Lady Bird Deed What Is It

Description

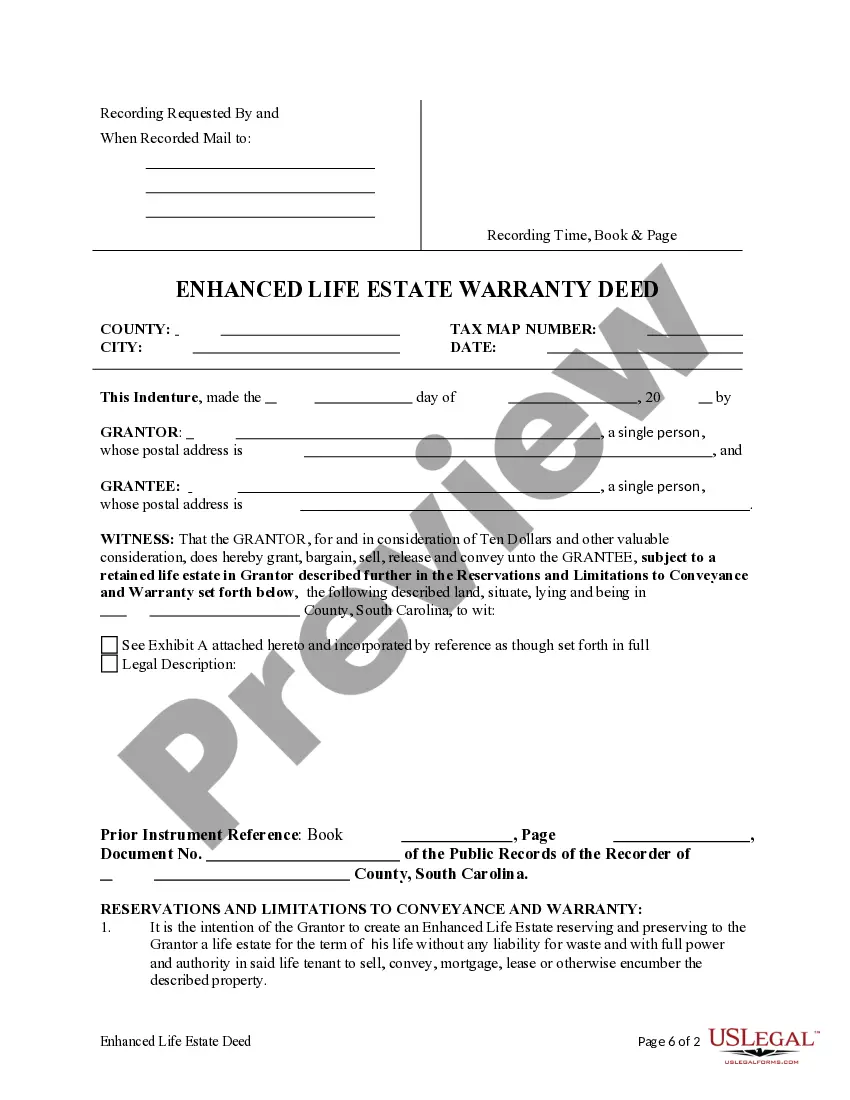

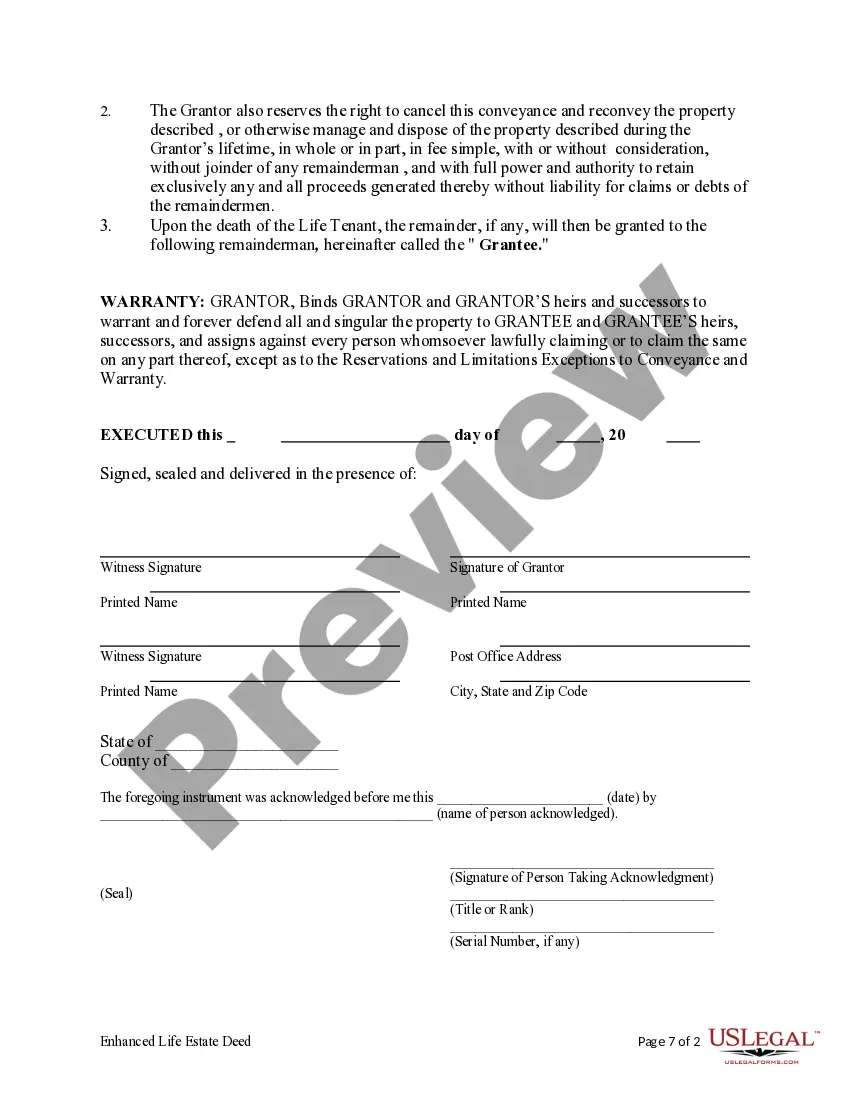

