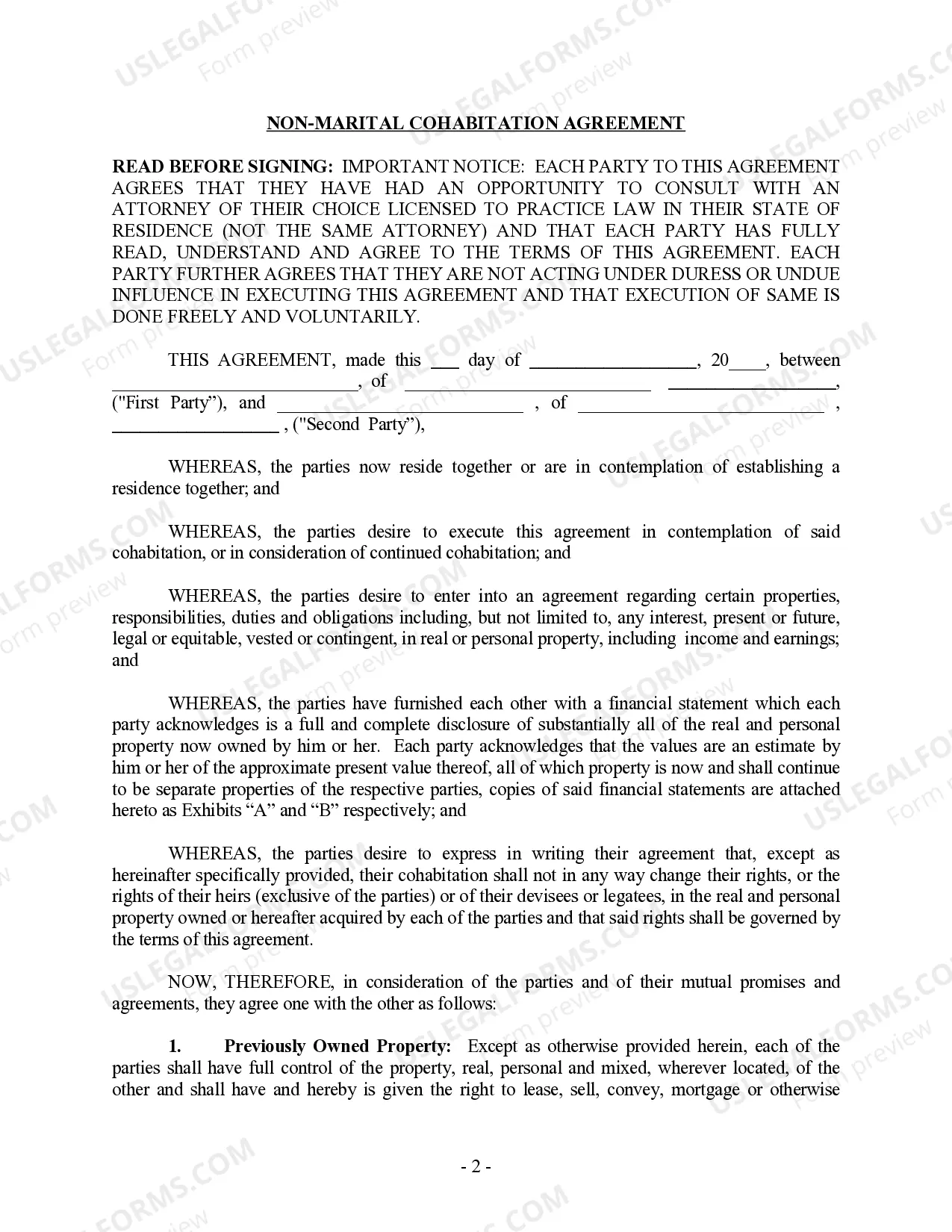

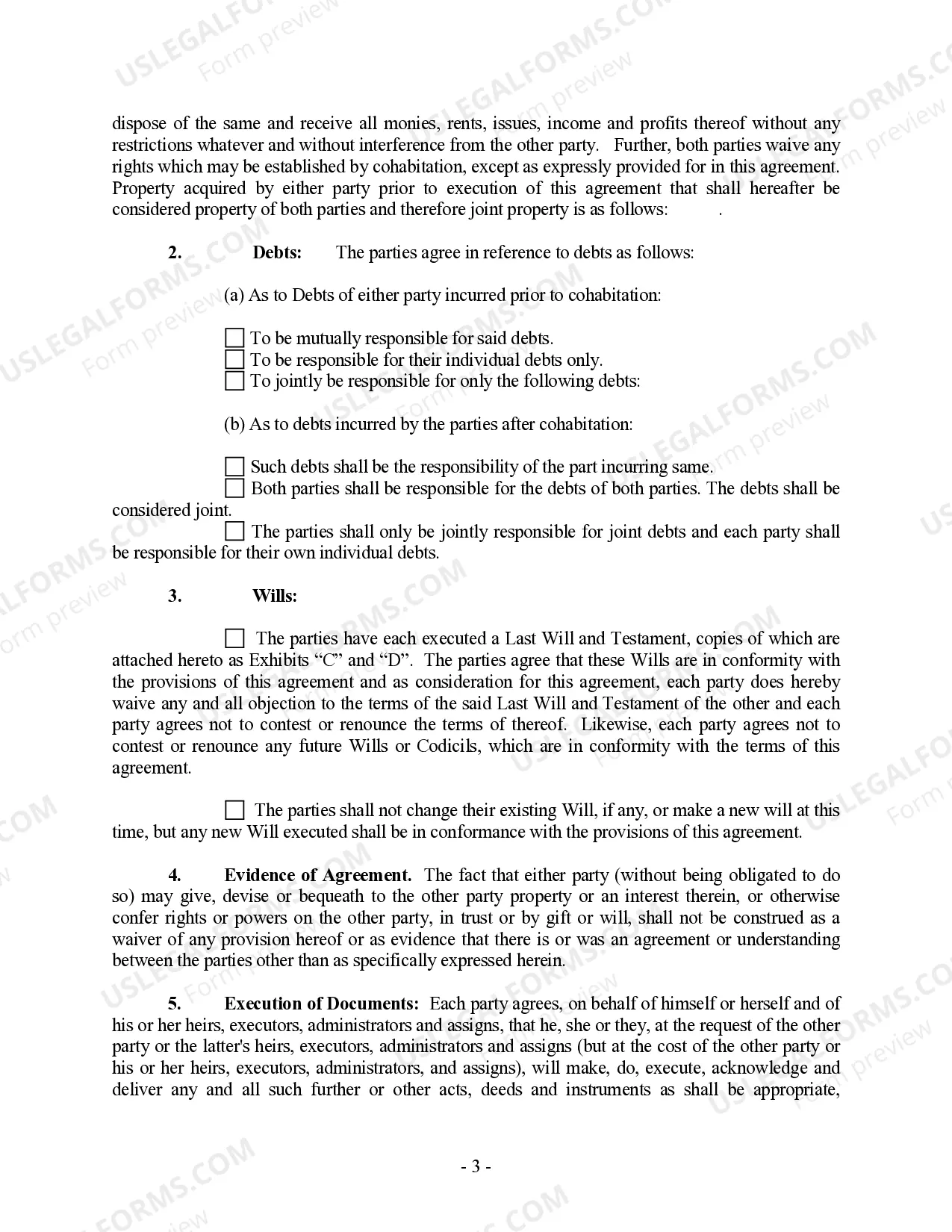

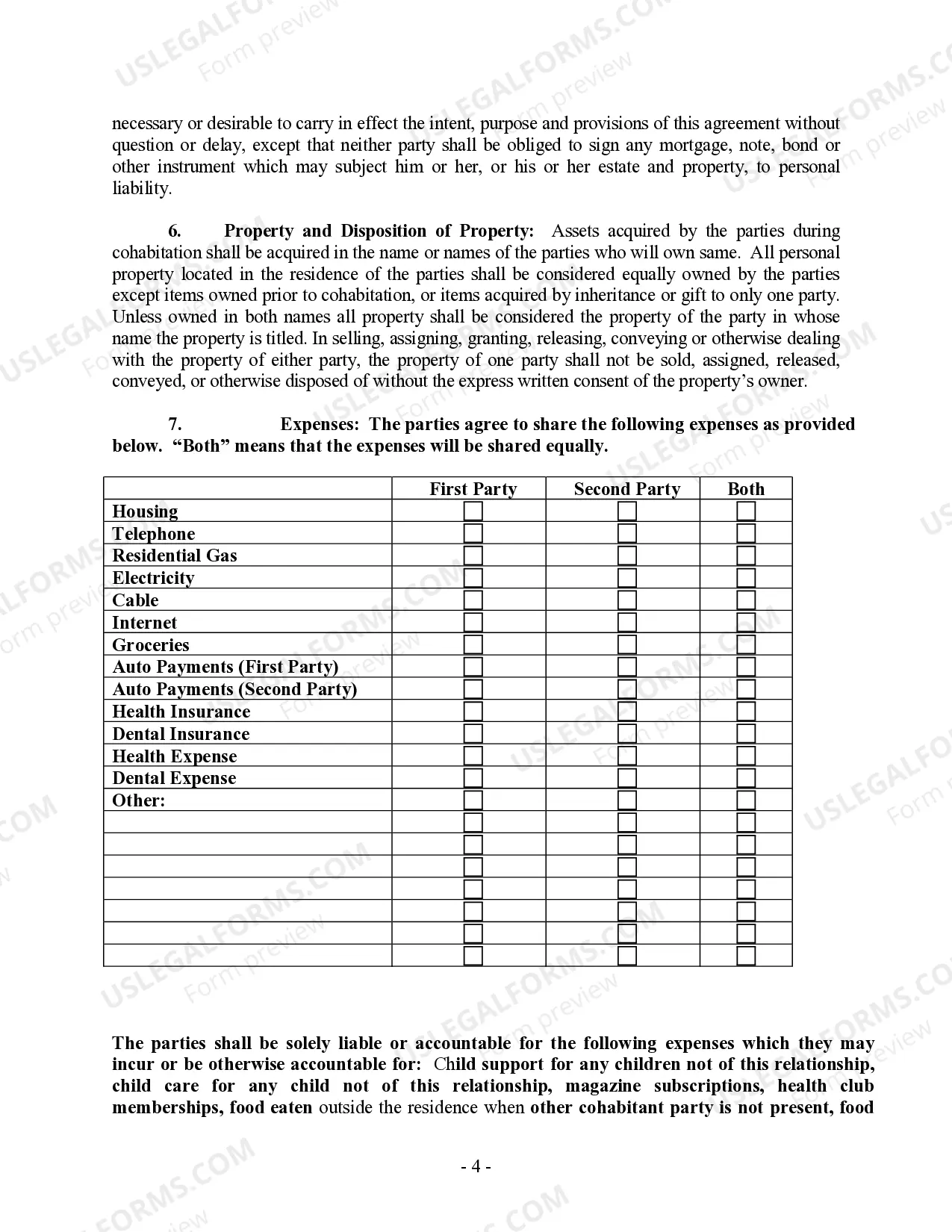

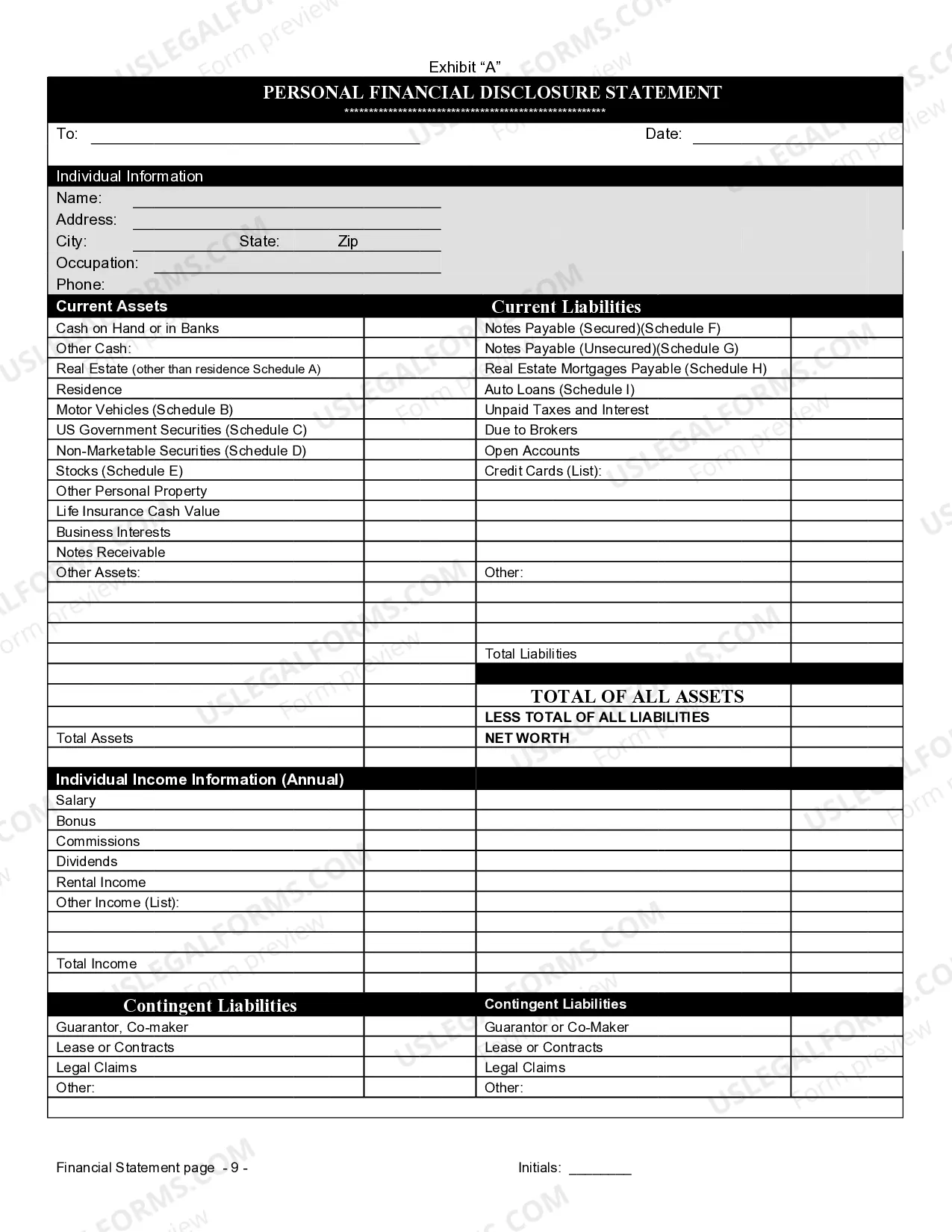

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

South Carolina Cohabitation Withholding

Description

How to fill out South Carolina Non-Marital Cohabitation Living Together Agreement?

Handling legal documents and procedures could be a time-consuming addition to your day. South Carolina Cohabitation Withholding and forms like it typically require you to search for them and understand how to complete them properly. Therefore, if you are taking care of financial, legal, or personal matters, having a extensive and hassle-free web catalogue of forms when you need it will help a lot.