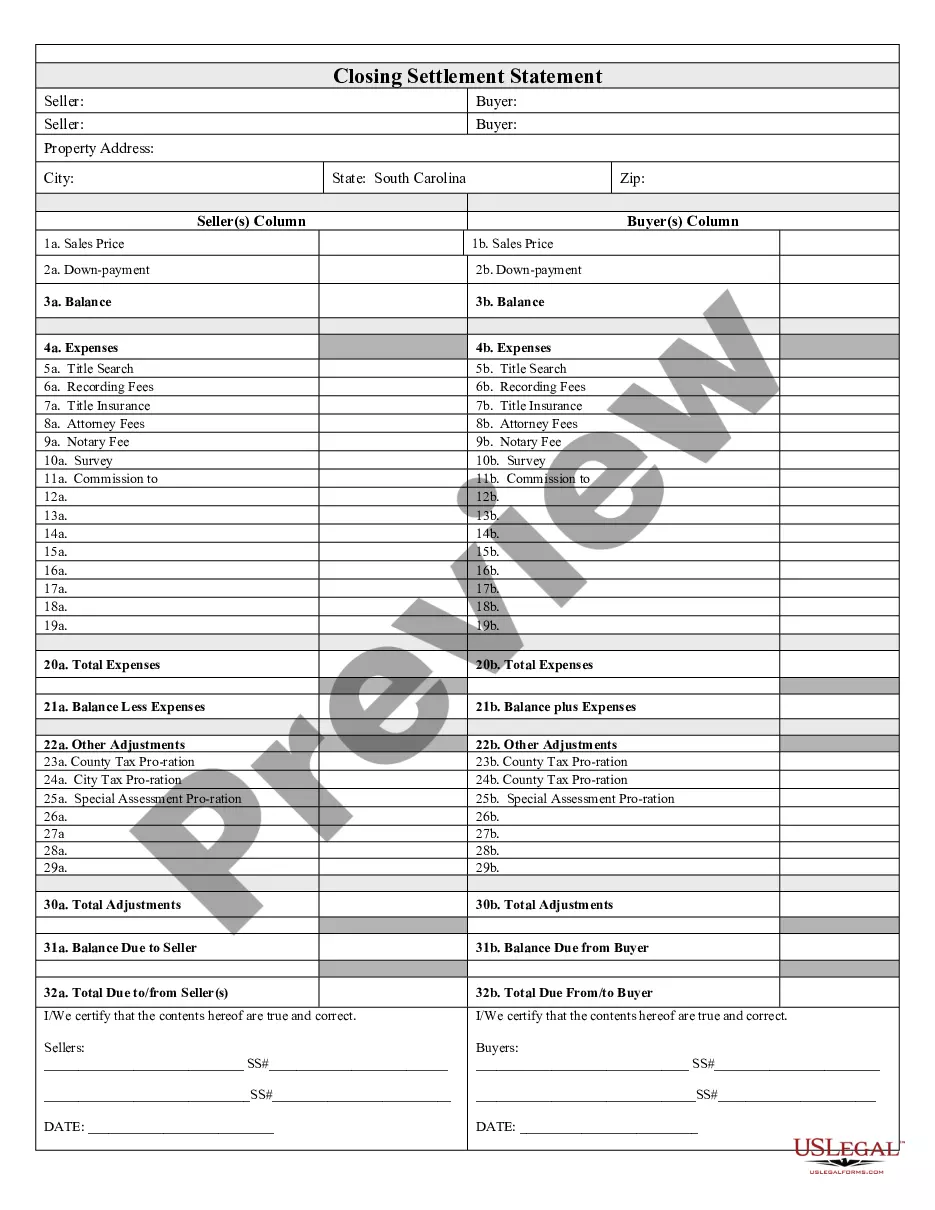

Closing Disclosure Statement With Income

Description

How to fill out South Carolina Closing Statement?

The Closing Disclosure Statement With Income you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and state laws. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Closing Disclosure Statement With Income will take you only a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or review the form description to ensure it satisfies your requirements. If it does not, use the search option to find the correct one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Select the format you want for your Closing Disclosure Statement With Income (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Cash to close includes the total closing costs minus any fees that are rolled into the loan amount. It also includes your down payment, and subtracts the earnest money deposit you might have made when your offer was accepted, plus any seller credits.

It means the amount of money you are borrowing from the lender, minus most of the upfront fees the lender is charging you.

Your lender is required to send you a Closing Disclosure that you must receive at least three business days before your closing. It's important that you carefully review the Closing Disclosure to make sure that the terms of your loan are what you are expecting.

Under the TRID rule, credit unions generally must provide the Loan Estimate to consumers no later than seven business days before consummation. Members must receive the Closing Disclosure no later than three business days before consummation.

Timing Requirements ? The ?3/7/3 Rule? The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.