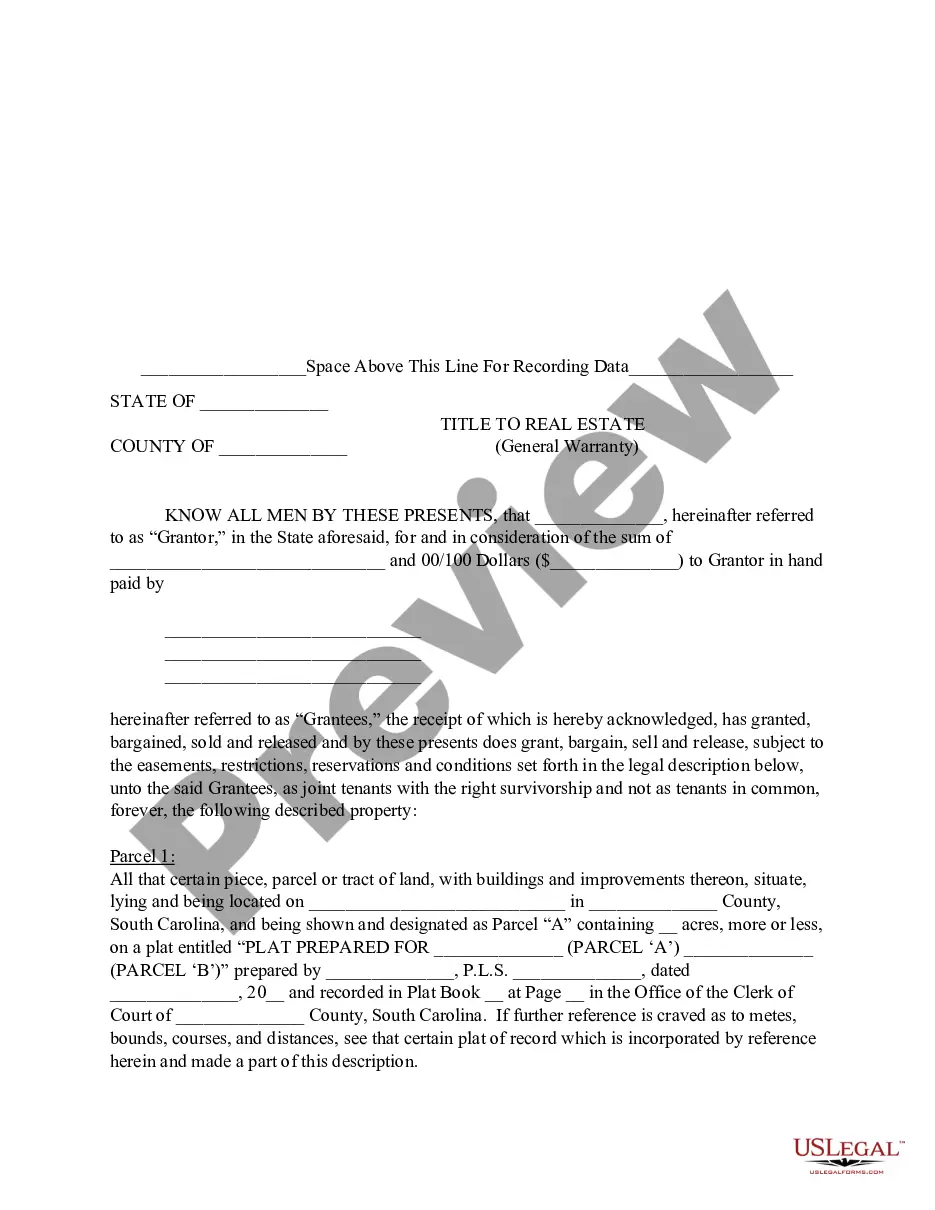

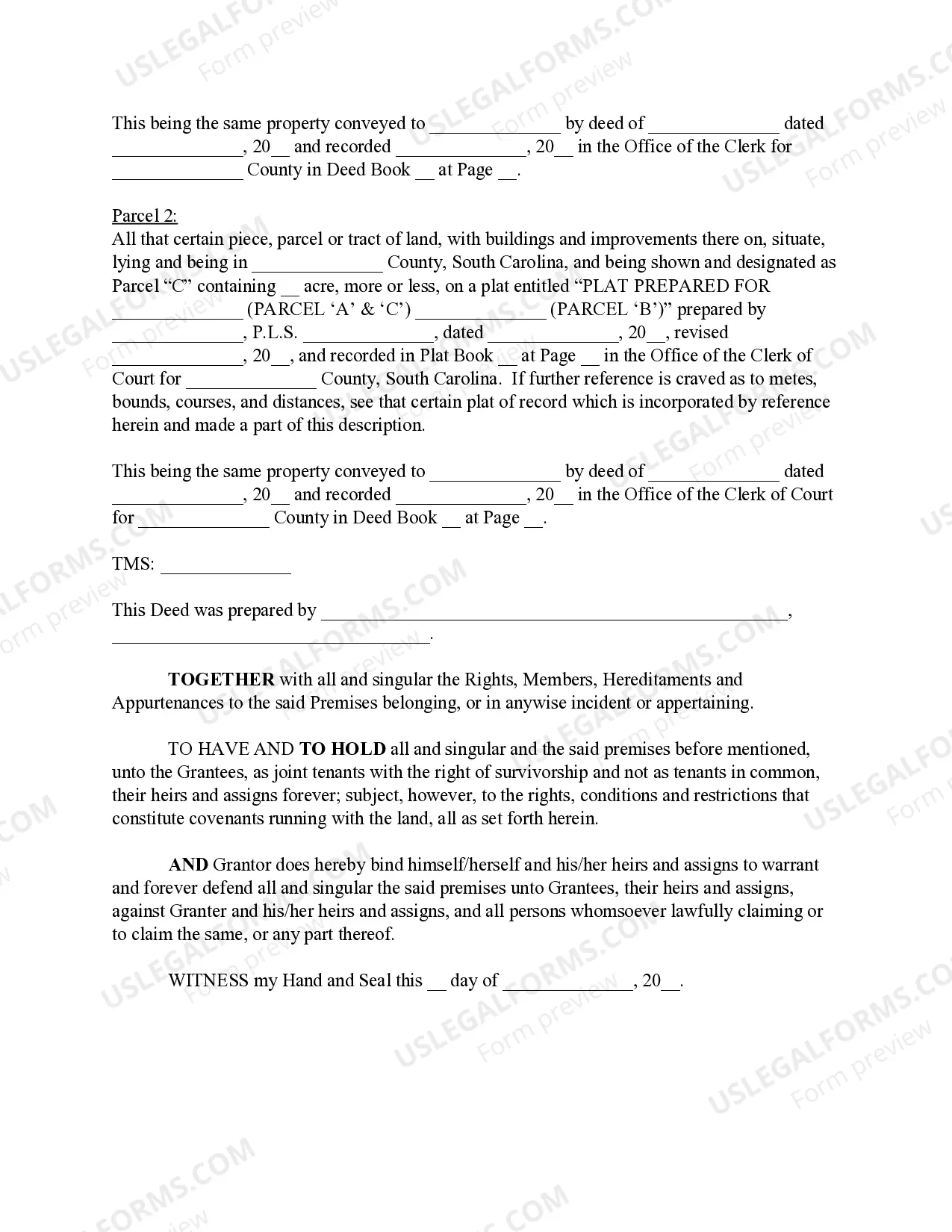

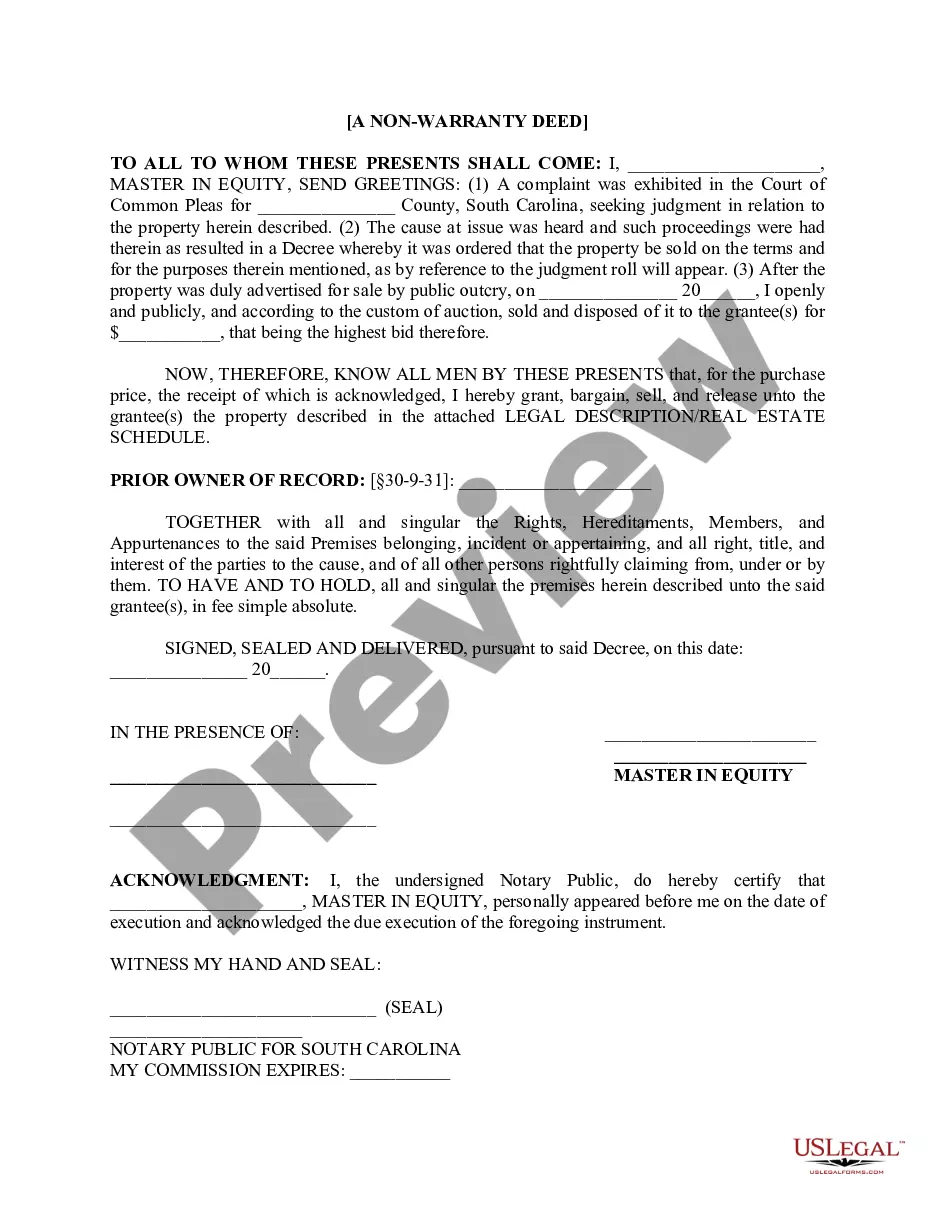

Title To Real Estate With Services

Description

How to fill out South Carolina Title To Real Estate?

Utilizing legal templates that comply with federal and local regulations is essential, and the internet provides a plethora of choices.

But what’s the purpose of squandering time looking for the appropriate Title To Real Estate With Services sample online when the US Legal Forms library has consolidated such templates in one location.

US Legal Forms is the premier online legal repository boasting over 85,000 editable templates created by attorneys for every professional and personal situation.

Review the template using the Preview feature or through the text description to confirm it aligns with your needs.

- They are easy to navigate, with all documents categorized by state and intended use.

- Our experts keep abreast of legal changes, ensuring your documents are always up-to-date and in compliance when obtaining a Title To Real Estate With Services from our site.

- Acquiring a Title To Real Estate With Services is straightforward and fast for both existing and new users.

- If you possess an account with a valid subscription, Log In and save the document sample you need in the appropriate format.

- If you are new to our site, adhere to the following steps.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Effective January 1, the small loan act applies to loans under $10,000 and not just $5,000 and certain other restrictions on scope are loosened. The anti-evasion provisions are also expanded. § 58-15-3(D). As of January 1, 2023, a fee of 5% of the principal may be charged for a loan of $500 or less.