Quitclaim Deed On Property With Mortgage

Description

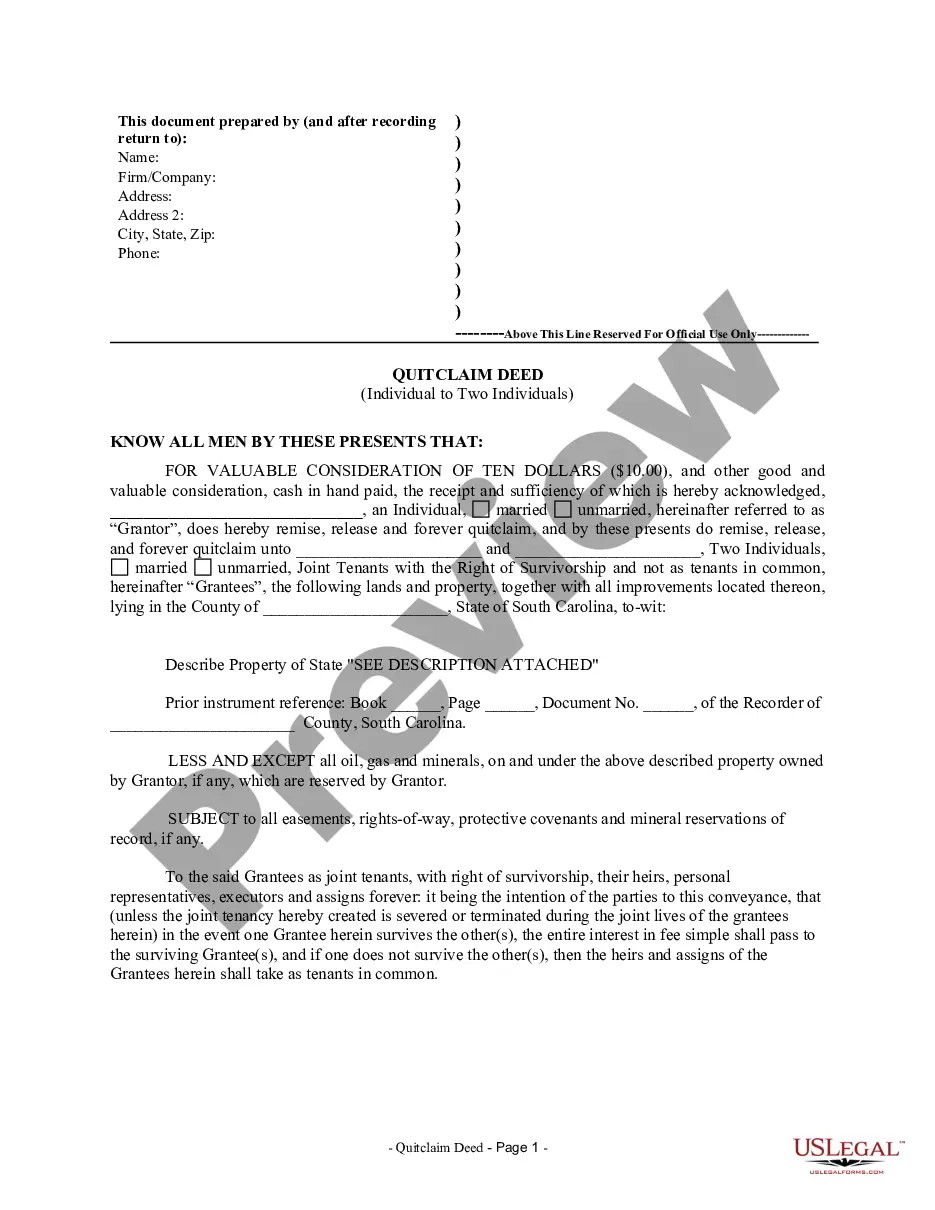

How to fill out South Carolina Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

- If you're a returning user, log in to access your account and download the necessary form by clicking the Download button. Ensure your subscription is active and renew if required.

- For first-time users, start by reviewing the Preview mode and form description to confirm you've selected the appropriate quitclaim deed that aligns with your jurisdiction's requirements.

