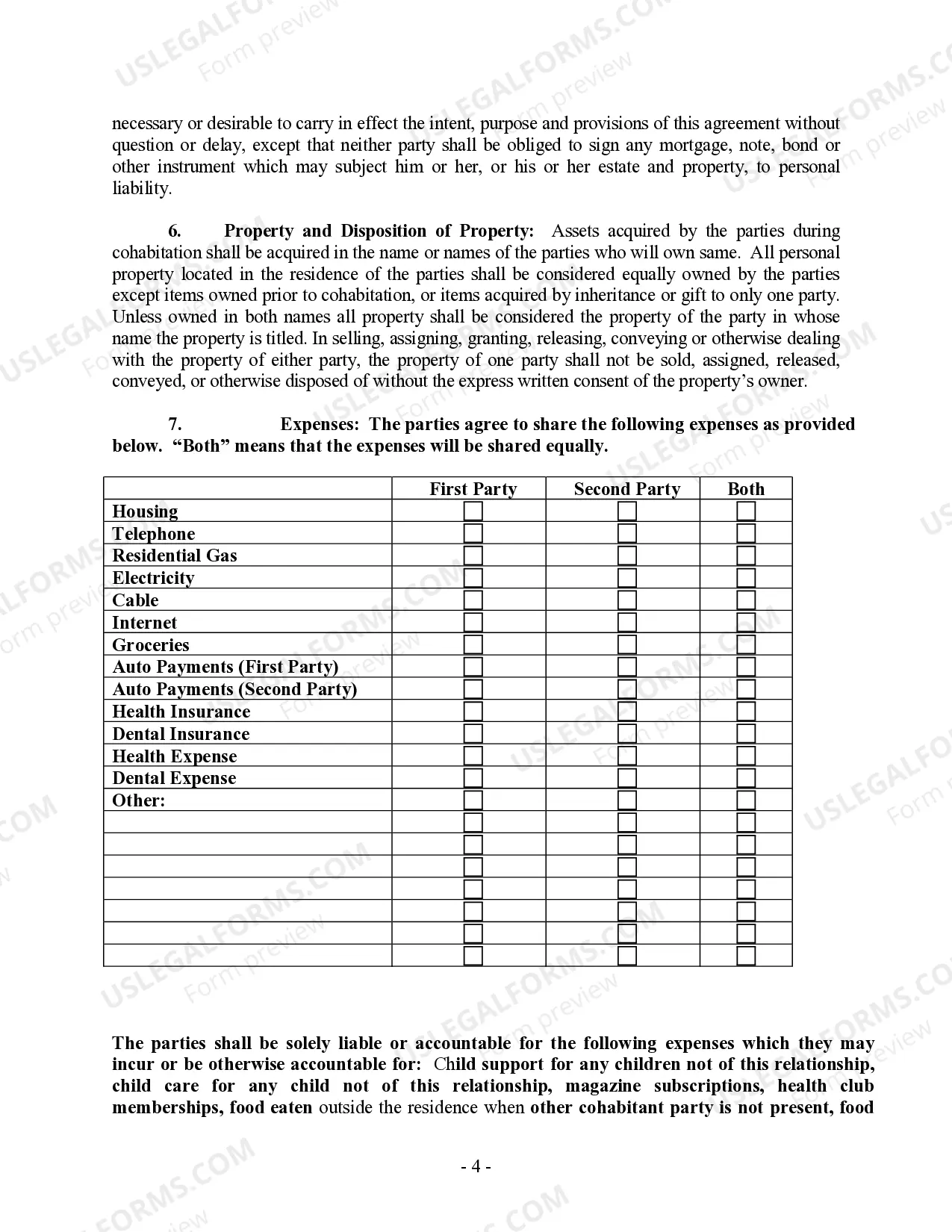

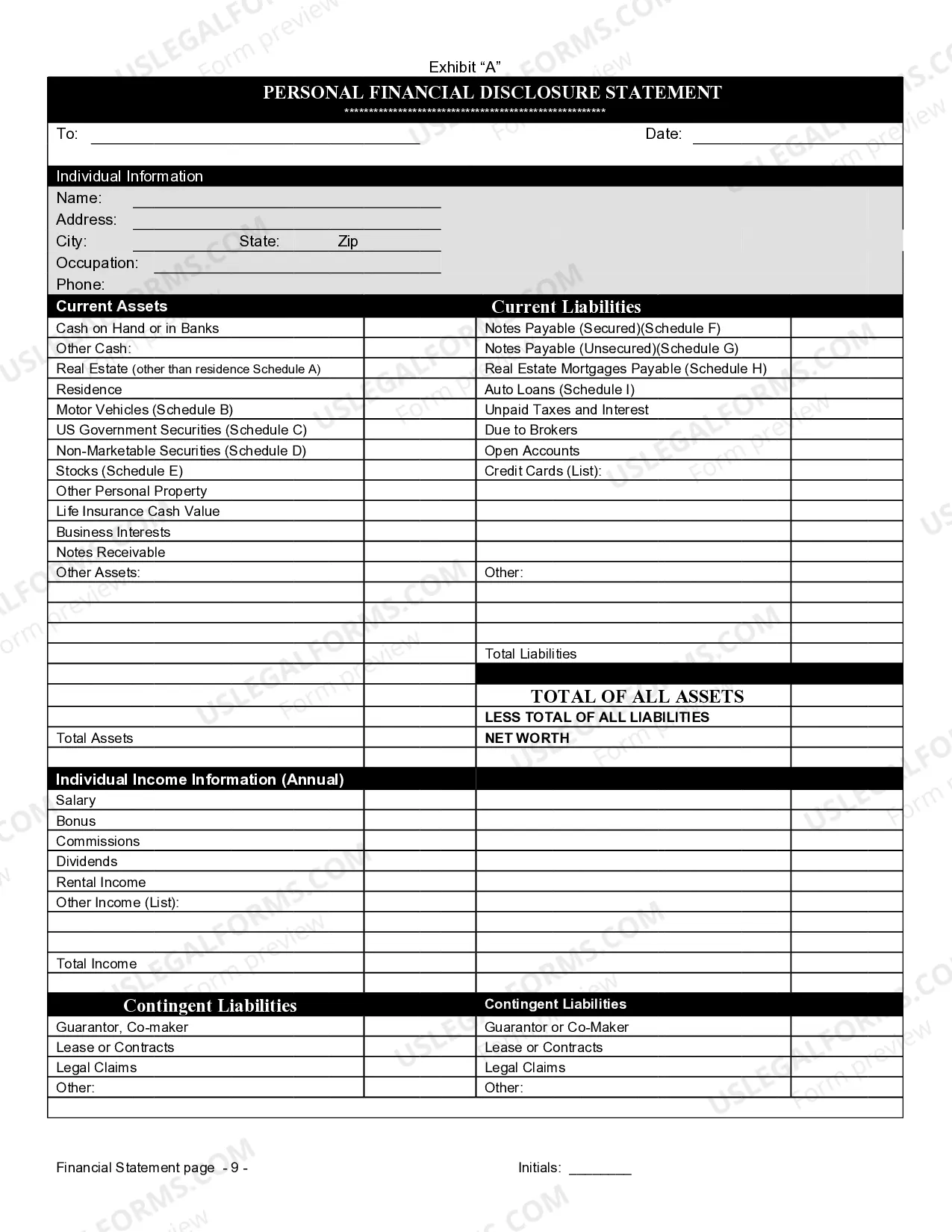

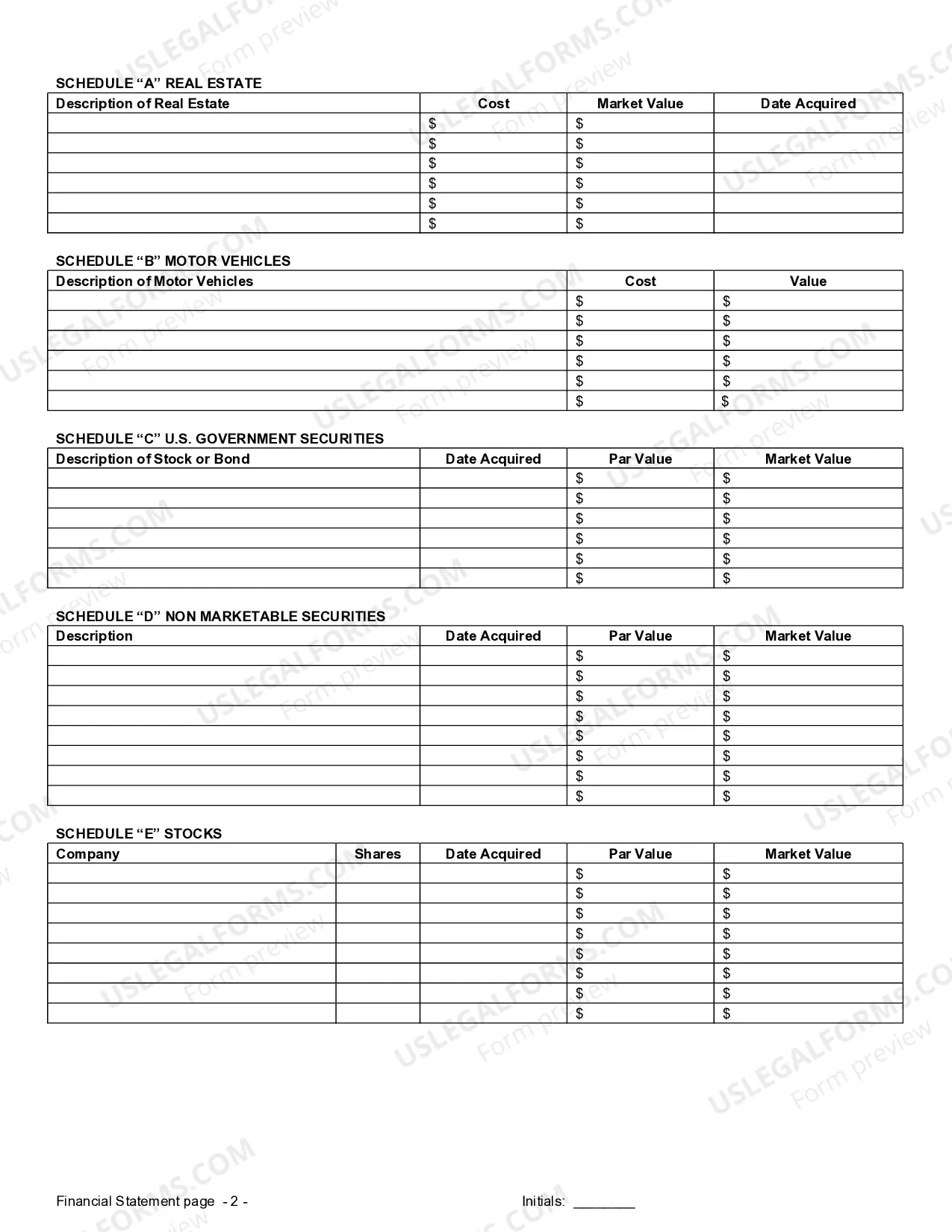

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

South Carolina Cohabitation Withholding Number

Description

How to fill out South Carolina Non-Marital Cohabitation Living Together Agreement?

Working with legal paperwork and procedures can be a time-consuming addition to the day. South Carolina Cohabitation Withholding Number and forms like it typically require that you search for them and understand how you can complete them properly. As a result, whether you are taking care of financial, legal, or individual matters, using a extensive and convenient web library of forms when you need it will significantly help.

US Legal Forms is the number one web platform of legal templates, featuring over 85,000 state-specific forms and a variety of resources to assist you to complete your paperwork