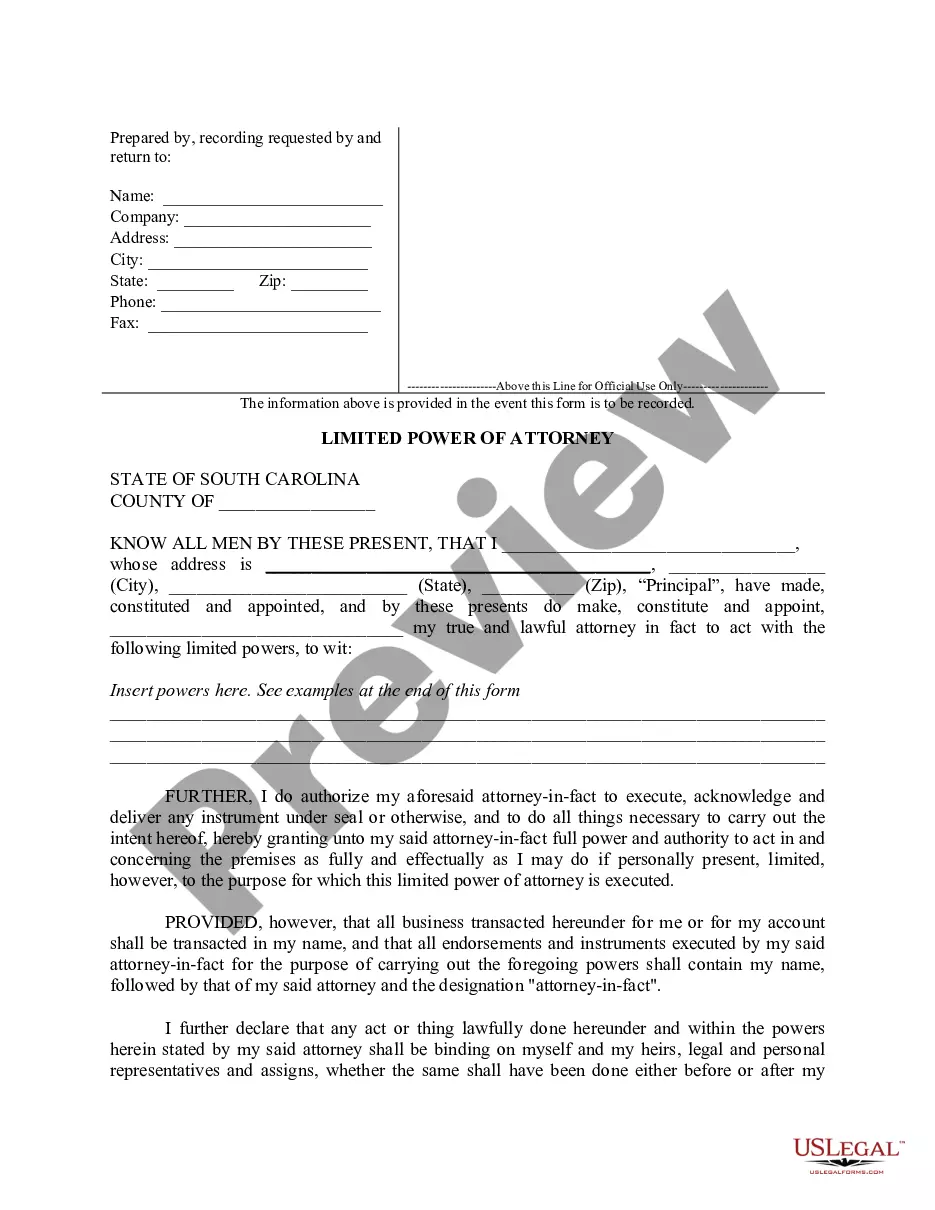

Power Attorney For Property

Description

How to fill out South Carolina Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you’re a returning user, log in to your account and access the necessary form by clicking the Download button. Ensure your subscription is active; if not, renew it based on your plan.

- If you’re a new user, start by checking the Preview mode and the description of the form to verify it aligns with your requirements and local jurisdiction.

- Should you find discrepancies, utilize the Search tab to locate the correct template that fits your needs.

- Purchase the document by selecting the Buy Now option and choosing your preferred subscription plan. You will need to create an account to enjoy full access to all resources.

