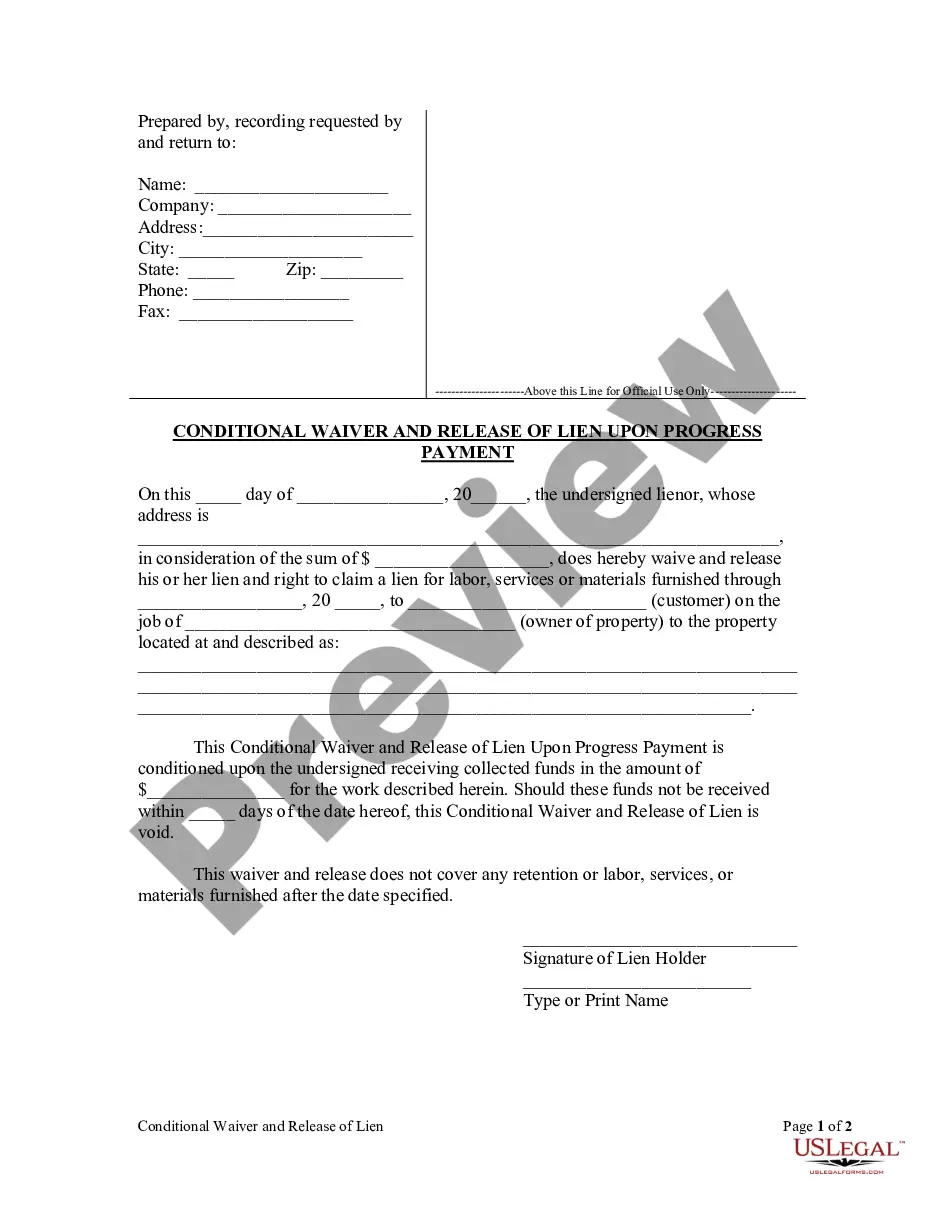

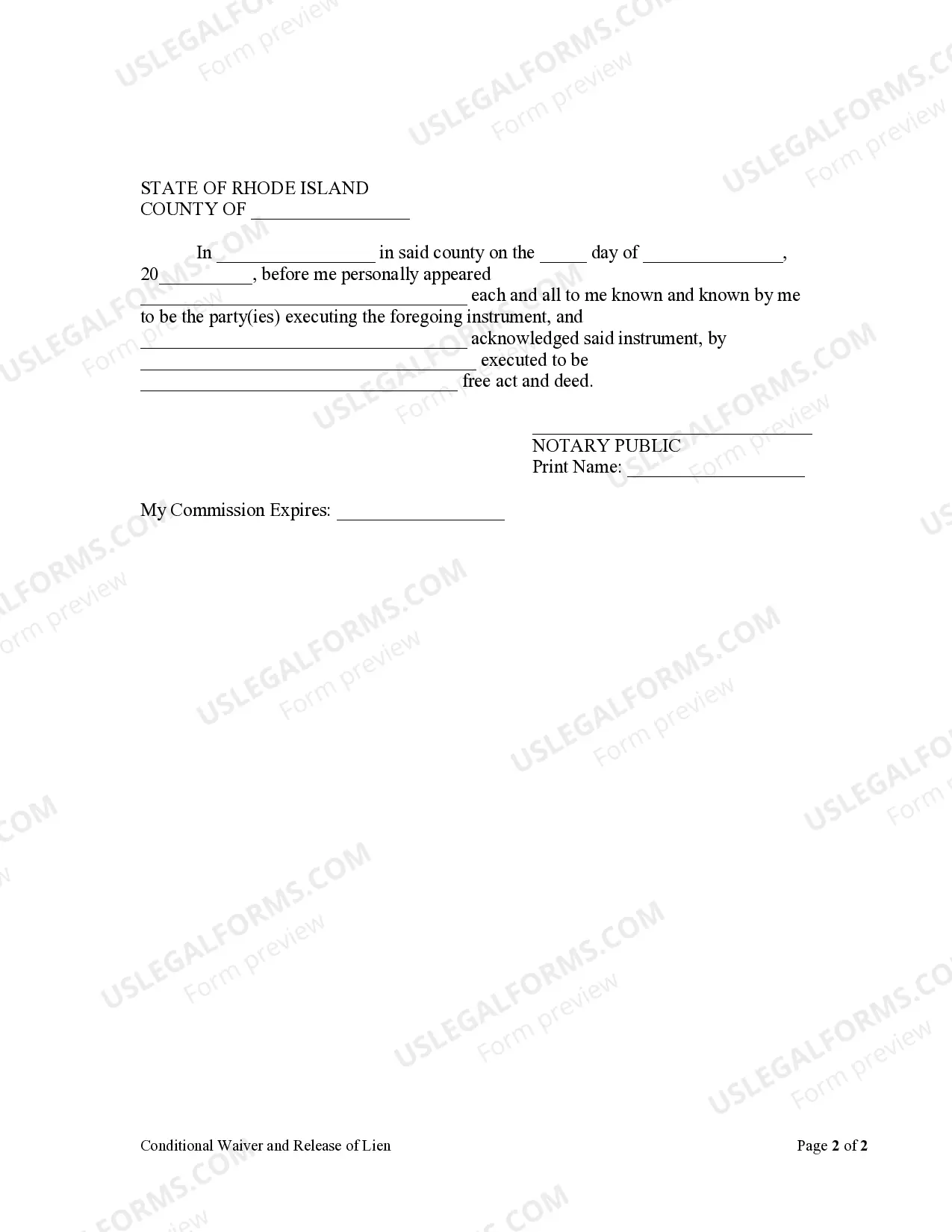

This Conditional Waiver and Release of Claim of Lien Upon Progress Payment is for use by a lienor to waive and release his or her lien and right to claim a lien for labor, services or materials furnished through a certain date to a customer on the job of the owner of property. This Conditional Waiver and Release of Lien Upon Progress Payment is conditioned upon the lienor receiving collected funds for the work described, and if these funds are not received within a certain days of the date of this waiver, this Conditional Waiver and Release of Lien is void.

Rhode Island Claim For Rent

Description

Form popularity

FAQ

Yes, rent relief programs continue to be available in Rhode Island, aimed at assisting residents in need. Local agencies manage these programs and can help you navigate the application process for a Rhode Island claim for rent. It is advisable to check eligibility criteria and deadlines, as they may change frequently. Utilizing platforms like US Legal Forms can simplify the process and provide the necessary documentation.

When you file a Rhode Island claim for rent, you can claim up to 100% of your eligible rent, depending on your circumstances. This includes any overdue amounts and may cover multiple months. Additionally, verifying your income and expenses can help determine the exact amount you can claim. It's essential to keep detailed records to support your claim.

There is no definitive age at which you stop paying taxes in Rhode Island or any state. However, once you reach a certain income level or retire, your tax obligations may change. It is essential to review your financial situation, as certain tax benefits may apply to seniors. For tailored advice, consider the resources available on the US Legal Forms platform to ensure you understand your tax responsibilities.

The property tax relief program in Rhode Island provides financial assistance to eligible individuals, including seniors, veterans, and those with disabilities. This program aims to help lessen the burden of property taxes, making homeownership more affordable. To apply, residents should contact their local tax office for details on eligibility and application procedures. You can also find information and forms on the US Legal Forms platform to streamline your application process.