effortlessly. Check out the library of appropriate documents available to you with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Safeguard your document management operations using a top-notch services that lets you make any form in minutes without any extra or hidden charges. Just log in to the account, locate South Carolina Cohabitation Withholding Number and download it straight away within the My Forms tab. You may also gain access to previously downloaded forms.

Would it be the first time using US Legal Forms? Sign up and set up an account in a few minutes and you will get access to the form library and South Carolina Cohabitation Withholding Number. Then, adhere to the steps below to complete your form:

- Be sure you have found the right form by using the Preview option and reading the form information.

- Choose Buy Now as soon as all set, and select the monthly subscription plan that suits you.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise assisting consumers deal with their legal paperwork. Find the form you require right now and improve any operation without having to break a sweat.

Form popularity

FAQ

Your SC Withholding File Number is a 9-digit number.

You must apply for a South Carolina Withholding file number to deposit your withholding payments. The fastest, easiest way to apply is online at MyDORWAY.dor.sc.gov. You can also apply by completing and submitting an SCDOR-111, Business Tax Application. The number makes you a withholding agent.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows ? 07-Mar-2022

You must apply for a South Carolina Withholding file number to deposit your withholding payments. The fastest, easiest way to apply is online at MyDORWAY.dor.sc.gov. You can also apply by completing and submitting an SCDOR-111, Business Tax Application. The number makes you a withholding agent.