- Complete your transaction by entering your credit card information or using PayPal for payment.

- Download and save the template on your device. You can also find it later in the My Forms section of your profile whenever required.

By utilizing US Legal Forms, you gain access to a robust collection of legal documents at competitive prices. Their expert assistance ensures that your documents are accurately filled out, offering peace of mind.

Don’t hesitate to take control of your legal needs today. Start your journey with US Legal Forms and empower yourself with effective legal solutions!

Form popularity

FAQ

You can obtain a power of attorney without a lawyer by using online resources or legal form platforms, such as USLegalForms. These platforms offer easy-to-follow templates that guide you in completing the necessary documents. Simply fill out the form, follow your state's requirements, and have it notarized to make it valid. This approach saves time and allows you to maintain control over the process.

The best person for power of attorney is typically someone you trust implicitly, as they will have significant control over your property-related decisions. This person should be responsible, financially savvy, and able to communicate effectively. Friends, family members, or a trusted advisor can be excellent choices. Take time to discuss your decision with potential candidates to ensure they are comfortable with the responsibilities.

To create a valid power of attorney in Pennsylvania, you need to be at least 18 years old and mentally competent. The document should specify the powers you are granting, particularly concerning property transactions. You must also sign the document in the presence of a notary public, and it is wise to have witnesses as well. Platforms such as USLegalForms can help you draft a compliant document.

Yes, in Pennsylvania, a power of attorney document must typically be notarized to be valid. This requirement helps verify the authenticity of the signatures and the intent of the parties involved. Additionally, having the document witnessed can further strengthen its legal standing. It's recommended to use services like USLegalForms for guidance on meeting these requirements.

The new power of attorney law in Pennsylvania, effective since January 1, 2015, introduces updated requirements for creating and using POAs. It includes stricter regulations on the duties and responsibilities of agents. Importantly, the new law aims to protect individuals from misuse of power, ensuring transparency and accountability in property matters. Familiarizing yourself with these changes can help you navigate your options more effectively.

To give someone power of attorney in Pennsylvania, you need to complete and sign a power of attorney document. This document must clearly state the powers you wish to grant, especially concerning property. It is vital to discuss your decision with the person receiving power of attorney to ensure they understand their responsibilities. You can find user-friendly templates on platforms like USLegalForms to simplify the process.

