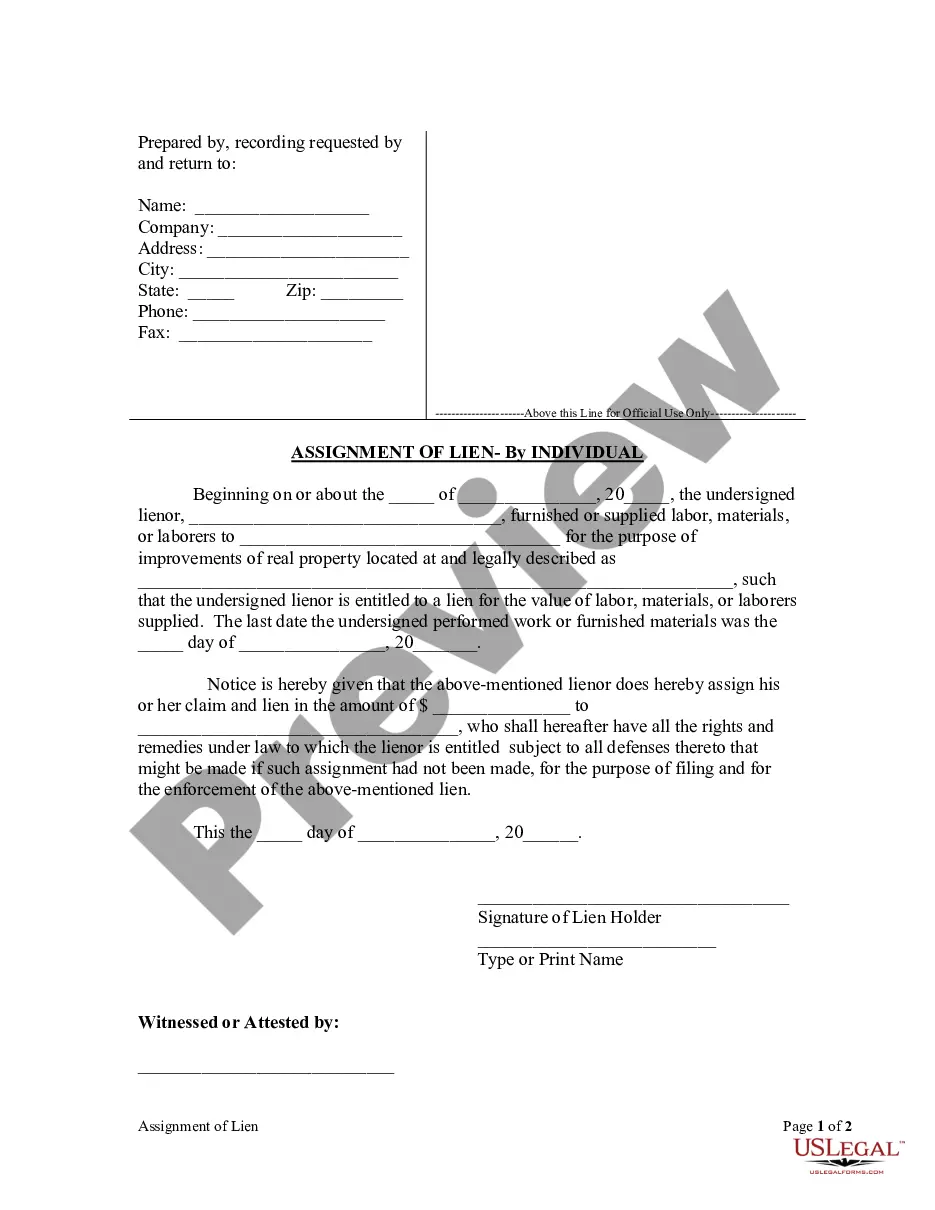

This Assignment of Claim of Lien form is for use by an individual lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that the lienor assigns his or her claim and lien to a person who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

South Carolina Lien Withdrawal

Description

Form popularity

FAQ

Yes, South Carolina is classified as a judicial foreclosure state. This means that lenders must file a lawsuit to initiate foreclosure proceedings. Understanding this legal framework can help you navigate the process more effectively and may assist in achieving a timely South Carolina lien withdrawal, should that become necessary.

Yes, South Carolina utilizes deeds of trust in financing arrangements. A deed of trust involves three parties: the borrower, the lender, and a trustee. If you're looking into South Carolina lien withdrawal, familiarizing yourself with this process can help you understand the implications it has on your property.

South Carolina operates primarily as a deed state. This means that when you take out a mortgage, you convey the title to the lender. If you wish to engage in a South Carolina lien withdrawal, it's vital to understand how these deeds operate to ensure a smooth process.

South Carolina's lien law provides guidelines on how liens are created, enforced, and withdrawn. It covers various types of liens, from mechanic's liens to judgment liens. Knowing the specifics of these laws can facilitate an effective South Carolina lien withdrawal, protecting your property rights down the line.

