South Carolina Trust Form With Two Points

Description

How to fill out South Carolina Living Trust For Husband And Wife With One Child?

Dealing with legal papers and operations can be a time-consuming addition to your day. South Carolina Trust Form With Two Points and forms like it usually require you to look for them and navigate the way to complete them effectively. Consequently, whether you are taking care of financial, legal, or personal matters, having a comprehensive and practical online library of forms when you need it will go a long way.

US Legal Forms is the best online platform of legal templates, boasting more than 85,000 state-specific forms and numerous tools that will help you complete your papers easily. Explore the library of relevant documents available to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Safeguard your papers managing processes having a high quality services that allows you to make any form in minutes without any extra or hidden fees. Simply log in in your account, find South Carolina Trust Form With Two Points and download it right away within the My Forms tab. You may also access previously downloaded forms.

Could it be your first time making use of US Legal Forms? Register and set up a free account in a few minutes and you’ll gain access to the form library and South Carolina Trust Form With Two Points. Then, adhere to the steps listed below to complete your form:

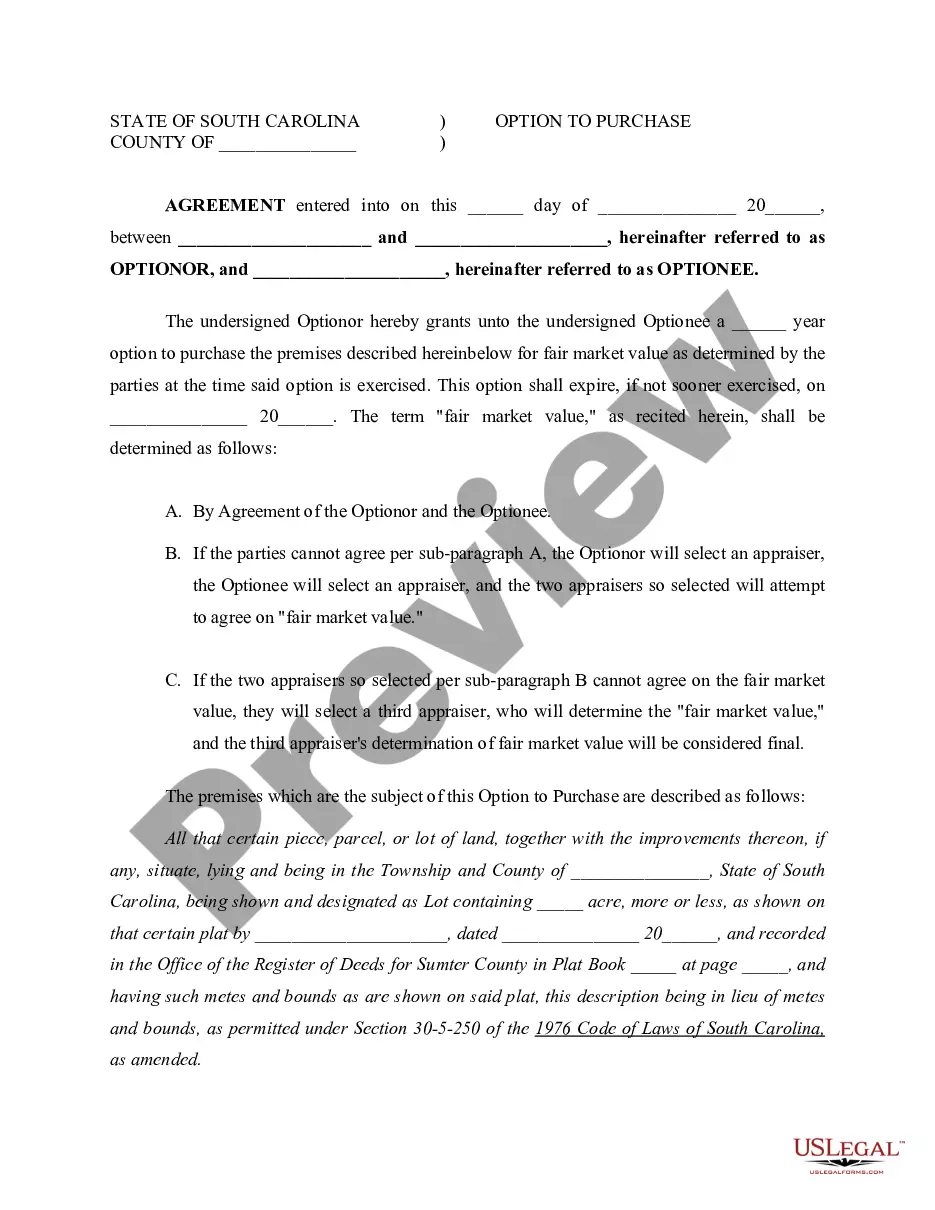

- Be sure you have the proper form using the Preview feature and looking at the form information.

- Choose Buy Now as soon as all set, and choose the subscription plan that is right for you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience assisting consumers deal with their legal papers. Discover the form you want right now and enhance any process without breaking a sweat.

Form popularity

FAQ

To make a living trust in South Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

One of the benefits of a living trust South Carolina is that it keeps the assets in the trust out of probate. Probate is a court proceeding used to verify and carry out a will. Probate can take months and involves costs: an attorney, executor, and court fees.

Creating a living trust in South Carolina involves creating a written trust document and signing it in front of a notary. The trust is not final until you transfer assets into it. A living trust might offer benefits that are valuable for you. Compare it with other estate planning options before deciding.

An electing small business trust is taxed at the highest rate as provided in SC Code Section 12-6-510?. Any other estate or trust pays the same rate that applies to individuals. An estate or trust may be eligible for the reduced Income Tax rate of 3% on active trade or business income from a pass through business.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.