South Carolina Trust Form For Death Of Spouse

Description

How to fill out South Carolina Living Trust For Husband And Wife With One Child?

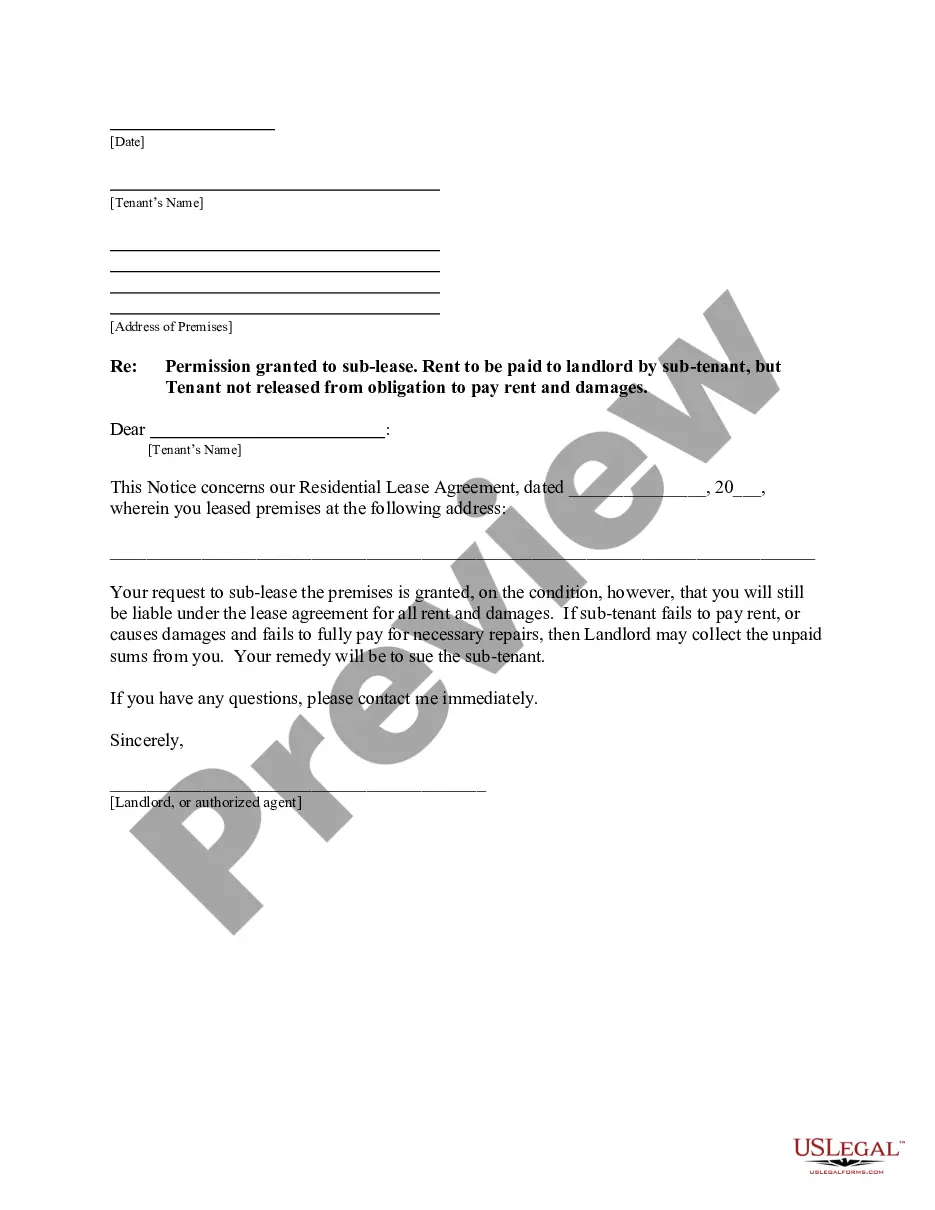

Whether for business purposes or for personal affairs, everyone has to handle legal situations at some point in their life. Completing legal paperwork needs careful attention, beginning from picking the correct form template. For example, when you pick a wrong edition of a South Carolina Trust Form For Death Of Spouse, it will be declined when you submit it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a South Carolina Trust Form For Death Of Spouse template, stick to these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s information to ensure it suits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to locate the South Carolina Trust Form For Death Of Spouse sample you need.