To remove a lien in South Carolina, you must follow a specific legal process. This often involves filing a motion in court or obtaining a lien release from the lienholder. Using a reliable resource like UsLegalForms can simplify the South Carolina lien withdrawal process, ensuring that all necessary documents are completed accurately.

In South Carolina, a lien typically lasts for a period of ten years. After this time, the lien will expire if it is not renewed. This means that property owners should take action toward a South Carolina lien withdrawal if the lien is no longer valid. Staying proactive can help you avoid complications in the future.

To obtain a lien release form for your South Carolina lien withdrawal, you can visit various online platforms that provide legal document templates. One helpful resource is UsLegalForms, which offers a collection of lien release forms specifically designed for South Carolina laws. By using their services, you ensure that your form meets legal requirements, simplifying the withdrawal process. It's important to complete this form accurately to avoid complications in your lien withdrawal.

To check for a lien on a property in South Carolina, visit your local county clerk’s office or their website. Many counties offer online databases where you can search by the property address or owner’s name. Additionally, using services like USLegalForms can streamline this process, providing access to necessary documents and reliable information about the South Carolina lien withdrawal process.

To file a lien in South Carolina, start by drafting a lien statement that includes essential details, such as the amount owed and a description of the property. Next, file this statement with the appropriate county clerk’s office where the property is located. Be aware of the specific timeframes for filing to avoid complications. Once the filing is complete, you can explore options for South Carolina lien withdrawal when the debt is settled.

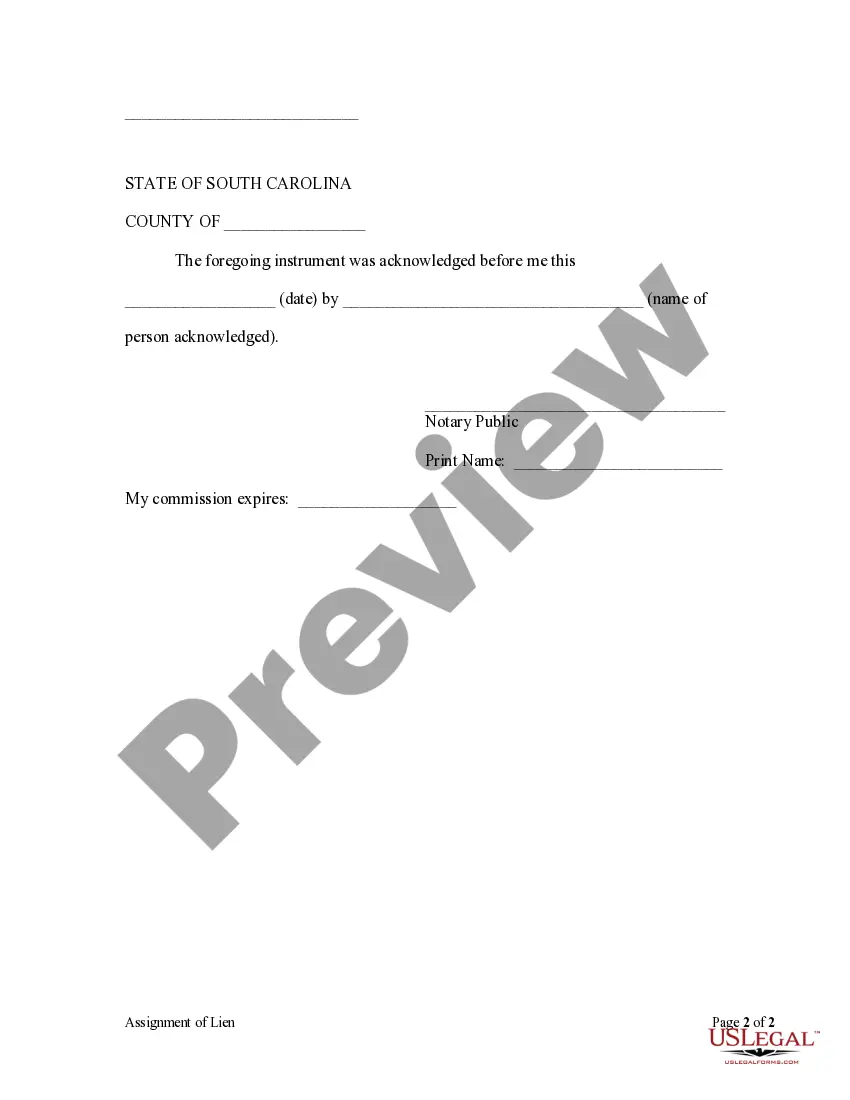

In South Carolina, lien waivers do not require notarization to be valid. However, having a notarized lien waiver can provide an extra layer of protection if disputes arise. It is always a good idea to document any agreements thoroughly. For those navigating the South Carolina lien withdrawal process, clear documentation can simplify future transactions.