Right To Cure Letter For Auto

Description

How to fill out South Carolina Notice Of Consumer's Right To Cure Default?

Legal management can be overwhelming, even for knowledgeable experts. When you are interested in a Right To Cure Letter For Auto and don’t have the a chance to commit searching for the right and updated version, the operations can be stressful. A robust web form catalogue can be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available at any time.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from individual to business papers, in one location.

- Employ innovative resources to accomplish and handle your Right To Cure Letter For Auto

- Access a resource base of articles, instructions and handbooks and resources connected to your situation and requirements

Save time and effort searching for the papers you will need, and use US Legal Forms’ advanced search and Preview feature to locate Right To Cure Letter For Auto and acquire it. In case you have a membership, log in to your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to see the papers you previously downloaded as well as handle your folders as you can see fit.

If it is your first time with US Legal Forms, create an account and obtain unlimited usage of all benefits of the library. Here are the steps to consider after downloading the form you need:

- Verify it is the right form by previewing it and looking at its description.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are ready.

- Choose a monthly subscription plan.

- Find the format you need, and Download, complete, sign, print out and send your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Enhance your daily papers managing in a easy and easy-to-use process today.

Form popularity

FAQ

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.

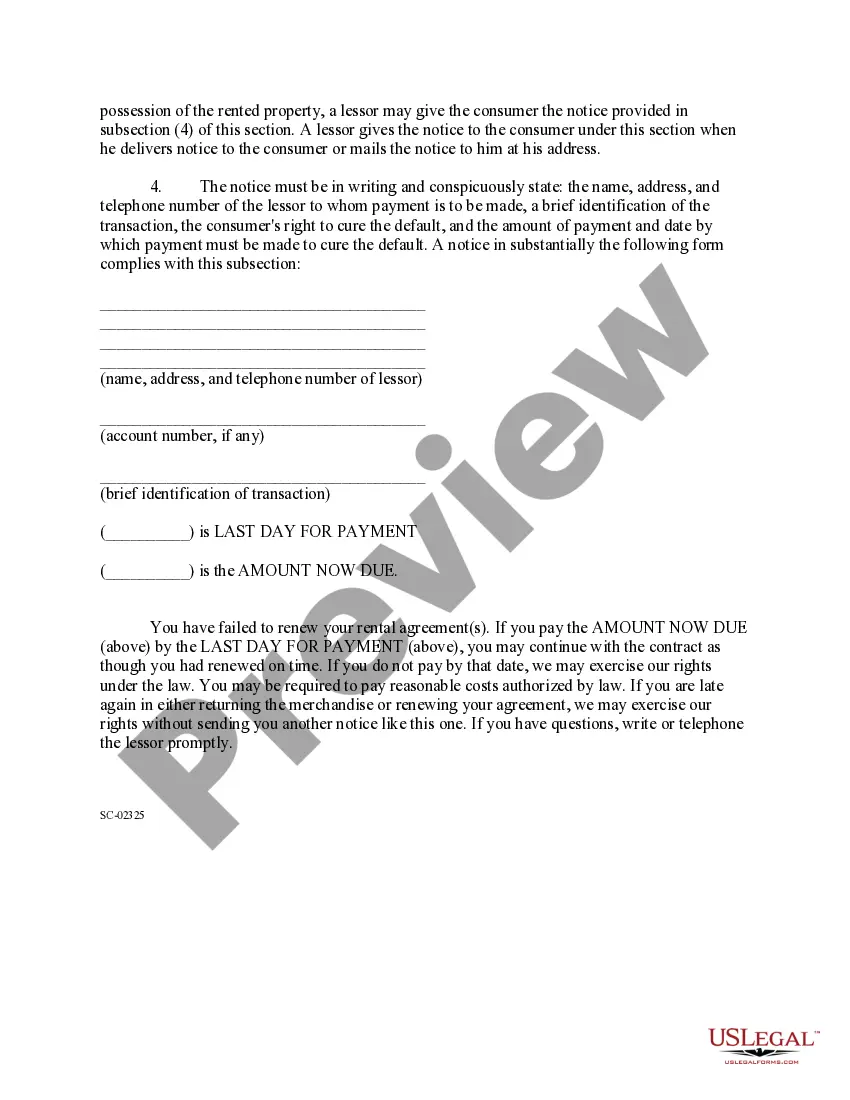

The right to cure letter, in simple terms, is a legal document that a mortgage lender sends to a borrower who has fallen behind on their payments. This letter serves as a formal notification and gives the borrower a specific period ? typically 30 to 120 days ? to resolve the default by paying the overdue amount.

The notice must tell you that you are in default and that you have 30 days to cure the default. The Right to Cure Notice says that if you do not get caught up on your payments, ?cure your default,? the bank can begin foreclosure proceedings to take your house.

Lender Name: Lender Address: My vehicle [describe make/model/year] was repossessed from [address where vehicle was located] on [date] because I defaulted on the loan to buy the vehicle. I demand that you return to me all of the personal property in the vehicle immediately.