- Get the file when it matches your requirements.

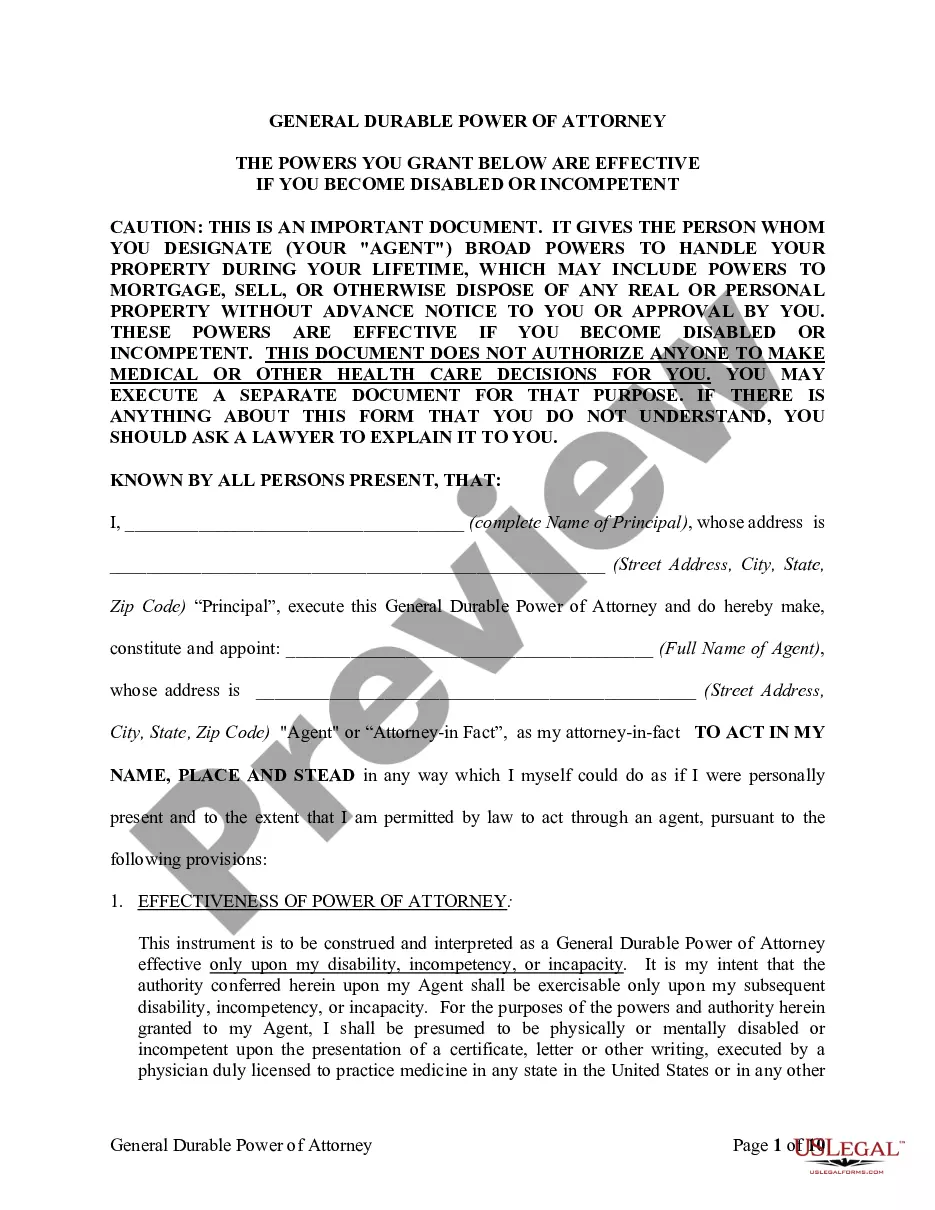

- If you have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Pick the document format you want and download the South Carolina Trust Form For Death Of Spouse.

- When it is saved, you are able to fill out the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time looking for the appropriate sample across the internet. Take advantage of the library’s simple navigation to get the right form for any situation.

