South Carolina Form Sc For Employees

Description

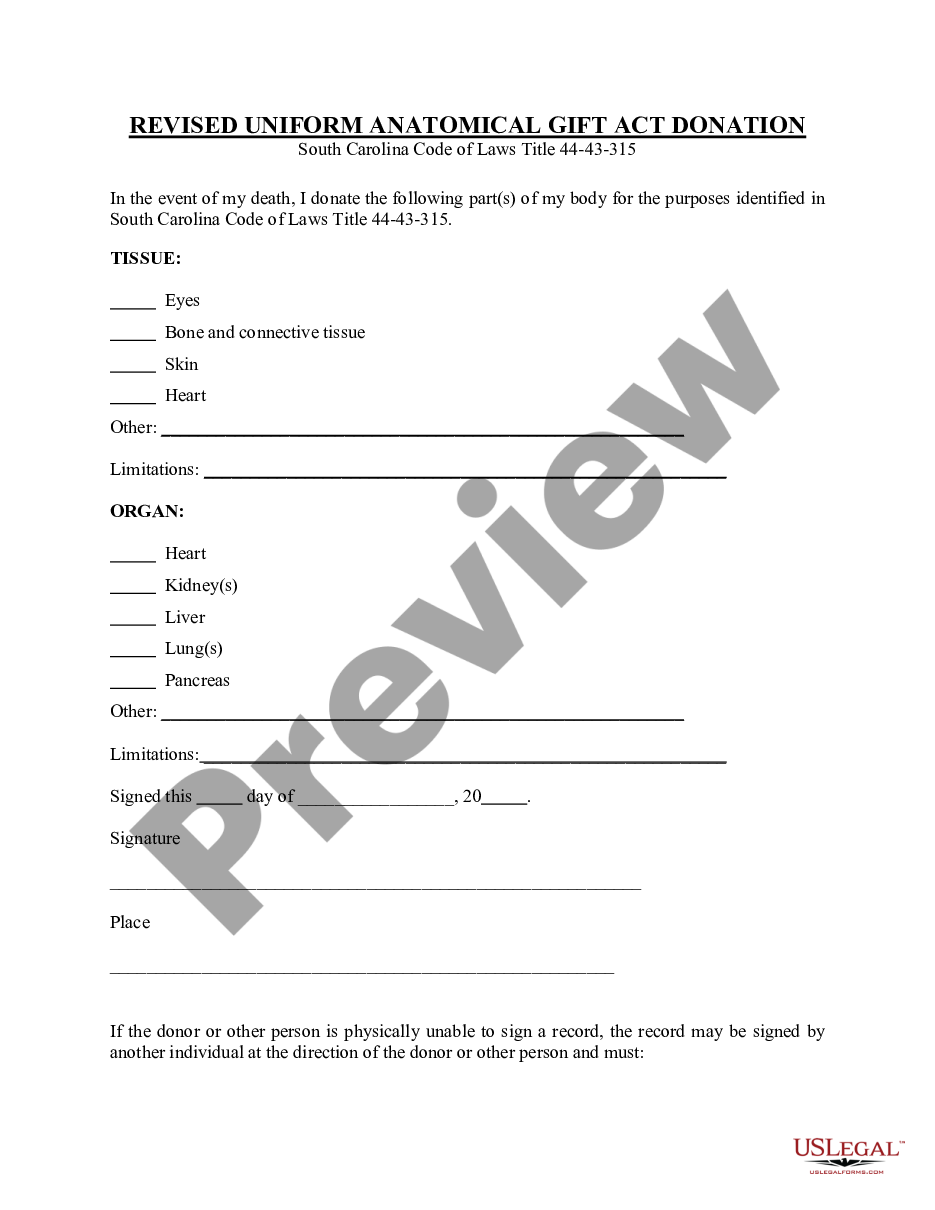

Any person of sound mind and who is eighteen years of age or more may give all or any part of his body for any purpose by will or by document other than a will.

Form popularity

FAQ

To apply for a South Carolina withholding number, you need to complete the registration process with the South Carolina Department of Revenue. You can typically register online, and you will need basic information about your business or employment. Having a withholding number is essential for compliance with state tax laws and is often part of filling out the South Carolina form SC for employees accurately. Taking this step ensures your withholdings are reported correctly.

When completing the SC W4, you should assess your personal and financial situation to determine the number of allowances you can claim. If you have significant deductions, you might want to claim more allowances to reduce your withholding. Conversely, if you expect to owe taxes, consider claiming fewer allowances. The South Carolina form SC for employees can guide you in finding the best approach.

No, allowances and dependents are not the same. Allowances affect how much tax is withheld from your paycheck, while dependents are typically children or other individuals you financially support. When filling out the South Carolina form SC for employees, you can claim allowances based on your dependents to adjust your withholding appropriately.

South Carolina tax brackets range from 0% to 7%. The income tax system is progressive, meaning higher income levels are taxed at higher rates. For employees, understanding these brackets is crucial for tax planning and ensuring proper withholding. When using the South Carolina form SC for employees, be mindful of your income to accurately estimate your tax liability.

Yes, South Carolina requires most corporations to file an annual report with the Secretary of State. This report helps maintain updated records for the corporation and ensures compliance with state laws. Missing the deadline can lead to additional fees or penalties. For those managing employee processes, the South Carolina form SC for employees may be useful in ensuring that all necessary forms are up to date.

Any corporation doing business in South Carolina or earning income within the state must file an SC corporate tax return. This includes both domestic and foreign corporations. Filing is essential for compliance with state regulations and avoiding penalties. To assist in this process, consider using the South Carolina form SC for employees to help manage any related employee tax filings.

When hiring in South Carolina, you need several forms, including the SC W4 for state tax withholding and the federal W-4 form. Additionally, employers must ensure compliance with federal reporting requirements like I-9 forms for employment verification. Utilizing the South Carolina form SC for employees can help streamline this process and ensure you have all the necessary documentation in order.

The SC W4 form is required for employees in South Carolina to determine the amount of state income tax withholding from their paychecks. This form ensures that the correct amount is deducted based on an employee's personal situation, such as marital status and dependents. Proper completion of the SC W4 is crucial to avoid underpayment or overpayment of taxes. Employers can assist employees by providing the South Carolina form SC for employees during onboarding.

SC 1120 is essentially the same as the SC 1120 form, specifically designed for corporate tax reporting in South Carolina. Corporations utilize this form to help the state assess their income and compute taxes accordingly. It's key for maintaining compliance with state tax laws. Make sure to reference the South Carolina form SC for employees for detailed filing guidance.

The SC 1120 form is a South Carolina-specific tax form that corporations must file to report their income, gains, and losses to the state. It is essential for determining the state corporate tax due. This form is related to the federal Form 1120, but it accommodates state-specific regulations and tax rates. Using the South Carolina form SC for employees, you can ensure all required forms are submitted correctly.