To avoid estate tax in Rhode Island, you can consider various planning strategies, such as gifting assets before passing. Reducing the size of your estate may help you fall below the threshold for taxation. Working with a tax professional can help you devise a comprehensive plan tailored to your situation. Additionally, the US Legal Forms platform offers resources that can simplify the process of estate planning.

In Rhode Island, there is no specific age at which you stop paying property taxes. However, residents who are 65 years or older may qualify for property tax relief programs designed to ease their financial burden. It is important to check with your local tax assessor's office to understand your eligibility for any exemptions. Utilizing the US Legal Forms platform can help you navigate these options efficiently.

To claim rent on your taxes in Rhode Island, you need to file a Rhode Island personal income tax return. Gather all relevant documents, such as your lease and proof of rent payments, to accurately report your rental expenses. Depending on your situation, you may qualify for tax credits that can reduce your tax liability. For more guidance, consider using the US Legal Forms platform to find the necessary forms and resources.

The property tax relief form for Rhode Island is a specific document that residents fill out to apply for property tax relief programs. This form requires detailed information about your income and property values. Completing it accurately can qualify you for financial benefits, ultimately assisting you with your Rhode island claim for rent. Many users find it helpful to utilize uslegalforms to access this form easily.

The property tax relief credit is a benefit designed to reduce the amount of property tax owed by eligible taxpayers. In Rhode Island, this credit can offer financial assistance based on specific criteria, including income and age. This relief helps ensure homeowners can afford to live in their properties without excessive financial strain. For more details on how this credit can apply to your Rhode island claim for rent, consult with tax professionals.

The RI 706 form is a Rhode Island estate tax return used to report the value of an estate after a person passes away. This form requires detailed information about the deceased’s assets and debts. If you are an executor, understanding this form is vital to fulfilling your duties. Additionally, managing properties in the estate may influence your Rhode island claim for rent, as it may affect tax obligations.