Power Attorney Release With Interest

Description

How to fill out Power Attorney Release With Interest?

Individuals typically link legal documents with something intricate that only an expert can manage. In a sense, this is accurate, as creating a Power of Attorney Release With Interest requires significant expertise in relevant subject matters, including local and regional laws.

However, with US Legal Forms, the situation has become more straightforward: pre-prepared legal templates for various life and business needs that adhere to state laws are compiled in a single online directory and are now accessible to all.

US Legal Forms offers over 85,000 current documents categorized by state and purpose, making it quick to locate the Power of Attorney Release With Interest or any other specific template within minutes.

All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them whenever necessary through the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe today!

- Review the page content thoroughly to confirm it matches your requirements.

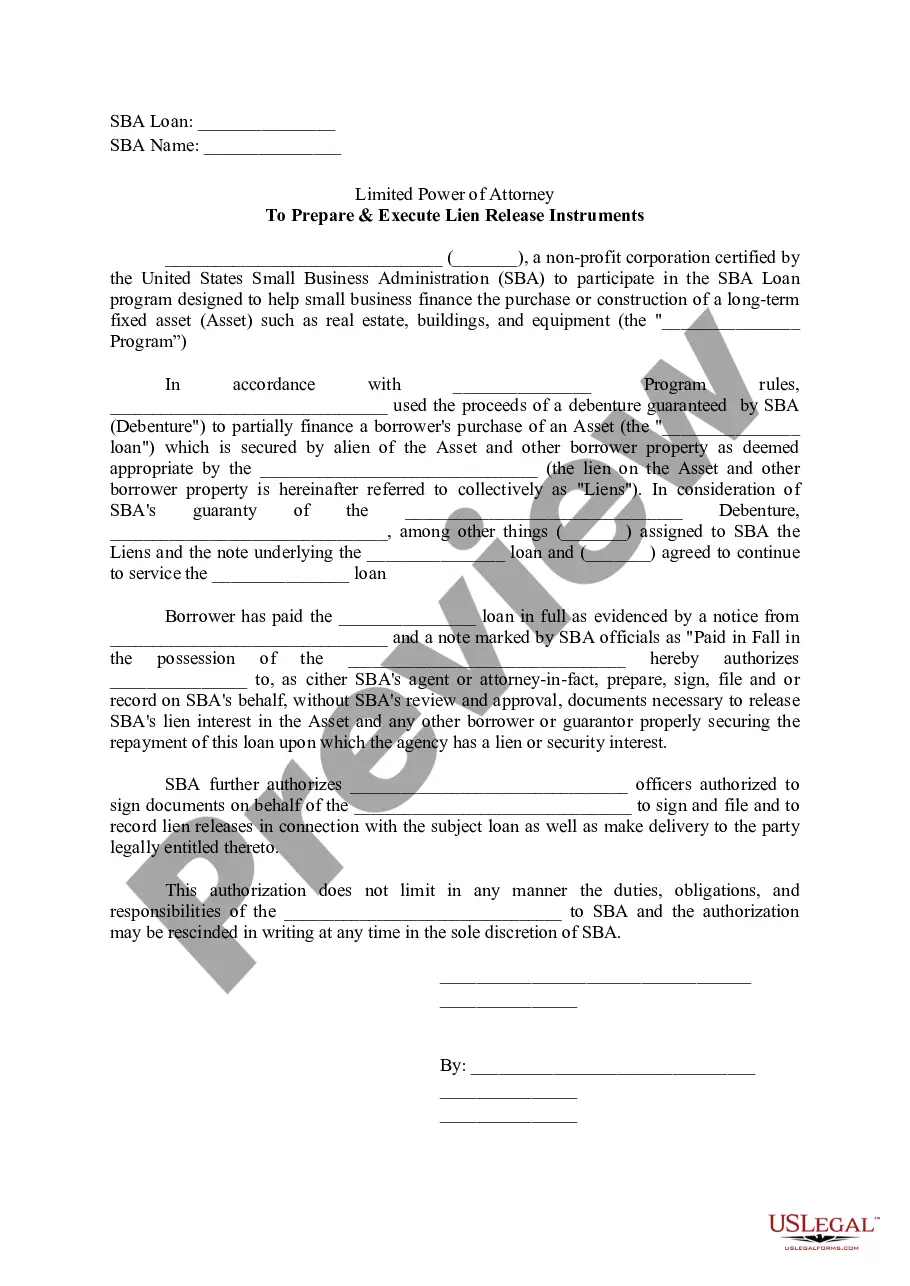

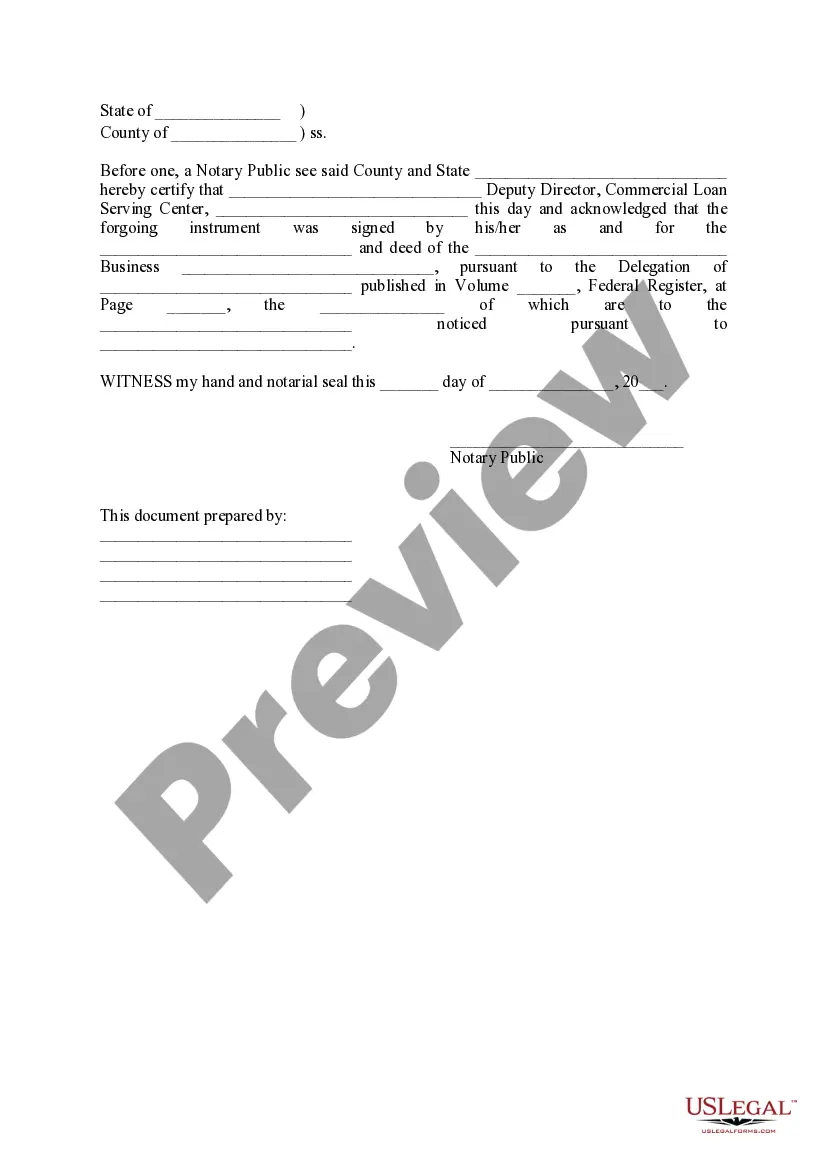

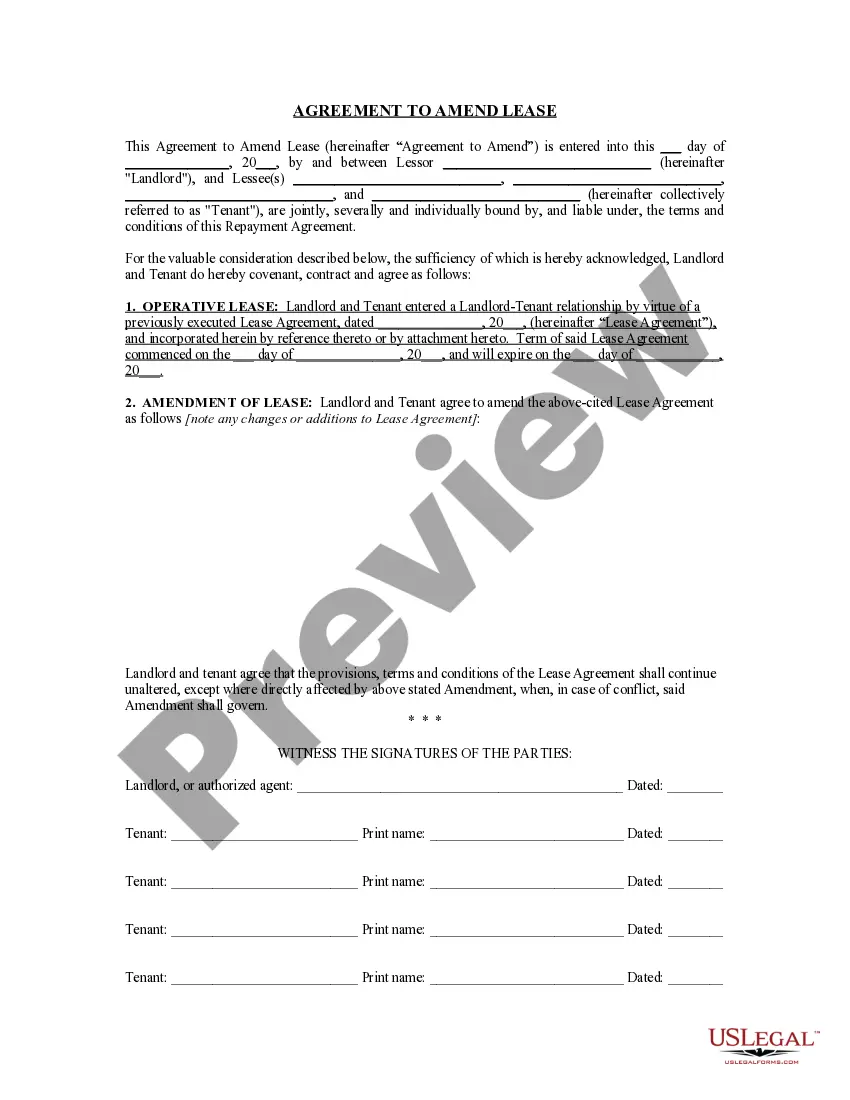

- Examine the form description or check it through the Preview option.

- Search for another example using the Search field above if the previous one does not meet your needs.

- Click Buy Now once you identify the correct Power of Attorney Release With Interest.

- Choose a subscription plan that fits your requirements and financial situation.

- Create an account or Log In to continue to the payment page.

- Purchase your subscription using PayPal or your credit card.

- Select the format for your sample and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Do I need to register the Enduring Power of Attorney document? In the ACT an Enduring Power of Attorney does not need to be registered unless it is being used on your behalf in respect of the transfer of, or other dealing with, land.

2.1 General powers under section 10 of the Powers of Attorney Act 1971. The Powers of Attorney Act 1971 provides a short form of general power of attorney that can be used by a sole beneficial owner of land. It operates to give the attorney authority to do anything that the donor can lawfully do by an attorney.

When you are appointed as an attorney, you are placed in a position of trust and you must always act in the best interests of the donor. You can only do the things the donor has authorised you to do. You can't ask anyone else to carry out any of your duties, unless the donor has authorised you to do so.