- If you need a different template, utilize the Search tab to find the right quitclaim deed. Confirm it fits your needs before proceeding.

- To purchase the document, click on the Buy Now button, select your preferred subscription plan, and create an account to access the library's resources.

- Complete your purchase by providing your payment details through credit card or PayPal. After payment, you will be able to save the form on your device.

- Download your quitclaim deed template to complete it. You can also access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms not only provides a robust collection of legal documents but also offers access to premium experts for assistance. This ensures that your quitclaim deed is accurately completed, providing peace of mind.

Begin your journey to a hassle-free quitclaim deed today by visiting US Legal Forms and discovering how easy it is to manage your legal paperwork.

Form popularity

FAQ

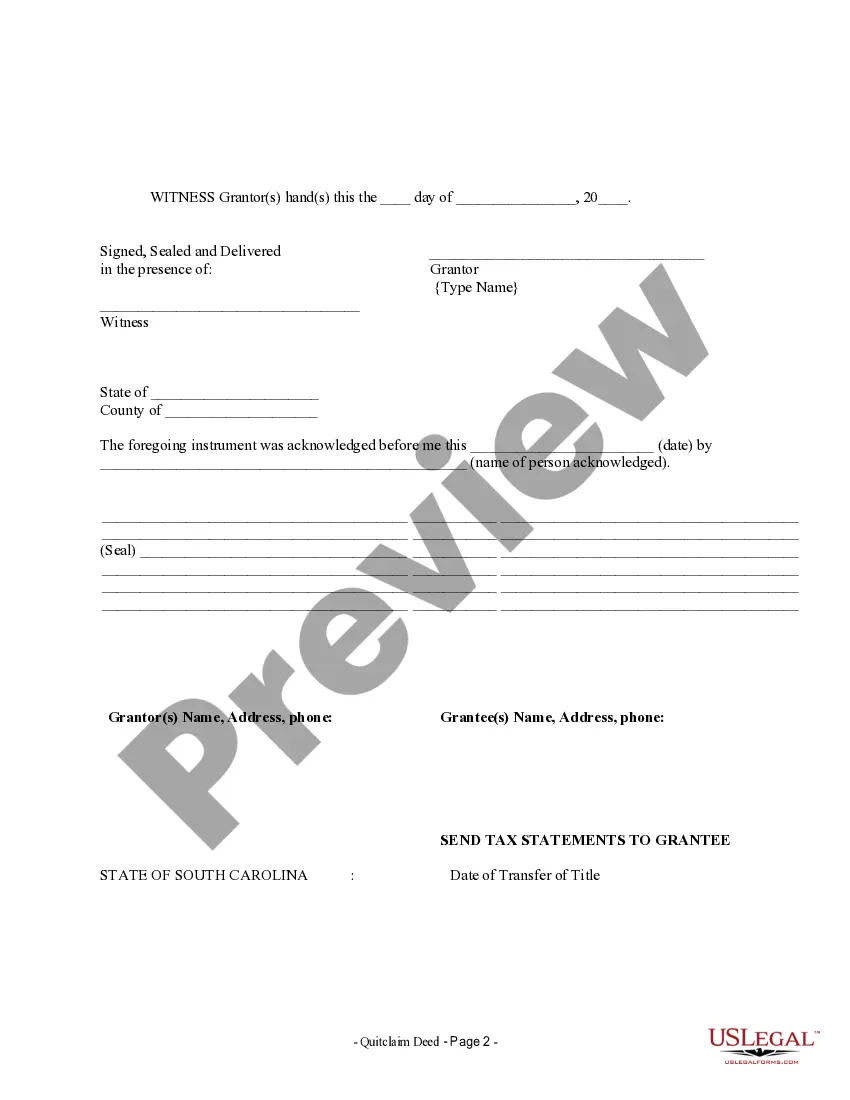

Filling out a quit claim deed is a straightforward process, involving filling in the grantor, grantee, and property details. It’s essential to include accurate descriptions to avoid future disputes. Consider using a service like US Legal Forms to access templates and guidance for completing your quitclaim deed on property with mortgage.

