Title: Understanding the Equitable Advisors Pyramid Scheme Format: Types and Detailed Description Introduction: Equitable Advisors, a well-known financial services firm, has been scrutinized for its alleged involvement in pyramid schemes. In this article, we will delve into the various formats and provide a detailed description of Equitable Advisors pyramid scheme, examining its practices and potential consequences. Gain insights into the different types of pyramid schemes associated with Equitable Advisors and understand their characteristics, helping you protect yourself from potential scams. 1. Basic Pyramid Scheme Format: The fundamental pyramid scheme format employed by Equitable Advisors typically involves three key elements: a) Recruitment: Individuals are encouraged to join the scheme by paying a fee or purchasing a product. b) Earnings: Participants are promised substantial returns by recruiting others into the scheme and earning commissions based on their downline's investments or participation. c) Expansion: The scheme relies on a continuous chain of recruits to fuel the financial gains for those at the top while leaving many participants at lower levels at a loss. 2. Equitable Advisors' Investment Pyramid Scheme Format: Equitable Advisors may also engage in investment pyramid schemes, wherein investors are enticed with promises of exorbitant returns through various investment vehicles: a) Exclusive Investment Products: Individuals are urged to invest substantial sums in exclusive investment products that allegedly generate high returns. b) Recruiting Investors: Participants are incentivized to recruit new investors, earning commissions based on their downline's investments. c) Inadequate Financial Disclosures: Equitable Advisors may withhold crucial financial information, making it difficult for participants to make informed investment decisions. 3. Multi-Level Marketing (MLM) Pyramid Scheme Format: Equitable Advisors, under the guise of multi-level marketing, may utilize pyramid scheme principles in their business model: a) Distributorship: Participants are encouraged to become distributors, marketing Equitable Advisors' products or services to earn commissions. b) Recruiting Down lines: Distributors are incentivized to recruit others and earn overrides or bonuses based on their downline's sales. c) Unsustainable Earnings: The scheme often requires an ever-expanding recruitment base, making it challenging for participants lower in the pyramid to generate consistent profits. 4. Pension or Retirement Pyramid Scheme Format: Equitable Advisors pyramid scheme may specifically target pensioners or individuals planning for retirement: a) False Retirement Solutions: Participants are presented with appealing retirement plans or investment opportunities promising steady income in their golden years. b) Recruitment of Pensioners: Existing members are encouraged to recruit retirees or those planning for retirement, leading to potential financial harm to vulnerable individuals. c) Drain on Pensions: Often, the scheme's sustainability relies heavily on the continuous flow of new investors' funds, jeopardizing pensioners' savings. Conclusion: Equitable Advisors pyramid schemes exploit individuals' aspirations for financial security and promising returns, utilizing various formats such as the basic pyramid scheme, investment pyramid scheme, MLM, and targeting pensioners. Awareness of these schemes and their characteristics is essential to protect oneself from potential scams. Remember to exercise caution and conduct thorough research before engaging with any investment opportunity or financial service provider to ensure the safety of your hard-earned money.

Equitable Advisors Pyramid Scheme Format

Description

How to fill out Equitable Advisors Pyramid Scheme Format?

