronics, furniture, and prepared foods. Being aware of these taxable items can help residents manage their finances better. This awareness is especially relevant for those navigating the stress of South Dakota annual foreclosures and tax lien sales. Additionally, platforms like US Legal Forms can provide guidance on understanding tax regulations.

Yes, South Dakota does not tax groceries, which is a significant benefit for residents. This policy helps maintain monthly budgets and ensures that families can provide for their needs without additional financial pressure. Being aware of this can assist residents amidst economic challenges, such as annual foreclosures and tax lien sales.

In South Dakota, the sales tax on clothing is set at a standard rate of 4.5%. However, some local jurisdictions may add additional taxes. Knowing the sales tax rates on various items, including clothing, is essential for budgeting, especially for those facing challenges like South Dakota annual foreclosures and tax lien sales.

South Dakota does not impose sales tax on certain essential items, including groceries, prescription drugs, and medical services. This regulation helps alleviate the financial burden on families, particularly in contexts related to annual foreclosures and tax lien sales. Understanding what is exempt can help residents manage their expenses more effectively.