If your name is on the deed but not on the mortgage, it means you own a share of the property legally but do not bear responsibility for the mortgage payments. A quitclaim deed on property with a mortgage can facilitate such arrangements. This can be common in situations like adding a spouse or family member to the deed.

Yes, you can add someone to the title even if your property is encumbered by a mortgage. This is often done through a quitclaim deed on property with a mortgage. Make sure to notify your lender, as they might want to review the change to ensure that it aligns with their policies.

Adding someone to a deed does not automatically change the mortgage terms. However, your lender may require notification and could evaluate the change in ownership. It is wise to discuss the implications with your mortgage company to ensure no unexpected consequences arise.

Yes, you can add someone to your deed even if you have a mortgage. However, you should consider your lender’s policies, as they may have specific requirements. Additionally, adding someone via a quitclaim deed on property with a mortgage can change your ownership percentage, impacting future responsibilities.

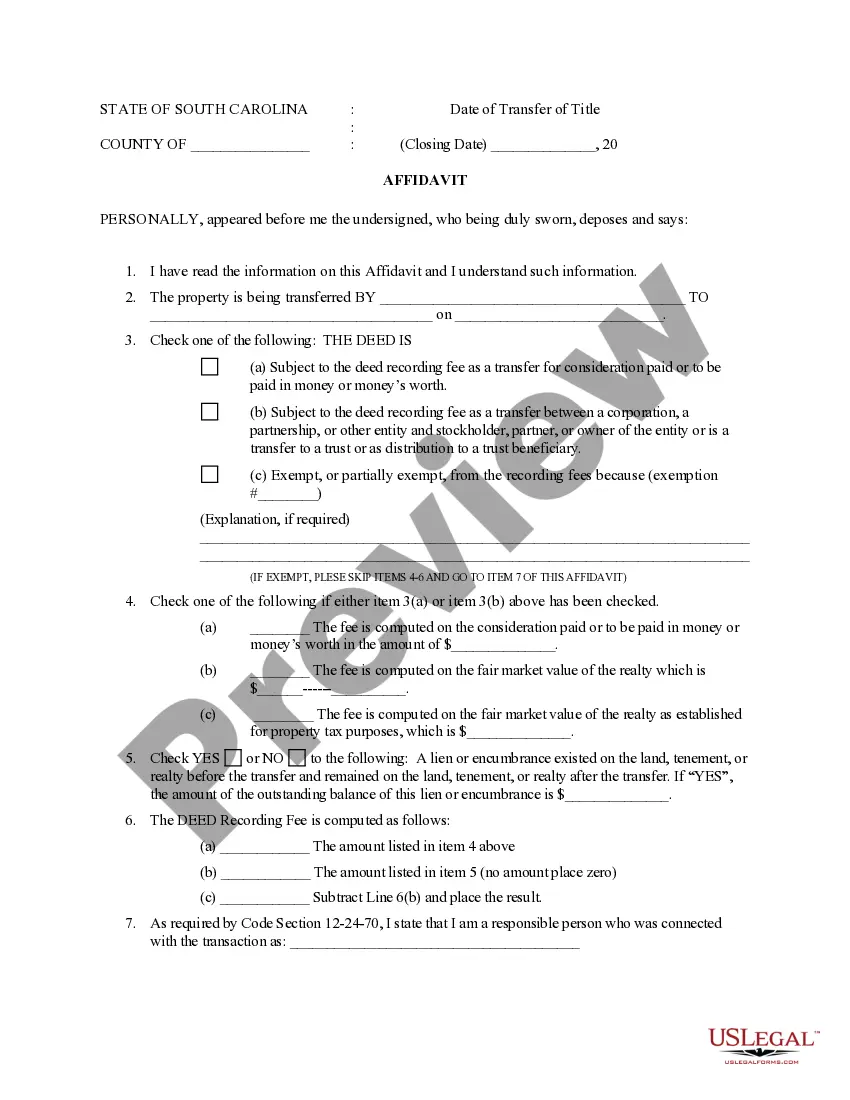

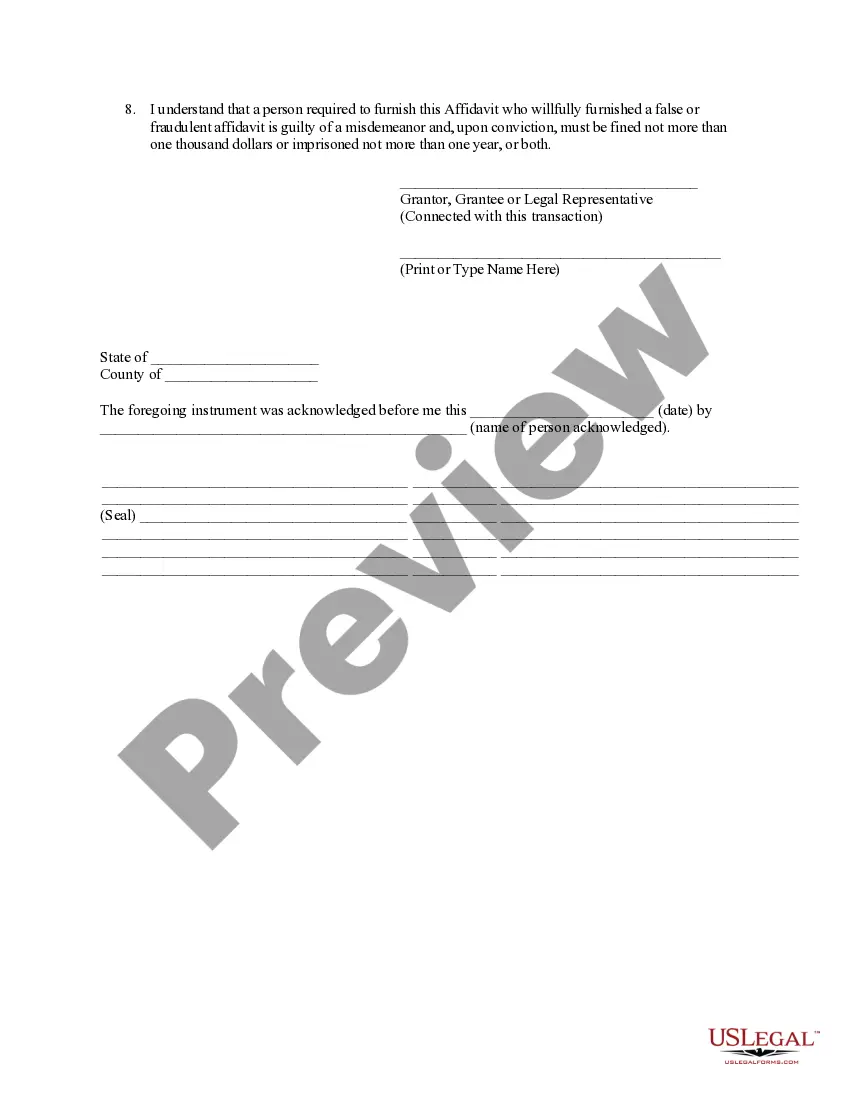

Quitclaim deeds on property with mortgage can raise concerns because they do not guarantee a clear title. Unlike other types of deeds, a quitclaim simply transfers whatever interest the grantor has, without any promises regarding its validity. This lack of assurance can lead to potential disputes or hidden liens. Therefore, it is essential to conduct thorough research and consider using platforms like US Legal Forms to ensure you understand the implications of using a quitclaim deed in your specific situation.

If your name is on the mortgage but not on the deed, you are legally responsible for the mortgage payments but do not own the property. This situation can complicate your financial and legal standing, especially if the property is sold or transferred. If you are considering a quitclaim deed on property with a mortgage, make sure to clarify your ownership rights and responsibilities.

A quitclaim deed has several disadvantages. It offers no warranty or guarantee about the ownership of the property, which can leave you vulnerable to claims from other parties. If there are existing liens or debts, the new owner may inherit those, impacting future financial stability. Therefore, before executing a quitclaim deed on property with a mortgage, consider consulting a legal expert.

The bank does not hold the deed to your property even when you have a mortgage. You keep the deed, but the bank has a secured interest. If you default on payments, the bank can initiate foreclosure. Understanding your rights under a quitclaim deed on property with a mortgage is essential for protecting your ownership.