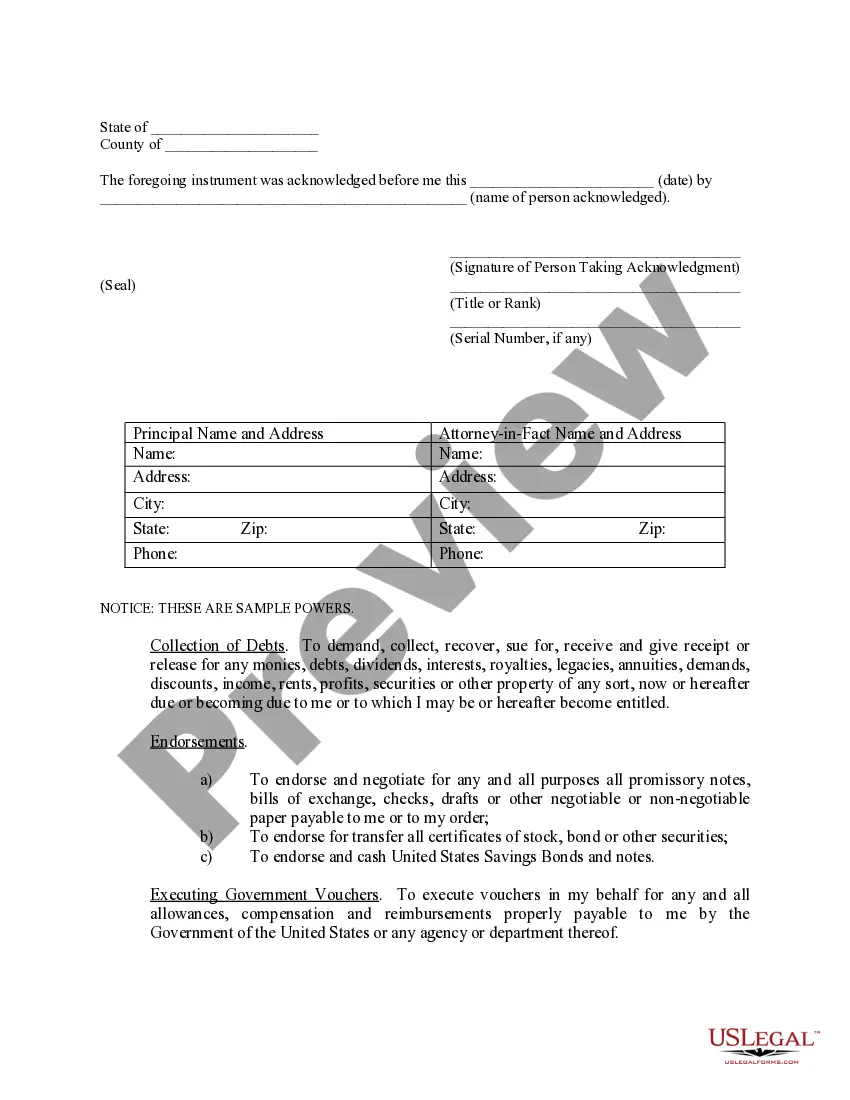

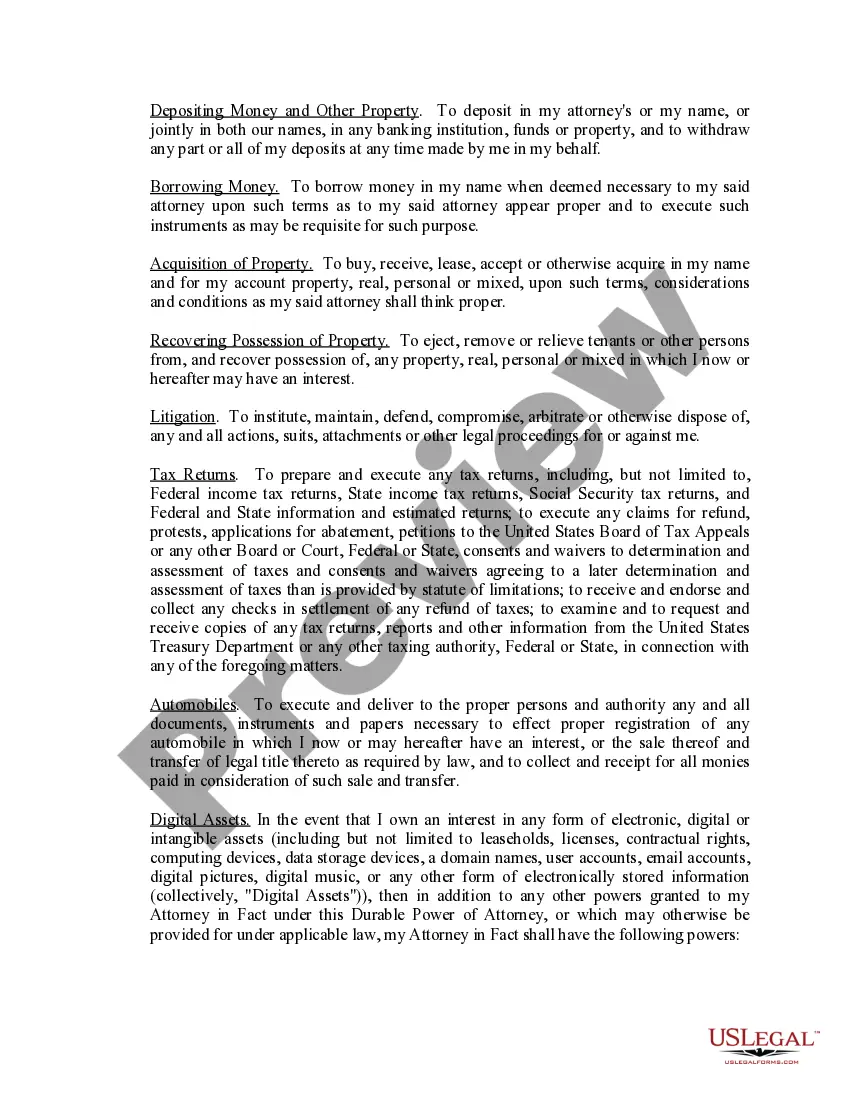

To fill up a power of attorney, begin by downloading a template that suits your state's requirements, such as the one offered by USLegalForms. Input the necessary information, including the names of both the principal and the agent, and specify the powers being granted. Review the document for accuracy and ensure you understand each section before signing. Clear instructions will help you execute an effective power attorney for property.