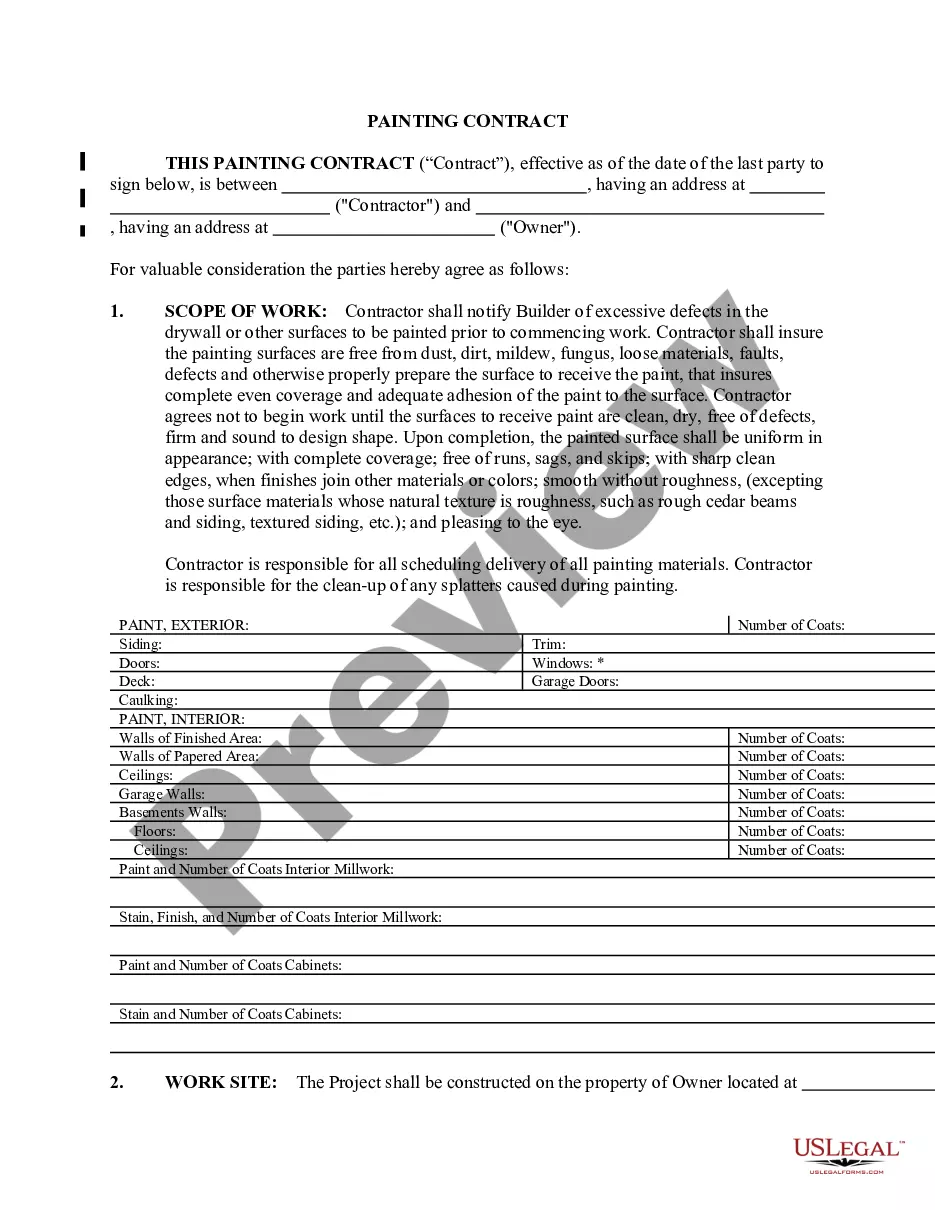

Creating legal documents from the ground up can sometimes be quite daunting.

Certain situations may require extensive research and significant financial investment.

If you’re searching for a more straightforward and budget-friendly method of generating Equitable Advisors Pyramid Scheme Format or any other documentation without unnecessary complications, US Legal Forms is readily available.

Our online repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-approved templates meticulously crafted by our legal experts.

US Legal Forms enjoys an impeccable reputation and more than 25 years of experience. Join us today and make document execution a straightforward and efficient process!

- Utilize our website whenever you need a dependable and trustworthy service through which you can promptly find and download the Equitable Advisors Pyramid Scheme Format.

- If you're a returning user and have set up an account with us before, just Log In to your account, select the form and download it immediately or re-download it anytime in the My documents section.

- No account yet? No problem. It only takes a few minutes to create an account and navigate through the library.

- However, before diving directly into downloading the Equitable Advisors Pyramid Scheme Format, consider the following tips.

- Examine the form preview and descriptions to ensure you’ve located the document you need.

Form popularity

FAQ

Yes, Equitable Advisors is a legitimate financial services firm that operates in the United States. It offers a range of financial products and services, including investment management and insurance solutions. While some individuals may misconstrue the business model as resembling an 'Equitable Advisors pyramid scheme format', it's essential to note that it follows conventional regulatory practices. As you explore your financial options, ensure you consider all credible information before making any decisions.

Yes, Equitable Advisors operates on a commission-based structure. This means that their advisors can earn commissions on products they sell. While this model is common in the financial industry, it is beneficial to understand how these commissions work. By comparing this with the Equitable Advisors pyramid scheme format, you can gain insight into how their compensation aligns with your financial goals.

To obtain your 1099 from Equitable Advisors, start by checking your account online or contacting their customer support for assistance. Usually, 1099s are made available electronically, ensuring a paperless, efficient process. If you face any issues retrieving your document, utilizing platforms like US Legal Forms can help guide you through necessary steps and paperwork. This can alleviate concerns you may have regarding financial documentation.

Not all financial advisors solely rely on commissions for their income. Many advisors also earn fees for their advice or services, creating a blend of income sources. It is essential to clarify how your advisor is compensated, as this impacts their recommendations. Understanding these compensation structures can demystify concerns related to the Equitable Advisors pyramid scheme format.

Equitable Advisors offers a variety of financial products, not just insurance. While they do sell insurance solutions, their portfolio also includes investment services and financial planning. Therefore, when engaging with Equitable Advisors, clients have access to a comprehensive range of financial services. This diversity helps to avoid misconceptions associated with the term 'pyramid scheme format' often attributed to limited offerings.

Equitable Advisors operates on a commission-based structure. This means that many financial advisors earn income based on the products they sell, which can include insurance policies and investment products. It’s important to note that earning commissions does not imply a pyramid scheme format; rather, it reflects a common practice in financial services. Individuals looking to understand the nuances of commissions in financial advising can benefit from exploring resources like US Legal Forms.

The lawsuit against Equitable Advisors focuses on allegations of deceptive practices and potentially operating in a pyramid scheme format. Clients claim they received misleading information about investment opportunities and risk. This legal action seeks accountability and restitution for harmed individuals. If you are uncertain about your situation, reaching out to legal resources like USLegalForms can help clarify your standing.

Equitable Advisors operates on a commission-based structure, but the details of compensation can vary depending on specific roles and products sold. While some advisors generate income solely through commissions, others may have a mix of salary and commissions. This structure can raise questions regarding the validity of their practices. Exploring this can provide insights into how the company interacts with its clients.

An equitable relief lawsuit aims to provide a remedy that restores fairness when monetary compensation is inadequate. In the context of Equitable, this type of lawsuit may address claims that the company operated under a pyramid scheme format, leading to financial hardship for clients. Understanding these legal options can empower you to take action if you believe you have been wronged. Resources such as USLegalForms can help clarify your options.

The exact amount of the Equitable settlement is still to be determined, as negotiations and legal proceedings are ongoing. However, some estimates suggest that the settlement could involve significant financial compensation for affected parties. If you have been impacted, consider reviewing the details as they unfold to understand your possible claims. Legal resources like USLegalForms can help guide you through any necessary actions.