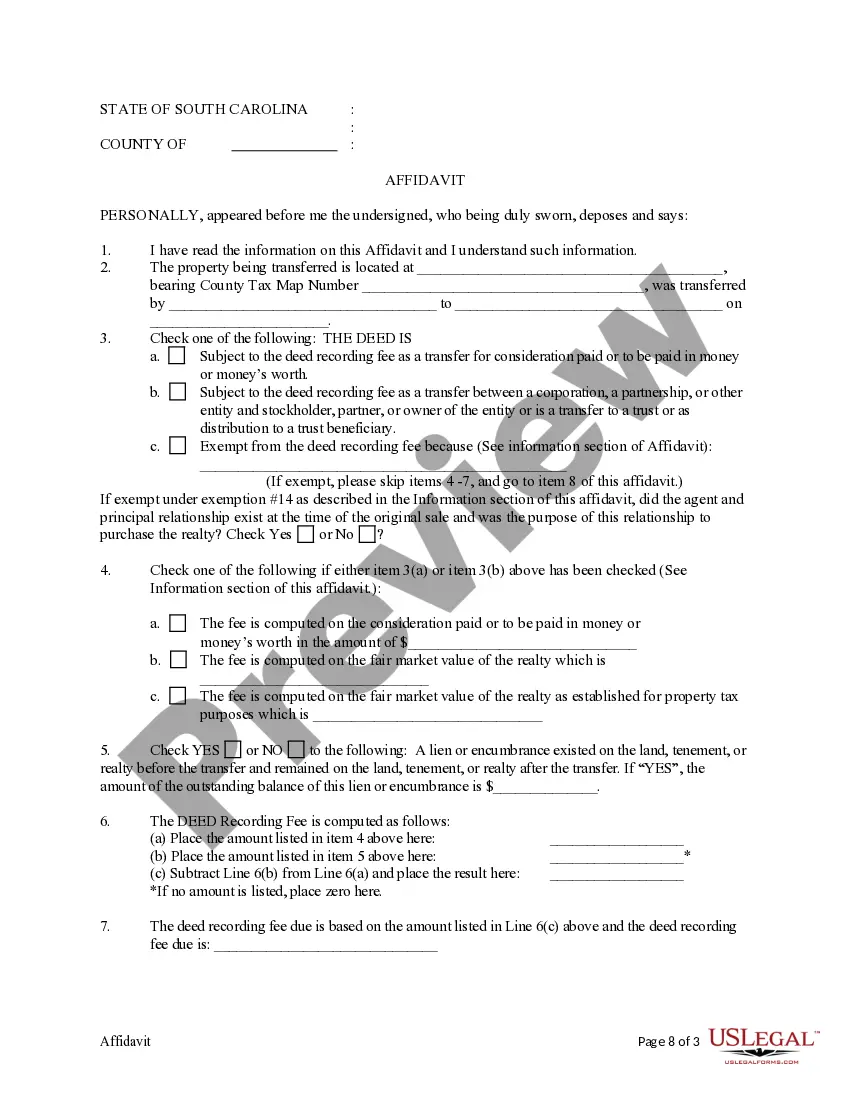

How to fill out South Carolina Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Individual?