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and a number of resources to help you complete your documents easily. Check out the catalogue of pertinent papers accessible to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Shield your document managing processes by using a top-notch services that lets you put together any form within a few minutes without any additional or hidden fees. Just log in to your profile, locate South Carolina Cohabitation Withholding and download it immediately in the My Forms tab. You can also gain access to formerly saved forms.

Could it be the first time using US Legal Forms? Register and set up an account in a few minutes and you’ll gain access to the form catalogue and South Carolina Cohabitation Withholding. Then, follow the steps below to complete your form:

- Be sure you have discovered the correct form by using the Review feature and looking at the form description.

- Pick Buy Now when all set, and choose the subscription plan that meets your needs.

- Select Download then complete, sign, and print out the form.

US Legal Forms has 25 years of experience assisting consumers handle their legal documents. Discover the form you require right now and enhance any process without breaking a sweat.

Form popularity

FAQ

The withholding amount is 7% of the amount realized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the amount realized on the sale by a nonresident corporation or any other nonresident entity, if the seller does not provide the buyer with a Seller's Affidavit stating the amount of gain ...

The court may determine that a continued cohabitation exists if there is evidence that the supported spouse resides with another person in a romantic relationship for periods of less than ninety days and the two periodically separate in order to circumvent the ninety-day requirement.

SC Code Section 12-8-590 requires an S Corporation or Partnership to withhold taxes at the rate of 5% on each nonresident shareholder's or partner's share of South Carolina taxable income. There are several exceptions to the withholding requirements.

You must apply for a South Carolina Withholding file number to deposit your withholding payments. The fastest, easiest way to apply is online at MyDORWAY.dor.sc.gov. You can also apply by completing and submitting an SCDOR-111, Business Tax Application. The number makes you a withholding agent.

The fastest, easiest way to apply is online at MyDORWAY.dor.sc.gov. You can also apply by completing and submitting an SCDOR-111, Business Tax Application. The number makes you a withholding agent.