Form popularity

FAQ

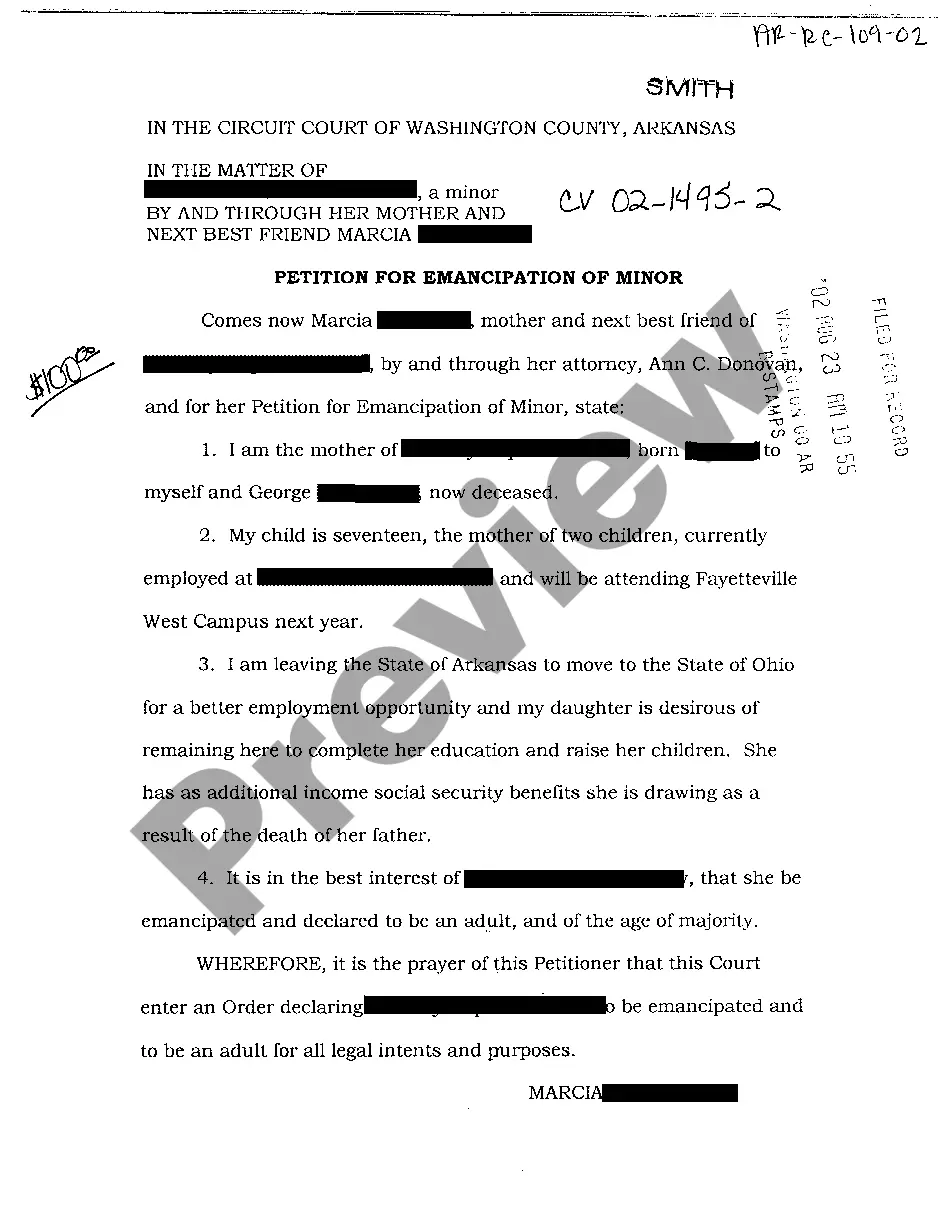

The intestate share of the surviving spouse is: (1) if there is no surviving issue of the decedent, the entire intestate estate; (2) if there are surviving issue, one-half of the intestate estate.

In South Carolina, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great grandchildren. If you don't, then your spouse inherits everything. If you do, then your spouse inherits 1/2 of your intestate property.