Filling out power of attorney paperwork requires you to provide specific information about the principal and the agent. You must outline the powers you are granting, ensuring they align with your needs. Additionally, it's essential to sign the document in the presence of witnesses or a notary as required by state law. Consider using USLegalForms to guide you through this process and create a legally sound power attorney for property.

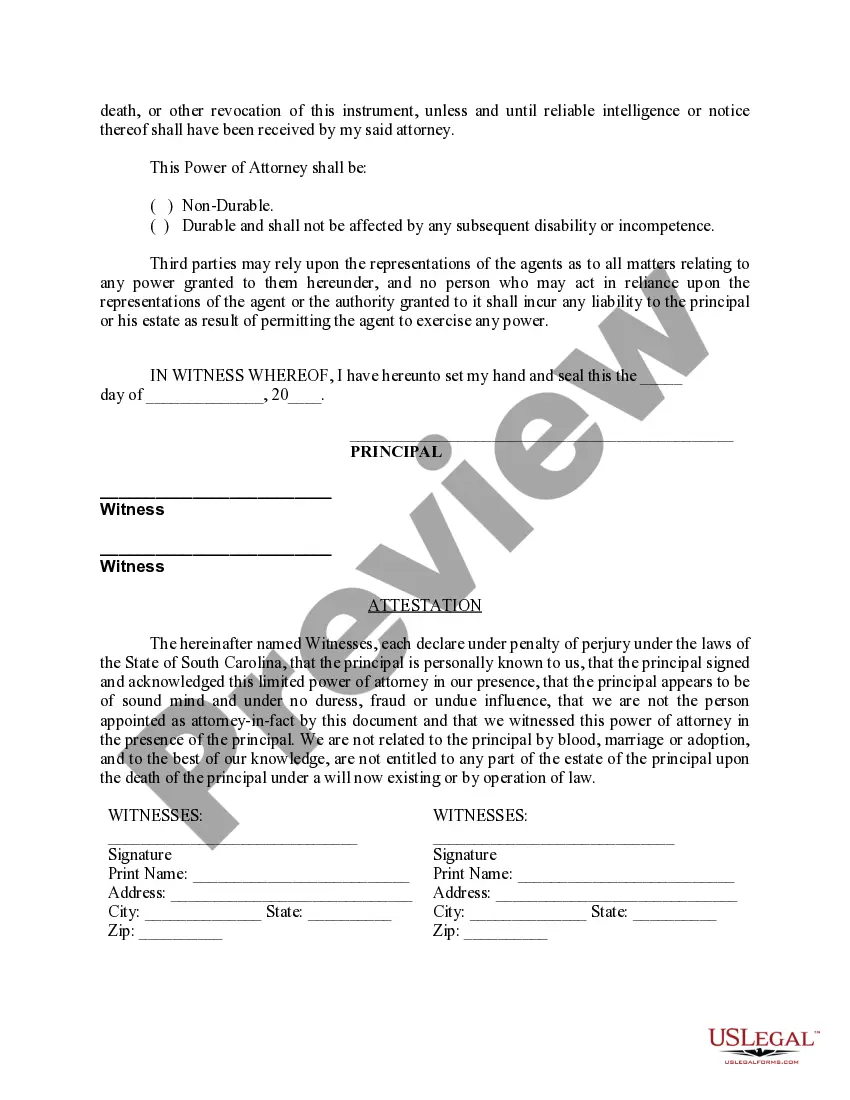

When signing as a power of attorney for property, the agent should write their own name followed by the term 'as attorney-in-fact' or 'power of attorney.' For example, if your name is Jane Doe and you are acting on behalf of John Smith, you would sign as 'Jane Doe, as attorney-in-fact for John Smith.' This clear identification helps ensure that all actions taken under the power of attorney are recognized as valid.

The best person to be a power of attorney is someone you trust completely, as they will have the authority to make important decisions for your property. Consider individuals who are responsible, organized, and capable of handling your financial matters. Often, this could be a close family member, a trusted friend, or a financial advisor. Selecting the right person is crucial for effective management of your power attorney for property.