Regardless of whether it is for corporate reasons or personal affairs, individuals must confront legal issues at some point in their lives.

Completing legal forms requires meticulous attention, starting with selecting the suitable form example. For instance, if you opt for an incorrect version of the Lady Bird Deed What Is It, it will be rejected upon submission.

With an extensive catalog from US Legal Forms available, you don't have to waste time hunting for the right sample on the web. Take advantage of the library's user-friendly navigation to find the appropriate template for any circumstance.

- Obtain the required sample via the search bar or catalog browsing.

- Review the form's details to ensure it aligns with your circumstances, state, and county.

- Click on the preview of the form to review it.

- If it is the wrong document, go back to the search feature to find the Lady Bird Deed What Is It sample you require.

- Acquire the template if it suits your requirements.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Select the relevant pricing option.

- Fill out the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Decide on the format you prefer for the document and download the Lady Bird Deed What Is It.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

One disadvantage of a Lady Bird deed is that it does not prevent creditors from reaching the property during the grantor's lifetime. This means that if the property owner accumulates debt or faces lawsuits, those creditors could still lay claim to the property. Moreover, not all states recognize Lady Bird deeds, which could limit their effectiveness. It’s beneficial to utilize platforms like uslegalforms to ensure proper implementation and protection for your assets.

Choosing between a Lady Bird deed and a trust depends on your unique circumstances. A Lady Bird deed simplifies the transfer of property upon death while maintaining control during your lifetime, which some find advantageous. In contrast, a trust might offer more comprehensive asset management and protection options. Evaluating your specific goals and needs is vital, and tools like uslegalforms can assist you in making the right choice.

Understanding the tax consequences of a Lady Bird deed is crucial for your estate planning. When the grantor passes away, the property typically receives a step-up in basis, which can minimize capital gains tax for heirs. However, any property tax implications at the time of transfer can vary by state, so consulting with a tax advisor is essential to understand your specific situation. This is where platforms like uslegalforms can guide you through the complexities.

The Lady Bird deed is a useful estate planning tool, but it does have some negatives. One major concern is that it does not provide the same level of asset protection as a trust. Additionally, if the property owner faces Medicaid issues, the property could be at risk. Lastly, understanding and drafting a Lady Bird deed requires careful consideration to avoid potential legal pitfalls.

A lady bird deed offers several benefits, primarily by allowing you to avoid probate and ensuring a direct transfer of ownership to your heirs. It also provides flexibility since you can retain the right to sell or change the property during your lifetime. Additionally, it often helps in reducing stress and legal costs for your loved ones afterward. To help you navigate this process, you can explore what the lady bird deed what is it means on platforms like uslegalforms.

While a lady bird deed has numerous advantages, it can also bring some disadvantages. For instance, it may not provide full asset protection from creditors or may have unintended tax implications in some cases. Additionally, the property remains part of your estate for Medicaid eligibility. Understanding these aspects of the lady bird deed what is it helps you weigh your options more effectively.

The primary purpose of a lady bird deed is to simplify the transfer of property upon death. It enables property owners to retain full control during their lifetime while ensuring a smooth transition to heirs without the complications of probate. This tool serves to protect your interests and streamline estate planning. Exploring the lady bird deed what is it can provide clarity on how it benefits you.

A lady bird deed can help you avoid capital gains tax when you transfer property at death. This method allows you to retain rights to the property during your lifetime, while the assets pass directly to your beneficiaries after you die. By doing this, you often bypass triggering capital gains taxes that might apply otherwise. Thus, understanding the lady bird deed what is it becomes essential for tax planning.

Generally, Medicaid cannot take your house if you have a properly structured lady bird deed. This legal tool allows you to dictate who receives your property after your death, which can help protect your home from Medicaid claims. However, it is essential to follow the legal requirements to ensure the deed is valid. Consulting with a legal expert, such as those available on uslegalforms, can help clarify any concerns regarding Medicaid and your lady bird deed.

A lady bird deed can offer protection for your home from Medicaid's estate recovery efforts. By allowing you to maintain ownership during your lifetime, it potentially makes your home exempt from Medicaid claims after you pass away. However, you need to ensure the deed is set up correctly to achieve this benefit. Therefore, understanding the relationship between a lady bird deed and Medicaid is vital when planning your estate.