The spousal elective share statute in South Carolina provides that the surviving spouse has the right to claim one-third of the estate even it they are completely disinherited in the decedent's last will and testament. Often, due to unhappy circumstances, someone will want to completely disinherit their spouse.

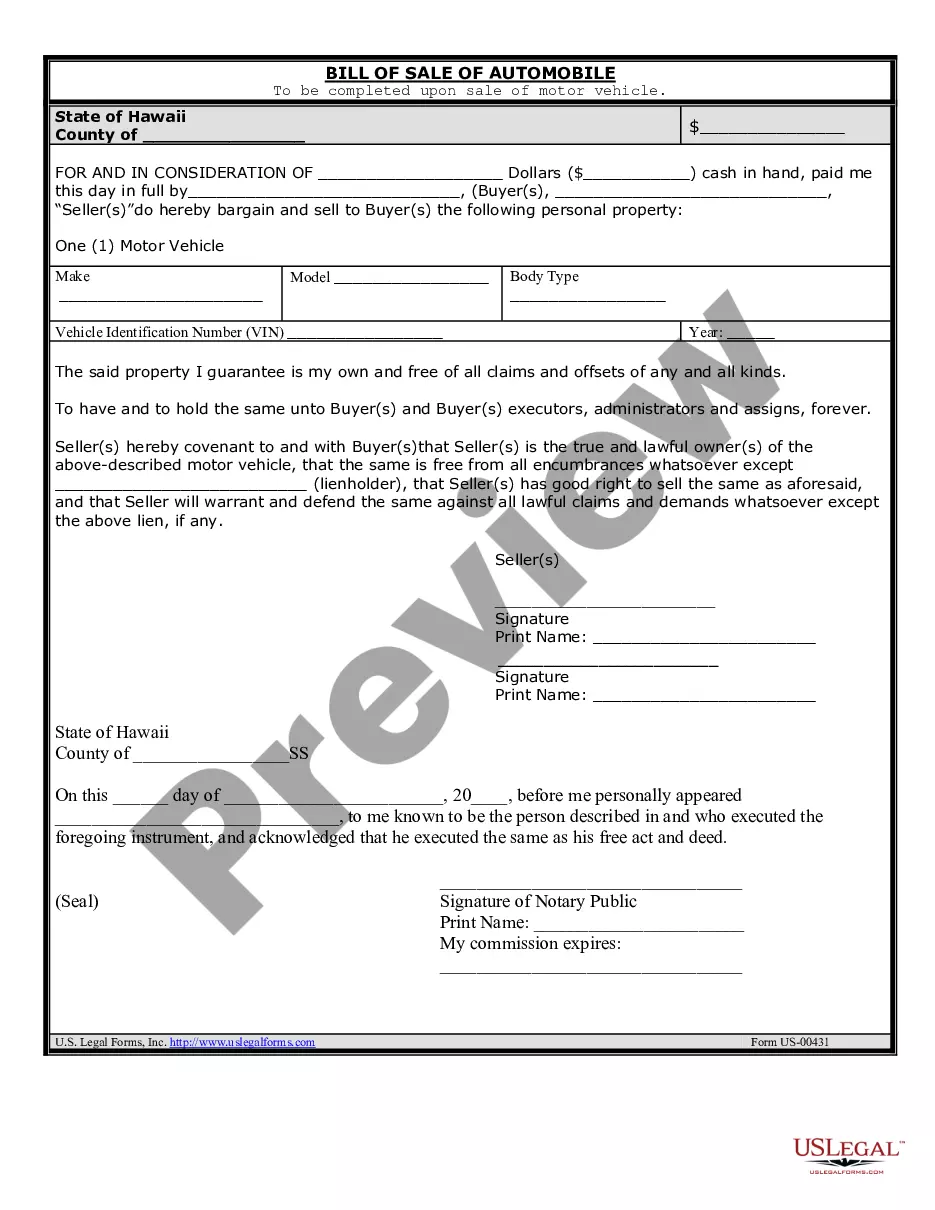

To make a living trust in South Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

If you have a spouse and no children, your spouse will inherit your entire estate. If you have a spouse and children, your spouse gets half and the remaining estate is split equally amongst the children. If you have no spouse or children, your parents would receive your estate.